E2W sales brake hard in April at 64,000 units, Ola share at 51%, TVS and Bajaj in close fight

After six straight months of over 75,000-units sales which culminated in best-ever sales of 137,000 units in FY2024-ending March, April 2024 with its reduced EV subsidy dampens demand albeit should see a pickup in buyer interest by July. Ola with over 33,000 units strengthens its grip on the market.

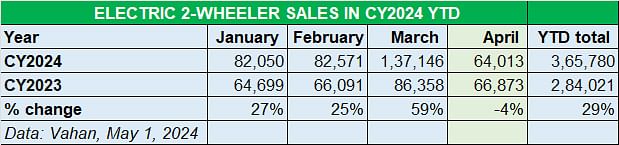

As expected, retail sales of electric two-wheelers in April 2024, the opening month of the new fiscal year 2025, have seen a sharp decline to a little over 64,000 units, down 4% on mega-March’s 137,146 units albeit this does not warrant a month-on-month comparison. That’s because March 2024 was both FY2024’s last month as well as the last for the FAME 2 subsidy scheme, which accelerated demand into the best-ever monthly sales last fiscal.

April, typically in India, is a month of slow sales what it being the first month of FY2025 and sales momentum gradually picks up, falls a bit in the monsoon months and then revs up again in the festive season around September-October. This year around, it's election season too which has impacted monthly sales.

At 64,013 units sold in April 2024, demand was down 4% YoY following typical slower offtake in the first month of a new fiscal, reduced subsidy and in turn higher EV prices for some of the popular models.

At 64,013 units sold in April 2024, demand was down 4% YoY following typical slower offtake in the first month of a new fiscal, reduced subsidy and in turn higher EV prices for some of the popular models.

From the perspective of the e-two-wheeler and e-three-wheeler industry, both will have to contend with slow-moving sales at least till June 2024. The now-reduced subsidy has already seen most of the leading e-two-wheeler OEMs increase prices of their products. While Ola did not effect any change, TVS, Bajaj Auto, Ather Energy and Hero MotoCorp have all revised their product prices upwards, marking an increase from Rs 4,000 through to Rs 16,000. This can somewhat dampen demand albeit the wallet-friendly long-term USP of an EV beats that of a fossil-fuelled counterpart on two or more wheels.

The new Electric Mobility Promotion Scheme (EMPS), valid for a four-month period from April 1 to July 31, 2024, has a total outlay of Rs 500 crore and aims to support the purchase of 372,000 EVs including 333,000 two-wheelers and 38,828 three-wheelers. While e-two-wheelers get a subsidy of Rs 5,000 per kWh with a maximum limit of Rs 10,000 per unit under EMPS, e-three-wheelers can avail a subsidy of Rs 5,000 per kWh with a maximum limit twice that of two-wheelers at Rs 10,000 per unit. Suffice it to say, July 2024 will see a similar spike in EV sales as in March 2024. Let’s see how the EV industry on two wheels fared in a slow-selling month.

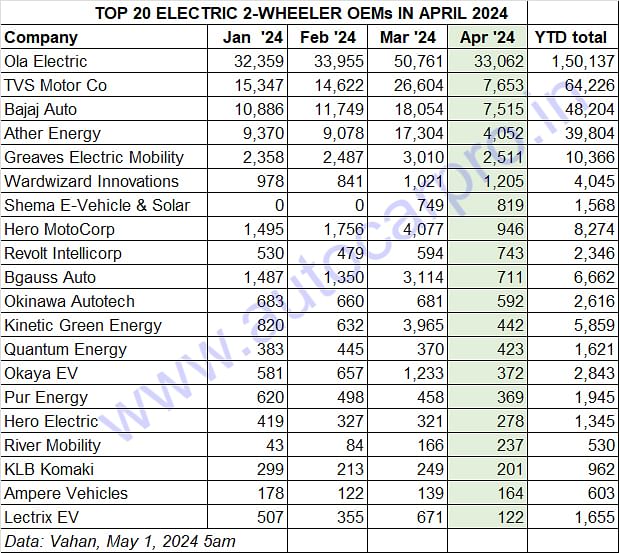

With over 33,000 units sold in April's reduced volumes, Ola Electric sees its market share increase to a never-before 51%, followed by TVS and Bajaj.

With over 33,000 units sold in April's reduced volumes, Ola Electric sees its market share increase to a never-before 51%, followed by TVS and Bajaj.

Ola tops with 33,000 units, TVS and Bajaj sell over 7,500 EVs each

Ola Electric, the market leader in FY2024 with over 325,000 units and 35% share of the record 944,000 units sold, has begun FY2025 on the same ultra-strong growth trajectory when it wheeled out of FY2024. In April, Ola sold 33,062 units, which gives it a never-before 51% share of the market. That’s a result of the company not raising EV prices despite the reduced subsidy, unlike its key rivals, TVS, Ather Energy and Bajaj Auto. Ola's cumulative four-month sales for CY2024 YTD are 150,137 units, which gives it a 41% market share.

On April 15, Ola announced new introductory prices for its S1 X portfolio in three battery configurations – 2 kWh (Rs 69,999), 3 kWh (Rs 84,999), and 4 kWh (Rs 99,999). The S1 X range marks the company’s entry into the mass market segment. With a lower cost of ownership and an 8-year/80,000km battery warranty, the S1 X is an attractive value proposition which is clearly reflected in the company’s strong April retails. Ola also put out new prices for the S1 Pro (Rs 129,999), S1 Air (Rs 104,999), and S1 X+ (Rs 84,999).

TVS Motor Co takes second position in April with 7,653 units and a 12% market share last month. Cumulative January-April 2024 retail sales at 64,226 units give TVS a 17.55% market share in the year to date. The iQube e-scooter remains a compelling buy and had sold 189,896 units in FY2024, recording sterling 96% YoY wholesales growth (FY2023: 96,654 units) for a market share of 19.37%, up from the 11.27% share it had in FY2023. The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

Bajaj Auto, with 7,515 Chetaks sold, is the No. 3 EV OEM for April 2024. Between January and April 2024, the company has sold 48,204 Chetaks, which gives it a 13% market share. Bajaj Auto, which markets the two Chetak variants – Urbane (Rs 123,319) and Premium (Rs 147,243) – continues to see strong demand. This is thanks to a ramped-up production and a growing dealer network, which is to be expanded from its existing presence in 164 cities and 200 touchpoints to around 600 showrooms in the next three to four months. Bajaj Auto is also soon (likely to be in May 2024) to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

As a result of Bajaj Auto moving up the ladder board, Ather Energy is now at No. 4 position with sales of 4,052 units and a market share of 6.32 percent. Ather’s January-April 2024 total at 39,804 units gives it a market share of 11 percent. On April 6, Ather launched the new Rizta at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z). While the S version is equipped with a 2.9 kwH battery and has a 123km range, the Z variant with a 3.7 kWH battery has a 160km range. Key highlights for the family EV include the largest two-wheeler seat in India and storage space aplenty.

Greaves Electric Mobility, which launched the new Nexus family scooter priced at Rs 109,900 on April 30, has sold a total of 2,511 units in April. Combined with Ampere Vehicles’ 164 units, the company’s April sales add up to 2,675 units.

Wardwizard Innovations is witnessing a spike in demand and its April sales at 1,205 units are its best monthly figures in the first four months of 2024. It’s the same scenario for Revolt Intellicorp which, with 743 units in April, clocked its best figures this year.

ALSO READ:

India EV sales in April are 50% of mega March’s 210,000 units

Electric car and SUV sales in India rise 22% to 6,577 units in April

April E3W sales up 8% at 41,127 units, Mahindra leads, YC EV No. 2, Bajaj races into fifth place

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

01 May 2024

01 May 2024

17129 Views

17129 Views

Shahkar Abidi

Shahkar Abidi