August sales a harbinger of better times for Indian car makers

The onset of the festive season and enhanced need for personal mobility have helped spike new car sales.

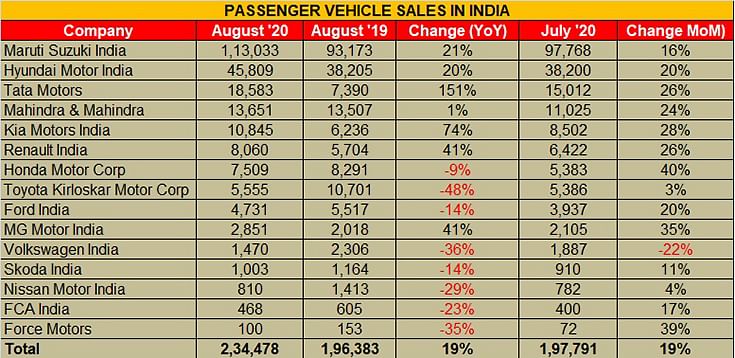

August 2020 has turned out to be quite an august month for the Indian passenger vehicle industry. The month has delivered the best-performance yet in the ongoing fiscal and is a harbinger of better times to come for the industry. Cumulative sales data from 15 OEMs reveals the industry despatched a total of 234,478 units in August, which is a good 19% year-on-year growth (August 2019: 196,383). August 2019 numbers, it may be recollected, were an all-time low for PV makers. Importantly, the month-on-month growth is also maintaining the same pace at 19 percent.

The bellwether of the Indian PV segment – Maruti Suzuki – registering year-on-year growth of 21 percent is in itself confidence-inspiring news for the entire segment as well as India Auto Inc. While the return of growth is also on account of a low year-ago base when the lack of liquidity had already started impacting demand last year, the gradual easing of restrictions on movement across the country, as well as the enhanced need of personal mobility in a post-Covid-19 world, have been the major factors driving growth last month.

Let’s take a closer look at how some car makers have fared last month:

Maruti Suzuki: 113,033 units (21.3%)

The company cumulatively sold 113,033 units in the month, recording a 21.3 percent growth (August 2019: 93,173). The growth was led by its entry-level and mid-size car range wherein the Alto and S-Presso hatchbacks at 19,707 units registered 94.7 percent YoY growth, while the pack of the Wagon R, Swift, Celerio, Ignis, Baleno and Dzire sold 61,956 units for a 14.2 percent YoY uptick.

Moreover, its Vitara Brezza and S-Cross SUV, which have seen a shift from being diesel-only to now petrol-only models, along with the XL6 and Ertiga sold 21,030 units and grew 13.5 percent.

Hyundai Motor India: 45,809 units (20%)

Hyundai Motor India too recorded a 20 percent growth with cumulative domestic sales of 45,809 units (August 2019: 38,205). Unlike Maruti, the growth in Hyundai’s case is led primarily by its UV models – the new Hyundai Creta and the Venue.

The second-generation Hyundai Creta, which was launched in end-March, has been the company’s star performer, selling 21,968 units over the months of May, June and July. The Venue, on the other hand, received a new update in the form of an innovative clutch-less manual transmission which is being christened as the iMT by the company and will also appear in the soon-to-be-launched Kia Sonet.

Mahindra & Mahindra: 13,651 units (1%)

UV maker Mahindra & Mahindra (M&M) reported sales of 13,651 units last month and recorded one percent growth compared to August 2019 when it had sold 13,507 units. The UV maker could be seeing demand of its tough body-on-frame vehicles such as the Scorpio and Bolero from the rural marketsowing to a good monsoon, as well as good urban demand for its nimble-footed sub-compact crossover – the XUV300.

While it unveiled the new Thar on August 15, M&M will launch the model on October 2 and from the looks of it, the company is aiming to target a wider set of audience with the new model.

Kia Motors India: 10,845 units (74%)

This sibling of Hyundai registered total sales of 10,845 units in the month, recording a noticeable 74 percent year-on-year growth when it had begun its India innings in August 2019 with sales of 6,236 units.

The Kia Seltos has consistently been one of the best-selling UV brands in the Indian market since its launch and now with the upcoming launch of the Hyundai Venue-based Sonet compact crossover, the company looks set to strengthen its foothold in the Indian market.

Renault India: 8,060 units (41%)

French carmaker’s Indian arm – Renault India – is also on a winning streak with its latest product – the Renault Triber. The compact, spacious and affordable seven-seater has given a big thrust to the company’s performance and enabled it to clock 8,060 units in August, thus, registering a 41 percent uptick over last year.

The company is now gearing up to launch the Kiger compact five-seater SUV this festive season.

Honda Cars India: 7,509 units (-9%)

The Japanese carmaker posted sales of 7,509 units, down 9% (August 2019: 8,291). August 2020 saw the company launch the new Jazz premium hatchback. In the past two months, Honda has launched three other models: New WR-V, new City and Civic Diesel BS VI. .

Speaking on the sales performance, Rajesh Goel, senior VP and Director, Marketing & Sales, Honda Cars India said, “A quarter into the unlock phase, we are progressing as per our plan, both in terms of supply and demand registering a sequential growth of 39% over July 2020. As we ramp up our daily production to 100% pre-COVID level this month, we are optimistic about the upcoming festive period and expect demand to improve further. However, considering that COVID-19 cases are constantly on a rise, we need to continuously monitor overall buying sentiment and its impact on auto sales going forward.”

Toyota Kirloskar Motor: 5,555 units (-50%)

The Japanese carmaker was left behind in the sales stack as it could manage sales of 5,555 units at a de-growth of 50 percent over August 2019, when it had sold 10,701 units. The company, however, marginally improved over July, with a 3 percent uptick.

What didn’t work in Toyota’s favour was a dynamic Covid-19 situation in Karnataka, where its plant is located in India. According to Naveen Soni, senior-vice president, Sales and Service, TKM, “We began August with a lot of apprehensions due to the skewed rise in Covid positive cases in Karnataka state and throughout the country. It had a resultant impact on both demand and supply scenarios. Fortunately, August witnessed an increase in demand for most of our models akin to pre-Covid times, including customer enquiries and orders. However, supplying vehicles from our end (to dealers) posed as a challenge due to the rising number of Covid cases in Bangalore and its surrounding areas, where most of our workforces reside. This even led us to ramp down production to a single shift so as to be able to ensure that we are taking all measures to safeguard the health and safety of our employees first, and of the community at large. Thankfully, more than half the Covid infected workers at TKM have recovered completely and are reporting back at work, after having completed all necessary protocols as laid down by the state health authorities. This has helped us immensely in inching up supplies so as to be able to cater to the increasing demands of our customers.”

MG Motor India: 2,805 units (41%)

MG Motor India registered sales of 2,805 units in August, thus, registering a 41 percent growth (August 2019: 2,018). Compared to July 2020, it recorded a 35 percent month-on-month growth as well.

According to the company, it is seeing improved traction for its Hector and Hector Plus SUVs with buyer preference towards personal mobility, as well as is now betting big on incentives announced under the Delhi and Telangana EV policies, which could help boost demand for its ZS all-electric crossover.

According to Rakesh Sidana, director – Sales, MG Motor India, “We have ramped up the overall production in August compared to July. We are working on fulfilling existing backorders for the Hector and prioritising vehicle deliveries for the ongoing festive season. The recovery in upcountry markets has been faster which should augur well during the festive season.”

All in all, August has been a rather august month for PV makers, giving some confidence about a speedier run in the coming months, which will see the onset of the festive season.

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

01 Sep 2020

01 Sep 2020

10573 Views

10573 Views

Ajit Dalvi

Ajit Dalvi