Mahindra strengthens its grip on the small CV segment

Jeeto proves to be a game-changer for M&M even as the new Supros make an impact in the market. For Tata Motors, the new Ace Mega is bringing in the numbers.

Home-grown player Mahindra & Mahindra’s aggressive growth strategy to gain market share in the small commercial vehicle (SCV) segment in India is paying off.

Its focus on new product launches and competitive pricing has paid off, helping the company attain a strong foothold in the goods carrier segment.

In October 2015, M&M launched two new products on the all-new Supro SCM platform – the 8- seater Supro Van and Supro Maxi Truck. Both these products, which are squarely targeted at the market leader Tata Motors’ Ace family of mini trucks, have seen good initial sales as seen in the sales statistics for the last six months of FY2015-16.

Following its commercial launch in October, the Supro sold 765 units in the first month, with numbers dropping in the subsequent months indicating that the new SCV managed to attract buyers but was not able to sustain them.

However, M&M’s mini truck Jeeto has impressed with consistent month-on-month sales of 1,500-2,000 units. After its launch in June, it sold close to 1,600 units and gradually began registering an increase in numbers. Thanks to the Jeeto, M&M’s overall numbers in the 2-tonne mini-truck segment have received a boost. In fact, the Jeeto has overtaken sibling Maxximo and is currently clocking over 2,000 units per month.

In the 2-tonne, mini-truck segment, M&M has increased its YoY sales by 82.4 percent during FY16, selling a total of 27,843 units against 15,255 units in FY15. In the overall segment, the Jeeto contributed nearly 73%, helping the company to increase its share in the category from 11.6% to 23.8%.

Tata Motors’ Ace loses market share

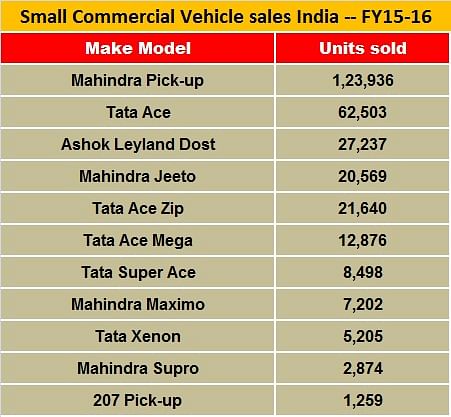

Tata Motors, which created the small CV segment many years ago with its Ace, has been the leader with the majority share. In FY’16, the company sold 84,143 units which gave it a market share of 72%. However, its market share is down from 83.6% to 72% and M&M is the clear gainer.

In the mini-truck segment, Tata Motors’ Ace and Ace Zip were both product leaders in 2015- 2016. While the Ace averaged monthly sales of 4,000-6,000 units to clock total sales of 62,503 units, the Ace Zip averaged sales of 1,800-2,100 units per month and sold 21,640 units for the whole year.

In the 2- to 3.5-tonne pick-up segment, M&M is the clear leader with over 69% market share in the category, thanks to its popular Bolero range of pick-ups. The average monthly sales for the pick-up were 9,000-12,000 units a month and a total of 123,936 units during 2015-16. Earlier this month, the company has launched a larger version of its successful Bolero pick-up truck, called the Big Bolero Pik-up. The new pick-up is targeted at customers who seek extra space in cargo and payload. Designed to cater to the needs of stand operators, businessmen and traders, the Big Bolero Pik-up will be available in 2 variants – offering payload capacities of 1,250kg and the industry-first 1,500kg.

Sensing competition from new players, M&M earlier this year launched the premium pick-up Imperio. The Imperio has been conceptualised and developed in-house by M&M’s engineers at the Mahindra Research Valley in Chennai, a project which saw an investment of Rs 70 crore. Production of the pick-up will be undertaken at the Chakan plant. The automaker may also introduce a CNG variant in the future. The Imperio replaces the Genio pick-up in India.

Tata Ace Mega makes an impact

On its part, Tata Motors has been looking to make new headway in the category with multiple product offerings. With products like the Super Ace, newly launched Ace Mega, Xenon Pick-up and 207 pick-up, Tata sold a total of 27,838 units in the fiscal for a market share of 15.1%. The Ace Mega, launched with the promise of offering more options to customers, has sustained its growth. Starting with 372 units in June, it registered its peak sale of 2,109 units in March 2016 and total sales of 12,876 units in 2015-16. With the Ace Mega, Tata Motors has wrested additional numbers in the pick-up segment and increased its market share by a healthy 31% in FY’16. Its second prominent product in the category is the Super Ace which recorded total sales of 8,498 units in FY’16. The Xenon pick-up sold a total 5,205 units during the fiscal, ranking third in its product list.

Another player in the pick-up segment is Ashok Leyland, with just single product – the Dost. The company has a 14.85% market share, up close with Tata Motors, and sold a total 27,237 Dosts in FY’16, up 11.5% year on year.

Following the strong recovery in the medium and heavy commercial vehicle segment, after three years of a down cycle, LCV (truck) sales have started showing signs of recovery from H2 FY2016 onwards. Replacement-led buying along with expectations of an uptick in demand from consumption-driven sectors is likely to support demand for LCVs.

Clearly, manufacturers want to cash on this demand and are likely to introduce more products to keep them up in the game. Also in the SCV segment, there is a clear shift in favour of pick-up trucks and OEMs are likely to introduce new models. Maruti Suzuki India and Isuzu Motors India are likely to enter the market this year with India-specific models, making the competition a lot more intense. Stay tuned for updates on this front.

Also read:

- India LCV market sees green shoots of recovery after two-year decline

RELATED ARTICLES

Legacy OEMs outsell Top 20 electric 2W startups, command 55% market share in April

With sales of 50,166 electric scooters in April 2025 and a 55% share of the 91,791 e-two-wheelers sold in April 2025, TV...

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

By Kiran Bajad

By Kiran Bajad

12 May 2016

12 May 2016

23006 Views

23006 Views