Auto sales shine in May, 16-month scooter run slows

With all segments, other than two-wheelers, posting double-digit growth, India Auto Inc is poised for strong growth. But inventory issues with Hero and Honda and high petrol prices could be impacting scooter sales.

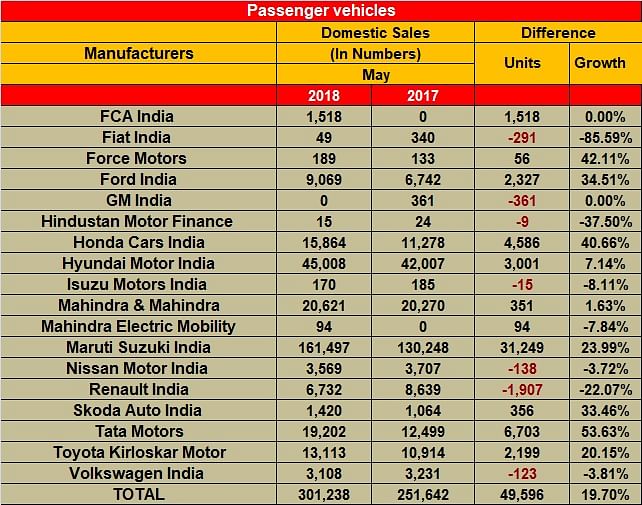

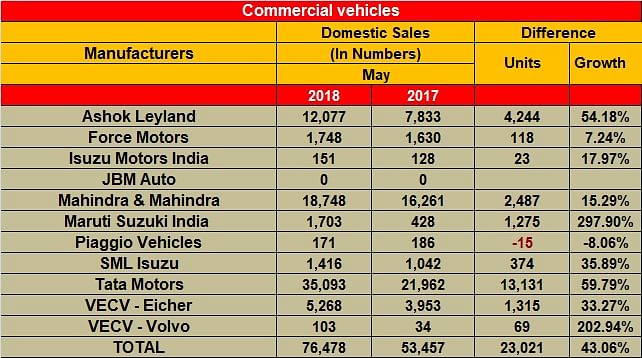

The hot Indian summer, even as it gives way to a bountiful monsoon, has shone on India Auto Inc what with overall sales numbers nearing the 2.3 million units mark. At 2,282,618 units sold last month, sales in May 2018 were a good 12.13 percent growth over the year-ago sales. All segments, other than two-wheelers, notched growth in double digits – passenger vehicles (301,238 / +19.65%), commercial vehicles (76,478 / + 43.06%), three-wheelers (54,809 / + 51.97%) and two-wheelers (1,850,093 / 9.19%).

What came as a sweet surprise though is the substantial recovery of passenger car and motorcycle sales, which over the past year or so have been overshadowed by UVs and scooters. While passenger cars cumulatively sold 199,479 units (+19.64%), motorcycles garnered overall sales of 1,221,559 units (+15.16%).

On the other hand, UV sales seem to have moderated at a growth rate of 17.53 percent, selling 82,086 units, scooters tripped registering de-growth of 1.40 percent, with overall sales of 555,467 units. This decline in scooter sales comes after consistent growth for a straight 15 months – scooters last saw de-growth of 14.50 percent in January 2017. It is understood that the decline is an outcome of inventory correction at some of the companies including Hero MotoCorp.

“With regard to passenger cars, while there was a lull in demand during May-June 2017 in anticipation of lower prices with the implementation of the GST regime from July 2017. A slew of new models launches are also giving a boost to passenger car sales. The numbers, however, will have to be monitored over the remaining part of the year to identify a clearer trend between passenger cars and UVs,” said Vishnu Mathur, director general, SIAM.

“Industry is performing consistently now. While there is growth in every segment, however, if we dive deeper into the company-wise sales, then there is inconsistency, especially with respect to the PV manufacturers,” Mathur added.

Within the CV space, goods carriers maintained their solid performance with total sales standing at 26,444 units (+94.81%) in the M&HCV category and 40,684 units (+27%) in the LCV category. Passenger carriers too recovered, with M&HCV passenger carriers selling 3,684 units (+17.25%) and LCV passenger carriers bringing in substantial growth with sale of 5,666 units (+20.40%).

“CVs have shown a very good growth and as we go along, we expect this growth to sustain itself because the high infrastructure spending due to upcoming elections, as well as a good monsoon, coming up,” said Mathur.

Maruti Suzuki India registered total sales of 161,497 units, posting notable growth of 24 percent on a year-on-year basis (May 2017: 130,248). Maruti’s growth could primarily be attributed to its range of compact cars, which includes the Swift, Baleno, Dzire, Celerio and the Ignis. These five cars collectively went home to 77,263 buyers, registering a remarkable growth of 50.8 percent (May 2017: 51,234).

Maruti's 20 millionth vehicle in India

Hyundai Motor India sold 45,008 units in May, growing by 7.14 percent (May 2017: 42,007). The Korean carmaker has been seeing consistent demand for its i20 hatchback and the Creta SUV, both of which now stand all refreshed and updated to tackle the rising competition in their respective segments.

The refreshed Creta from Hyundai

Mahindra & Mahindra (M&M) remained near-flat in its performance in the month, with overall PV sales notching 20,621units, up 1.63 percent (May 2017: 20,290). This is attributed to its primary sales, driven by its UVs, remaining flat at 19,295 units (May 2017: 19,331).

The newly launched Mahindra XUV 500

According to Rajan Wadhera, president, Automotive Sector, M&M, “May has relatively been a subdued month compared to April. At Mahindra, we have by and large maintained our growth momentum during the month of May 2018, especially in commercial vehicles. On the back of a buoyant economy, our M&HCV division continues to outperform. Exports have also been strong with a high growth. With the forecast of an upcoming normal monsoon we are confident of good growth in the coming months”.

Tata Motors seems to be going places and the company registered sales of 19,202 units in May 2018, a substantial increment of 53.63 percent (May 2017: 12,499). While the company saw continued demand for the Tiago hatchback and the Tigor compact sedan siblings, with cumulative sales of its passenger cars clocking 11,516 units and growing by 18 percent, UVs, on the other hand, brought in a substantial growth of 463 percent, with overall sales ticking at 5,973 units, primarily being driven by the Nexon and the Hexa.

Tata Motors is celebrating its group's 150th anniversary

Honda Cars India strongly recovered from a sharp slump in April to post robust sales, selling 15,864 units and growing a remarkable 41 percent (May 2017: 11,278).The main factor for this significant recovery is the commencement of dispatches of the new second-generation Amaze, which was launched on May 16 and sold 9,789 units in the month, the highest number any model has ever been able to individually clock in the Japanese carmaker’s portfolio.

According to Rajesh Goel, senior VP and director, Sales and Marketing, Honda Cars India, “We are delighted with the customer response to the all-new Amaze which has helped our overall sales grow by 41 percent in May 2018. The customers have appreciated the car for its one class-above offering of unmatched bold design, sophisticated & spacious interiors, advanced engine technology and outstanding driving dynamics.”

The newly launched Honda Amaze

“During last month, we prioritised Amaze production volumes to cater to the strong customer demand. We are confident that we will continue with our sales momentum in coming months,” he added.

Ford India registered cumulative domestic sales of 9,069 units in May, registering a notable growth of 34.51 percent (May 2017: 6,742). According to Anurag Mehrotra, president and managing director, Ford India, “Our continued focus on executing our strategic pillars of a strong brand, right products, competitive cost and effective scale have ensured our growth which continues to be better than the industry. At a macroeconomic level, the outlook is positive thanks to good monsoon forecast. However, the industry needs to be exercise caution given the rising commodity and fuel prices that are expected to result in higher inflation.”

Toyota Kirloskar Motor recorded cumulative sales of 13,113 units in May, posting a growth of 20.15 percent(May 2017: 10,914).According to N Raja, deputy managing director, Toyota Kirloskar Motor, “We are happy to have achieved a double-digit growth of 20 percent in domestic sales in May 2018. Along with the segment-leading products Fortuner and InnovaCrysta, the Yaris has been a significant contributor to the overall positive sales growth as compared to the same period last year. We would like to thank our loyal customers for their relentless support and confidence that they have on Toyota products.”

Toyota delivers 1000 units of Yaris

Two-wheeler OEMs clock over 9 percent growth in May 2018

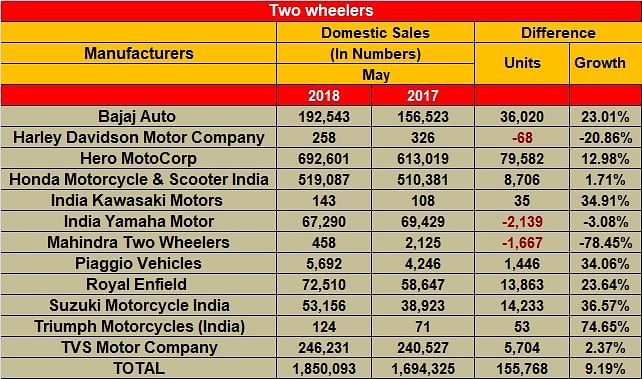

In line with Autocar Professional’s online report, which stated that two-wheeler sales have grown by 9.21 percent YoY in May 2018 based on the numbers shared by the top six manufacturers, SIAM data states that the overall domestic 2W segment has grown by 9.19 percent last month. Total sales for May 2018 stood at 1,850,093 units (May 2017: 1,694,323).

While motorcycles sold 1,221,559 units (up 15.16 percent), scooter sales dropped to 555,467 units (down by 1.40 percent) and moped sales rose 4.01 percent to 73,067 units. While motorcycle sales are back on growth track, scooters, which have been driving the overall two-wheeler growth until now, have reported a marginal decline, this after a strong 15-month run; the last monthly decline was in January 2017 when Honda Motorcycle & Scooter India (HMSI) and Hero MotoCorp reported a correction in numbers. It appears the same reason can be attributed to the decline in scooter sales in May 2018 too. While Honda – India’s largest scooter player – has already reported a marginal decline in scooter sales in May, Hero MotoCorp has corrected its scooter inventory last month, say SIAM officials. This can be verified by the marginal decline in the scooter production numbers as reported by SIAM data. A total of 608,345 scooters were manufactured for the domestic as well as export markets in May 2018 as against 617,017 units produced in May last year. The monthly scooter production, hence, was down by 1.41 percent YoY. Nevertheless, SIAM, along with the industry analysts, expect scooter demand to get back on growth track soon.

Meanwhile, the demand for mopeds, India’s most cost-sensitive mode of two-wheeled transport, continues to grow YoY.

The onset of monsoon across the country is good news as it drives farm output, leading to increased demand for two-wheelers. Amongst the top six OEMs, Hero MotoCorp and Suzuki Motorcycles have recorded one of their best-ever monthly performances in May 2018. Bajaj Auto too registered decent YoY growth too.

Recording one of the best sales performances in recent times, Hero MotoCorp has sold 706,365 units in May 2018 (including exports), up 11 percent year-on-year (May 2017: 633,884). It plans to roll out four premium products this fiscal including two 200cc motorcycles and two 125cc scooter models.

HMSI has reported domestic sales of 519,072 units in May 2018, up 1.70 percent YoY (May 2017: 510,381). This flat growth can be attributed to a YoY decline in the sales of scooters for Honda. Honda, which has not disclosed the split in its domestic sales of scooters and motorcycles, has reported total scooter sales of 342,976 units (down by 1.36 percent YoY) and total motorcycle sales of 208,625 units (up 10.19 percent YoY). Both the numbers include the export shipments as well as the domestic sales.

Speaking on Honda’s two-month (April-May) performance in FY2019 and the months ahead, Yadvinder Singh Guleria, senior vice-president - Sales and Marketing, HMSI said, “Honda continues its upward sales momentum in FY2019. In a period of just 2 months (April-May’18), more than 100,000 additional customers have joined the Honda family as compared to the same period last year.”

The company, which has recently expanded its regional footprint in Vijayawada (Andhra Pradesh) and Rajkot (Gujarat) with new zonal offices, had rolled out the new 2018 edition of its 110cc scooter Dio. The new Dio facelift, which comes with a starting price tag of Rs 51,292 (ex-showroom, Delhi), is squarely aimed at boosting its domestic demand specially at a time when summer vacations are getting over and college resume classes. The Dio scooter is a popular model among the college-going students and youngsters.

On the export side, while the company has already launched its 125cc scooter Grazia in Nepal and Sri Lanka, it has also confirmed its plans of exporting the new 160cc X-Blade to the two markets.

TVS Motor Company has reported domestic sales of 246,231 units in May 2018, up 2.4 percent YoY. It had sold 240,527 units in the domestic market in May last year. It sold total of 95,879 scooters last month (up 11.9 percent YoY; May 2017: 85,681 units). On the other hand, TVS Motor sold 126,711 motorcycles in May 2018 (up 7.4 percent YoY; May 2017: 118,014 units). Both numbers include export shipments.

On the overall front, the company’s two-wheeler performance registered growth of 8.2 percent with sales increasing from 275,426 units in May 2017 to 298,135 units in May 2018.

Pune-based Bajaj Auto has reported domestic motorcycle sales of 192,543 units, up 23 percent YoY, in May 2018. It had sold 156,523 units in May last year. The company continues to bank on the recent launches under its Discover brand. Among other performers is its flagship Pulsar brand along with its CT100 and Platina commuter umbrellas. The sales under its Avenger and V brands have now plateaued. Autocar Professional learns that the company is aggressively focusing on its alliance with UK’s Triumph Motorcycles currently.

Royal Enfield sold 72,510 units in May 2018, thereby recording growth of 24 percent YoY. The company has recently launched its limited edition Classic 500 Pegasus model in the UK and in India. The company aims to manufacture and sell only 1,000 units of its Pegasus model, which is inspired by the Royal Enfield motorcycles made during the World War II era in the UK.

Recording one of its best-ever monthly performances in the domestic market, Suzuki Motorcycle India has clocked sales of 53,167 units in May 2018, up 36.59 percent YoY. The company had sold 38,923 units in May 2017. The company has recently launched its popular Gixxer motorcycle featuring an anti-lock braking system (ABS) with a starting price of Rs 87,250 (ex-showroom, Delhi). Suzuki has started dispatching the ABS variant to its retail showrooms in May.

The ABS variant of Suzuki Gixxer

With a bountiful monsoon expected, consumer sentiment on the upswing and a rash of new models in the new product factory across OEMs, expect the two-wheeler industry to record even better numbers in the coming months.

CV sales maintain strong momentum in May

India's commercial vehicle sector continues to maintain its strong momentum for the second month in a row in the current fiscal. The growth has come on the back of overall buoyancy in the economy, higher spending by the government in infrastructure development, road construction, increase in the number of irrigation facilities and housing projects across the country, thus resulting in strong demand for M&HCVs and tippers.

All the OEMs, including Tata Motors, Ashok Leyland, VE Commercial Vehicles and Mahindra & Mahindra have recorded strong M&HCV sales in the month. However, it is to be noted that manufacturers are benefiting from last year’s low base, when BS IV emission norms had come into effect and the sales were impacted significantly in the first quarter of FY18.

The CV industry has been gradually witnessing a greater preference for higher-tonnage trucks over the past decade; the demand has gradually shifted from 16T to 25T and is further shifting in favour of 31T and 37T trucks.

In particular, the 37T segment witnessed a sharp jump in sales, due to increasing preference for higher-tonnage trucks. Capacity addition (in tonnage terms) in the system outpaced volume growth and grew by 30 percent as compared to a 19 percent increase in M&HCV (Truck) sales in FY2018. The share of the 35T and above segment increased to 63 percent in FY2018 from 19 percent (FY2013) and the average tonnage of the trucks in India has improved considerably from 15T in FY2009 to 20T during FY2018.

How the OEMs fared in May

Tata Motors’ overall domestic sales in the CV segment was 36,806 units, which was up by a healthy 56percent. (May 2017: 23,606). The M&HCV truck segment sustained its strong growth momentum with the sale of 12,424 units, marking a growth of 90% over last year.

According to Tata Motors, “This growth has been led by the government’s focus on infrastructure development, road construction, building of irrigation facilities and housing projects across the country. Additionally, sectors like auto carriers, 3PL players, cement, steel and oil tankers are also driving the growth in the economy. The SCR technology that was introduced in M&HCV trucks last year had gained customer confidence and continued to establish its TCO superiority.”

The I&LCV truck segment registered major growth with sales of 4,106 units, up by 73 percent over May 2017 figures. This growth is attributed to the new product launches, penetration of e-commerce and increased rural consumption. As per the company, the recently launched Tata Ultra range of ILCV trucks is gaining significant acceptance and is contributing to the volume growth.

The SCV cargo and pickup segment maintained its growth momentum with the sales of 15,567 units, up by 47percent over May 2017. With the growth in e-commerce sector and the hub-spoke model continuously evolving, the small commercial vehicles are in demand for the last mile connectivity needs across the rural and urban markets. The newly launched Tata Ace Gold has been well received in the market and is seeing strong demand. The commercial passenger carrier segment posted a growth of 14 percent after selling 4,709 units in May 2018. The onset of the annual school season also led to robust demand for school buses.

Ashok Leyland’s total sales for the month of May remained strong with 13,659 units, thus growing by 51 percent. (May 2017: 9,075). M&HCV sales continue to stay strong with 10,421 units, up by 70 percent (May 2017: 6,143) while LCVs grew by 10 percent YoY with 3,238 units sold. (May 2017: 2,932).

Mahindra & Mahindra's overall commercial vehicles sale went up by 15 percent to 18,748 units in the month (May 17: 16,261). M&HCV sales went up by 163 percent to 1,152 units. (May 2017: 438). The below-3.5T GVW segment grew by 11percent YoY, selling 16,763 units (May 2017: 15,111), while those in the above-3.5T GVW segment registered a growth of 17percent with sales of 833 units (May 2017: 712).

VE Commercial Vehicles continued its strong growth with the sales of 5,268 units, up by 33.3 percent in the domestic market. (May 2017: 3,953 units).

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

11 Jun 2018

11 Jun 2018

13279 Views

13279 Views

Shahkar Abidi

Shahkar Abidi