Hero Electric best-seller for second consecutive month, e2W sales cross 225,000 in April-August

With sales of 10,482 units in August on the back of July’s 8,953 units, Hero Electric jumps two ranks to take No. 2 position, after Okinawa Autotech; e2W industry sales cross 50,000 in August.

Electric two-wheeler sales in India are on a roll and August 2022’s retail numbers are the best yet this fiscal: 50,475 units. While this is a massive 238% year-on-year increase on the pandemic-impacted August 2021’s 14,913 units, they constitute a more realistic 13% month-on-month growth over July 2022’s 44,595 units.

Last month’s e-two-wheeler retails, as revealed by Vinkesh Gulati, chairman of FADA India Research & Academy, indicate that numbers have crossed the 50,000-unit mark for the first time and point to the way ahead. Cumulative sales for the first five months of FY2023 – April-August 2022 – have gone past the 225,000 mark, ample proof that FY2023 is well set to be a record-setting year for the electric two-wheeler industry.

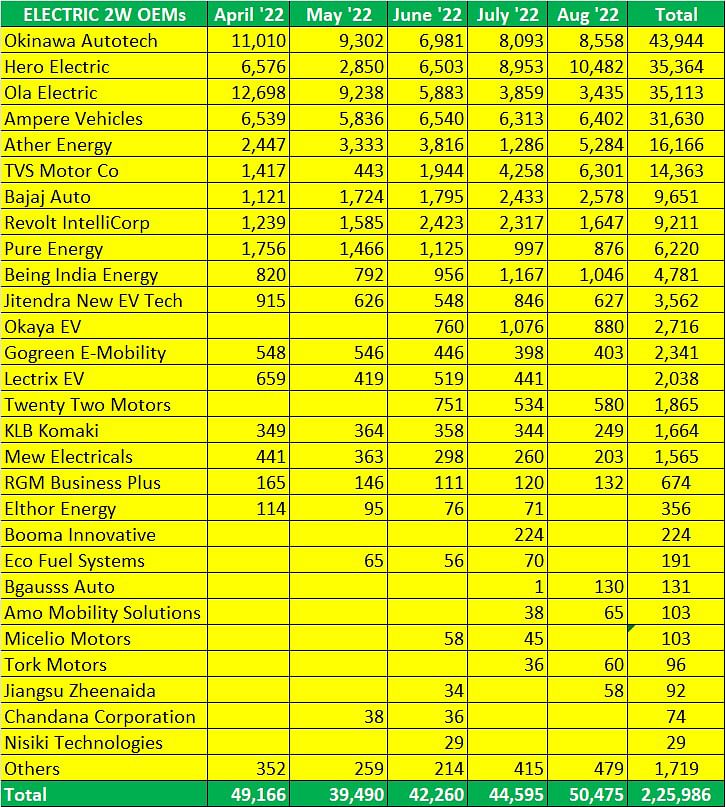

A look at the data table at the bottom of this analysis reveals that the top 10 players account for 206,443 units or 91% of total retail sales of 225,986 units. There’s a hotly contested battle underway at the top, particularly among the top four – Okinawa Autotech, Hero Electric, Ola Electruc and Ampere Vehicles.

Hero Electric jumps two ranks to be No. 2

The company which has made the maximum gains last month is Hero Electric, which has topped monthly e-two-wheeler sales for the second month in a row. After clocking 8,953 units in July 2022, the OEM has bettered that score with 10,482 units, its best yet this fiscal. This smart market performance takes Hero Electric’s cumulative sales to 35,364 units, helping it jump two ranks from its No. 4 in July 2022 to No. 2 in August and going ahead of Ola Electric (35,113 units) and Ampere Vehicles (31,630 units).

Hero Electric, which is aggressively driving expansion, currently has over 700 sales and service outlets and trained roadside mechanics on EVs. It has also partnered with a various of NBFCs to enable easy finance solutions for EV buyers. Hero is also very actively increasing its EV charging network and has recently tied up with Jio-bp to enable its customers to get access to that widespread charging and swapping network, which is also open to other vehicles. Earlier this year, it began manufacturing and rollout of its Optima and NYX e-scooters from Mahindra Group’s plant in Pithampur, Madhya Pradesh.

Okinawa remains strong No. 1, Ampere hot on Ola’s heels

Okinawa Autotech, which has a large portfolio of both high- and low-speed e-scooters, is well placed in the lead with 43,944 units, averaging monthly sales of 8,788 units. The company, which is seeing strong demand for its iPraise+ and Praise Pro high-speed models, currently has a network of over 350 dealers in key metro cities and now aims to reach Tier 2-3 cities as well as rural India.

There is a battle underway between third-placed Ola Electric and Ampere Vehicles, which at the end of August are separated by 3,483 units. Ola has seen its sales slow down considerably over the past fourth months. From a high of 12,698 units in April 2022, August’s 3,435 units are the lowest monthly numbers in the ongoing fiscal.

With 31,630 units in April-August 2022, Ampere Vehicles is seeing sustained demand.

Ampere Vehicles with cumulative five-month sales of 31,630 units has been registering a consistent performance and is averaging 6,326 units a month. Last month, Ampere inked a partnership with Flipkart, India’s homegrown e-commerce marketplace, to accelerate sales of the Ampere Magnus EX electric scooter. In the pilot phase, customers across Bengaluru, Kolkata, Jaipur, and Pune will be able to access the product and also avail of state-specific subsidies and benefits. After placing an order on Flipkart, the customers will be contacted by the local authorised dealership for completion of RTO registration, insurance, and delivery of the scooter. The entire process, from the time of order to doorstep delivery, will be completed within 15 days, says the company.

One of the highlights for Ather Energy in August was the rollout of its 50,000th 450X.

Bangalore-based smart EV OEM Ather Energy retailed 5,284 units last month, its best performance this fiscal, and has a five-month tally of 16,166 units. Its wholesales, as per SIAM, were 6,410 units for August indicative of the company keeping its showrooms stocked for the festive season.

Smart EV maker Ather Energy has seen a sharp 29% month-on-month decline to 1,286 units (June 2022: 2,816 units) and is the only other OEM to cross the 10,000-units cumulative retail sales mark for April-July 2022. One of the highlights last month was the rollout of Ather’s 50,000th 450X. Ather, which claims it is the leading EV OEM in the state of Kerala with a 34% market share, also inaugurated three new experience centres in Pune, Chennai and Ranchi.

TVS and Bajaj also plug into EV growth story

As demand for electric two-wheelers continues on its strong growth trajectory in India, ICE two-wheeler and electric scooter rivals Bajaj Auto and TVS Motor Co are also making robust gains with their electric scooters. Interestingly, both companies launched their products – the Bajaj Chetak and TVS iQube – in the same month: January 2020.

Retail sales improving for Bajaj Chetak and TVS iQube even as the sales network grows.

Proof of the rising market demand for TVS iQube and Bajaj Chetak is that their combined wholesales till end-August 2022 have crossed the 50,000-unit mark. As per SIAM wholesale data, while TVS Motor Co with 31,342 units has the larger share – 59% – of the pie, Bajaj has sold a total of 21,589 units over the past 32 months.

The real-world retail story is no different: TVS has 14,363 units to its credit in the April-August 2022 period, while Bajaj has sold 9,651 units. Both companies are gradually expanding their retail network and customer reach for their electric scooters.

Retail sales data: courtesy Vinkesh Gulati

Growth outlook: Racing towards 600,000 units and more in FY2023

What is adding tailwinds to sales of the eco-friendly commuters on two wheels is the marked increase in prices of petrol-powered scooters and motorcycles, particularly after the technological upgrade to BS VI in April 2020. As is known, the BS VI mandate has necessitated the use of electronic fuel injection (EFI) technology which is significantly more expensive than the now-defunct carburettor technology. Furthermore, it is understood that apart from the higher acquisition cost of BS VI two-wheelers, the cost of repair is also higher compared to non-EFI products.

Given the sustained demand in the e-two-wheeler market and the huge market potential, the 600,000-unit sales milestone should be crossed in FY2023. Following the incidents of e-scooter fires earlier this year with three OEMs, the government as well as the entire EV industry eco-system is hard at work to ensure top-notch battery and cell management. This is imperative because consumer confidence in electric two-wheelers, one of the low-hanging fruits of the industry along with three-wheelers, remains strong.

India is targeting EVs to account for 30% of its mobility requirements by 2030, driven by the FAME scheme, state subsidies and much increased availability of models across segments. Given the current pace of buying in the overall two-wheeler arena – 3.3 million two-wheelers sold in FY2022 – that could be still some distance away. Nonetheless, given the positive trend, e-two-wheeler OEMs will be looking to make the most of demand coming their way.

ALSO READ

EVs take 3.6% of two-wheeler sales in India in H1 2022

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

11 Sep 2022

11 Sep 2022

17604 Views

17604 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal