India's Auto Retail Sales Rise 4.84% in June 2025 Despite Monthly Decline

Vehicle retail volumes show year-on-year growth across all categories while dealers express cautious optimism amid monsoon challenges and supply constraints.

India's automobile retail sales recorded a 4.84% year-on-year increase in June 2025, reaching 20.04 lakh units compared to 19.11 lakh units in June 2024, according to data released by the Federation of Automobile Dealers Associations (FADA). However, sales declined 9.44% month-on-month from May 2025's 22.13 lakh units.

The positive annual growth was driven by increases across all vehicle categories, with construction equipment leading at 54.95% growth, followed by tractors at 8.68%, commercial vehicles at 6.60%, three-wheelers at 6.68%, two-wheelers at 4.73%, and passenger vehicles at 2.45%.

For the first quarter of fiscal year 2026 (April-June), overall retail volumes grew 4.85% year-on-year to 65.43 lakh units, with two-wheelers contributing the largest share at 47.99 lakh units.

Two-Wheelers Show Resilience Despite Monthly Decline

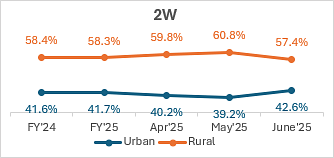

Two-wheeler sales reached 14.46 lakh units in June 2025, representing a 4.73% increase from the previous year but a 12.48% decline from May 2025. The segment benefited from festival and marriage season demand, though financing constraints and variant shortages moderated growth.

Hero MotoCorp maintained its market leadership with 27.23% share, followed by Honda at 24.56% and TVS Motor at 19.52%. Electric vehicle penetration in the two-wheeler segment increased to 7.28% from 5.79% in June 2024.

Rural areas accounted for 57.4% of two-wheeler sales, indicating continued demand from smaller towns and villages. Early monsoon rains and rising electric vehicle adoption influenced buying patterns during the month.

Three-Wheelers Maintain Steady Growth Momentum

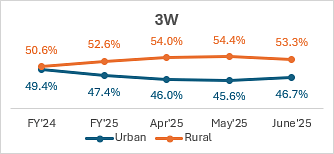

Three-wheeler retail sales totaled 1.00 lakh units in June 2025, up 6.68% year-on-year and down 3.66% month-on-month. The segment showed consistent performance with electric vehicles dominating at 60.18% market share.

Bajaj Auto led the three-wheeler segment with 35.92% market share, while Mahindra & Mahindra secured 7.89%. The category includes passenger vehicles, goods carriers, and e-rickshaws, with electric variants continuing to gain traction.

Rural markets contributed 53.3% of three-wheeler sales, reflecting the segment's importance in last-mile connectivity and goods transportation in smaller towns.

Passenger Vehicles Face Inventory Challenges

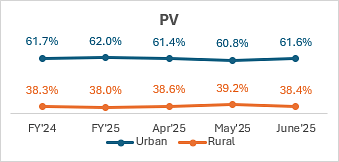

Passenger vehicle sales reached 2.98 lakh units in June 2025, marking a 2.45% year-on-year increase but a 1.49% month-on-month decline. Heavy monsoon rains and tight market liquidity affected footfall and conversions despite elevated incentive schemes.

Maruti Suzuki maintained its dominant position with 39.15% market share, followed by Mahindra at 13.74% and Hyundai at 12.87%. Dealer inventory levels remained elevated at approximately 55 days, raising concerns about stock management.

Urban areas accounted for 61.6% of passenger vehicle sales, with petrol and ethanol-powered vehicles holding 48.15% market share. Electric vehicle adoption in the segment increased to 4.43% from 2.52% in June 2024.

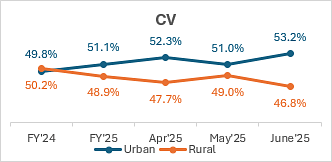

Commercial Vehicles Navigate Cost Pressures

Commercial vehicle sales totaled 73,367 units in June 2025, showing 6.60% year-on-year growth despite a 2.97% month-on-month decline. Early-month deliveries supported volumes before monsoon-related slowdowns affected demand.

Tata Motors led the commercial vehicle segment with 33.31% market share, followed by Mahindra at 26.83% and Ashok Leyland at 17.79%. New taxation norms and mandatory air-conditioned cabin requirements increased ownership costs.

The segment faced challenges from muted infrastructure demand and elevated price points, though extended order pipelines provided some support to manufacturers and dealers.

Construction Equipment Records Strong Performance

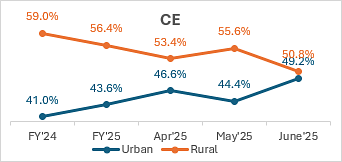

Construction equipment sales reached 8,558 units in June 2025, representing a remarkable 54.95% year-on-year increase and 44.98% month-on-month growth. The segment benefited from robust government capital expenditure on infrastructure projects.

JCB India led the construction equipment market with 27.92% share, followed by Action Construction Equipment at 10.33%. Government spending on roads, railways, metros, and green energy projects supported demand.

Urban areas contributed 49.2% of construction equipment sales, reflecting increased construction activity in metropolitan regions driven by infrastructure development programs.

Tractors Benefit from Agricultural Momentum

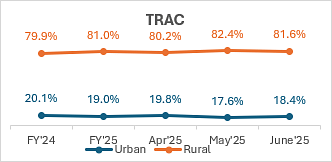

Tractor sales reached 77,214 units in June 2025, up 8.68% year-on-year and 7.25% month-on-month. The segment gained from early Kharif sowing, which increased 11.3% year-on-year to 262.15 lakh hectares.

Mahindra & Mahindra dominated the tractor segment with 22.69% market share, followed by its Swaraj division at 18.50% and International Tractors at 13.13%. Rural areas accounted for 81.6% of tractor sales.

Above-normal monsoon forecasts and stronger farm incomes supported tractor demand, though heavy rainfall in some regions created logistical challenges for dealers and customers.

Market Outlook and Dealer Sentiment

FADA's dealer survey revealed mixed sentiment for July 2025, with 42.8% expecting flat sales, 26.1% anticipating de-growth, and 31.1% forecasting growth. Only 21% of two-wheeler dealers, 38% of passenger vehicle dealers, and 32% of commercial vehicle dealers reported healthy enquiry flows.

Challenges include rare-earth material shortages affecting component production, geopolitical tensions, potential US tariff spillovers, and monsoon-related disruptions. However, government infrastructure spending and rural demand driven by agricultural activity provide support.

FADA represents over 15,000 automobile dealerships across India, employing approximately 5 million people. The organization collaborates with the Ministry of Road Transport and Highways to compile retail data from 1,386 of 1,445 Regional Transport Offices nationwide.

RELATED ARTICLES

India’s PV Market Estimated To Have Clocked Record January Sales With 4.5 Lakh Units

Lean dealer inventories and robust retail demand after the GST cut helped the industry start 2026 on a strong note.

Budget FY27: Allocation estimate for PM E-Drive Scheme at Rs 1,500 Cr

The subsidies for electric two-wheelers and three-wheelers are set to expire by March 31, 2026, while incentives for ele...

Budget 2026-27: Sitharaman Proposes 4,000 E-Buses for East India Industrial Corridor

Clean-energy fleet in five eastern Purvodaya states marks the latest phase in a national push that has sanctioned 7,293 ...

By Angitha Suresh

By Angitha Suresh

07 Jul 2025

07 Jul 2025

4867 Views

4867 Views

Ketan Thakkar

Ketan Thakkar

Anurag Chaturvedi

Anurag Chaturvedi