INDIA SALES ANALYSIS: APRIL 2016

With a host of Indian communities celebrating the New Year (Gudi Padwa, Baisakhi, Vishu, Bihu, Ugadi and Cheti Chand) on April 14-15, automakers saw improved demand and ramped up their dispatches to cash in on the festive mood.

Maruti Suzuki, Hyundai and Mahindra kick-start new fiscal on a high note

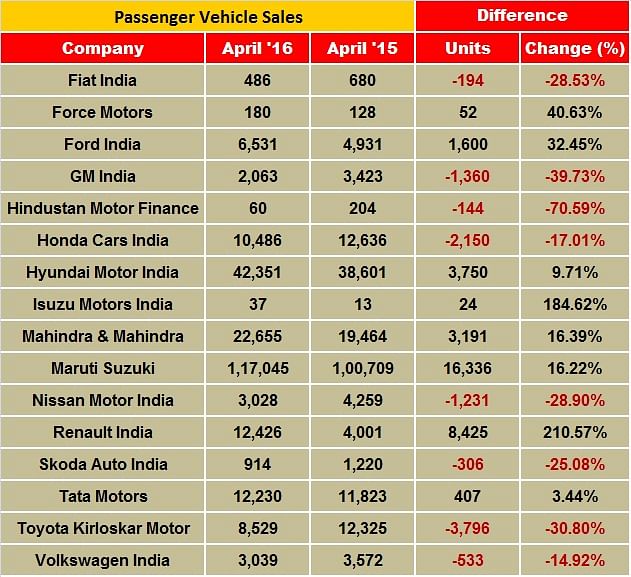

Recently launched models continued to drive passenger vehicle sales in April as the top automakers reported double digit growth during the month. The industry also benefitted from the splurge in spending during the month on account of festive demand.

With a host of Indian communities celebrating the New Year (Gudi Padwa, Baisakhi, Vishu, Bihu, Ugadi and Cheti Chand) on April 14-15, automakers saw improved demand and ramped up their dispatches to cash in.

As a result, the country’s top 3 PV makers – Maruti Suzuki India, Hyundai Motor India and Mahindra & Mahindra – posted healthy sales figures to kick-start 2016-17 on a high note.

The demand for new models also outweighed the recent announcement of price hikes by automakers. Most carmakers had announced a price hike after the Union Budget, which introduced a new infrastructure cess on passenger vehicles. In the Budget, the government had announced 1% infra cess on all small cars (petrol, LGP & CNG) with engines not above 1200cc, 2.5% on sub-4 metre diesel cars with engine capacity not exceeding 1500cc, 1% luxury tax on cars above Rs 10 lakh, and 4% on higher engine capacity cars.

While some manufacturers had effected a price hike in March itself, others had delayed the price rise till April.

As per the sales data, Maruti Suzuki India reported a 16 percent YoY growth in domestic sales to 117,045 units during April, thanks to its expanding footprint in the premium car segment.

Maruti’s sales were led by the compact and the utility vehicle segments, with the newer models like the Baleno and the Vitara Brezza gathering momentum.

During the first month of the new fiscal, the entry level duo of the Alto and Wagon R sold 31,906 units, down 10 percent (April 2015: 35,403), while the compact car quintet of the Swift, Ritz, Dzire, Celerio and Baleno sold 45,700 units, up 8 percent (April 2015: 42,297). Demand for the premium Ciaz sedan continued to rise, having sold 5,702 units, up 22.3 percent (April 2015: 4,662).

The recently launched Vitara Brezza provided a big fillip to the company’s UV sales in April as they rose over 260 percent to 16,044 units (April 2015: 4,452 units). The vans segment also continued to post double digit growth with sales of 14,520 units, up 20.3 percent.

The company’s strong performance despite a slowdown in its bread and butter entry level hatchbacks is a clear indicator of the changing buyer preferences in the Indian PV market.

According to research and rating agency ICRA, the market share of small cars fell to 20% in 2015-16 from 30% in 2010-11. While that of the compact and super compact grew to 45% from 39% and that of UVs has risen to 22% from 13%, in the same period.

Hyundai Motor India registered domestic sales of 42,351 units in April 2016, which marks a year-on-year (YoY) growth of 9.7 percent (April 2015: 38,601).

Commenting on the April sales, Rakesh Srivastava, senior vice-president (Sales and Marketing), Hyundai Motor India, said, “In an industry seeing challenges on rural sales and diesel vehicle sales, Hyundai continued its growth momentum with volume growth of 9.7% over last year with strong performance from the Creta, Elite i20 and Grand.”

Mahindra & Mahindra’s passenger vehicles division (which includes UVs, cars and vans) sold 22,655 units in April 2016 as against 19,464 units during April 2015, registering a growth of 16 percent.

Speaking on the auto sales performance for April 2016, Pravin Shah, president & chief executive (Automotive), M&M said: "At Mahindra we are happy to have begun the new financial year with a growth of 14 percent. We do hope that the Honorable Supreme Court, while taking a decision on diesel vehicles ban in NCR region on May 9, will take cognizance of all the facts including the role that the automotive industry plays in the country's industrial growth. Going forward, we hope to maintain our growth momentum with our wide range of product portfolio as well as the new launches of variants and refreshes, as per the need of our customers.”

Renault India saw another month of exponential growth in its sales with the strong performance of the Kwid. The carmaker registered a solid 211% rise in the domestic sales to 12,426 units in April 2016 as against 4,001 units in the corresponding month last year.

Speaking on the company’s sales performance, Sumit Sawhney, country CEO and managing director, Renault India Operations, said, “The Renault Kwid has received an overwhelming response in the Indian market, not only from the metros but also from smaller cities and towns. Going forward, we are confident of maintaining the sales momentum, as we strategically work towards expanding our sales and service network in India.”

Honda Cars India's (HCIL) monthly domestic sales went down 17% with sales of 10,486 units in April 2016 against 12,636 units in the corresponding month last year. HCIL also exported a total of 496 units during April 2016.

Honda's City and Amaze sedans were the bestsellers with sales of 5,793 and 2,639 units respectively. The Jazz posted underwhelming sales of 869 units with Brio, Mobilio and CR-V making up the rest of the numbers.

Elaborating on the continuing challenge to the industry, Jnaneswar Sen, senior vice president, Marketing & Sales, Honda Cars India said, “The automobile industry is facing big challenge because of sudden shift in consumer preferences from diesel to petrol. Moreover the continuing ban on diesel has also impacted consumer sentiment. All these have impacted HCIL sales as there is a big mismatch in demand and availability of required variants. We are now taking corrective measures to address the situation. Despite the current challenges, HCIL is confident of positive growth in this fiscal."

Toyota Kirloskar Motor was another Japanese carmaker to register negative sales in April with sales falling by nearly 31% to 8,529 units (April 2015: 12,325 units). The company exported 978 units of the Etios series last month as against 1,334 units of the Etios series in the same month last year.

Commenting on the monthly sales, N Raja, director & sr vice president, Sales & Marketing, Toyota Kirloskar Motor said, “We are hopeful that the Honorable Court in the next hearing of 9th May 2016 will lift the ban on registration of diesel vehicles above 2,000cc in the National Capital Region (NCR), which is impacting only our sales efforts, as our cars dominate the 2000cc+ diesel vehicle space. In the month of April, we had strategically planned the production volumes of the current generation Innova, as we gear up to introduce the new Innova Crysta in the Indian market this month. We are hopeful that with the introduction of the Innova Crysta, we will see a growth in our overall sales."

The Toyota Camry however, continues its growth spree and has clocked more units when compared to the corresponding period last year.

Ford India’s combined domestic wholesales and exports in April grew to 16,470 vehicles from 14,215 vehicles in the corresponding month last year. April domestic sales grew to 6,531 vehicles against 4,931 units, while exports grew to 9,939 vehicles compared to 9,284 units as in the same month last year.

“Our three-pronged brand transformation strategy based on introducing products that customers want and value, addressing the cost of ownership perception and delivering a differentiated customer experience continues has enabled us to deliver above industry growth rate,” said Anurag Mehrotra, executive director (Marketing Sales and Service) at Ford India.

With important launches like the Toyota Innova Crysta and the Honda BR-V lined up in May and followed by Datsun Redigo in June, sales could pick up steam even further in the coming months.

Apart from new launches, the Supreme Court’s verdict on the Delhi-NCR diesel ban on May 9 could also be a key factor for PV sales in the coming months. Thus far the apex court has extended the ban in Delhi-NCR, but some reports suggest that the court might consider imposing a green tax of 30% on diesel vehicles to regulate them. Nevertheless, the lack of policy clarity is what is hurting the industry more than the ban itself and hopefully the apex court would come out with clear guidelines and thus help in laying a roadmap for the industry going forward.

Two-wheeler OEMs begin FY2016-17 on a peppy note, new models give sales charge

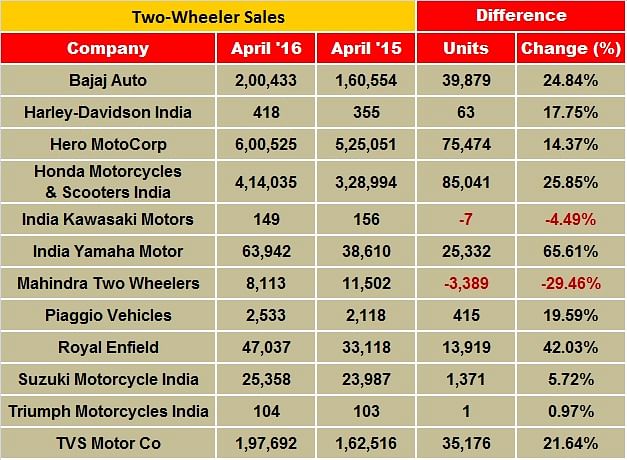

Indian two-wheeler manufacturers have kicked off the new fiscal year on a sound note. The sales performance for April 2016, as reported by some of the top players, along with the forecast of above average monsoons, suggests that the market can hold on to growth for the first quarter of FY2016-17.

OEMs like Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), Bajaj Auto, Royal Enfield and India Yamaha Motor have reported year-on-year growth for the last month.

The largest two-wheeler manufacturer by volumes, Hero MotoCorp has reported double-digit growth – as it did in February and March 2016 – in its overall sales volumes for April including domestic and exports. The company sold 612,739 units (April 2015: 533,305) in April 2016, recording a healthy growth of 14.89 percent YoY.

An official release states that, “In addition to maintaining its leadership in the 100cc segment, Hero has also been further consolidating its leadership in the 125cc segment, driven particularly by the best-selling motorcycle Glamour, which grew by 23 percent in the last financial year (FY2016).”

The company has also garnered good response to its new scooter models – Maestro Edge and Duet. With one of the largest R&D facilities in the world that any two-wheeler manufacturer has, Hero MotoCorp is now working on a number of indigenous projects for Indian as well as global markets.

HMSI, the number two player in the domestic two-wheeler segment, has also reported a YoY growth of 26.52 percent in its overall sales for April 2016. The company has reported total sales of 431,011 units including exports of 17,040 units last month.

A split of domestic scooter and motorcycle sales conveys that HMSI registered sales of 263,320 units and 150,651 units of scooters and motorcycles respectively last month. It recorded a growth of 33.14 percent and 14.82 percent in its scooter and motorcycle portfolios respectively.

HMSI’s official sales release mentions that its domestic share now stands at 27 percent, gaining by one percent in April 2016. Further, the company has also added production capacity to accommodate the ever-increasing demand of its scooter models. It registered a sharp surge of 35 percent in the demand for its Activa brand of scooters during the last month. According to the company, it has sold more than 235,000 units of Activa models last month.

Bajaj Auto has clocked total sales of 291,898 motorcycles (including exports) in April 2016, marking a YoY growth of almost 2 percent. The flat growth can be attributed to the low export demand, thanks to the turmoil in the global oil prices that has affected its key markets such as Egypt, Nigeria and others.

However, the company continues to perform well on the domestic front. Interestingly, the domestic sales performance of Bajaj Auto bailed it out from reporting negative numbers for FY2015-16.

Reporting a substantial growth of almost 66 percent YoY for last month, India Yamaha Motor sold 63,927 units (including exports to Nepal) as against 38,568 units sold in April last year.

According to the company, the good growth can be attributed to increasing penetration and its expansion in Tier 2 and 3 cities along with its customer-centric activities. The Fascino scooter model and the 150cc FZ series motorcycles stand out as the largest-selling models for the company.

Commenting on his company’s growth in April 2016, Roy Kurian, vice-president – sales and marketing, Yamaha Motor India Sales, said: “As the Q1 (company follows calendar year) growth trajectory of 47 percent steadily heads into the current quarter with 66 percent growth in April 2016, Yamaha will continue its consolidated performance of steady sales growth along with more network expansion. The Fascino is doing extremely well and with the Cygnus Ray-ZR launched, Yamaha is looking to further augment its position in the scooter market by targeting a 10 percent market share by end of 2016. Yamaha’s introduction of the Saluto RX will sport more excitement as now it will cater to the requirements of basic commuter segment.”

According to a recent analysis of the scooter segment by Autocar Professional, Yamaha’s market share for FY2015-16 stood around 6 percent.

Meanwhile, continuing its dream run, Royal Enfield has registered total sales of 48,197 units for April 2016 including exports of 1,160 units. The company’s domestic sales stood at 47,037 units (April 2015: 33,118), which indicates YoY growth stands at 42 percent.

While the company commands a large loyal customer base in India, which continues to grow overtime, it is working on a number of new projects to enter into developed and mature motorcycle markets globally.

Commercial vehicles sustain momentum in April sales

April 2016 has also brought cheer for the domestic commercial vehicle manufacturers with almost all posting positive numbers.

Like the last fiscal, the medium and heavy commercial vehicle (M&HCV) segment continues to grow in double digits but importantly light commercial vehicles (LCVs) have posted positive numbers, signaling overall growth in the sector.

In its outlook for 2016-17, rating agency ICRA expects the CV industry to continue its growth momentum. The M&HCV segment, which has been consistently growing since the past year and a half, is likely to see double-digit growth on the back of replacement demand and improving fleet operator viability.

The M&HCV segment is set to register growth of 13-15 % in FY17 aided by an uptick in demand, complete roll-out of BS-IV norms and improving viability of fleet operators and replacement demand.

After consistent de-growth over the past three years, LCV (Trucks) have begun to see a recovery. ICRA anticipates replacement-led demand along with expectations of pick-up in demand from consumption-driven sectors. Despite a slowdown, there is likely to be improved viability of LCV fleet owners due to lower diesel prices. LCV (Truck) sales will likely grow by 13% in FY2017 on the back of a low year-ago base and replacement-led demand (i.e. average age of LCV (Trucks) has risen to 5.3 years in FY 2016). Some pre-buying ahead of the complete rollout of BS-IV norms is also likely to aid growth. ICRA expects the overall bus segment in to grow by 13% 2016-17.

Ashok Leyland’s overall sales were up 28% YoY with total sale of 9,514 units (April 2015: 7,389 units). The M&HCV sales increased 20% to 7,871 units. (April 2015: 6,549 units), the LCVs were up 22% it sold 2,309 units. (April 2015:1,886 units).

Tata Motors’ total sales of 23,367 units were up 13.8% (April 2015: at 20,536 units). M&HCV sales grew 14.4% at 11,642 units (April 2015: 10,179). Tata Motors' LCVs have notched strong double-digit growth at 12.3 %, selling 13,496 units (April 2015: 12,010).

Mahindra & Mahindra’s M&HCVs numbers were substantially up by 82%, the company sold 472 units in the month. (April 2015: 260 units). While the below-3.5T GVW segment notched up 12% growth with sales of 11,834 units. (April 2015: 10,594 units). The above 3.5T GVW segment gained 35% with sales of 641 units (April 2015: 475 units).

VE Commercial Vehicles registered 32.5% growth, selling 4,641 units in the domestic market (April 2015: 3,503 units).

- With inputs from Shourya Harwani, Amit Panday & Kiran Bajad

Recommended:

- UVs lead the charge in April

- India Auto Inc sees under-utilisation of manufacturing capacity of 45%

RELATED ARTICLES

Legacy OEMs outsell Top 20 electric 2W startups, command 55% market share in April

With sales of 50,166 electric scooters in April 2025 and a 55% share of the 91,791 e-two-wheelers sold in April 2025, TV...

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

By Autocar Professional Bureau

By Autocar Professional Bureau

02 May 2016

02 May 2016

30567 Views

30567 Views