Early Monsoon Give Hope to Auto Dealers in India

The latest vehicle retail data for June 2025, released by FADA, points to an overall pick up in auto-retail volumes in June compared to last year, with the total number climbing by 4.84%.

As the first showers of the 2025 monsoon swept across India, arriving eight days ahead of schedule and covering the nation a full nine days early, they did more than just break the summer heat. For the country's vast rural economy, the rains heralded a season of renewed optimism, translating directly into brisk business for the automotive sector.

The early and abundant rainfall, which the India Meteorological Department (IMD) forecasts to be 106% of the long-period average, has acted as a powerful stimulant for demand in India's agricultural heartland. Spurred by the rains, early Kharif sowing is reported to have surged by 11.3% year-on-year, covering 262.15 lakh hectares as of late June. This robust start to the sowing season is underpinning stronger farm incomes, and in turn, firing up demand for vehicles in the hinterlands.

The latest vehicle retail data for June 2025, released by FADA, provides concrete evidence of this rural-led revival, with overall auto-retail volumes climbing by a healthy 4.84% compared to the same month last year.

Tractors and Two-Wheelers: Barometers of Rural Prosperity

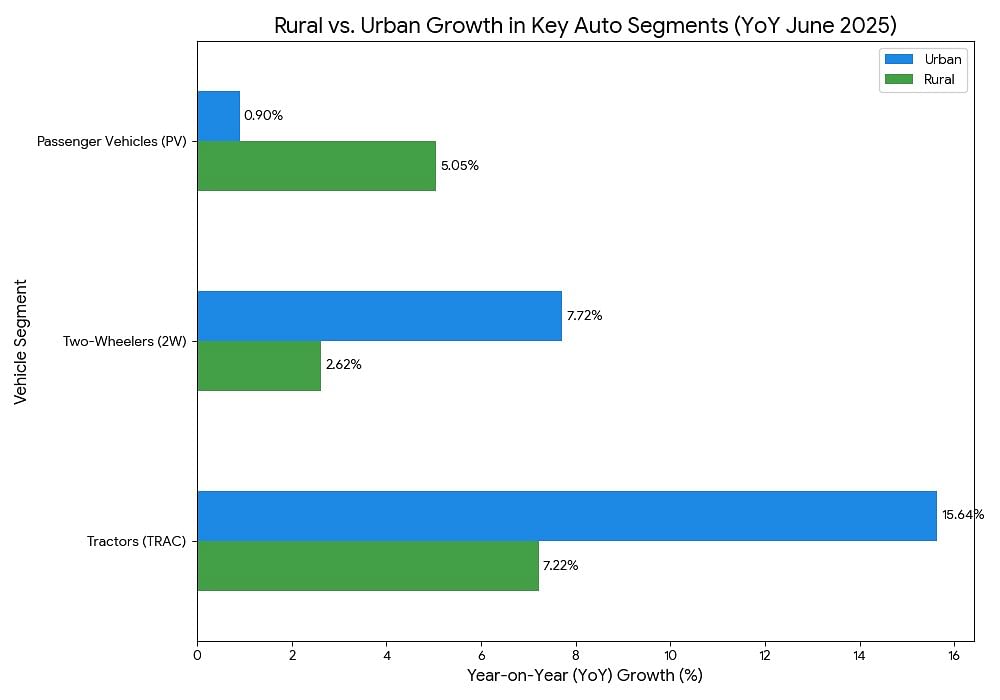

Nowhere is this trend more apparent than in the sales of tractors and two-wheelers, the twin barometers of the rural economy. The tractor segment, intrinsically linked to agricultural activity, posted a robust 8.68% year-on-year (YoY) growth in June. With rural markets accounting for a staggering 81.6% of all tractor sales, this uptick is a direct reflection of farmers investing in mechanisation, buoyed by the promise of a bountiful harvest.

Similarly, the two-wheeler segment, which saw a 4.73% YoY increase, was significantly influenced by this rural resurgence. While early-cycle softness was noted, demand driven by the marriage season and festivals was bolstered by renewed activity in the hinterlands following the monsoon's arrival. Rural India constitutes a majority 57.4% of the two-wheeler market, making its sentiment a critical driver for the industry's largest players.

“Early monsoon rains and rising EV penetration also shaped buying patterns,” FADA President CS Vigneshwar said, adding that financing constraints and intermittent variant shortages played the role of a moderator.

The clearest sign of a rural-driven market, however, emerges from the passenger vehicle (PV) segment. Even as urban PV demand remained nearly flat with a mere 0.90% YoY growth, the rural market saw sales surge by an impressive 5.05%.

A Picture of Cautious Optimism

Reflecting on the quarterly performance, FADA President Mr. C S Vigneshwar noted, "In Q1 FY26, retail sales tracked exactly to our forecasts—overall volumes rose 4.85% YoY". He added that the association remains confident of a robust ramp-up in the coming months as seasonal demand takes effect.

However, the industry is not without its challenges. The same rains that bring prosperity can also bring peril. FADA’s near-term outlook warns that while the above-normal monsoon should bolster rural demand, it also introduces "logistical complexities" in heavy-precipitation zones. This has been a reality in states like Maharashtra and Karnataka, where excessive rainfall has led to waterlogging, disrupting the transport of farm produce and delaying vehicle deliveries.

Furthermore, economic headwinds persist. The FADA report points to several factors tempering the market's enthusiasm:

- Inventory Levels: Passenger vehicle inventory remains elevated at approximately 55 days, a point of concern for dealers.

- Cost Pressures: Price hikes effective in July, alongside higher ownership costs for commercial vehicles due to new taxation and mandatory AC-cabin norms, are weighing on buyer decisions.

- Financing Constraints: Tight market liquidity and financing constraints were cited as moderating factors for both two-wheeler and passenger vehicle sales.

- Dealer Sentiment: A survey of dealers reveals a tilt towards a slowdown, with a combined 68.9% anticipating flat or de-growth in sales for July, compared to just 31.1% who expect growth. This is more bearish than two months ago, when 37.5% of the respondents were expecting growth in the next month.

This mixed backdrop has led FADA to adopt a "stance of cautious optimism". The positive momentum from agrarian tailwinds and robust government capital expenditure on infrastructure is undeniable. Yet, the industry must remain agile to navigate monsoon-related disruptions, persistent supply constraints, and liquidity pressures.

For now, the Indian auto market is witnessing a K-shaped recovery, with rural demand providing a powerful engine of growth. As the monsoon continues its journey across the subcontinent, all eyes will be on the hinterlands to see if this initial spark can ignite a sustained revival for the entire industry.

RELATED ARTICLES

Renault Brings Back Iconic Duster SUV with Strong Hybrid, Turbo Engine

The price will be revealed in March, with deliveries of the turbo variant starting in April, followed by the strong hybr...

India Plans Sharp Cut in Car Import Tariffs to 40% Under Proposed EU Trade Pact: Reuters

According to Reuters, the Indian government has agreed to immediately reduce duties on a limited number of EU-built cars...

Weekly News Wrap: Truck Makers go Aggressive; Toyota, Skoda Expand Portfolios

Product launches dominated the week, with new trucks from Tata Motors and Ashok Leyland and fresh action in the SUV segm...

07 Jul 2025

07 Jul 2025

2693 Views

2693 Views

Kiran Murali

Kiran Murali

Arunima Pal

Arunima Pal

Autocar Professional Bureau

Autocar Professional Bureau