Car majors report low single-digit growth in FY2019

Coming on the back of FY2018 when PV sales clocked 14% growth, it was felt FY2019 would make for an easy drive. But a combination of factors played spoilsport.

In the early months of FY2019 (April 2018-March 2019), it was felt that the new fiscal would be a record-breaking one with double-digit growth, coming as it did on the back of a robust FY2018. But the passenger vehicle (PV) industry's hopes were belied because the second and third quarters turned into sales speedbreakers. ,

OEM numbers were hugely impacted through a combination of high fuel prices right till November 2018, a massive liquidity crunch in NBFCs, which impacted sales in semi-urban India, a bundled long-term premium insurance regulation and, more recently, the run up to the general elections. What's more, in metros and urban India, shared mobility in the form of Uber and Ola are having an impact on new vehicle purchases.

Poor consumer sentiment essentially translated into tepid sales, particularly in Q4. Till end-February 2019, the PV segment had recorded 8 percent year-on-year growth, a figure captains of industry would be unhappy with. Given the sales numbers that the leading PV manufacturers have announced today, it is clear that the industry will end up with single-digit growth, a fact which will be known when apex body SIAM reveals the final data next week.

Nonetheless, not all is doom and gloom. FY2018 had closed with sales a tad short of the 25 million mark at 24,972,788 units, notching 14 percent YoY growth albeit on a low year-ago base in 2017 due to GST implementation. So, situation though poor, is still under control.

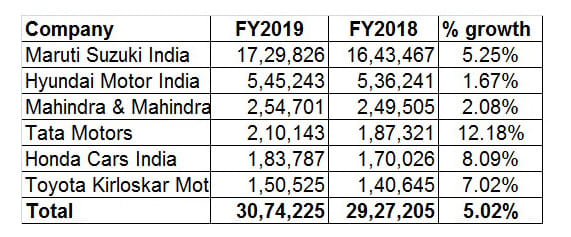

Let’s have a look at how some of the top OEMs fared in FY2019:

Maruti Suzuki India: The leader in the domestic passenger vehicle segment with an overall market share of over 51 percent, has sold a total of 1,729,826 units in FY2019, the fiscal year ended March 31, 2019. This marks 5.3 percent year-on-year growth (FY2018: 1,643,467).

Segment-wise, a big dampener came in the form of a sharp drop in demand for the entry level duo of the Alto and old Wagon R, whose sales of 368,990 units were down 13.6 percent on FY2018 (427,183). However, the six-car group of the new Wagon R, Ignis, Celerio, Swift, Baleno and Dzire made up for that with sales of 871,864 units, a smart growth of 16.5 percent (FY2018: 748,475). Consumer demand for the premium Ciaz sedan seems to be slowing – at 46,169, sales in FY2019 were down 21.6 percent on FY2018 (58,913).

On the utility vehicle front, thanks to continued demand for the No. 1 best-selling UV in the country – the Vitara Brezza – Maruti has clocked a 4.1 percent YoY increase in sales. The Brezza, along with the Ertiga MPV, Gypsy and S-Cross, sold a total of 264,197 units (FY2018: 253,759).

Hyundai Motor India: The country’s second largest car manufacturer, has reported its highest-ever domestic market sales in a fiscal. The Korean carmaker sold a total of 545,243 units, which points to 1.7 percent YoY growth (FY2018: 536,241 units).

Hyundai exported a total of 162,105 passenger vehicles in FY2019, which is a 5.3 percent YoY growth over FY2018's 153,943 units.

Mahindra & Mahindra: The UV specialist saw total sales of 254,701 units in FY2019, recording a growth of 2 percent (FY2018: 249,505). Even as it launched a slew of new UV products, its core domain remained absolutely flat in performance with UVs going home to 235,362 buyers (FY2018: 233,915), registering a growth of only 1 percent. Its cars and vans (including those sold from Mahindra Electric), however, observed a notable uptick of 24 percent with overall sales of 19,339 units (FY2018: 15,590).

Tata Motors: The home-grown manufacturer's Passenger Vehicles Business sales in the domestic market for FY2019 are the highest ever in the last six years at 210,143 units, a growth of 12 percent (FY2018: 187,321 units). The company has seen a smart uptick in its sales mainly due to demand for its new-generation cars like the Tiago, Tigor and SUVs like the Nexon, Hexa and more recently the Harrier. However, in March 2019, due to continued weak consumer sentiment, PV sales witnessed a drop of 12 percent at 17,810 units as compared with 20,266 units sold in March 2018.

Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, said, "As an eventful fiscal with multiple new product interventions comes to an end, we are happy to report the highest ever sales in the last six years, with a growth of 12 percenet in FY2019. March 2019 witnessed a challenging environment with the market being under immense stress. Despite this, our newly introduced SUV – the Harrier – has received an overwhelming response. Beginning the new fiscal with a fresh outlook, we promise to deliver the best to our customers."

Honda Cars India: The Japanese carmaker clocked annual domestic sales of 183,787 units in the fiscal recording a moderate growth of 8 percent over the last fiscal (FY2018: 170,026). In the month of March, the company recorded monthly domestic sales of 17,202 units, as compared to 13,574 units a year ago, registering a 27 percent growth.

According Rajesh Goel, senior vice-president and director, Sales and Marketing, Honda Cars India, "We have closed FY2019 with growth of 8 percent. Strong sales efforts from the dealers and company during the prevailing tough market scenario resulted in this growth rate, which is ahead of the industry. One of our growth drivers was the all-new Amaze. The launch of our global bestsellers Civic and CR-V reinforced Honda’s premium product line-up.” He further added. Bookings for the D1 segment sedan have surpassed the 2,400 unit mark, claims Honda.

Toyota Kirloskar Motor: The company has sold a total of 150,525 passenger vehicles in the past 12 months, marking a year-on-year growth of 7 percent (FY2018: 140,645 units). March 2019 numbers, at 12,818 units, are up 2 percent YoY (March 2018: 12,539).

According to the company, the popular Innova Crysta MPV has registered positive growth in FY2019 compared to FY2018. The Etios Liva hatchback has seen a YoY growth of 13 percent. Also, the recently launched new Camry Hybrid has received a good market response with a sales growth of 6 percent in the January to March 2019 period compared to the same period a year ago. Bookings for the eco-friendly sedan have crossed the 500 mark since its launch in January 2019.

Commenting on the sales performance, N. Raja, deputy managing director, Toyota Kirloskar Motor, said, “We are happy to have clocked a growth of 7 percent in domestic sales in FY2019. The Innova Crysta and Fortuner have been maintaining the growth trajectory and continue to be leaders in the segment."

With a weakened buyer sentiment being a prevalent trend around the time of general elections and a slightly dampened business environment, expect sales to regain their jive a quarter into the new fiscal. The industry should soon be firing back on all its cylinders.

Also read: CV makers record double-digit growth, cross million sales for the first time in FY2019

RELATED ARTICLES

Rolls-Royce CEO Holds Meeting with Indian Prime Minister in New Delhi

Prime Minister Modi welcomes aerospace company's plans to expand operations and collaborate with India's youth.

Mahindra Doubles Tractor Growth Forecast to 22-24% for the Fiscal

The upward revision comes on the back of a strong third quarter in which M&M reported a 23% jump in tractor volumes, sel...

Can Switch Mobility Build a Moat in India’s Cut‑Throat E‑Bus Market?

Ashok Leyland commands around 40% share in India’s bus market, and is using that base to push electrification.

01 Apr 2019

01 Apr 2019

9691 Views

9691 Views

Shristi Ohri

Shristi Ohri

Shahkar Abidi

Shahkar Abidi