Strong March numbers drive CV industry towards record sales in FY2018

This is unquestionably the best period for CV makers in a long time and all the major OEMs like Tata Motors, Ashok Leyland, Mahindra Truck & Bus and VE Commercial Vehicles have recorded smart gains.

Fiscal year 2017-18 is turning out to be one of the best years for the Indian commercial vehicle industry, much awaited after five years of tepid growth. The segment, which is the barometer of the country’s economy, is now firmly positioned on growth road and sales of both the critical medium and heavy commercial vehicle (M&HCV) and light commercial vehicle (LCV) segments are accelerating.

Not only is the return of replacement demand helping OEMs but government initiatives like stricter enforcement of overloading resulting in fleet operators preferring rated loads is pushing demand for higher-tonnage trucks. Also, with GST being introduced last April and removing the state tariff barriers, truck productivity has risen sharply.

Fleet operators, who are betting big on higher-tonnage trucks, are benefiting from higher productivity, better turnaround times and improved truck uptime. After an initial hiccup at the beginning of FY2018 when the CV market was transiting to BS IV emission norms and saw customers delay buying, the CV market buying new vehicles with a vengeance. What also helped was that OEMs also addressed the supply constraints of BS IV trucks.

Given the many headwinds the industry faced at the beginning of FY2018, overall year-on-year CV industry growth was expected to be a modest 6-7 percent. However, between April-February 2017-18, the sector has clocked over 19 percent.

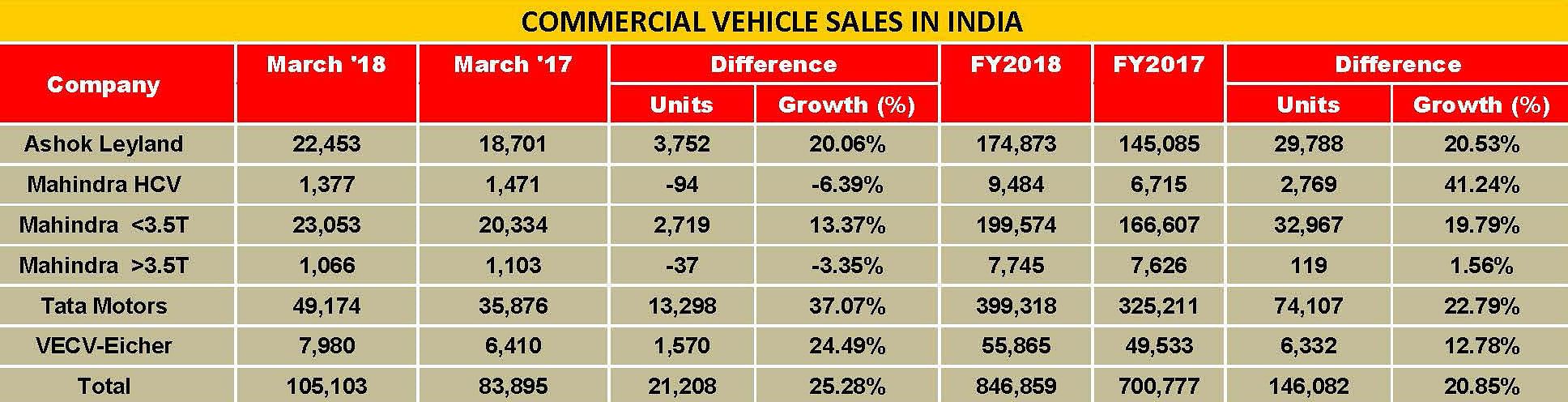

This is unquestionably the best period for CV makers in a long time and all the major OEMs including Tata Motors (22.79%), Ashok Leyland (20.53%), Mahindra & Mahindra (20%) and VE Commercial Vehicles (12.78%) which have all notched double-digit growth in FY2017-18.

Industry sources tell Autocar Professional that the buoyancy in the CV sales is likely to remain for next couple of quarters as the demand cycle looks stronger. Also, government initiatives towards higher infrastructure spend and focus on the manufacturing industry to maintain the 7-7.5 percent rate of GDP will further help the CV industry.

How the OEMs fared in March

Tata Motors, the CV market leader, sold a total of 399,318 units in FY2018 in the domestic market, a growth of 23 percent (FY2017: 325,211 units). In

March 2018, it sold 49,174 units, an increase of 37 percent (March 2017: 35,876 units). According to the company, “This growth was on the back of government’s push towards infrastructure development, restriction on overloading, road construction and mining activities along with increasing demand from e-commerce & FMCG applications.”

M&HCV truck sales saw steady growth at 16,886 units, higher by 21 percent March 2017. The tipper segment drove the demand and grew over 58 percent as a result of increased requirements for aggregate, sand and coal movement across the country for road construction and mining projects. Additionally, the strong acceptance of the BS IV range of products with SCR technology and new product launches also contributed to improved numbers.

The I&LCV truck segment reported a strong performance at 5,737 units, up by 97 percent YoY, bolstered by new product launches and growing demand for container and refrigerated trucks following an uptick in the agriculture-based, FMCG, 3PL logistics and E-commerce sectors.

Tata Motors’ SCV cargo and pickup products saw robust demand with sales of 19,464 units, up by 52 percent. The volumes were aided by government/municipal applications, high private consumption-led growth in both rural and urban markets and a general uptick in buying sentiment.

Interestingly, the commercial passenger carrier (buses) segment posted highest-ever sales at 7,087 units, up 13 percent. These numbers were due to robust demand for school buses, the new AIS 140 norms and the AIS 125 ambulance body code implementation from April 1. The Tata Winger clocked its best-ever sale of over 986 units. Tata Motors also recently bagged orders for electric buses in six cities out of nine cities, making it a significant player to support the government’s electrification drive.

Ashok Leyland’s cumulative sales in FY2018 were 174,873 units (FY2017: 145,085 units), which is a growth of 21 percent. In March 2018, the Chennai-based manufacturer sold 22,453 units, up 20 percent (March 2017: 18,701). M&HCV numbers remain positive, growing by 12 percent with sales of 17,057 units (March 2017: 15,277) while LCVs grew by a strong 58 percent YoY with 5,396 units (March 2017: 3,424).

Mahindra & Mahindra, which has embarked on an aggressive market share expansion through new products, network expansion and aftersales initiatives, sold a total of 216,803 units to record strong growth of 20 percent (FY2017: 180,948 units). In March 2018, its sales were up by 11 percent to 25,496 units (March 2017: 20,335). While M&HCV sales de-grew by 6 percent to 1,377 units (March 2017: 1471), the below-3.5T GVW segment has grown by 13 percent YoY, selling 23,053 units (March 2017: 20,334), while those in the above-3.5T GVW segment declined by marginal 3 percent with sales of 1066 units (March 2017: 1103).

VE Commercial Vehicles’ domestic sales grew 24.5 percent with total sales of 7,980 units (March 2017: 6,410 units). The company’s cumulative sales in FY2018 were 55,865 units, which marks growth of 13 percent (FY2017: 49,533 units).

RELATED ARTICLES

Honda Cars India Domestic Sales Down 22.75% in April 2025

In view of the prevailing market conditions and subdued consumer sentiment, the company had strategically moderated disp...

Royal Enfield Reports 6% Year-on-Year Growth in April 2025

Export volumes rose by 55% year-on-year, while domestic sales remained relatively stable with a 1% increase.

India Ranks 4th in Global Optimism, Faces Inflation and Emerging Challenges: IPSOS Survey

The survey highlights strong optimism among global south countries, particularly APEC markets.

02 Apr 2018

02 Apr 2018

15353 Views

15353 Views

Arunima Pal

Arunima Pal