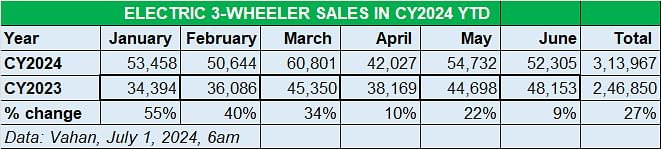

Electric 3-wheeler sales rise 27% in first-half 2024 to 314,000 units

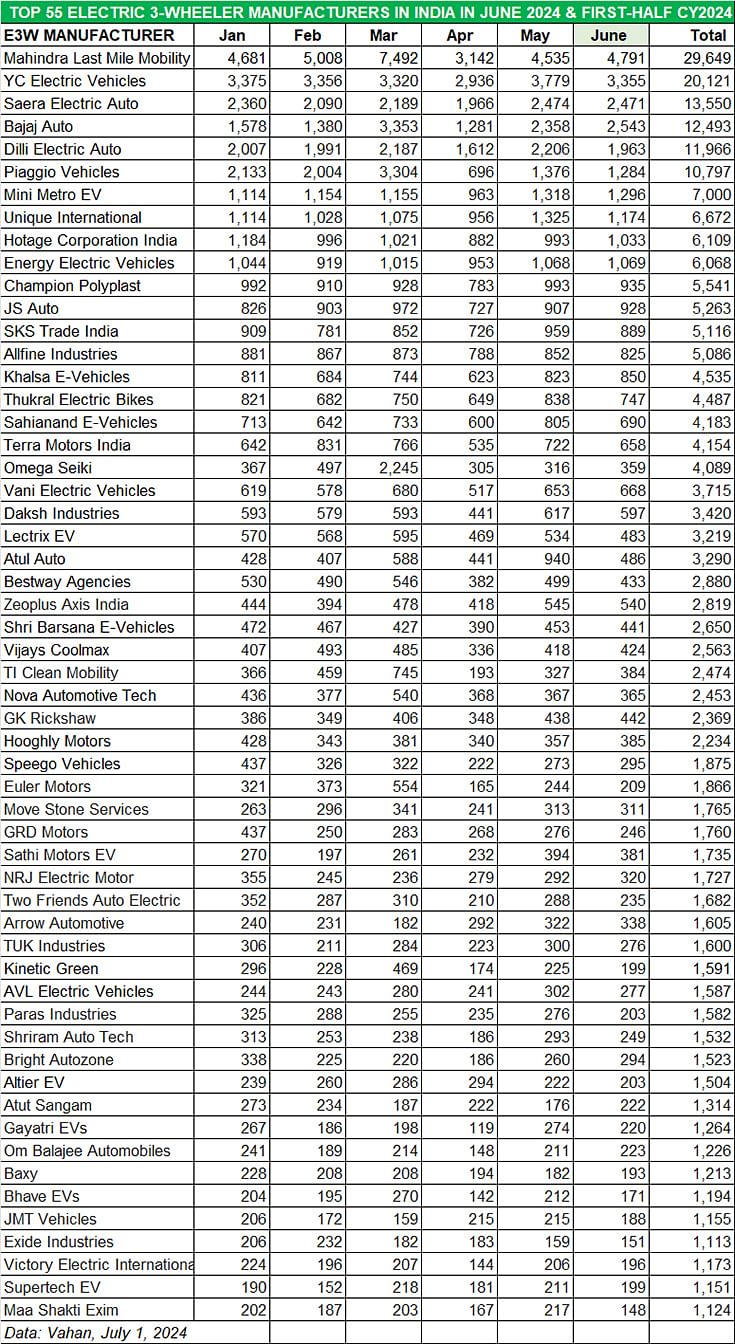

Demand for zero-emission passenger and cargo three-wheelers continues to grow at a rapid pace. January-June 2024 retails are 54% of CY2023’s record sales and will surpass the 600,000 milestone for the first time year. Mahindra Last Mile Mobility with 29,649 units leads with a 9% market share, followed by YC Electric, Saera Auto and Bajaj Auto.

The electric three-wheeler industry continues to pump up the volumes in the current year. As per retail sales data on the Vahan website (as of July 1, 2024), this segment of the EV industry has sold a total of 313,967 units, which constitutes 54% of CY2023’s record sales of 583,717 units. Annual sales in CY2022 were 350,557 units.

Like the e-two-wheeler industry, e-three-wheeler OEMs have been impacted by the now-reduced subsidy which has a number of OEMs increase product prices. While this can somewhat dampen demand, the wallet-friendly long-term USP of an EV remains a draw in the electric three-wheeler segment, which has seen the fastest transition to e-mobility amongst all vehicle segments.

A look at the past six months’ retails shows that the FAME II subsidy scheme-ending month of March 2024 delivered the highest numbers: 60,801 units. Nevertheless, the monthly average for H1 2024 at 52,327 units is a good 11,186 units above the H1 2023 monthly average.

Average monthly sales in H1 2024 were 52,327 units. The industry is well on its way to surpass the 600,000 milestone for the first time in a calendar year.

Average monthly sales in H1 2024 were 52,327 units. The industry is well on its way to surpass the 600,000 milestone for the first time in a calendar year.

The new Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category).

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. The retail sales data table above indicates the growth trajectory for the ongoing fiscal year.

Mahindra & Mahindra drives towards record sales

Of the 500 players in the fray, Mahindra Last Mile Mobility continues to be unassailable market leader. In the first six months of CY2024, the company has sold a total of 29,649 units, which makes for a YoY increase of 28% (January-June 2024: 23,214 units). This gives it a 9.44% share of the e-three-wheeler market and positions it comfortably ahead of the competition. The company has averaged monthly sales of 4,941 units, surpassing the 4,500 sales mark in five of the past six months.

MLLM, which sold a total of 54,599 units in CY2023, has already achieved 54% of that in first-half 2024, and is headed for record sales this year.

MLMM, whose portfolio includes the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo catering to multiple mobility operations, continues to gain from growing demand for its Treo Plus and e-Alfa Super passenger and cargo variants. To ensure sustained supplies to meet growing demand for its portfolio, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

YC Electric Vehicles has sold 20,121 units in January-June 2024, up 14% YoY (H1 2023: 17,639 units). The company’s H1 2024 sales are 49% of its total CY2023 sales of 40,788 units. YC Electric continues to witness sustained demand for its five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC EV.

At No. 3 is Saera Electric Auto with 13,550 units in the first six months of this year, up 12% on year-ago retails of 12,116 units.

Bajaj Auto, which had entered the electric three-wheeler market in June 2023, has registered retail sales of 12,493 units in the January-June 2024 period. This gives the company a 4% share of the total industry’s 313,967 units sold in H1 2024. The Pune-based auto major, which is the IC engine three-wheeler market leader, has two products on sale – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0.

The company’s sales spike is reflected in its rate of growth. In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13. Thirteen months down the line, it is now No. 4. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to achieve higher numbers.

Dilli Electric Auto maintains its fifth position on the OEM ladderboard with 11,966 units, up by just 0.55% YoY (H1 2023: 11,035 units).

Italian major Piaggio Vehicles has clocked retail sales of 10,797 units in H1 2024, which is a smart increase of 28% YoY (H1 2023: 8,452 units). The company is benefiting from its new models and aggressive network expansion. The Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra. On May 1, it launched a battery subscription model for its Apé Elektrik three-wheeler in 30 cities across India in an effort to simplify ownership and eliminate upfront battery costs.

3Ws: Fastest shift to electric mobility

Total retail sales of three-wheelers across multiple fuels – petrol, diesel, CNG, LPG and electric – between January 1 and June 30, 2024 were 574,267 units. Of this zero-emission electric three-wheelers accounted for 313,967 units, which makes for a 55% share compared to CNG (30% – 173,323 units), diesel (11% – 64,730 units) or petrol (1% – 6,934 units).

This effectively means that the e-three-industry continues to maintain its position as the fastest amongst all vehicle segments on making the transition to e-mobility, with every second three-wheeler sold in India being electric.

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

01 Jul 2024

01 Jul 2024

22541 Views

22541 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi