April E3W sales up 8% at 41,127 units, Mahindra leads, YC EV No. 2, Bajaj races into fifth place

The electric three-wheeler industry has opened FY2025 on a more sedate note compared to the double-digit growth in FY2024. Mahindra Last Mile Mobility maintains its market leadership, ahead of YC Electric Vehicles by 202 units even as Bajaj Auto, which entered the market 11 months ago, is fast upping the ante.

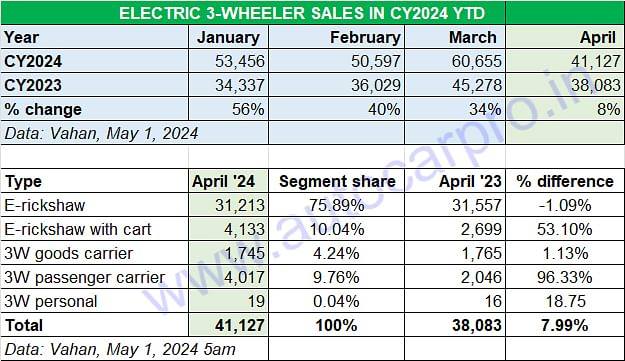

Like the electric two-wheeler industry, e-three-wheelers too have felt the heat of the opening month of FY2024 in terms of slower sales offtake compared to the past few months. Typically used to clocking high double-digit growth, in April 2024, total retail sales were a more sedate 41,127 units and an 8% increase on year-ago sales of 38,083 units in April 2023. Nevertheless, as the two segments did in FY2024, their combined sales of 105,140 units – 41,127 e-three-wheelers and 64,013 e-two-wheelers – account for 93.54% of India EV Inc’s total retail sales of 112,396 units.

Passenger-transporting electric rickshaws have the major share of e-three-wheeler market. Every second three-wheeler sold in India is now electric.

Passenger-transporting electric rickshaws have the major share of e-three-wheeler market. Every second three-wheeler sold in India is now electric.

April, typically in India, is a month of slow sales what it being the first month of FY2025 and sales momentum gradually picks up, falls a bit in the monsoon months and then revs up again in the festive season around September-October.

From the perspective of the e-two-wheeler and e-three-wheeler industry, both will have to contend with slow-moving sales at least till June 2024. The now-reduced subsidy has already seen most of the leading OEMs increase product prices. This can somewhat dampen demand albeit the wallet-friendly long-term USP of an EV and the electric three-wheeler segment has seen the fastest transition to e-mobility.

The new Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers (L5 category). While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit. Suffice it to say, July 2024 will see a similar spike in EV sales as in March 2024.

As per Vahan data, on May 1, 2024 at 5am, a total of 80,101 three-wheelers (petrol, CNG, LNG and electric) have been retailed in April 2024. This means e-three-wheelers, at 41,127 units, account for 51% of total retails, reaffirming the fact that every second three-wheeler sold in India is now an EV. CNG-only models accounted for 25,527 units or 32% of all three-wheeler sales last month. Demand for diesel three-wheelers is now down – at 9,762 units, they accounted for just a 12% share of the overall three-wheeler market and it continues to decline.

This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

Compared to fossil fuel or CNG-powered models, the long-term wallet-friendly proposition of electric three-wheelers is drawing both single-user buyers (autorickshaw drivers) as well as fleet operators. The retail sales data table above indicates the growth trajectory for the ongoing fiscal year.

Mahindra Last Mile Mobility (MLMM) retailed 3,139 electric passenger and cargo three-wheelers in April 2024.

Mahindra Last Mile Mobility (MLMM) retailed 3,139 electric passenger and cargo three-wheelers in April 2024.

Mahindra maintains leadership, only 5 OEMs register 4-figure sales in April

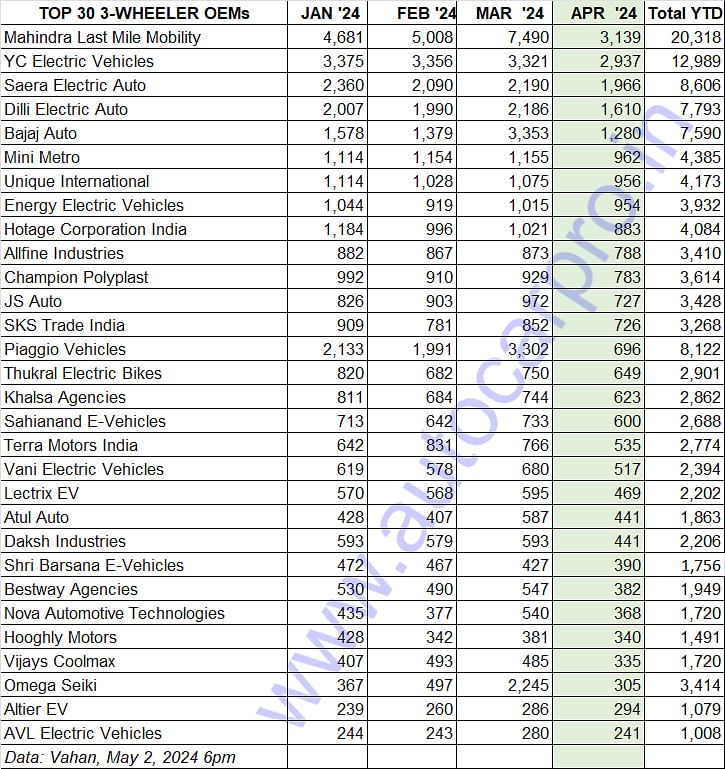

This sub-segment of the EV industry, which has all of 480 players fighting for a slice and more of the action, is dominated by only a few. Vahan data of the retail sales in April 2024 reveals that of the Top 30 OEMs, only the top five have clocked four-figure sales while the next 26 OEMs have registered sales between 950 units and 250 units (see Top 30 OEM sales table below).

Mahindra Last Mile Mobility (MLMM), the market leader in FY2024 with 60,542 units, maintains its lead in the first month of the new fiscal. In April 2024, the company retailed 3,139 units, 202 units ahead of the No. 2 OEM, YC Electric Vehicles. MLMM’s cumulative sales for the first four months of CY2024 (January-April 2024) are 20,318 units, well ahead of the competition. The company, whose portfolio includes the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo catering to multiple mobility operations, has benefited from the launch of two new products – the Treo Plus and e-Alfa Super passenger and cargo variants. Also, to meet the growing demand for its products MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

YC Electric Vehicles, which sold 2,937 units, continues to witness sustained demand for its five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for YC EV.

Saera Electric Auto with 1,966 units is ranked third among 480 players, maintaining its position. Likewise, No. 4 remains Dilli Electric Auto with 1,610 units. Bajaj Auto, with 1,280 units, is ranked fifth in April.

Piaggio Vehicles, with cumulative January-April 2024 sales of 8,122 units, is fifth in the EV manufacturer rankings in the year to date but 14th in April with 699 units. The company is benefiting from its new models and aggressive network expansion. The Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra. Piaggio is already gearing up for a subsidy-free EV market – on May 1, it launched a battery subscription model for its Apé Elektrik three-wheeler in 30 cities across India in an effort to simplify ownership and eliminate upfront battery costs.

The OEMs with sales between 700 to 900 units in April include Mini Metro EV (962 units), Unique International (956 units), Energy EV (954 units), Hotage Corporation (883 units), Allfine Industries (788 units), Champion Poly Plast (783 units), JS Auto (727 units), and SKS Trade India (726).

The Bajaj Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

The Bajaj Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

Bajaj Auto: the dark horse for FY2025

The big growth story in the e-three-wheeler domain remains Bajaj Auto. As we wrote in our growth outlook for FY2025 last month, the dark horse in this fiscal is the Pune-based Bajaj Auto, which is the IC engine three-wheeler market leader and is a recent entry into e-three-wheelers in June 2023. With two products – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 – Bajaj Auto has sold 1,280 units in April. Its cumulative January-April 2024 sales at 7,595 units give it a 3.67% market share. Not bad for a company which entered the market 11 months ago.

The company’s sales spike is reflected in its rate of growth. In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to be making the headlines regularly, as well as keeping the top OEMs worried.

ALSO READ:

India EV sales in April are 50% of mega March’s 210,000 units

Electric car and SUV sales in India rise 22% to 6,577 units in April

E2W sales brake hard in April at 64,000 units, Ola share at 51%, TVS and Bajaj in close fight

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

01 May 2024

01 May 2024

17364 Views

17364 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi