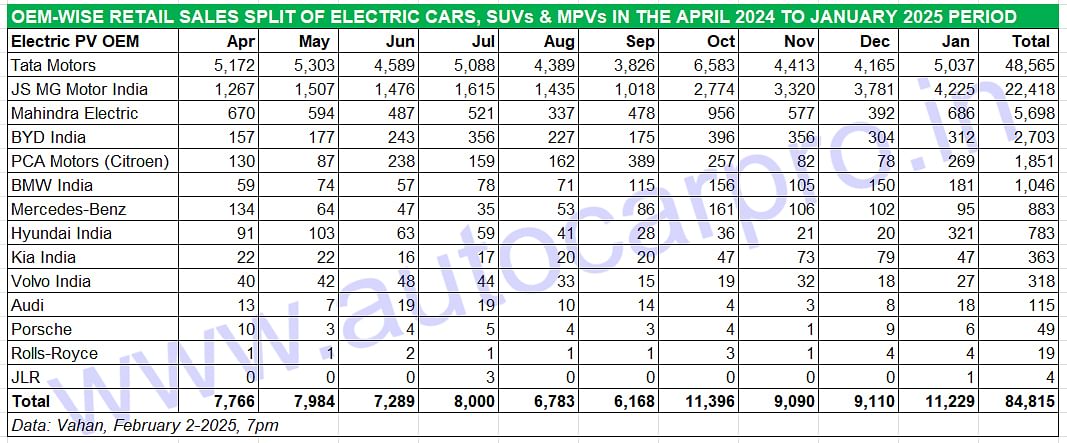

Electric car and SUV sales up 32% at 11,231 units in January, Tata EV share 45%, JSW MG Motor 37%

January 2025 turns out to be the second-best month for electric passenger vehicles in the current fiscal after festive October 2024. While market leader Tata Motors, which retailed 5,037 EVs, is feeling the heat of the rising competition, JSW MG Motor with 4,225 EVs has seen its market share jump three-fold in a year. The seven luxury EV makers sold 332 units, up 13 percent.

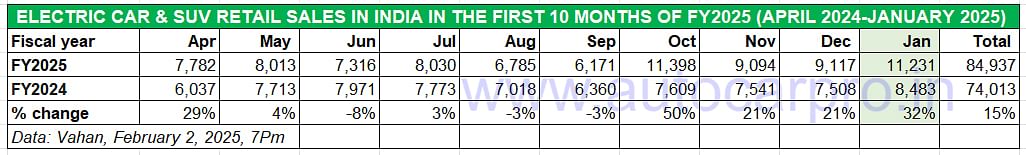

The key newsmakers at last month’s Bharat Mobility Global Expo in New Delhi, which saw over 90 new product launches and reveals, were electric vehicles on two and four wheels. Most of the 34 vehicles unveiled on January 17 were zero-emission products, clearly pointing the way the industry is headed. With the two leading passenger vehicle manufacturers Maruti Suzuki India and Hyundai India plugging into the e-mobility industry in full earnest, the dice has been cast. January 2025, the first month of the new year, saw 11,231 new EVs being bought, as per retail sales data from Vahan (February 2). This marks a 32% YoY increase (January 2024: 8,483 units).

With two months left to go in FY2025, India ePV Inc’s first 10 months’ sales are already 93% of FY2024’s record retails of 91,303 units.

With two months left to go in FY2025, India ePV Inc’s first 10 months’ sales are already 93% of FY2024’s record retails of 91,303 units.

On the cumulative front, total retails for the April 2024 to January 2025 period at 84,937 units are up 15% on year-ago sales of 74,013 units. With two months left to go in FY2025, the first 10 months’ score is 93% of FY2024’s record ePV sales of 91,303 units and currently just 6,366 units away from setting a new high. This will be achieved in the first two to three weeks of February 2025.

There’s plenty of action underway and the fast-growing competition for a bigger slice of the electric car and SUV market has eaten into market leader Tata Motors’ share, which now is at its lowest in the past three years. Let’s take a detailed look at the movers and shakers in the opening month of CY2024, the first month of the fourth quarter of FY2025, and also for the first 10 months of FY2025.

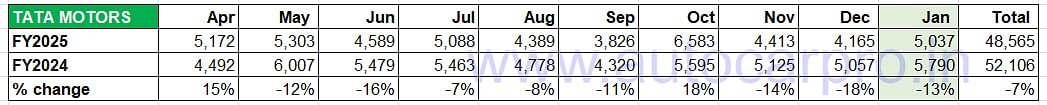

TATA MOTORS

TATA MOTORS

January 2025: 5,037 EVs, down 13% YoY – Market share: 45%

Apr ’24-Jan ’25: 48,565 EVs, down 7% YoY – Market share: 57%

CY2024: 61,435 units, up 2% YoY – Market share: 62%

Tata Motors registered EV retails of 5,037 units in January, down 13% YoY (January 2024: 5,790 EVs). This gives Tata a monthly market share of 45% compared to 68% in January 2024, clearly indicating the impact of the growing competition in this segment.

Tata Motors registered EV retails of 5,037 units in January, down 13% YoY (January 2024: 5,790 EVs). This gives Tata a monthly market share of 45% compared to 68% in January 2024, clearly indicating the impact of the growing competition in this segment.

For the first 10 months of FY2025, a total of 48,565 Tata EVs have been driven home by their owners, which is a 7% YoY decline. This translates into a current market share of 57% compared to 70% in April 2023-January 2024. In CY2024, the company had clocked retails of 61,435 units, up 2% YoY and a market share of 62 percent.

The company continues to have the largest e-PV portfolio in India (for a mass-market carmaker) comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV.

Following the launch of the Punch EV, first Tata EV vehicle built on the new Gen 2 architecture called Acti.EV, in January 2024, Tata Motors launched the Curvv EV in August 2024, also born off the same architecture and which also underpins a range of new Tata SUVs including the recently revealed Harrier EV and the upcoming Safari EV. A much-looked-forward-to model is the Harrier EV equipped with 4WD and slated for launch in the first half of CY2025.

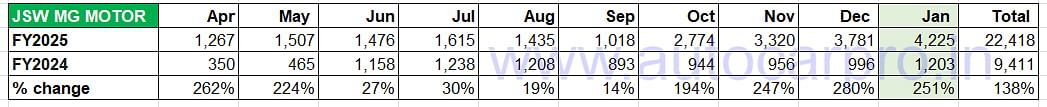

JSW MG MOTOR INDIA

JSW MG MOTOR INDIA

January 2025: 4,225 EVs, up 251% YoY – Market share: 37%

Apr ’24-Jan ’25: 22,418 EVs, up 138% YoY – Market share: 26%

CY2024: 21,464 units, up 125% YoY. Market share: 21%

The Windsor EV, launched in September 2024, has powered sales since then. JSW MG Motor's highest monthly sales of 4,225 units have come in January.

The Windsor EV, launched in September 2024, has powered sales since then. JSW MG Motor's highest monthly sales of 4,225 units have come in January.

JSW MG Motor India, which wrapped up CY2024 on a very strong note with retails of 21,464 EVs and a 21% market share, is maintains its rich vein of growth in FY2025. In January 2025, the car and SUV OEM sold 4,225 EVs, up 251% on a low year-ago base of 1,203 units. This gives it a 37% share of January sales, a three-fold jump from the 14% in January 2024. For the first 10 months of FY2024, with sales with 22,418 units, up 138% YoY, it gets a market share of 26%, double its 13% year ago.

This is mainly the result of a brand-new product. The MG Windsor EV, the company’s third electric vehicle after the ZS EV and Comet EV, has clearly added tailwinds to sales. Launched on September 2024, strong demand for the Windsor EV has hugely accelerated sales (as seen in the data table above) from October onwards. Priced at Rs 13.49 lakh (ex-showroom) and billed as India's first intelligent Crossover Utility Vehicle (CUV), the Windsor EV combines features of both a sedan and an SUV.

Furthermore, JSW MG Motor India is also benefiting from its innovative Battery-as-a-Service (BaaS) program for its EVs. According to the OEM, this flexible ownership program eliminates the upfront cost of the battery, enabling customers to pay only for its usage. This subscription model lowers the per-kilometre expense significantly reducing the initial acquisition cost to ensure an economical ownership experience. Under BaaS, the Windsor is available at Rs 999,000 + battery rental @ Rs3.5/km, MG Comet EV starts at Rs 499,000 + battery rental at Rs2.5/km and the MG ZS EV is offered at Rs 13.99 Lakh + battery rental at Rs 4.5/km.

The company is also upping the ante on the sales network front by expanding to Tier 3 and Tier 4 cities as well as rural markets across India. There are plans to set up 100 new touchpoints by the end of 2024, and setting up 520 touchpoints in 270 cities by the end of March 2025.

MAHINDRA & MAHINDRA

MAHINDRA & MAHINDRA

January 2025: 686 EVs, down 13% YoY – Market share: 6%

Apr ’24-Jan ’25: 5,698 EVs, up 19% YoY – Market share: 7%

CY2024: 7,104 units, up 66% YoY. Market share: 7%

Mahindra & Mahindra, the third-ranked EV OEM, sold has sold 686 XUV400 electric SUVs in January 2025, down 13% YoY (January 2024: 784 units), which could also mean eSUV buyers are awaiting the release of the new born-electric BE 6 and XEV 9e. This performance gives the company a 6% market share. Total 10-month retails at 5,698 units are up 19% YoY (as shown above) and give the company a 7% share of the ePV market in India.

Mahindra & Mahindra, the third-ranked EV OEM, sold has sold 686 XUV400 electric SUVs in January 2025, down 13% YoY (January 2024: 784 units), which could also mean eSUV buyers are awaiting the release of the new born-electric BE 6 and XEV 9e. This performance gives the company a 6% market share. Total 10-month retails at 5,698 units are up 19% YoY (as shown above) and give the company a 7% share of the ePV market in India.

The Mahindra XUV400 EV, currently priced between Rs 16.74 lakh and 17.49 lakh, comes with 34.5kWh and 39.4kWh battery options, with MIDC ranges of 359km and 456km, respectively.

M&M, which will have added manufacturing capacity of around 100,000 units for its upcoming Born Electric vehicles by end-March 2025, plans to invest Rs 12,000 crore towards its EV programme. On November 26, 2024 M&M launched the first of its two ‘Born Electric’ SUVs – the Be 6e (priced from Rs 18.90 lakh) and the XEV 9e (priced from Rs 21.90 lakh) – built on its innovative INGLO (Intelligent Electric Global) platform. Bookings for the two new e-SUVs are to commence on February 14 with deliveries beginning end-February or early March 2025. Expect Mahindra’s EV numbers to then accelerate like never before.

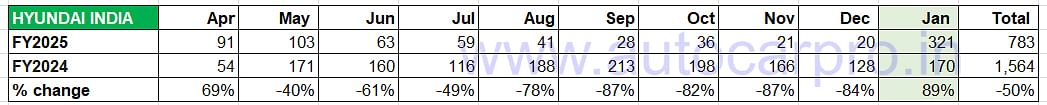

HYUNDAI MOTOR INDIA

HYUNDAI MOTOR INDIA

January 2025: 321 EVs, up 89% YoY – Market share: 2.85%

Apr ’24-Jan ’25: 783 EVs, down 50% YoY – Market share: 0.92%

CY2024: 910 units, down 43% YoY. Market share: 0.91%

Hyundai Motor India, the second-ranked passenger vehicle manufacturer in India after Maruti Suzuki India, has moved up to No. 3 for January 2025. The company has had a torrid first 9 months of this fiscal what with having only a single product – the Ioniq 5. But with the launch of the Creta Electric on January 17, the sales numbers have begun rising. The 321 units in January 2025 are Hyundai’s best monthly sales in the current fiscal, which gives it a 3% market share, and can only get better in the coming months and year.

Hyundai Motor India, the second-ranked passenger vehicle manufacturer in India after Maruti Suzuki India, has moved up to No. 3 for January 2025. The company has had a torrid first 9 months of this fiscal what with having only a single product – the Ioniq 5. But with the launch of the Creta Electric on January 17, the sales numbers have begun rising. The 321 units in January 2025 are Hyundai’s best monthly sales in the current fiscal, which gives it a 3% market share, and can only get better in the coming months and year.

The cumulative 10-month total at 783 units is down 50% YoY but now that the much-awaited Creta EV, the all-electric avatar of the high-selling Creta midsize SUV, is in the fray, Hyundai should fare much better in FY2025 and CY2025. The recently listed Korean auto major has outlined strategic EV launch game-plan which comprises four models including a mas-market model.

At the Auto Expo 2025, BYD took the covers off the Sealion 7 EV, its second eSUV after the Atto 3 in India.

At the Auto Expo 2025, BYD took the covers off the Sealion 7 EV, its second eSUV after the Atto 3 in India.

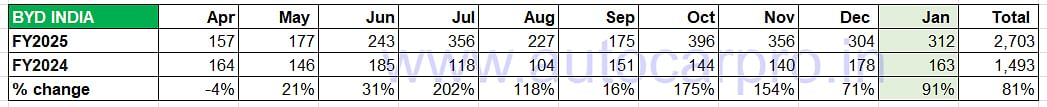

BYD INDIA

January 2025: 312 EVs, up 91% YoY – Market share: 2.77%

Apr ’24-Jan ’25: 2,703 EVs, up 81% YoY – Market share: 3.18%

CY2024: 2,819 units, up 40% YoY. Market share: 2.84%

BYD India, which sells the all-electric Atto 3 SUV, Seal sedan and the new eMAX 7 MPV maintains its No. 4 EV OEM position with total sales of 312 units, up 91% YoY (January 2024: 163 units). October 2024, which saw 393 BYD EVs sold, was its best month ever since the Chinese OEM began ePV sales in India.

BYD India, which sells the all-electric Atto 3 SUV, Seal sedan and the new eMAX 7 MPV maintains its No. 4 EV OEM position with total sales of 312 units, up 91% YoY (January 2024: 163 units). October 2024, which saw 393 BYD EVs sold, was its best month ever since the Chinese OEM began ePV sales in India.

At the Auto Expo 2025 last month, BYD took the covers off the Sealion 7 EV, its second eSUV after the Atto 3 in India. Positioned as an SUV alternative to the stylish BYD Seal sedan, the Sealion gets a five- seat cabin with stylish coupe-SUV body style. It has similar headlamps and connected tail-lamp setups with a more aggressive front and rear bumper design. The cabin is pretty similar to the Seal sedan, with the highlight being a large rotating screen that has been a signature feature in most BYD models.

The Sealion 7, which is 4.8 metres long and is equipped with FWD and RWD, is powered by a 82.5kWh battery which is has a maximum range of up to 567km. BYD is to announce the pricing strategy for the Sealion 7 on February 17, with deliveries commencing from March.

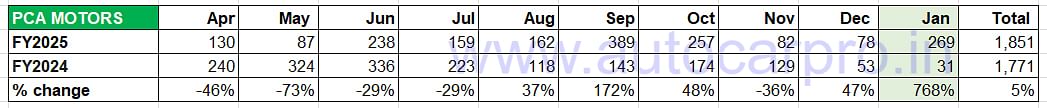

PCA MOTORS / CITROEN INDIA

PCA MOTORS / CITROEN INDIA

January 2025: 269 EVs, up 768% YoY – Market share: 2.39%

Apr ’24-Jan ’25: 1,851 EVs, up 5% YoY – Market share: 2.17%

CY2024: 1,873 units, down 4% YoY. Market share: 1.89%

PCA Motors (Citroen India) has recorded retail sales of 269 EVs in January 2025, up 768% on a very low year-ago base of just 31 units. Its cumulative 10-month sales of 1,851 units are up 5% YoY. This gives the company both a monthly and 10-month market share of 2 percent.

PCA Motors (Citroen India) has recorded retail sales of 269 EVs in January 2025, up 768% on a very low year-ago base of just 31 units. Its cumulative 10-month sales of 1,851 units are up 5% YoY. This gives the company both a monthly and 10-month market share of 2 percent.

After hitting best-ever monthly sales of 388 units in September 2024, and following it up with 256 units in October, retail sales fell sharply to 82 units in November and 00 units in December. The company, which retails the Citroen e-C3 (electric avatar of the C3 hatchback), has a fair number of bookings from EV fleet operators. The eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, could see increased sales momentum in CY2025. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E.

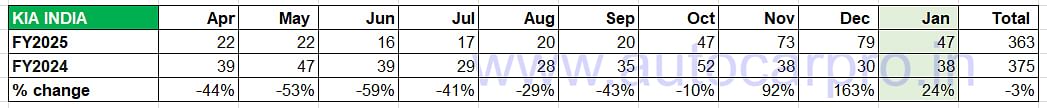

KIA INDIA

KIA INDIA

January 2025: 47 EVs, up 24% YoY – Market share: 0.41%

Apr ’24-Jan ’25: 363 EVs, down 3% YoY – Market share: 0.42%

CY2024: 401 units, down 8% YoY. Market share: 0.40% Kia India sold 47 EVs this January, up 24% on January 2024’s 38 units. Till September 2024, the company had only a single EV in the market – the EV6. In October, the company launched the six-seater EV9 SUV, priced at Rs 1.3 crore. The EV9 is being brought through the CBU route and is now Kia’s flagship offering in the country, sitting above the EV6. The EV9 has no direct rivals in India, but it gives some competition to luxury electric SUVs such as Mercedes EQS SUV, EQS SUV, BMW iX and Audi Q8 e-tron.

Kia India sold 47 EVs this January, up 24% on January 2024’s 38 units. Till September 2024, the company had only a single EV in the market – the EV6. In October, the company launched the six-seater EV9 SUV, priced at Rs 1.3 crore. The EV9 is being brought through the CBU route and is now Kia’s flagship offering in the country, sitting above the EV6. The EV9 has no direct rivals in India, but it gives some competition to luxury electric SUVs such as Mercedes EQS SUV, EQS SUV, BMW iX and Audi Q8 e-tron.

January 2025's retails of 11,229 units are the second-best monthly numbers after October 2024's 11,396 units.

January 2025's retails of 11,229 units are the second-best monthly numbers after October 2024's 11,396 units.

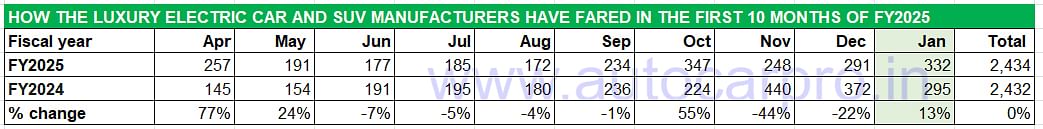

LUXURY EV SALES UP 13% IN JANUARY BUT FLAT FOR FIRST 10 MONTHS OF FY2025

As per Vahan retail sales data, demand luxury electric cars, sedans and SUVs rose by 13% in January 2025 to 332 units. However, cumulative 10-month retails at 2,434 units constitute flat sales (April 2023-January 2024: 2,432 units). As per Vahan data, five of the seven luxury carmakers have seen their sales decline including the market leader (see data table above).

As per Vahan retail sales data, demand luxury electric cars, sedans and SUVs rose by 13% in January 2025 to 332 units. However, cumulative 10-month retails at 2,434 units constitute flat sales (April 2023-January 2024: 2,432 units). As per Vahan data, five of the seven luxury carmakers have seen their sales decline including the market leader (see data table above).

BMW India, the luxury EV market leader (1,046 units, down 14%), has sold 176 fewer units than its year-ago 1,222 EVs. This gives BMW a current market share of 43% compared to 50% in April 2023-January 2024.

Mercedes-Benz India, which has rolled out a flurry of new models in the past year, has registered the highest YoY growth in this segment. Its 10-month sales of 883 units are up 89% YoY, a robust performance which has helped its market share rise to 36% from 19% a year ago.

Volvo India, the No. 3 in the luxury EV makers list, has 318 EVs to its name, down 37% on the 508 units a year ago. As a result, its market share stands reduced to 13% from 21% a year ago.

Audi India, with retails of 143 units in CY2024, has seen flat sales, matching its CY2023 performance (143 EVs) for a market share of 5% versus 5.41% a year ago.

Porsche, which has sold 49 EVs in the April 2024-January 2025 period, is down by a sizeable 48% on its year-ago retails of 94 zero-emission cars and SUVs.

For the 10-month period under review, luxury EVs accounted for 2.86% of the overall Indian e-PV market of 84,937 units compared to 3.28% in April 2023-January 2024.

ELECTRIC CAR & SUV BUYERS TO BENEFIT FROM WIDER PRODUCT CHOICE IN CY2025

January 2025, with the mega Bharat Mobility Global Expo, provided a glimpse into the fast-expanding electric passenger vehicle industry in India. The once product-choice-restricted e-PV buyer in India is finally getting an array of products to choose from.

Maruti Suzuki unveiled the 500km-range e-Vitara, its first-ever electric SUV, which will be officially launched in March 2025 and will take on the Tata Curvv EV, Hyundai Creta Electric, MG ZS EV and Mahindra BE 6.

Hyundai Motor India launched the Creta Electric, the zero-emission avatar of its best-selling product and India’s No. 1 midsize SUV, the Creta, at Rs 17.99 lakh. With an up to 473km range, the Creta Electric joins a growing segment of midsize electric SUVs.

While electric PV market leader Tata Motors showcased the production version of the Harrier EV with 4WD which is to launched in the first half of this year, Toyota Kirloskar Motor displayed the Urban Cruiser EV. This is Toyota’s version of the Maruti e-Vitara and will be launched in the second half of CY2025. JSW MG Motor India, which is currently having a great run in the market, revealed the M9 MPV and the Cyberster convertible.

Vietnamese EV maker Vinfast, which is setting up a manufacturing plant in Tamil Nadu, displayed its first models for the Indian market – the VF 6 and VF7.

The luxury EV makers also made an impact at the Auto Expo 2025 with BMW India taking the covers off the X1 Long Wheelbase All Electric and Mercedes-Benz launching the EQS Maybach SUV 680 ‘Night Series’. German sportscar maker showcased two BEVs – the all-new Macan SUV and the refreshed Taycan sports sedan.

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

03 Feb 2025

03 Feb 2025

14885 Views

14885 Views

Ajit Dalvi

Ajit Dalvi