Boom time for midsize motorcycles in India

Powered by Royal Enfield, the oldest player in its category, the midsize motorcycle market in India is recording a new high in domestic demand and is pegged to touch half-a-million units in FY2015-16.

Recognised as the next booming category in the motorcycle market by all the major OEMs, the midsize motorcycle segment is expected to touch half-a-million units in terms of its annual size for the financial year ending March 2016.

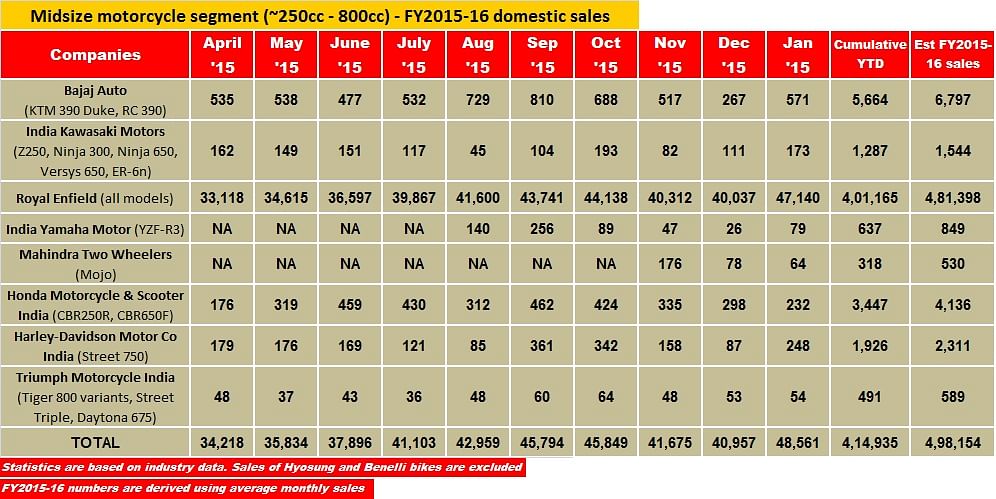

According to an analysis by Autocar Professional, the segment is estimated to close FY2015-16 with total sales of over 498,000 units. The market sales analysis of the segment is based on the reports submitted by eight companies that sell their products in the midsize motorcycle segment.

This segment is driven by Royal Enfield, which is the oldest player in this category and operating in India for decades, on the back of a strong demand for its products. According to our analysis, Royal Enfield is estimated to contribute close to 480,000 units, accounting for a whopping domestic market share of close to 96 percent, to the overall segment sales.

However, it is interesting to also take note of the other OEMs which are estimated to record consolidated sales of around 20,000 units with the most affordable model costing closer to Rs 1.75-2.00 lakh range (on-road) for the ongoing fiscal.

The rise in the demand for midsize motorcycles, roughly understood as a category with engine displacement in the range of 250cc-800cc and a price-tag likely to be Rs 100,000 and above, reflects a number of economic factors at play. These mainly include rising per capita income, a large base of premium commuter users migrating to bigger motorcycles, a trend of riding groups that is catching up across the country, and growing aspirational values associated with bigger motorcycles.

To capitalise on these potential factors, the companies are also picking up pace in bringing new models in the booming space. For example, January 2015 to January 2016 has seen at least 12 new model additions in this segment from companies such as Triumph Motorcycles India, India Kawasaki Motors, India Yamaha Motors, Honda Motorcycle & Scooter India (HMSI), DSK Benelli and even Mahindra Two Wheelers.

Industry analysts say that the companies bringing their models in an about-to-explode market is a well-thought business strategy, which includes initiation of their operations and growing brand network and visibility by the time market demand begins to consolidate.

Clear examples can be seen in the form of Triumph Motorcycles’ push for its adventure tourers (three new 800cc Tiger 800 variants brought last year), DSK Benelli’s launch of four midsize motorcycles (across 250cc to 600cc), HMSI, Yamaha and Kawasaki kick-starting local assembly operations of the 649cc CBR 650F, 321cc YZF-R3 and 649cc Versys 650 respectively and Mahindra Two Wheelers’ commercial rollout of the 295cc Mojo.

The most affordable bike in the midsize segment comes from Royal Enfield, which is the age-old four-stroke, single-cylinder, 346cc Bullet 350 (on-road price-tag of close to Rs 1.05 lakh, Delhi). Meanwhile, at an on-road (Delhi) price tag of close to Rs 8 lakh, Honda’s CBR 650F is understood to be the most expensive in the segment.

STATISTICS SPEAK

There are a total of 11 visible brands that currently sell midsize motorcycles in India namely – Bajaj Auto’s KTM, Kawasaki, Yamaha, Honda, Royal Enfield, Mahindra, Benelli, Hyosung, Harley-Davidson, Triumph Motorcycles and Ducati. Of these Royal Enfield and DSK Motowheels (via Benelli and Hyosung brands) have the largest portfolio of midsize motorcycles on offer, followed by Triumph Motorcycles and India Kawasaki Motors.

A glimpse of the cumulative sales performance by the two-wheeler industry in the midsize segment reveals that eight OEMs, which have reported their sales, have registered total sales of at least 414,935 units between April 2015 to January 2016. Extrapolating the sales performance of each OEM (as mentioned in the chart) for 12 months, the statistics convey that the industry is likely to record 498,154 units of total sales by March 2016.

Additionally, official sources at DSK Motowheels, a Pune-based company that imports, assembles and sells the motorcycles under two brands – DSK Benelli and DSK Hyosung – told Autocar Professional that they are aiming to sell 2,500 units and 1,500 units respectively. The bulk sales (over 2,000 units) for Benelli will come from 250cc-600cc models.

Clubbing DSK Motowheels’ projections with the consolidated sales of the 8 brands underlines that the industry will, for the first time, touch half-a-million sales in FY2015-16.

The statistics also point out that Bajaj Auto via its KTM brand and Honda stand as the second and third largest players in the category.

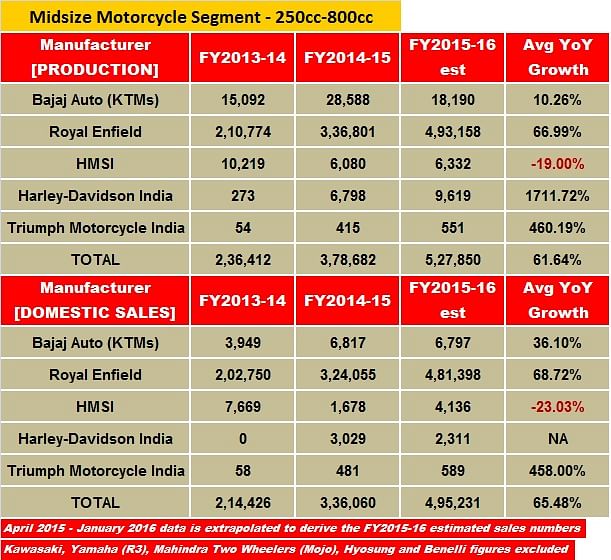

That said, the production of Bajaj KTM models at its Chakan plant is relatively down this year over the last fiscal due to a decline in export demand. The company had produced 28,588 units of the KTM 390cc models in FY2014-15. For the ongoing fiscal, the production estimate is 18,190 units. The company, however, has performed steadily in the domestic market. While Bajaj Auto had sold 3,949 units in FY2013-14, it sold 6,817 units in FY2014-15, and is estimated to sell close to 6,800 units this fiscal.

Honda, which had launched its single-cylinder, 249cc CBR250R model as its first midsize motorcycle in India over five years ago, has relatively lost traction in this segment over time. However, the model was joined by the CBR650F last year with HMSI beginning local assembly operations. Putting the two models together, Honda is estimated to locally produce more than 6,300 units and sell close to 4,000 units by March 2016.

Harley-Davidson India, which sells the Street 750, is estimated to locally produce more than 9,500 units of this model at its Bawal factory this fiscal. While the company has seen a drop in local demand for the Street 750, it is estimated that it will export more than 7,000 units of this model.

Kawasaki and Triumph, on the other hand, are expected to close 2015-16 with sales of close to 1,544 units and 589 units respectively in the midsize motorcycle category.

The other two new entrants this year – Yamaha YZF-R3 and Mahindra Mojo – are expected to close the year with sales of close to 849 units and 530 units respectively.

WHAT 2016 AUTO EXPO BROUGHT TO THE SEGMENT

The 2016 Auto Expo has brought in two new brands, and has also given a glimpse of potential future products from two other OEMs in the medium-sized motorcycle market. The mega-event saw UM Motorcycle India launch three models from its Renegade family and the BMW G310R in its production-ready state.

While the three single-cylinder, 279cc Renegade cruisers from UM India were launched at a starting ex-showroom Delhi price tag of Rs 1.59 lakh, the price and launch details of the BMW G310R remain undisclosed.

Autocar Professional had reported that UM India had received close to 150 bookings within seven hours of launching its models on February 3, 2016. The company plans to accept no more than 10,000 bookings in the first phase due to capacity constraints.

The other two brands that gave a glimpse of potential future midsize motorcycles were TVS Motor Company, which showcased its Akula 310 concept based on BMW’s G310R, and Hero MotoCorp. Hero's naked street motorcycle concept named XF3R is understood to be built upon a 300cc engine. These concepts do hint at the OEMs' perception of the midsize category in the country.

BIKES WITH 2 OR MORE CYLINDER ENGINES TO SELL 7,000 UNITS

While analysts say that single-cylinder engines will continue to dominate the motorcycle industry in the long run in India, it is interesting to take note of the rise in the sales of motorcycles with two or more cylinder engines.

The estimated sales of midsize models (with two or more cylinder engines) from Triumph, Harley-Davidson India, Yamaha, Kawasaki and Honda’s four-cylinder CBR 650F put together for the ongoing fiscal total 5,293 units.

Further, DSK’s sales estimates of models from its Hyosung and Benelli brands add at least 2,000 units to the topline. This consolidates the total expected sales of motorcycles with two or more cylinder engines to 7,000 units in 2015-16.

The most affordable model in the midsize category with at least a two-cylinder engine configuration retails for more than Rs 3 lakh. DSK Hyosung’s Aquila 250, a locally assembled cruiser powered by a V-twin, 249cc engine, could be the most affordable model. It comes with a price tag of close to 3.10 lakh (on-road, Delhi).

UPCOMING PRODUCTS

Royal Enfield, which has benefited from the cost efficiencies of single-cylinder engines, recently unveiled yet another single-cylinder model, the 411cc Himalayan adventure tourer. While its price is not announced, the bike is expected to roll out this month.

Meanwhile, DSK Motowheels is planning to bring at least five new midsize motorcycles over the next 12 months under its Benelli and Hyosung brands, with the bulk being positioned for the entry level (300cc) customers.

The company has confirmed that it plans to bring the faired sibling of the twin-cylinder, 300cc TNT 300, which is already on sale, called Tornado 300 by July 2016, followed by the two-cylinder, 500cc adventure tourer Benelli TRK 502 in September.

Further, it plans to update the V-twin, 249cc Hyosung GT250R with GT300R, and the GV250 (Aquila 250) with the GV300, in the second half of 2016.

Expect to see more launches this year in the 300cc-320cc engine displacement class. They include Yamaha’s twin-cylinder, 321cc MT-03, BMW’s G310R and TVS’s production bike based on the Akula 310 concept as displayed at the Auto Expo.

Reliable sources have also confirmed that Bajaj Auto is looking at commercially rolling out a few all-new models in the medium size motorcycle category. The company, which has been no less than a bellwether of the 200cc-400cc class, is expected to expand its customer base by rolling out an Avenger cruiser and a Pulsar based on the single-cylinder, 375cc engine later this year. Therefore, expect the segment to witness substantial expansion in 2016-17.

Another concept from Auto Expo 2016 that hints at becoming a potentially convincing future product is Honda’s CX-02. Designed and developed as an urban adventure tourer prototype, the CX-02 is a beefier, bigger version of the CX-01 concept from the 2014 Auto Expo.

Designed completely grounds-up by the Indian R&D team of Honda’s two-wheeler wing, the concept is based on a twin-cylinder engine with displacement of close to 500cc. According to a Honda R&D official, the concept, which is considered to be an expensive project by the company, is designed with city-riding as well as highway-touring applications for urban buyers. Though there is no word on the production version of this concept, the official (on condition of anonymity) did reveal that it was displayed at the event to garner feedback from the visitors at the Expo.

Meanwhile, Autocar Professional broke news about BMW Motorrad incorporating its legal entity in India to take on the anticipated growth in the market in the coming years. Clearly, the last two years and the ongoing fiscal could be referred as the formative years for the medium-size motorcycle category, which has already garnered the attention of some of the most reputed global brands. Stay tuned for all the action.

RELATED ARTICLES

Hyundai: Going Beyond Business

Hyundai Motor India sets an example for manufacturing companies across the country with its extensive and impactful soci...

Pawan Goenka: From Rural Madhya Pradesh To India's Space Corridors

The story of Pawan Goenka's life mirrors that of India's ascent—humble beginnings, bold bets, and a mission to make Indi...

M&M and SML Isuzu: Strategy, Synergy, and Game Plan

Mahindra & Mahindra has acquired SML Isuzu, a key player in the small and medium sized CV market in India. But can this ...

By Amit Panday

By Amit Panday

12 Mar 2016

12 Mar 2016

13488 Views

13488 Views

Shahkar Abidi

Shahkar Abidi