Kinetic Engineering Promoters step in with growth funds via preferential issue

From the total, Rs 100 cr will go to the electric vehicle subsidiary, while the remaining funds will be invested in Kinetic Engineering Ltd. The company has plans to enter battery manufacturing and solar energy.

Pune-based automobile maker Kinetic Engineering has obtained the approval of its board of directors to raise up to Rs 177 crore, mostly from its promoters.

Going by the disclosure, the money will be raised by issuing warrants that can be converted to shares within 18 months at the rate of Rs 171 per warrant.

Kinetic shares were being trading at Rs 164 each before the news broke, and are now being quoted at Rs 183 each.

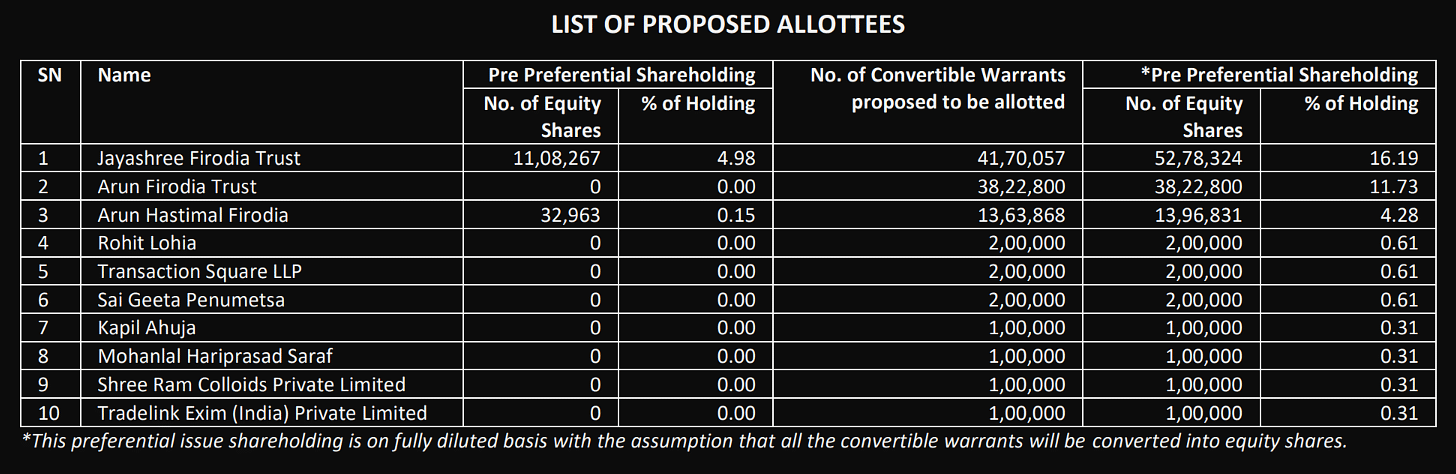

Out of the total 1.04 crore warrants proposed to be issued, 41.7 lakh shares will be issued to Jayashree Firodia Trust, followed by 38.2 lakh warrants to Arun Firodia Trust and 13.6 lakh warrants to Arun Hastimal Firodia. Several private entities will also subscribe to warrants, including Transaction Square LLP and Sai Geeta Penumetsa.

If and when the warrants are converted to shares by the allottees for Rs 171 each, their stakes in the company will increase substantially.

For example, the stake owned by the Jayashree Firodia Trust will go from 11.1 lakh shares, or 4.9%, to 52.8 lakh shares, or a 16.2% stake (see chart).

Following this capital infusion, the promoters aim to increase their ownership stake in the company from 59% to 70% by 2027.

Ajinkya Firodia, Vice Chairman of Kinetic Group, confirmed this and told Autocar Professional that the company currently has an order book exceeding Rs 100 crore and is seeing strong volumes from clients such as Mahindra & Mahindra. Renault amongst its other customers such as Renault, American Axle, TATA Motors, Mahindra & Mahindra, Ashok Leyland, Magna Powertrain, Sonalika tractors, Carraro products, and many others.

From the fund raise, the company plans to invest close to Rs 100 crore in its electric vehicle subsidiary, Kinetic Watts and Volts, while the remaining funds will be invested in Kinetic Engineering Ltd. Additionally, Kinetic management has also outlined plans to establish a battery manufacturing facility and engage in solar energy projects.

Company officials outlined an investment strategy that involves a phased approach: Rs 60 crore by March 2025, followed by Rs 44 crore by March 2026, and Rs 73 crore by March 2027. Kinetic has set an ambitious revenue target of Rs 1,000 crore by 2029 and aims to finish the current fiscal year (FY 24-25) with around Rs 160 crore.

Regarding future fundraising initiatives, Firodia indicated that the current funding round is primarily supported by HNi's and friends. However, the company is open to potential collaborations with international clean energy funds as it seeks to enhance its presence in the rapidly evolving electric vehicle market.

Firodia also mentioned that Kinetic is in discussions to form a partnership with a European company to develop gearbox designs intended for supply to Indian original equipment manufacturers (OEMs). Additionally, the company plans to launch solar panel gearboxes soon.

Reflecting on the current fiscal year, Firodia noted, "This year has posed challenges for our company, with the industry showing mixed signals, and we expect to conclude the year with a turnover of Rs 160 crore."

Aligned with its commitment to electric vehicle advancements, Kinetic is focusing on developing sophisticated drivetrain solutions, gear systems, and other related products through its subsidiary, Kinetic Watts & Volts.

Kinetic, which has a manufacturing facility located in Ahmednagar a covers an area of 70 acres, and employs over 1,000 personnel. All its products produced by Kinetic Engineering Ltd. are certified under IATF

Sharing his vision for the firm, Firodia said this capital infusion and the issuance of strategic warrants underscore the promoters’ confidence in KEL’s long-term strategy, positioning the company to capitalize on emerging opportunities in the evolving mobility landscape. "The investment will be deployed to strengthen working capital, enhance manufacturing capabilities, and drive innovation in product development, particularly in high-growth areas such as electric vehicle (EV) components as well as fuel innovation, improve operational efficiencies, and meet the evolving demands of the automotive and EV industries,” he remarked

RELATED ARTICLES

Axis Bank Named Preferred Financer for Tesla in India

Axis Bank will offer customised auto loans with tenures of up to 10 years and a fully digital onboarding process for Tes...

Exclusive: TVS Surpasses Yamaha to Become 3rd-Largest Global 2W Maker by Volume

The Indian OEM sold a total of 5.46 million two-wheelers in 2025, while Yamaha recorded sales of approximately 5 million...

Escorts Kubota Targets Doubling South India Market Share to Tap Paddy Growth

The company's Shaurya series, built for wetland farming, is part of a broader push to double its market share in souther...

By Amit Vijay M

By Amit Vijay M

21 Jan 2025

21 Jan 2025

5106 Views

5106 Views

Angitha Suresh

Angitha Suresh

Autocar Professional Bureau

Autocar Professional Bureau