Suzuki Motor Raises FY31 Revenue, Operating Profit Targets

The company raised its revenue target for the financial year ending March 2031 to 8 trillion yen (₹4.62 lakh crore) from the target of 7 trillion yen (₹4.41 lakh crore) announced in January 2023.

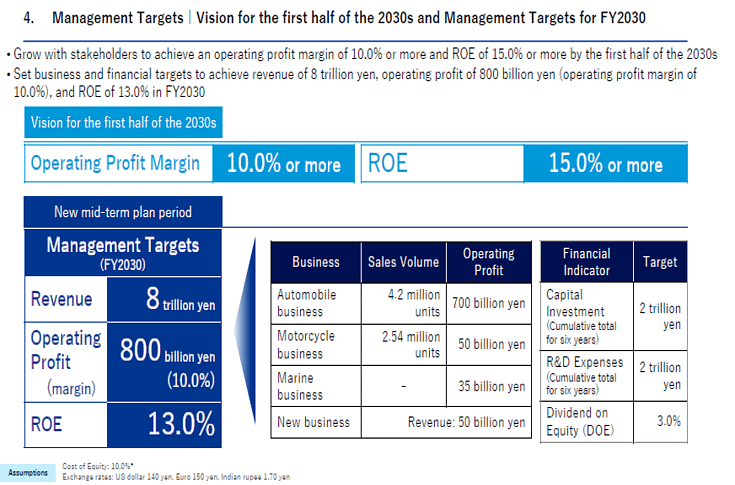

Japanese car and two-wheeler maker Suzuki Motor Corporation has raised its revenue target for the financial year ending March 2031 (Japanese FY30) to 8 trillion yen (₹4.62 lakh crore) from the target of 7 trillion yen (₹4.41 lakh crore) announced in January 2023, according to the company's new mid-term management plan for FY26-31.

The company has also guided for its operating profit to nearly double over seven years,from 465 billion yen in FY24 (Japanese FY23) to 800 billion yen (₹46,160 crore) by FY31. Operating profit margin is set to grow to 10% or more. It also expects its return on equity metric to expand to 13% by FY31 compared to 11.7% FY24.

The company said its profit growth will be driven by rising volumes and product value, particularly higher sales of SUVs and electrified vehicle technology.

“Amid an increase in the EV (electric vehicle) ratio, increasing labor cost, rising material costs (strengthening the supplier foundation, increase in raw material, energy cost, etc.), we aim for profit growth through improved profitability by increasing sales volume and increasing product and brand value,” the Japanese carmaker said.

Besides expected operational and sales improvements, Japanese manufacturing companies can benefit from the recent depreciation seen in the yen, which boosts their overseas revenue.

On the sales front, Suzuki expects its total global volume to reach 4.20 million units by FY31, up from 3.16 million units in FY24 -- a CAGR of 4% over the next seven years.

Investments

To achieve higher profitability and improve efficiency, Suzuki Motor said it will proactively make necessary growth investments by securing maximum funds. The company has set a capital expenditure, and research and development expense target of 2 trillion yen each by FY31.

Of the 2 trillion yen allocated for capital expenditure till FY31, the company will spend 750 billion yen towards increasing production capacity, 500 billion yen for preparation of new models, and 250 billion yen towards improving quality and efficiency. It will also allocate 350 billion yen for sales points and test equipment, and 150 billion yen for carbon neutral initiatives at Suzuki Smart Factory, according to the presentation.

The automaker also plans to make battery-related investments, but it will be based on the market conditions.

Out of 2 trillion yen capital investment announced by Suzuki Motor, around 1.2 trillion yen will go to expanding India business. This comes against the downward revision of long-term sales outlook by the automaker for its India subsidiary.

Suzuki Motor has guided for a volume of 2.54 million units in India by FY31 (Japanese FY30), as against the 3 million units target announced in October 2023. It is guiding for a slower compounded annual growth rate of 5% in the next six years as against the previous expected CAGR of 8%. Despite this, India will increase its share of Suzuki’s global sales during this period, accounting for 60% of its total global sales, up from 56% in FY24, and will remain its fastest-growing market.

RELATED ARTICLES

Weekly News Wrap: February Sales Surge, Bajaj Flags Maharashtra EV Policy risk, ZF Eyes more India Pacts

Demand momentum stayed intact, but subsidy disputes, capacity constraints and global supplier bets set the real tone of ...

VST Tillers Tractors Reports 36% Jump in February 2026 Sales

VST Tillers Tractors posted a rise across both power tillers and tractors in February 2026, with year-to-date volumes al...

Exposure Not Very High in Middle East, Closely Monitoring Situation: Maruti Suzuki

The Middle East accounts for 12.5% of Maruti Suzuki’s total exports.

20 Feb 2025

20 Feb 2025

3331 Views

3331 Views

Darshan Nakhwa

Darshan Nakhwa

Autocar Professional Bureau

Autocar Professional Bureau

Kiran Murali

Kiran Murali