EV sales in India rise 41% in April 2023 to over 109,000 units

April was the seventh consecutive month that overall EV sales surpassed the 100,000-unit mark in India; Ola, with 21,573 units, clocks best-ever monthly sales; ePV leader Tata Motors’share drops to 73% with Mahindra snapping up second place with 499 units; Olectra Greentech tops ebus retails.

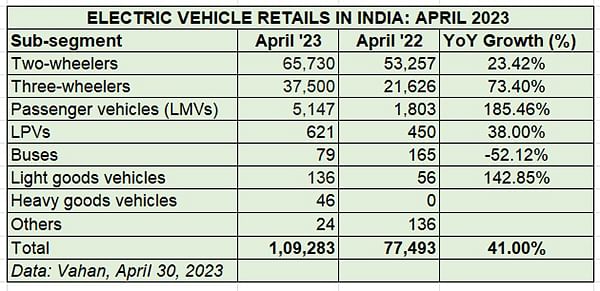

Electric vehicle (EV) retail sales in April 2023, the first month of the new fiscal year 2024, have risen by 41% year on year to 109,283 units (April 2022: 77,493 units). This data, sourced from Vahan (as of 8.30 pm, April 30, 2023) makes April the seventh month in a row that overall EV sales in India have crossed the 100,000-unit mark. While April 2023 retails are better than those in January 2023 (102,709 units) and February 2023 (107,039 units), they are down 28% on March 2023’s 140,541 units.

As is known, FY2023 saw the domestic EV industry clock over 11,81,734 retail sales, up 155% on FY2022 (4,58,757 units), and cross the million milestone for the first time, accounting for 30.37% of total India Auto Inc sales of over 3.89 million units.

Of the total 109,283 EVs retailed in April 2023, two- and three-wheeled EVs – the most affordable products in the zero-emission segment – account for 60% and 34% share respectively. Electric passenger vehicles, which are seeing growing demand amidst the personal usage consumer transition to electric mobility, accounted for 5,147 units and 4.70% share of the EV industry retails last month. Let’s take a closer look at how each sub-segment performed along with the company-wise retails.

Of the total 109,283 EVs retailed in April 2023, two- and three-wheeled EVs – the most affordable products in the zero-emission segment – account for 60% and 34% share respectively. Electric passenger vehicles, which are seeing growing demand amidst the personal usage consumer transition to electric mobility, accounted for 5,147 units and 4.70% share of the EV industry retails last month. Let’s take a closer look at how each sub-segment performed along with the company-wise retails.

Electric 2-wheelers: 65,730 units / up 23% YoY

Ola records best-ever monthly retails, TVS sells 8,717 iQubes

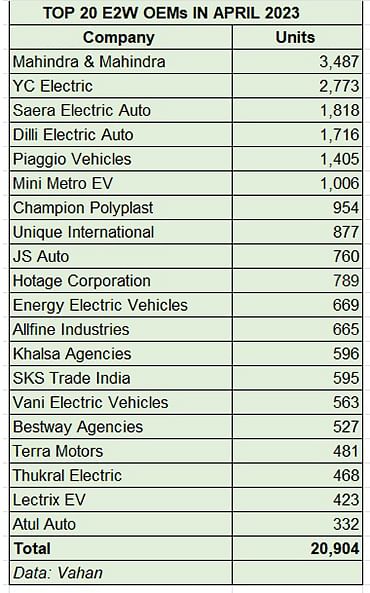

The electric two-wheeler industry, which has all of 103 players in the growing marketplace, has chalked retail sales of 65,730 units in April 2023, up 23.42% (April 2022: 53,257 units). The Top 10 account for 59,474 units or 90% of total retails in April. While only OEM (Ola Electric) has registered five-figure sales, seven others have clocked four-figure retails.

Ola Electric, the market leader in FY2023 with an over-21% share, continues its dominance with a strong opening in FY2023. The company has retailed a total of 21,573 units in April 2023, its best-ever monthly sales yet, beating the 21,389 units of March 2023. Ola, which commands a 33% market share in April, has the huge lead over its rivals and is 12,853 units ahead of the single-product TVS Motor Co which sold 8,717 iQubes last month. It is understood that the Chennai-based two-wheeler OEM is working to expand its EV portfolio with new products developing between 5 to 25 kilowatts. The iQube is powered by a 4.4kW e-motor.

In third place is Ampere Electric, which was the surprise package of FY2023 and had taken second rank in the Indian electric two-wheeler industry. In April, Ampere Vehicles, the EV arm of Greaves Cotton, sold a total of 8,265 units. Ampere, which has a portfolio of three models – the Zeal, Magnus and Primus – is seen a sustained uptick in demand for its EVs.

Bengaluru-based Ather Energy, which saw 7,680 of its smart electric scooters being bought across the country, takes fourth rank in the Top 10 list. It is followed by Bajaj Auto with 3,607 units of the Chetak scooter, Hero Electric (3,287) and Okinawa Autotech (3,217). Okaya EV is the last of the OEMs with four-figure sales (1,508).

Electric 3-wheelers: 37,500 units, up 73% YoY

Mahindra Last Mile Mobility maintains 9% share

The other ‘low-hanging fruit’ of the EV industry, three-wheeled EVs sold a total of 37,500 units, up 73.40% (April 2022: 21,626 units). This sub-segment, which has all over 330 players and counting, continues to see strong double-digit growth, thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Mahindra Last Mile Mobility, the market leader in FY2023 with over 35,000 units and a 9% share, has kicked off FY2024 on a strong note: 3,487 units in April 2023. The company maintains its 9% share of the market and is expanding production. On April 18, a new line for Treo e-three-wheelers was inaugurated at the Haridwar plant.

MLMM, which has six EVs on sale – the Treo, Treo Yaari and e-Alfa Mini for passenger transport and the Zor Grand, Treo Zor and the e-Alfa cargo for goods transportation, is benefiting from its focus on low cost of ownership and high profitability. The Zor Grand cargo EV, launched on August 30, 2022, at Rs 360,000, as per the company, can save up to Rs 600,000 in ownership costs over a five-year period when compared to a diesel-engined cargo three-wheeler and up to Rs 300,000 versus a CNG cargo three-wheeler.

YC Electric, the No. 2 e-three-wheeler OEM in FY2023, maintains its rank in April with 2,773 units. This company, which retails five products – Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations – is benefiting from low initial product cost (from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000).

Four other players have sold in excess of 1,400 units each – Saera Electric (1,818), Dilli Electric (1,716), Piaggio Vehicles (1,405) and Mini Metro (1,006).

As the detailed data table (below) reveals, the Top 10 OEMs accounted for 15,585 units, which translates into 41.56% of total sales in this sub-segment.

Tata Motors, with its 4-model portfolio, retailed 3,748 EVs in April; the XUV400 has given Mahindra a new charge, helping it go past MG Motor India even as Citroen India with its eC3 checks in.

Tata Motors, with its 4-model portfolio, retailed 3,748 EVs in April; the XUV400 has given Mahindra a new charge, helping it go past MG Motor India even as Citroen India with its eC3 checks in.

Electric passenger vehicles: 5,147 units, up 185%

Leader Tata Motors share reduces to 73%, Mahindra takes No. 2 rank with 499 units

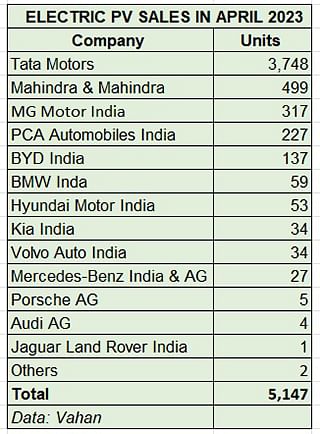

The electric car and SUV segment has recorded its second-best monthly sales in April 2023 – 5,147 units. This is a 185% YoY increase (April 2022: 1,803 units) and 1,946 units behind the best-ever monthly sales of 7,093 units in March 2023.

Electric PV market leader Tata Motors, which has the biggest EV portfolio in India in the form of the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), sold a total of 3,748 units. However, the company, which has over the past year consistently maintained a commanding near-80 share of the e-PV market, now sees its market share reduce to 73% as a result of growing competition.

That new competition has arrived in the form of Mahindra & Mahindra, which had launched its all-electric XUV400 – the first real rival to the Tata Nexon EV, which is the best-selling ePV in India. As per Vahan data, M&M, which also retails the e-Verito, clocked sales of 499 units in April 2023, which gives it a market share of 9.69% and also takes it ahead of MG Motor India (317 units). PCA India, which retails the Citroen eC3, the electric version of the C3 hatchback, moves into fourth place with 226 units, ahead of BYD India (137 units). Luxury carmakers contributed 130 units or 2.52% to total sales in this sub-segment of electric cars and SUVs.

With the recently launched MG Comet EV entering the fray and the Tata Tiago EV in the market for a few months now, sales of electric passenger vehicle numbers should see a smart uptick in the coming months given that these two cars are the most affordable EVs on four wheels at present in India.

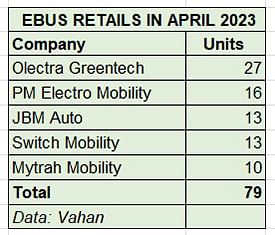

Electric buses: 79 units, down 52% YoY

Olectra Greentech sells 27 units, PM Electro Mobility 16

Compared to 165 electric buses sold in April 2022, a year later the number is down 52% to 79 buses, possibly because Tata Motors may not have participated in any fresh tenders from the Central and State governments for procurement. Olectra Greentech is the leader in April 2023 with 27 units, followed by PM Electro Mobility with 16 units. JBM Auto and Ashok Leyland’s EV arm (Switch Mobility) are tied in third place with 13 units each. The only other OEM to figure in last month’s retails is Mytrah Mobility with 10 units.

Expanding EV market offers more product choice

The shift from IC engine vehicles to EVs is underway in India, which has outlined EVs to account for 30% of its mobility requirements by 2030. This domestic industry momentum is being driven by the FAME scheme, state subsidies and a growing portfolio of products across vehicle sub-segments.

Increasing consumer awareness about the need to use eco-friendly transport and the wallet-friendly nature of EV cost of ownership over the long run is proving to be a big catalyst to adoption of electric mobility. This, even as the private sector chips in by setting up new EV charging infrastructure across the country.

Given the Union Budget 2023’s focus on this segment of the automobile industry, the increased allocation of the FAME II subsidy should help accelerate sales of EVs. The transition of consumers towards electric mobility for personal use as well as B2B operations is on the upswing. Last-mile delivery operators and the e-commerce industry, particularly in urban India, are now banking on electric cargo vehicle to deliver the goods in a cost-efficient manner.

Furthermore, recognising the huge business potential, component manufacturers are fast upping the ante on localising EV parts, either through full ground-up development or through technology licences. This will lead to enhanced optimisation of costs and in turn EV affordability.

Finally, what is benefiting EV buyers, particularly in the two-, three- and four-wheeler segments, is the growing product basket. Greater choice in the marketplace offers a multiplicity of choice to EV buyers and also creates healthy competition, which is a win-win scenario for India EV Inc.

ALSO READ

EV sales in India in 2022 record 210% growth, cross a million for the first time

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

01 May 2023

01 May 2023

45815 Views

45815 Views

Shahkar Abidi

Shahkar Abidi