CV makers record double-digit growth, cross million sales for the first time in FY2019

With cumulative sales of 1,001,623 units from six OEMs, India’s CV industry clocks best-ever fiscal sales and crosses the million-unit milestone for the first time.

Despite FY2019 being an iffy fiscal year, full of ups and downs (with more of the latter), the commercial vehicle industry in India has come out with flying colours in the domestic market. That’s because CV OEMs have crossed the million-unit (10 lakh) sales milestone for the first time in a fiscal.

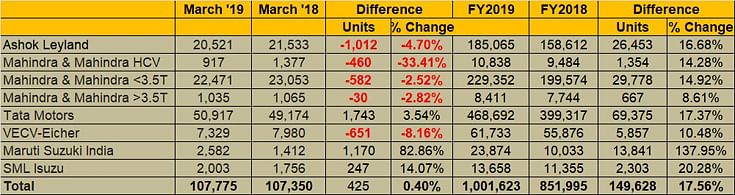

In FY2018, the CV industry sold a total of 856,453 units, which marked 19.94 percent year-on-year growth, and best-ever sales in a fiscal. Now, as per Autocar Professional’s analysis, and given the sales data released by 6 manufacturers, India’s CV industry has done even better to not only post better overall numbers but also register double-digit growth for the second year in a row. At a cumulative 1,001,623 units, the 6 OEMs have helped the industry record near-18 percent YoY growth (see sales table below).

Ideally, the CV industry should have posted better numbers, given the cracking speed at which it was driving along in the first nine months of FY2019. However, like the passenger vehicle industry, it was impacted by slowing growth in the fourth quarter. The flat industry growth in the month of March 2019 (see detailed sales table below) is indicative of the tough Q4 FY2019.

The CV industry faced multiple headwinds during the year such as the revised axle-load norms, the NBFC crisis, slowing down of the economy and overall subdued movement of goods, rural market distress and lower-than- expected activity in the overall manufacturing sector. However, what helped overall numbers was the brisk traction in the first nine months of FY2019 along with a push by the government in infrastructure spend, affordable housing and irrigation projects, partial replacement demand and higher freight movement helped buffer the downturn.

The key beneficiaries from FY2019’s CV sales were tipper trucks and ICVs, with both segments seeing strong demand from the construction and e-commerce sectors, respectively. With infrastructure projects on the upswing, the tipper segment remained buoyant throughout the year and grew in double digits. Along with the M&HCV segments, SCVs too recorded good growth as a good monsoon, improved private consumption and strong support from replacement demand and continuous demand for higher mobility in rural areas drove demand.

According to CV industry leader Tata Motors, “The market continues to exhibit subdued demand on the back of the lingering effects of a liquidity crisis, lag effect of the implementation of revised axle load norms, a slowing economy and weak IIP growth index. The base effect is also playing a role in the muted growth of the CV industry with regard to H2 FY 18. Demand for M&HCV cargo trucks continues to be sluggish with the implementation of revised axle load norms. After the axle load norms implementation, the freight carrying capacity of M&HCV parc has increased by 20 percent, but the freight growth has not been able to absorb this increased capacity, resulting in lower demand for new trucks. The slowing economy, coupled with purchase deferrals during election season, has also contributed to subdued demand for M&HCV cargo trucks in recent months. However, the tipper segment, on the other hand, continued to grow, clocking 12 percent growth on the back of infrastructure development and affordable housing projects.”

How the OEMs fared in FY2019

Replicating FY2018’s double-digit performance, Tata Motors sold 468,692 units in FY2019, growing by a strong 17 percent YoY (FY2018: 3,99,317). Likewise, its M&HCV sales grew by a solid 12 percent at 151,105 (FY2018: 134,399).

For Tata, its I&LCV truck sales in the domestic market comprised 56,996 units, up a strong 23 percent (FY2018:46,321). This segment has not been impacted by the revised axle load norms, and the boom in the e-commerce segment and discretionary consumption also helped drive higher growth. The company’s SCV cargo and pickup sales totaled 206,393 units, marking strong growth of 24 percent (FY2018: 166,727). And sales in the the commercial passenger carrier segment (buses) were up 4 percent to 54,198 units (FY2018: 51,870).

Ashok Leyland, the second largest heavy truck maker and CV player in the country, had a remarkable year as it registered double-digit growth in FY2019 on the back on higher traction in its LCV business. The company sold 185,065 units in the domestic market (FY2018: 158,612 units). Its M&HCVs notched 13 percent growth with sales of 131,936 units (FY2018:116,534) and likewise its LCVs clocked healthy 26 percent YoY growth with 53,123 units sold (FY2018: 42,078).

Mahindra Truck & Bus' overall CV sales were up 15 percent in FY2019 to 248,601 units (FY2018: 216,802). The company, which has a strong presence in the LCV segment, is pushing hard to get a significant share of the profitable M&HCV segment with its Blazo and Furio range. In FY2019, the company has crossed the 10,000 units M&HCV sales mark segment by selling 10,838 units, up 14 percent YOY. M&M’s typically strong area –the below-3.5T GVW and above-3.5T GVW segments – grew 9 and 14 percent respectively with sales of 199,574 and 7,744 units in FY2019.

VE Commercial Vehicles, another player driving hard to grab M&HCV market share through its modern and varied range of Pro Series trucks in the haulage, tipper and tractor-trailer segments registered growth of 10.5 percent by selling 61,733 units (FY2018: 55,876).

Maruti Suzuki India, which has a single vehicle in the CV segment in the form of the Super Carry LCV, sold a total of 23,874 units in FY2019, which marks 138 percent YoY growth, albeit this is on a low year-ago base.

SML Isuzu, which is in the LCV segment, sold 13,658 units in FY2019, up 20 percent on the numbers a year ago.

FY2020 growth outlook

Ratings agency ICRA says the demand environment for commercial vehicles is likely to remain subdued in the near term, especially in the wake of upcoming general elections and a high year-ago base. However, likely pre-buying in early 2020 and a continued thrust on the infrastructure sector will drive recovery in the second half of FY2020. That would just what the CV OEMs will be hoping for, fingers firmly crossed.

Also read: Car majors report low single-digit growth in FY2019

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

02 Apr 2019

02 Apr 2019

25505 Views

25505 Views

Shahkar Abidi

Shahkar Abidi