CV sales remain flat in November, OEMs await India's economic recovery

CV industry sees muted growth over post-festive season commercial vehicle sales plunge back in red.

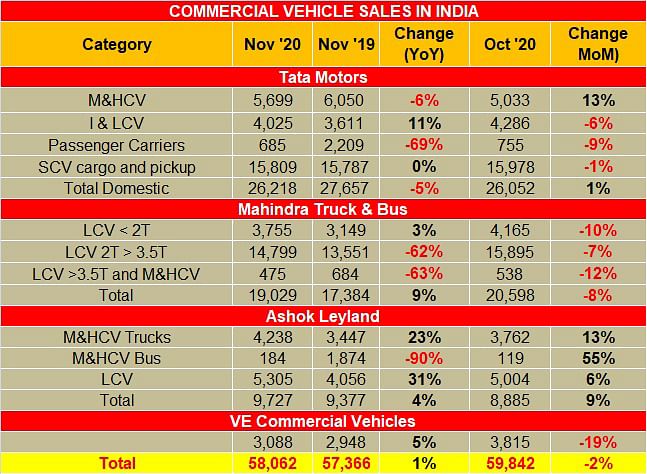

The commercial vehicle industry has now again plunged back in red after witnessing a few months of growth. In November, overall wholesales comprised 58,062 units, a growth of 1 percent over the same period last year, but registered a 2 percent drop over October.

The extended festive period in November was expected to drive momentum for the beleaguered commercial vehicle industry, but weak economic activities coupled with financial constraints led to many customers deferring their purchase decision.

In terms of sales, Tata Motors has regained its leadership with sales of 26,218 units in November, which is 5 percent lower than what it sold for the same period last year, but just a percentage higher over October 2020. Despite a significant drop in passenger carriers sales, the company saw demand for I&LCV picking up.

Mahindra & Mahindra reportedly sold 19,029 CVs, which is 9 percent higher YoY, but 8 percent lower compared to the previous month. Commenting on the performance Veejay Nakra, CEO – Automotive Division, Mahindra & Mahindra said: “We have witnessed double-digit growth in pick-ups. Our small commercial vehicle brands Bolero Pik Up, Supro and Jeeto continue to see strong demand in both rural and urban markets.”

On the other hand, Ashok Leyland saw a robust demand for its M&HCV trucks and LCV segment both witnessing double-digit growth. The company reported overall CV sales of 9,727 units (4% YoY), compared to 9,377 units for the same period last year. Interestingly, Ashok Leyland was the only OEM to witness positive monthly growth across segments.

Chennai-based Volvo Eicher Commercial Vehicles (VECV) reported sales of 3,088 units, which is 5 percent higher YoY, but a drop of 19 percent over the month of October.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Dec 2020

01 Dec 2020

8816 Views

8816 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal