Mahindra & Mahindra keeps rivals at bay in India's pick-up market

In FY2017, despite growing competition, Mahindra & Mahindra retained its tight hold on the country’s pick-up segment with over 65 percent market share in the 2-3.5T pick-up segment with total sales of 136,574 units.

In the light commercial vehicle (LCV) segment in India, the goods carrier sub-segment is the biggest in terms of volume. The two categories – 2T mini-truck and 2-3.5T pick-up – have seen some intense competition between two leading players, namely Mahindra & Mahindra and Tata Motors. Ashok Leyland, with just a single product offering – the Dost – is also making a pitch in the segment.

In FY2017, despite growing competition, M&M retained its tight hold on the country’s pick-up segment with over 65 percent market share in the 2-3.5T pick-up segment with total sales of 136,574 units. However, despite selling nearly 10,000 more units, it lost 3 percent market share in the category as compared to FY2016 (126,824 units). This indicates that the pick-up segment has been growing significantly.

The change is attributed to the growing popularity of pick-ups as a preferred mode of transportation within cities as bigger trucks are not allowed within city limits, particularly during daytime. Also due to higher power and bigger loading capacities, pick-ups offer more operating profit to operators. This segment is largely operated by driver owners, whose profit is driven by higher volume and faster turnaround time resulting higher revenue per trip.

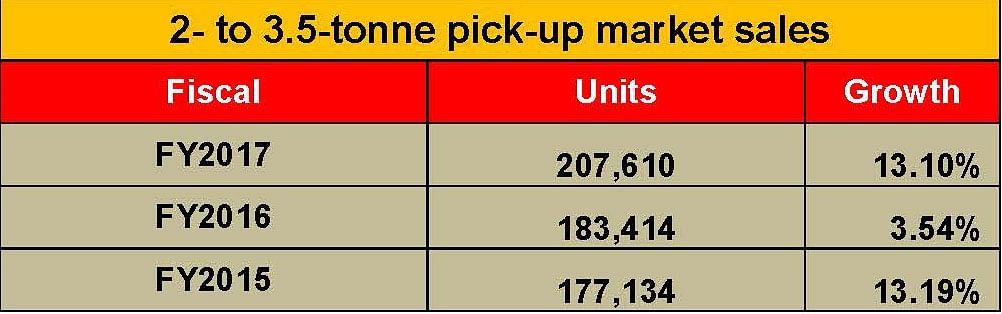

How the pick-up market numbers stack up since FY2015

A close look at the last three years’ sales volumes of the overall pick-up segment reveals the growing demand for such commercial vehicles. In FY2015, a total of 177,134 units were sold, rising 3.5 percent to 183,414 units in FY2016, and then recording 13 percent YoY growth to 207,610 units in FY2017.

M&M, riding on its popular Bolero pick-up range, sold a total of 393,148 units in a three-year period: 129,755 units in FY2015, 126,819 units in FY2016 and 136,574 units in FY2017. However, the three-year period has seen its market share decline from 73 percent to 69 percent and then to 65 percent.

Tata Motors, the second largest player in the segment, has in the past year been on an aggressive new product drive, mainly with a view to taken on the market leader. The company has an expansive product portfolio including the Super Ace, Tata 207 and the Xenon Pick-up. However, the Xenon has not really taken off in the market.

Earlier this year, in January, Tata Motors rolled out the new Xenon pick-up, rechristened as the Yodha, and offering a wide range of commercial applications with claimed USPs of high levels of performance and lowest operating cost. Squarely targeted at the Mahindra competition, the Yodha has a rated payload of up to 1250kg, is available in 4×4 and 4×2 options in single-cab and double-cab versions, and comes with a starting price of Rs 605,000. Between January and March 2017, the Yodha sold 39,055 units and had a market share of 18.8 percent, helping Tata increase its share in pick-up segment by 3 percent. It can be gleaned that Tata Motors has been consistently increasing its volumes and market share. In FY2015, FY2016 and FY2017, the company sold 21,231 units, 27,838 units and 39,055 units respectively for a market share of 11.9 percent, 15.1 percent and 18.8 percent.

Ashok Leyland, the No. 3 in the segment with its Dost, is close behind Tata Motors. The Chennai-based manufacturer aims to become a full range CV player with plans to introduce a new LCV every quarter this fiscal. In FY2017, the company sold 30,463 Dosts (+11.8%) for a markets share of 14.6 percent.

Declining 2T mini-truck segment

The 2T mini-truck segment, which Tata Motors drove single-handedly with its Ace range of small trucks introduced in 2005, has been recording declines as changing buyer preference for higher payload trucks and faster turnaround time has impacted sales adversely.

In FY2014, sales of the 2T mini-truck segment with sales of 166,974 units dropped by a massive 67 percent from 247,426 units in FY2013. Sales dropped further to 131,455 in FY2015, to 116,560 in FY2016 and saw flat growth in FY2017 with 116,890 units.

M&M, with a strong product like the Jeeto, has been able to grab considerable market share from Tata Motors. In FY2017, M&M sold 30,033 units in the segment and has doubled its market share to 25.6 percent in the last two years.

Ratings agency ICRA in its growth outlook for FY2018 estimates that the LCV truck segment is likely to grow by 6-8 percent on the back of replacement demand as well as an improvement in demand from consumption-driven sectors, rural markets, e-commerce and finance.

RELATED ARTICLES

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

TVS eyes new markets for iQube e-scooter in rural India

TVS Motor Co, which has topped the electric two-wheeler market for the past four months, looks to expand the predominant...

India is world’s largest electric 3W market for second year in a row

India, which overtook China to become the world’s largest electric 3-wheeler market for the first time in CY2023, mainta...

12 May 2017

12 May 2017

51531 Views

51531 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau