Car sales in India plummet to all-time low in August 2019

With a 41.09 percent de-growth, passenger cars record their worst-ever monthly sales in history; overall automobile industry down 23.55 percent

As the automobile industry in India continues to witness a bloodbath in its sales performance, with numbers down month on month since the past 11 months, August 2019 has emerged to be not so august for the sector, which has finally hit its rock bottom in the month. But will it plunge even more?

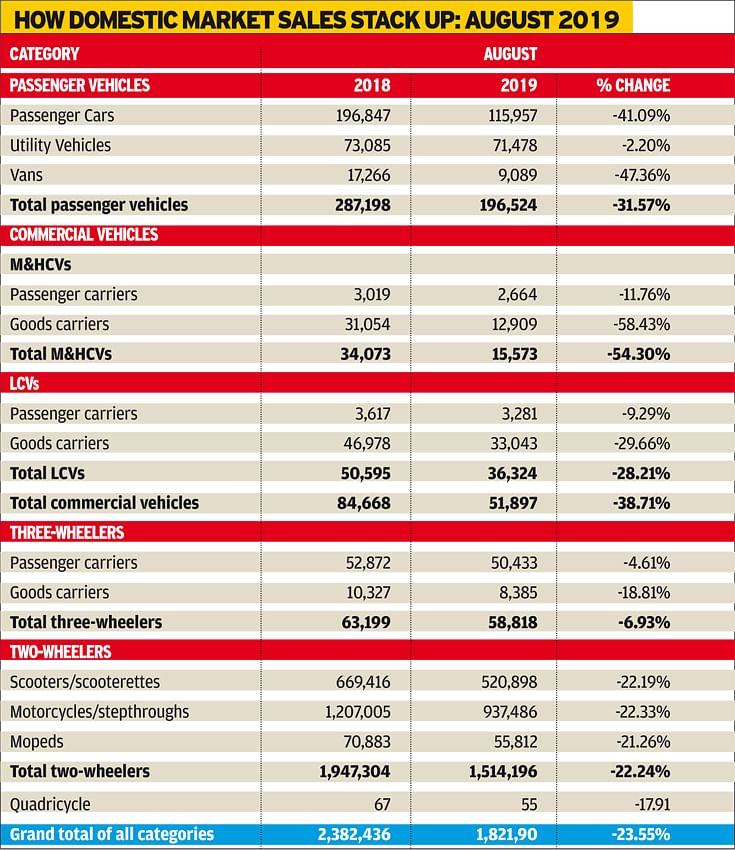

Overall industry sales stood at 1,821,490 units (August 2018: 2,382,436 / -23.55%), a new low clocked since FY1998 when SIAM began tabulating industry sales figures for both domestic and export markets.

Passenger vehicle (PV) sales, which slumped 31.57 percent to 196,524 units (August 2018: 287,198) have also hit an all-time low, with passenger cars performing even worse at 115,957 units (August 2018: 196,847) and dropping by massive 41.09 percent. Interestingly, new launches in the form of MG Hector and the Kia Seltos have seen the UV sub-category improve slightly and arrive at a de-growth of 2.20 percent with total UV sales culminating at 71,478 units (August 2018: 73,085). Vans, on the other hand, continue to record dismal numbers at 9,089 units (August 2018: 17,266 / -47.36%).

While the overall commercial vehicle (CV) sector dwindled 38.71 percent with net sales of 51,897 units (August 2018: 84,668), M&HCVs recorded a 54.30 percent drop with 15,573 units (August 2018: 34,073) and LCVs registered a 28.21 percent decline at 36,324 units (August 2018: 50,595). For sticking a reference, January 2009 saw the CV segment record a pitiful performance of 50.95 percent de-growth. Both passenger carriers and goods carriers within M&HCVs dropped 11.76 percent and 58.43 percent, respectively, with sales for each sub-category standing at 2,664 units (August 2018: 3,019) and 12,909 units (August 2018: 31,054), respectively.

Within the LCV category, passenger carriers dropped 9.29 percent to 3,281 units (August 2018: 3,617) and goods carriers slumped 29.66 percent to record sales of 33,043 units (August 2018: 46,978).

While three-wheelers were seen observing a slightly lower drop in performance of 6.93 percent de-growth, with volumes culminating at 58,818 units (August 2018: 63,199), two-wheelers, again were the ones to hit rock bottom with overall de-growth in performance coming to be at 22.24 percent and sales only about reaching 1,514,196 units (August 2018: 1,947,304). This is the segment's worst performance in three years when two-wheelers were down 22.04 percent last in December 2016.

Scooters and motorcycles both fell by similar levels with the former recording a 22.19 percent drop in sales at 520,898 units (August 2018: 669,416) and the latter observing a drop of 22.33 percent with net sales closing at 937,486 units (August 2018: 1,207,005).

PV and 2W exports up

While there are concerns about rising inventory levels both at dealerships and at the OEM stockyards, the two voluminous segments – PVs and two-wheelers – are seen showing a rise in their exports, with OEMs upping efforts to liquidate overt inventories and recover some cost.

Passenger vehicle exports were up 14.73 percent in the month with overall shipments of 69,749 units (August 2018: 60,795). Passenger car shipments at 53,099 units were also higher by 13.94 percent compared to last year (August 2018: 46,603) and so were UVs at 16,305 units (August 2018: 13,778) which registered an uptick of 18.34 percent. Hyundai Motor India (17,80 / +10.48%), Ford India (15,933 / + 26.39%), Nissan Motor India (7,653 / + 32.36%, Renault India (1,650 / + 24.53%), Volkswagen Indian(7,705 / + 74.44%) and Toyota Kirloskar Motor (848 / + 68.92%) were seen taking the exports route to negotiate troubled waters in the Indian market.

In the two-wheeler segment, while scooter exports were down by a substantial 15.36 percent at 36,235 units (August 2018: 42,812), it was the motorcycles which at 260,817 units and at a growth of 6.33 percent (August 2018: 245,294) made the overall two-wheeler segment record an uptick of 3.30 percent with total export shipments of 298,426 units (August 2018: 288,880).

The improved exports performance of both of these vehicle categories saw overall exports in the month of August reflect an improvement of 2.37 percent with total shipments coming out to be at 421,107 units (August 2018: 411,341).

With dealers continuing to offer hefty discounts and OEMs resorting to no-production days trying to moderate inventory pile-ups and bringing in some corrections, the current situation in the industry is that of moderating inventories ahead of the April 1, 2020 BS VI deadline. While the festive season, which has begun this month, usually sees dealers stocking up to cater to more customers coming in during the auspicious time, the scenario this time around is quite different. Overexpectations and guesstimates have taken a backseat with everyone moving forward with a doubly cautious approach. However, industry still hopes that things get better in a couple of quarters.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

09 Sep 2019

09 Sep 2019

7174 Views

7174 Views

Autocar Professional Bureau

Autocar Professional Bureau