INDIA SALES ANALYSIS: NOVEMBER 2016

Just when vehicle sales across segments were beginning to accelerate, the demonetisation of old currency has come as a speedbreaker. Showroom footfalls have reduced and retail sales across vehicle segments are slowing down.

Just when India’s automobile sector spanning passenger cars, SUVs, two- and three-wheelers, and commercial vehicles, was beginning to accelerate, it came across a speedbreaker in the form of demonetisation on November 8.

Since then, the government’s ban on old currency notes of Rs 500 and Rs 1,000, aimed at taking out 86% of the currency in circulation in the country, slow issuance of new currency notes and their lack of widespread availability has dampened market sentiment substantially. The impact is being felt not only in the automotive sector but also across many others including FMCG and e-retailing. Footfalls in vehicle showrooms have reduced considerably and the enquiries that come in are not translating into sales. In the coming days, automakers will look to realign production schedules to deal with slower supplies to dealers.

The Federation of Automobile Dealers Associations (FADA) has said that the entire auto retail trade has come under severe stress and has urged vehicle manufacturers to reduce inventory at dealerships which are saddled with stock.

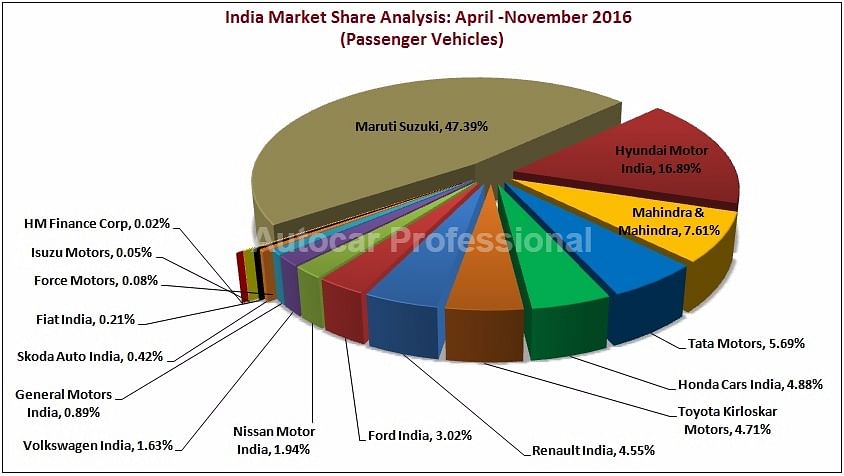

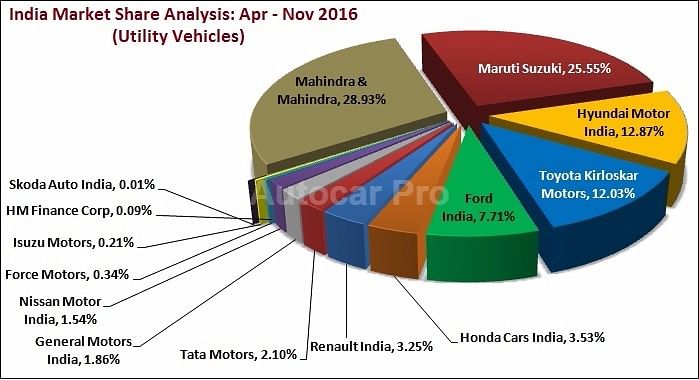

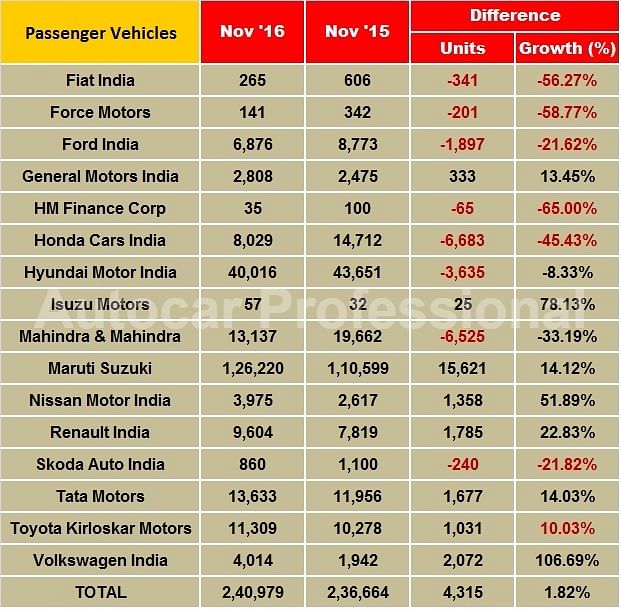

Among the carmakers, companies like Maruti Suzuki India and Toyota Kirloskar Motor, which are seeing handsome demand and waiting periods for some high-selling models, November sales have shown good growth. That’s because they have had a sizeable number of advance bookings in hand. In comparison, UV manufacturer Mahindra & Mahindra, which sees a substantial number of its sales come in from rural India, has seen a sizeable drop in its November sales numbers.

It’s early days yet and overall November 2016 sales numbers may not reflect the real impact of the demonetisation exercise, since the month had opened up in the Diwali festive season which is when most new vehicle buyers take deliveries. Expect automakers to take a relook at their growth forecasts for the fiscal as industry pundits believe it will take a quarter or more before normalcy returns to the retail automobile sector. Here’s looking at how some of the sales numbers OEMs have announced for November 2016.

Maruti Suzuki India has announced sales of 135,550 units in November 2016, up 12.2% year on year (November 2015: 120,824). This includes 126,325 units in the domestic market (+14%) and 9,225 units of exports (-9.8%).

Industry observers had felt the demonetisation exercise would impact India’s largest passenger vehicle manufacturer. However, consumer demand for Marutis seems to be still strong. Nevertheless, the real impact of the demonetisation strategy will be seen in total December sales considering the first few days of November would have seen passenger vehicle deliveries during the Diwali festival.

Demand bounces back

In October 2016, SUV sales had saved the blushes for Maruti Suzuki, which saw marginal sales growth of 2.2% with total domestic sales of 123,764 units (October 2015: 121,063). But demand for Maruti Suzuki cars seems to have bounced back. The company, which is experiencing a manufacturing capacity crunch at its Gurgaon and Manesar plants as well as growing competition from rival products, with attractive discounts on offer, is understood to have rejigged production for slow-selling models to accommodate demand for high-selling products like the very popular Baleno hatchback and the Vitara Brezza compact SUV.

In November 2016, the entry level duo of the Alto and Wagon R sold a total of 38,886 units, up 8.1% year on year (November 2015: 35,981). The Swift/Ritz/Celerio/Baleno/Dzire quintet sold a total of 49,431 units last month, 10.8% (November 2015: 44.626). Demand for the Dzire Tour taxi was down at 3,017 units, down 10.3% (November 2015: 3,363). Sales of the premium Ciaz sedan dipped marginally with 5,433 cars going home to new buyers (November 2015: 5,509), down 1.4% YoY. Overall, the company’s passenger cars sold a total of 96,767 units, up 8.1% year on year (November 2015: 89,479).

What is giving overall Maruti sales a boost is the consistent and surging demand for the Vitara Brezza which, along with the Gypsy, Ertiga and S-Cross, sold 17,215 units last month, a handsome 98% year-on-year increase (November 2015: 8,688).

For the eight-month April-November 2016 period, the carmaker has sold a total of 127,182 UVs, which is a staggering 132% YoY growth. The key contributor to this increase is the Vitara Brezza which, since its launch in early March 2016, has sold a total of 66,478 units till end-October. Expect November to have added over 10,000 units to this tally.

Meanwhile, the Super Carry LCV, which was launched on September 1, sold 105 units in November, taking its total tally in April-November 2016 to 268 units.

Hyundai Motor India registered domestic sales of 40,016 units in November 2016, down 8% compared to the same month last year when it sold 43,651 units. Hyundai which is the country's largest passenger car exporter shiiped 17,077 unit in November.

Mahindra & Mahindra (M&M) has reported sales of 13,217 passenger vehicles (which includes UVs, cars and vans) in November 2016, down by 32.78% year on year (November 2015: 19,662).

Demand from the rural India market, which accounts for a sizeable number of Mahindra vehicle sales every month, has dropped sharply due to the demonetization move.

Commenting on the November numbers, Pravin Shah, president and chief executive (Automotive), M&M, said: “While we expected an improved auto industry performance on the back of the festive season and other positive parameters such as rural demand and interest rates softening, the sudden announcement of demonetisation has brought in an immediate disruption and uncertainty. While it is a good and welcome step in the mid- to long-term, this has dampened overall sentiments leading to postponed buying and resulting in a major drop in volumes during November. This is significant as the automotive industry had just started experiencing stability after a long and tough period of uncertainty.”

He added, "We at Mahindra are working with our network partners and customers by extending necessary help and support to minimise the challenges currently being experienced.”

Meanwhile, Tata Motors passenger vehicles recorded sales at 12,736 units in the domestic market in November 2016, with a growth of 22% compared to 10,470 units sold in the same month last year.

The passenger car sales continued its growth momentum with a growth of 26% due to strong demand for the Tata Tiago.

Cumulative sales growth of all passenger vehicles in the domestic market, were 101,712 units, up 16% compared to 87,935 units in November 2015.

Toyota Kirloskar Motor sold a total of 11,309 units in the domestic market in November 2016, up 10% YoY (November 2015: 10,278). The company also exported 1,284 units of the Etios series in November 2016 compared to 1,110 units in November 2015.

Commenting on the monthly sales, N Raja, director and senior VP (Sales & Marketing), Toyota Kirloskar Motor, said: “November has been a very exciting month for us as we launched the all- new Fortuner. We are overwhelmed by the response it has received – over 6,200 bookings already. We have shipped close to 2,500 units of the new Fortuner to our dealerships across the country. The sale of the new Fortuner has almost doubled this month when compared to the same period last year.

“The Innova Crysta and the Platinum Etios have also done really well with the Crysta clocking more than 50,000 units in just six months of its launch in India. However, demonetisation has had its impact on our sales as it has affected customer walk-ins at dealerships, order bookings and timely deliveries. This will pose as a major challenge in the upcoming days as customers are still dealing with the effects of demonetisation. To assist customers during this phase, we have introduced various cashless schemes like 100% on-road funding, payments through E-Wallet and PayTM to ensure smooth and hassle-free buying experiences.”

Honda Cars India has announced domestic wholesales of 8,029 units in November 2016, down 45.43% YoY (November 2015: 14,712).

The City sedan was the company’s bestseller with 2,658 units, followed by the Jazz witgh 2,655 units and the Amaze with 1,971 units. Of the two SUVs, the BR-V sold 419 units and the CR-V 21 units. While the Brio went home to 202 buyers, the Mobilio MPV saw 101 units being sold last month. The recently launched Accord Hybrid sold 2 units.

Commenting on the sales performance, Yoichiro Ueno, president and CEO, Honda Cars India, said, “November saw major disruptions in the market due to the ongoing effects of demonetisation and the cash crunch. The consumer sentiment was low and footfalls and enquiries at the dealerships also slowed down during the month. We have taken several constructive steps to neutralise the impact of demonetisation, which includes squeezing the wholesales to avoid stock piling up at the dealerships. We believe that the situation will normalise in the near future and our sales performance will improve accordingly.”

Meanwhile, German carmaker Volkswagen sold 4,014 units in the Indian market in November 2016as compared to 1,942 units sold in the corresponding month of the previous year, up 107% YoY.

Michael Mayer, director, Volkswagen Passenger Cars India commented, "We have witnessed an encouraging growth with our November sales welcoming new members to the Volkswagen family. Earlier this year, we launched the Ameo and were positive that the vehicle would succeed in drawing car buyers' attention and it has lived up to our expectations."

Volkswagen attributes majority of its growth to the increasing sales of the Ameo. Also, the carmaker recently announced the introduction of ABS and dual airbags as standard fitments across its model range in India.

Commenting on the industry’s outlook, Abdul Majeed, partner, Price Waterhouse said, "Demonetisation will have significant negative impact at least in the next two to three months across the board in the automotive sector, especially two-wheelers, SUVs, luxury vehicles and commercial vehicles. What measures the government will take next to push economic growth will be the key for the automotive sector’s growth. November 2016 wholesale numbers will not reflect on-ground retail sales; OEMs who have a waiting period for successful models will not be impacted significantly in the short term.”

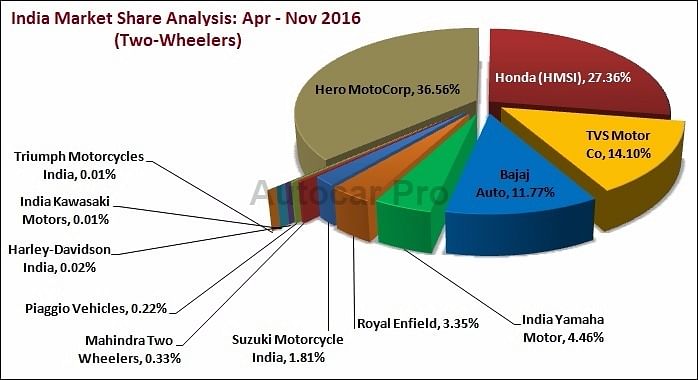

Cash crunch adds to year-end woes for 2-wheeler OEMs

Like the passenger and commercial vehicle sector, the cash crunch has hit the two-wheeler sector as well. The 12 OEMs which provide their production and sales data to SIAM have jointly reported total sales of 12,43,251 units, which marks a YoY decline of 5.85 percent.

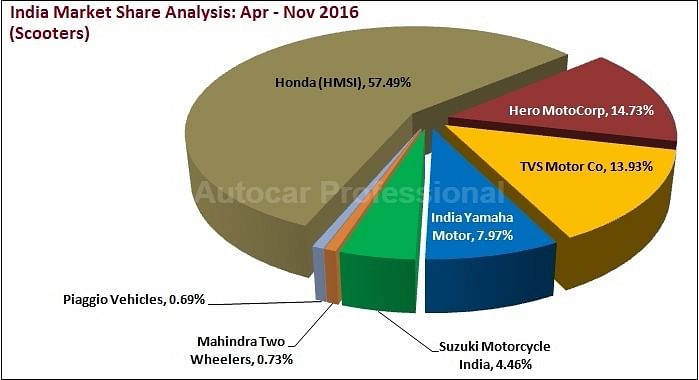

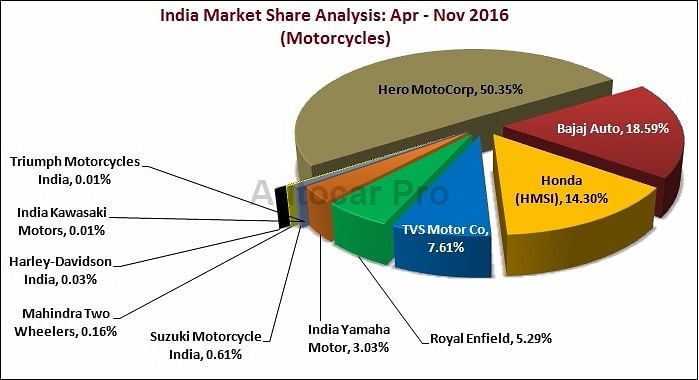

In November, seven out of 12 OEMs reported a YoY drop including three of the big four – Hero MotoCorp, Honda Motorcycle & Scooter India, Bajaj Auto and TVS Motor Co – that together command a market share of more than 90 percent.

While it’s no surprise that Hero MotoCorp, the largest two-wheeler company, registered the sharpest drop in terms of YoY sales volumes in November, TVS Motor Co managed to avoid the decline by reporting flat growth (in overall two-wheeler business) of 0.53 percent YoY. This, interestingly, can be attributed to the spurt in the sales of its mopeds.

At the other end of the market, global brands such as Harley-Davidson India, Triumph Motorcycles India and India Kawasaki Motors have also been impacted by the government’s move to crack down on the unaccounted cash flow in the economy.

Hero MotoCorp, the bellwether of the Indian two-wheeler industry, registered a decline of 13.02 percent YoY, reporting total domestic sales of 468,119 units in November 2016 (November 2015: 538,180).

Last month, the company unveiled a 125cc commuter motorcycle, specifically designed and developed for the African markets, Dawn 125 at the EICMA Motorcycle Show in Milan.

Bajaj Auto clocked total domestic sales of 139,765 units, down by 8.45 percent YoY (November 2015: 152,663). The company has strategically timed the launch of its Dominar 400 on December 15 ensuring that it banks upon the initial booking numbers in a conventionally lean month.

Honda Motorcycle & Scooter India (HMSI) closed the month with total domestic sales of 299,414 units, down by 4.02 percent YoY. (Nov 2015: 311,946 units).

Disclosing how Honda managed to put a check on its declining sales volumes after the note ban, Y S Guleria, senior vice-president, sales and marketing, HMSI, said: “Compared to festival buying in November last year, this year the industry was prepared for an organic correction in November. However, the demonetisation announcement took everyone with surprise. Two-wheeler sales dropped by 50 percent in the first 3-4 days of announcement. But recovery started in the second week, and by the end of the month, Honda’s all India sales returned to almost 80 percent of normal levels with South, West and East (regions) leading the recovery.”

Deploying a clever strategy, the HMSI management increased its focus on export orders and upgraded the point of sale network with online payment gateways. This, according to the company, resulted into quick containment of sharply falling sales.

Bucking the trend of declining numbers, No. 3 player, TVS Motor Company, posted total domestic two-wheeler sales of 191,499 units leading to flat growth of 0.53 percent YoY (November 2015: 190,490 units). The most affordable two-wheeler model(s) from TVS’s stable – the mopeds, which are mainly purchased by local, small-time businessmen – saw sales spurt in mopeds, thereby providing a buffer to overall numbers. However, TVS scooter and motorcycle sales were impacted negatively. While scooter sales fell 2.73 percent YoY to 69,759 units, motorcycle numbers fell 25.57 percent to 45,359 units. Moped sales, in comparison, were up 32.07 percent YoY to 76,381 units.

Royal Enfield registered total sales of 55,843 units, up by 38.53 percent. (Nov 2015: 40,312 units). However, it is understood that the growth in this context is the result of pre-bookings for models carrying waiting periods. Commenting on the sales performance, Rudratej Singh, President, Royal Enfield said "RE continues its momentum by registering a monthly growth of 41 percent (including exports) over November 2015. Even in this month we have added to our already robust order book.”

India Yamaha Motor reported total domestic sales of 51,106 units, up by 19.64 percent YoY (Nov 2015: 42,718 units). The company, which is riding on the growth of its scooter portfolio, witnessed a relative decline in its domestic dispatches for November 2016 as compared to October 2016.

Suzuki Motorcycle India (SMIL) reported total domestic sales of 30,826 units in November 2016, up by 31.94 percent YoY (Nov 2015: 23,364 units). Piaggio Vehicles, on the other hand, clocked total sales of 4,643 units, up by 101.43 percent YoY (Nov 2015: 2,305 units). Suzuki and Piaggio are clear examples of how the growing demand for scooters is driving their local business units. While Suzuki’s growth is strongly backed by the new Access 125, the Aprilia SR 150 is pulling up the numbers for Piaggio Vehicles.

Although December traditionally remains a lean month from sales perspective, it would be interesting to note how Bajaj Auto will perform after rolling out its much-awaited Dominar 400, and subsequent developments in the industry.

Commercial Vehicles drive into the slow lane

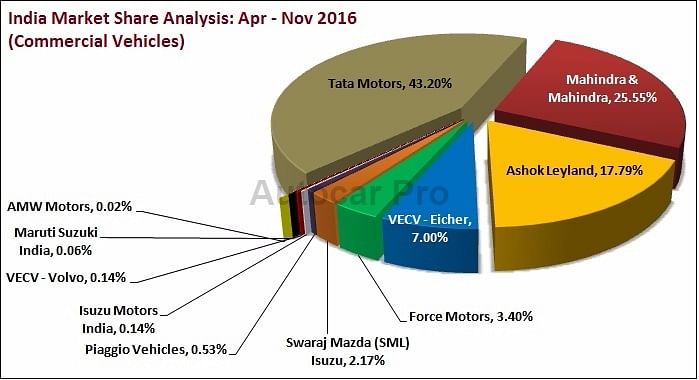

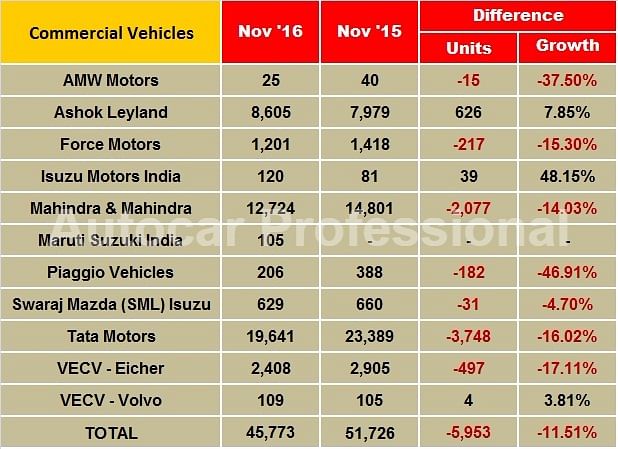

The impact of demonetisation, which has implications for the overall Indian economy, has already had an impact on the commercial vehicle sector. Other than Ashok Leyland, all manufacturers across segments have registered negative sales in November.

The CV industry, after a brief three months of low sales, had bounced back in October with M&HCVs registering considerable gains. It was expected that the industry will maintain the forecasted growth curve to close the fiscal year on a positive note. Now that forecast seems a little too promising since overall trucks sales are down as also sales in the LCV segment, which was experiencing good growth, have declined sharply in the month.

Ratings agency ICRA has predicted that the Indian government’s two-week-old demonetisation move and the resultant cash crunch is gradually having its impact on the automobile industry across the passenger vehicle, two-wheeler and the commercial vehicle sectors. Demonetisation will impact CV sales in the near-term as fleet operators are likely to put new vehicle purchases on hold, it said.

According to ICRA, “Despite high financing penetration in the CV space, the impact of tight liquidity is likely to cripple the road logistics sector in the near-term and would prompt the transport community to put their vehicle replacement or addition plans on the back burner.”

ICRA’s channel check with various stakeholders in the logistics sector including road transporters, CV dealers and Non-Banking Finance Companies (NBFCs) suggests that although it is too early to assess the full downside, the impact of the liquidity crunch has already resulted in a near-term drop in demand for trucks. Availability of trucks, especially from market-load operators, has also reduced significantly due to limited availability of cash to meet trip expenses. CV financiers also reveals that proportion of cash collections have also dwindled over the last 10 days.

Talking to a business newspaper, Ravi Pisharody, head of commercial vehicles business, Tata Motors, the market leader in the domestic market, admitted that the number of enquiries to buy new trucks almost disappeared, but he is confident that demonetisation will be a “distant memory” in the next six months when the government starts spending on infrastructure.

“There is a lot of uncertainty because the pipeline is not moving at all. After Diwali, we had an upbeat situation, but things haven't moved since then. Potential buyers have furnished documents to purchase vehicles and given them to financiers, but they have not closed the deals,” the newspaper quoted Pisharody.

Bus sales remain intact

According to ICRA, the impact of demonetisation on buses is likely to be lower due to the higher share of institutional client base. Among the three segments of the CV industry, ICRA believes that the bus segment would be the least impacted by the demonetisation move in the near-term owing to a higher proportion of sales to institutional clients (i.e. SRTUs, schools and colleges, and travel operators).

For instance, SRTUs, which account for a majority of bus sales in India, typically place orders in advance and take deliveries over 6-12 months. Likewise, the demand for school and college segment is also unlikely to be impacted in the short-term as most of the sales take place between February-June.

Unmoving freight rates

ICRA also suggests that freight rates have not moved in line with recovery in diesel prices due to low cargo availability. As a result of low demand from key sectors, freight rates have also not kept pace with the increase in diesel prices over the past 4-6 months. For instance, since April 2016, diesel prices have recovered by 16%, while freight rates have increased by only 3-4%.

The Index of Road Freight (RFI) indicates a marginal increase in freight rates during this period. As a result of higher diesel cost, the profitability of fleet operators has also come under pressure on a sequential basis. However, in comparison to the past couple of years, the current situation in much better.

Yet, freight rates on select routes have risen by 7-9% owing to increase in diesel prices and festive season. North-India bound freight rates have increased, while other regions, especially East & South have seen easing.

How the CV makers have fared in November

Barring Ashok Leyland, all the OEMs’ November sales numbers reveal sharp declines in their overall CV sales as the smartly growing LCV sector has also come under pressure and registered negative sales.

After registering its highest sales of 2016 in October, Tata Motors' overall CV sales plunged by over 17%. The company sold 20,538 CVs in the domestic market in November 2016 (November 2015: 24,828 units.) After a strong recovery in both the M&HCV and LCV segments registered a drop in November. Sales of Tata Motors’ light and small commercial vehicles dropped by 13% over November 2015 last year. The bus segment reported a growth of 60%, even as MH&ICV cargo sales on a much larger base, saw a drop of 28%, with long haul cargo operators being severely affected by the cash crunch and deferring purchases. However, the construction segment continued to grow strongly by 46%, thereby maintaining a robust cumulative growth of 30% for the year.

Following October’s strong double-digit growth Ashok Leyland’s total sales saw just 7% YoY growth with sales of 9,574 units (November 2015: 8,971 units). Holding onto October’s momentum, its M&HCV sales remained positive and were up by 10% with sales of 6,928 units (November 2015: 6,297 units). LCV sales though grew by just 1% with sales of 2,646 units (November 2015: 2,674 units).

Mahindra & Mahindra’s total CV numbers dropped significantly by 15% with sales of 12,644 units (November 2015: 14,801 units). Its M&HCVs continue to be negative zone, down by 22%, with sales of 356 units (November 2015: 454 units). The below-3.5T GVW products declined by 16% with sales of 11,837 units (November 2015: 14,014 units), while those in the above-3.5T GVW segment were the only segment which has witnessed growth of impressive 35% YoY with sales of 451 units (November 2015: 333 units).

VE Commercial Vehicles also not been able to hold on its growth momentum as its domestic sales declined by 17.1% with total domestic sales of 2,408 units in the domestic market (November 2015: 2,905 units).

Recommended:

- Domestic sales down 5.48% in November as demonetisation dampens buying sentiment

- Scooter sales decline in November after 44 months of growth

RELATED ARTICLES

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

By Autocar Professional Bureau

By Autocar Professional Bureau

02 Dec 2016

02 Dec 2016

30829 Views

30829 Views