Renault still bullish on India's tough MPV market

The MPV market remains a tough nut to crack. Apart from the few OEMs with MPVs at present, most have either dropped their product or shelved plans to introduce new offerings. This leaves the door open to the Lodgy, feels Renault.

Renault India, which is all set to launch the Captur crossover, is in no rush to introduce electric vehicles in India. While the Kwid hatchback continues to be its best-seller, the company remains optimistic on its Lodgy multi-purpose vehicle.

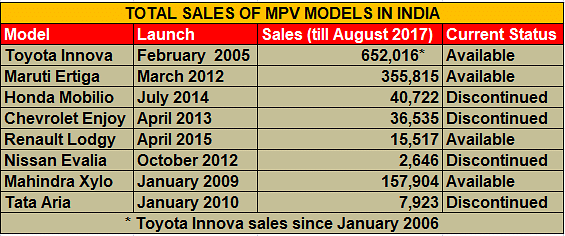

French carmaker Renault, which has revealed the Captur crossover ahead of its India launch, is eager to be part of the booming SUV segment which today accounts for one out of every four PVs sold in India. Even as the likes of the Maruti Vitara Brezza, Hyundai Creta, Mahindra Bolero, Maruti Ertiga and Toyota Innova top the UV sales charts, Renault still has not given up on its Lodgy Multi-Purpose Vehicle (MPV), a segment where few models have clicked in the country.

The MPV segment in India remains a tough nut to crack. Apart from the few OEMs with MPVs at present, most have either dropped their existing product or shelved plans to introduce new offerings. Renault though is in no mood to drop or shelve its Lodgy. In what seems to be a contra move, the company is optimistic about its MPV gaining traction what with most rivals shying away.

The MPV segment has seen a drop of almost 43 percent in volumes but Sumit Sawhney, MD and CEO, Renault India, is quite optimistic that the company, which sells around 400 Lodgys a month, has yet to see its best days. He says, “Yes, the segment is stressed but the Lodgy has still got a lot of potential. Because, first of all, a lot of competitors have dropped out and secondly, others have decided not to bring new products in this segment. As a result, there is nobody left; so we expect this business to grow.”

Sawhney further explains his optimism: “See it is simple. What is currently happening in India? Highways are getting developed, and city and inter-city connectivity is improving. In the past three to four years, infrastructure projects were in a bad shape. New projects have started coming up now. What does this development require? People movement. Till now, everyone was leveraging the existing fleet but that fleet has aged. All these people will return for replacement, so which car will they buy?”

The fleet segment, which initially saw sales being dominated by the likes of the Chevrolet Tavera, Toyota Qualis and then the Innova, among others, has been isolated with many OEMs either discontinuing their product or re-positioning them.

With GM having dropped its India story, the Tavera is history. While the old Toyota Innova commanded a huge market, the 60-70 percent upward revision in prices of the new Innova Crysta leaves an MPV opportunity in the market. Thus, Sawhney is bullish that the growth will come for the Lodgy: “People’s movement will require a bigger vehicle. So the point by default is that you will have opportunity because people movement in India will not stop.”

RENAULT’S INDIA INNINGS TILL NOW

Renault has witnessed a lot of ups and downs in India. The French automaker, which entered India in 2005, started selling the Logan under a JV with Mahindra & Mahindra. By 2008, the company integrated logistics to manufacture and supply components to its other plants globally. In the same year in September, it opened its design studio in Mumbai, making the Indian facility one of five global studios. By 2009, it inaugurated a technology and business centre with its global Alliance partner Nissan. 2010 was when the company went aggressive with its India ambition, the same year it ended its JV with Mahindra and later started its manufacturing facility in Chennai, with an investment of Rs 4,500 crore.

2011-12 saw the introduction of the Fluence, Duster, Pulse and Scala in the Indian market, with the Koleos marking its global debut launch in India. In 2014, the company for the first time introduced a concept car outside Europe, marking the birth of the Kwid – designed in India, made for the world. The game-changing Kwid, which has sold 186,203 units till end-August 2017, has given the company a firm footing in India.

According to Sawhney, the Kwid has been one of the highest selling cars for the company in India, and with various options in terms of power and transmission variants (0.8L engine, 1.0L, AMT). He says the Kwid, without offering any discounts, still remains one of the high-in-demand hatchbacks.

EV DREAM LACKS A CLEAR ROADMAP

The Indian government has announced an ambitious all-electric vehicle program by 2030. At last month's SIAM Convention, Road transport and highways minister Nitin Gadkari sent out a stern message to automakers urging them to switch to alternative fuel, saying he will not mind "bulldozing" them to curb pollution.

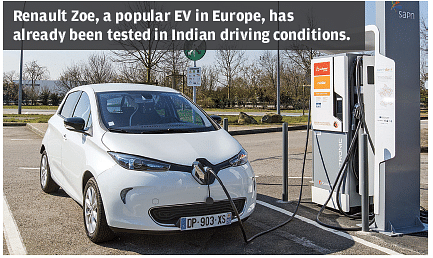

Renault, with its global alliance partner Nissan, has a bunch of EVs both in the commercial and passenger vehicle segments, is yet to introduce a model in India.

Speaking to Autocar Professional about the lack of clarity of the country's EV policy, Sawhney says, “It needs a lot of clarity. Why will people buy electric cars, are Indians too sensitive to the environment? Probably, the answer is no. Nobody will buy, except for a minuscule percentage. The only way it can work is if you offer three things – high range, low cost and low downtime. Range and downtime are something we as OEMs can manage. It is in our hands.”

He adds that bringing the cost down can only happen if the government works in sync with industry and with a clear roadmap. There is a need to create an eco-system that includes the right taxation policies. Globally, wherever EVs adoption has happened, it is due to a stronger support by the government. For instance, there is a huge differentiation between taxes on EVs in the NCR and the rest of the country.

Another aspect is the need for a proper supply chain in the country, India does not even have a single gigawatt factory for producing the core batteries for EVs, while India’s immediate neighbour China has around 108, which reveals the huge disparity between ambition and reality.

Sawhney feels that the government should not mix policy and strategy. He says, “Policies don’t change, strategies do. The government should not mix strategies as policies.”

Renault has the capabilities in place, but is awaiting further clarity and a conducive environment before plugging into the EV market in India. In fact, the company has been testing its Zoe electric car for over six months here. Sawhney now has to inform Renault HQ as and when he takes the call on entering the Indian EV space, with the Zoe, or any other model.

The Indian market now provides Renault some interesting prospects. Mass electric mobility is taking shape, offering the European brand a chance to play in it. On the other hand, if Sawhney's bet on the MPV front clicks, Renault India's sales graph could get a new charge.

RELATED ARTICLES

Hyundai: Going Beyond Business

Hyundai Motor India sets an example for manufacturing companies across the country with its extensive and impactful soci...

Pawan Goenka: From Rural Madhya Pradesh To India's Space Corridors

The story of Pawan Goenka's life mirrors that of India's ascent—humble beginnings, bold bets, and a mission to make Indi...

M&M and SML Isuzu: Strategy, Synergy, and Game Plan

Mahindra & Mahindra has acquired SML Isuzu, a key player in the small and medium sized CV market in India. But can this ...

05 Oct 2017

05 Oct 2017

9105 Views

9105 Views

Kiran Murali

Kiran Murali

Shahkar Abidi

Shahkar Abidi