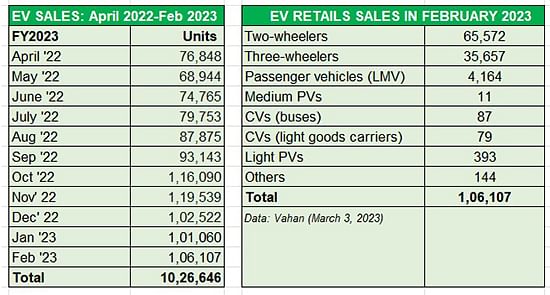

EV sales charge past 100,000 units for fifth month in a row and a million in FY2023’s first 11 months

Retails of 106,107 electric vehicles in February indicate sustained growth for India EV Inc, which has charged past the million milestone in the first 11 months of FY2023; electric PVs also scale a monthly high.

Sales of electric vehicles (EVs) in India have surpassed the 100,000-units milestone for the fifth consecutive month. As per the government’s Vahan data (as of 10pm, March 3), new EV registrations in February 2023 were 106,107 units, improving upon January 2023’s 101,060 units and December 2022’s 102,522 units (see data table below). They are, however, below November 2022's 119,539 units and October 2022's 116,090 units.

There’s more number-crunching news – cumulative sales for the first 11 months of the ongoing fiscal year (April 2022 to February 2023) are 10,26,692 units, marking the first time that EV sales have crossed the million-units mark in a fiscal. It may be recollected the EV sales crossed the million-units mark for the first time in CY2022: 10,09,911 units. And, considering that Vahan data does not include sales from the state of Telangana and the armed forces, expect the numbers to be somewhat higher.

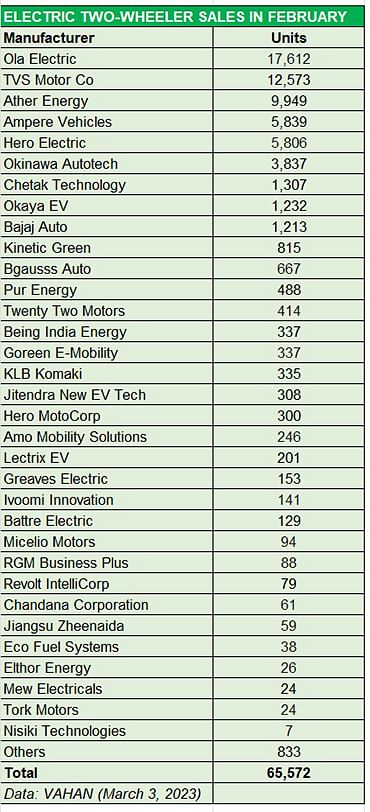

Electric 2-wheelers: 65,572 units

Ola leads, TVS records best monthly sales

At 65,572 units, the electric two-wheeler industry has recorded its best sales in the past three months, bettering December 2022’s 65,091 units and January’s 64,458 units. However, last month’s tally is a good 11,066 units less than October 2022’s 76,638 units.

Only two players – market leader Ola Electric and TVS Motor Co – have registered new vehicle retails of over five figures in February, both going past the 10,000 units mark. Seven others have clocked four-figure sales (see data table below).

Ola Electric, with 17,612 units – its second best monthly sales this fiscal after January 2023’s 18,282 units – leads the company rankings and has a 27% share of this segment for February. With a total of 129,866 units for the first 11 months of FY2023 and a good lead over rival OEMs, the company is set to be the market leader for this fiscal.

TVS Motor Co is the surprise package, taking No. 2 position for the second straight month and 19% market share. The company has consistently improved its market performance, month on month, and February’s 12,573 units are its best monthly sales yet, bettering the 10,423 units in January.

Ather Energy is in third position with 9,949 units, its best monthly retails since launch. Cumulative 11-month sales are 63,963 units.

Ampere Vehicles with 5,839 units in February 2023 is the No. 4 OEM in February and has 74,932 units to its name for the first 11 months of FY2023. However, its cumulative sales are lower than those of Okinawa Autotech (89,785 units) and Hero Electric (80,954 units). Both OEMs have seen much higher monthly numbers in CY2022 and were among the Top 3 not very long ago. Their slowed-down monthly sales are an impact of the FAME-II subsidy being revoked.

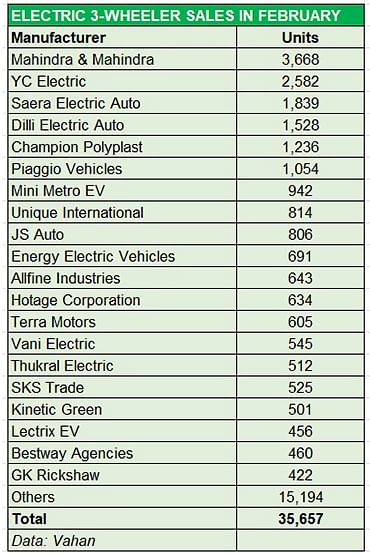

Electric 3-wheelers: 35,657 units

M&M maintains No. 1 position with 3,668 units

February 2023’s sales of 35,657 units are better than January’s 32,908 units but less than November 2022’s 38,720 units or September 2022’s 36,138 units, two of the best months for the e-three-wheeler industry in FY2023. Cumulative 11-months sales are 5,096 units short of the 350,000 mark for the fiscal.

In this EV sub-segment, which has over 300 OEMs in the fray, Mahindra & Mahindra with 3,668 units and a 10% share, remains the market leader, ahead of YC Electric. The company continues to see demand for its cargo- and passenger carrying electric three-wheelers.

Other than M&M, five other OEMs – YC Electric (2,582), Saera Electric Auto (1,839), Dilli Electric Auto (1,528), Champion Polyplast (1,236) and Piaggio Vehicles (1,054 units) recorded five-figure sales of over 1,000 units.

Eleven companies including Kinetic Green (501) sold over 500 units each last month (see data table below), while there are plenty more with sales below that number.

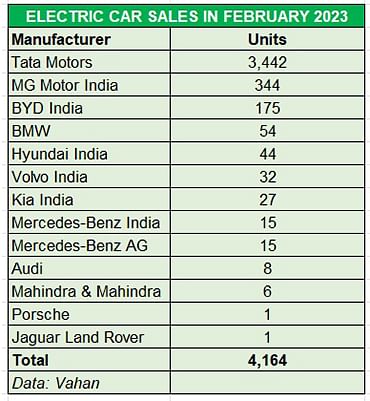

Electric passenger vehicles: 4,164 units

Electric carmakers record best-ever monthly sales

The electric passenger vehicle industry has just notched its best-ever monthly sales yet – 4,164 units in February, which translates into 149 units being sold each day. This is clearly an impact of the electric car parc growing with new models being introduced in the market.

Reflecting the strong month-on-month growth in the ongoing fiscal, February’s sales are a 42% growth over January 2023’s 2,940 units. Total retails in the first 11 months are 32,922 units, up 136% on April 2021-February 2022’s 13,958 units. With one month left for FY2023 to end, total ePV retails are just 196 units short of surpassing that.

In February, market leader Tata Motors, which has the biggest EV portfolio in India in the form of the Nexon EV, Tigor EV, Tiago EV and the Xpres-T (for fleet buyers), sold an estimated 3,442 units for an overwhelming 83% share of sales. It is followed by MG Motor India with 344 units and BYD India with 175 units.

India EV growth story revs up

The shift from IC engine vehicles to EVs is underway in India, which has outlined EVs to account for 30% of its mobility requirements by 2030. This industry momentum is being driven by the FAME scheme, state subsidies and a growing portfolio of products across vehicle segments.

The domestic EV industry’s sales growth can be attributed to an increase in the availability of products, high petrol, diesel and CNG prices, state subsidies and sops offered under FAME II. Growing consumer awareness about the need to use eco-friendly transport and the wallet-friendly nature of EV cost of ownership over the long run is a big catalyst to adoption of electric mobility.

Given the Union Budget 2023’s focus on this segment of the automobile industry, the increased allocation of the FAME II subsidy should help accelerate sales of EVs across sub-segments.

The Auto Expo 2023, held last month, was a veritable showcase of EVs to come in the near future, which augurs well for the industry. Meanwhile, recognising the huge business potential, component manufacturers are fast upping the ante on localising EV parts, either through full ground-up development or through technology licences. This will lead to enhanced optimisation of costs and in turn EV affordability.

ALSO READ:

Indian EV industry opens CY2023 with retail sales of over 100,000 units

EV sales in India in 2022 record 210% growth, cross a million for the first time

RELATED ARTICLES

UVC: The Segment That Recovered, But Didn’t Transform

The compact SUV segment gained from the GST cut, but its mid-year weakness was only partly about pricing. The structural...

The 28 Per Cent Shift: How the GST Cut Reshaped the Sub-4m Market

Taken together, Mini, Compact, and sub-4m SUV segments have moved to a materially higher demand level — and the shift ap...

GST IMPACT: Entry-Level Car Sales Double in Four Months

The Mini segment’s response to the September 2025 GST reduction is the single most measurable policy impact in recent In...

04 Mar 2023

04 Mar 2023

20264 Views

20264 Views

Shruti Shiraguppi

Shruti Shiraguppi

Angitha Suresh

Angitha Suresh