Cash crunch hits auto sales, November numbers down 5.48%

The move to demonetise Rs 500 and Rs 1,000 currency notes exactly a month ago has seen strapped-for-cash customers, particularly in rural India, and buyers in urban India delay purchase decisions including those for new vehicles.

Just as automakers in India had feared, the government’s demonetisation strategy, implemented from November 8, has had its impact on vehicle sales, which indicate a slowdown across segments.

The move to demonetise Rs 500 and Rs 1,000 currency notes exactly a month ago has seen strapped-for-cash customers, particularly in rural India, and buyers in urban India delay purchase decisions including those for new vehicles.

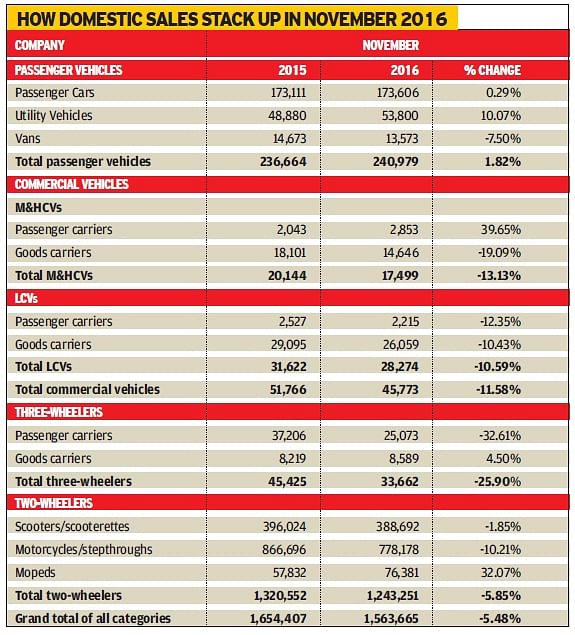

As per the November 2016 sales numbers released today by apex industry body, the Society of Indian Automobile Manufacturers (SIAM), overall vehicle sales have slipped into negative territory after 15 months of continuous growth. Also, considering these are wholesale numbers of vehicles supplied by OEMs to their dealers across the country, the real-world retail story could show even poorer sales.

It was in August 2015 that the Indian auto industry had last seen a year-on-year growth decline (-2.07). Overall November 2016 sales numbers at 1,563,665 units are down 5.48 percent year on year. The slowdown in sales is being felt across all the vehicle segments. However, industry body SIAM says November sales have been “temporarily disrupted due to demonetisation,” which indicates that it is hopeful consumers will begin the buying habit sooner rather than later.

The passenger vehicle (PV) segment is the only one which has kept its head above water. At 240,979 units sold in November 2016, the segment posted marginal YoY growth of 1.82 percent. While passenger car sales were flat at 0.29 percent, UVs saved the day with sales of 53,800 units (+10.07%), while van sales were down to 13,573 units (-7.50%).

The vital commercial vehicle (CV) segment, which was just about beginning to accelerate at the end of October, has seen an 11.58 percent decline in numbers. Overall CV sales were 45,773 units, comprising 17,499 M&HCVs (-13.13%) and 28,274 LCVs (-10.59%).

The three-wheeler sector is also down. November 2016 sales were a total of 33,662 units (-25.90%).

The two-wheeler sector, it seems, is bearing the brunt of the demonetisation impact, what with sales from rural India sharply slowing down. In November 2016, total two-wheeler sales were 1,243,251 units, down 5.85 percent YoY.

What is significant is that scooter sales, which have had a surging and continuous run of growth for over two years now, have fallen to 388,692 units (-1.85%). Demand for motorcycles was also down last month, with sales of 778,178 units (-10.21%).

With slowing sales of scooters – which have proved to be a buffer to slackening motorcycle sales –two-wheeler industry CEOs will be a worried lot.

Nevertheless, there is always a bright side to the story – those in the market to buy a new vehicle could never have had it better, considering OEMs will be offering discounts aplenty to reduce inventory levels.

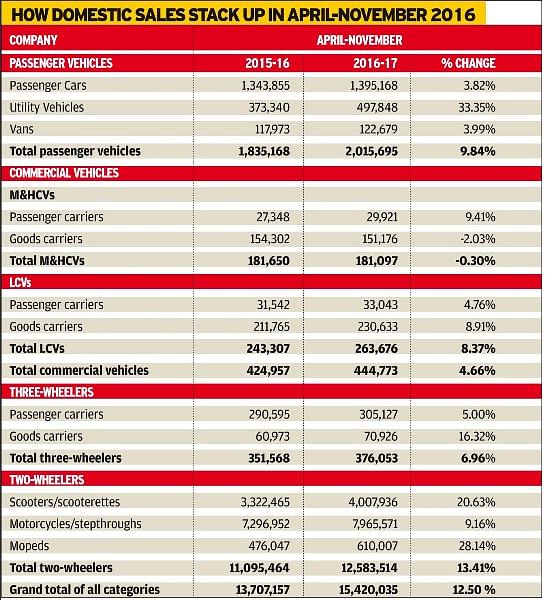

How April-November 2016 sales stack up

The overall good showing of industry in the first seven months of FY2017 has helped stave off the poor November numbers. Nevertheless, industry pundits are of the opinion that it will take a quarter or two more for the country to weather the full impact of the demonitisation strategy. Till then, vehicle manufacturers will be keeping their fingers firmly crossed, hoping that customer footfalls increase and more customer enquiries turn into sales.

In the eight-month April-November 2016 period, PV sales rose 9.84 percent, with passenger cars, utility vehicles and vans growing by 3.82 percent, 33.35 percent and 3.99 percent respectively year on year.

The overall CV segment registered a growth of 4.66 percent in April-November 2016. While Medium & Heavy Commercial Vehicle (M&HCV) sales declined by (-) 0.30 percent, Light Commercial Vehicle numbers grew by 8.37 percent during April-November 2016 over the same period last year.

Three-wheeler sales grew by 6.96 percent in April-November 2016; passenger and goods carrier sales grew by 5.00 percent and 16.32 percent respectively.

Two-wheelers sales registered a growth at 13.41 percent during April-November 2016 over April-November 2015. Within the segment, scooters, motorcycles and mopeds grew by 20.63 percent, 9.16 percent and 28.14 percent respectively in April-November 2016 over April- November 2015.

Also read:

- Passenger Vehicles sales hit 55-month high in October

- Scooter sales decline in November after 44 months of growth

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

By Ajit Dalvi

By Ajit Dalvi

08 Dec 2016

08 Dec 2016

8924 Views

8924 Views

Autocar Professional Bureau

Autocar Professional Bureau