Gradual demand recovery, infra projects drive M&HCV sales in September

The medium and heavy commercial vehicle segment is seeing the green shoots of recovery.

The commercial vehicle industry is hopefully witnessing recovery, which is being led by the medium and heavy commercial vehicle (M&HCV) truck segment. In fact, a closer look at the major CV players in India’s wholesales for the month of September 2021 depicts an average of 67% growth in just the M&HCV segment.

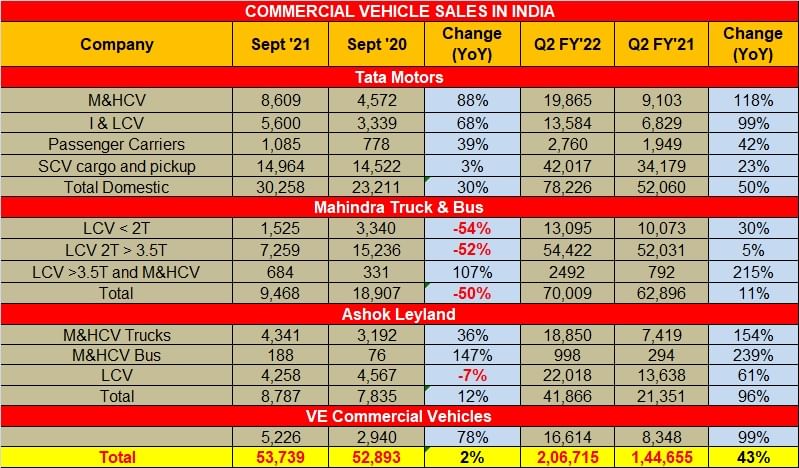

For the month, overall sales are 53,739 units, a growth of 2 percent over the same period last year. In terms of Q2 FY2022 sales, the overall industry wholesales saw a growth of 43 percent at 206,715 units compared to 144,655 units last year.

Tata Motors, the country’s largest commercial vehicle maker, reported wholesales of 78,226 units for Q2 FY2022 (+50% YoY) and sold 30,258 CVs in September, a growth of 30 percent, with every segment reporting uptick in sales.

Girish Wagh, executive director, Tata Motors said, “Tata Motors’ CV domestic saled in Q2 FY2022 at 78,226 units was around 80% higher than the previous quarter and 50% higher the same quarter last year (Q2 FY2021). Post the second Covid wave, markets are witnessing gradual demand recovery across most segments led by M&HCVs with improving fleet utilisation levels, higher number of road construction projects awarded and improving cement consumption. International business continued the recovery momentum and grew by around 28% over the previous quarter and 155% over the same quarter last year (Q1 FY2021).”

“Semiconductor shortage continues to impact the auto industry globally. The impact of supply shortage due to restrictions in East Asia continued in September, leading to moderation of production and offtake volumes. The situation is fluid and we continue to work to mitigate the impact on our customer orders through an agile, multi-pronged approach,” added Wagh.

Chennai-headquartered Ashok Leyland sold 41,866 units in Q2 FY2022, which was 96 percent higher compared to same period last year. Its September 2021 sales at 8,787 units were an uptick of 12 percent YoY.

The ongoing semiconductor shortage crisis has impacted Mahindra & Mahindra which sold 70,009 units for Q2 FY2022 (+11%). Interestingly, in September 2021, the company reported sales decline of 50 percent selling 9,468 units (September 2020: 18,907).

VE Commercial Vehicles, like Tata and Ashok Leyland, benefited from the gradual revival with sales of 16,614 units for Q2 FY2022 (+99%), which includes sales of 5,226 units in September (+78% YoY) compared to 2,940 units for the same period last year.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

01 Oct 2021

01 Oct 2021

11981 Views

11981 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau