Hyundai Capital to Enter India by 2026, Bolstering Hyundai’s Integrated Mobility and Finance Ecosystem

With Hyundai Capital India, the carmaker eyes stronger rural reach, higher dealer profitability and a seamless ownership experience across touchpoints.

Hyundai Motor India (HMI) is set to strengthen its presence across the automotive value chain with the launch of Hyundai Capital India in 2026, marking the South Korean carmaker’s formal entry into auto financing, leasing and mobility services in one of its fastest-growing global markets.

The announcement was made by José Muñoz, Global COO, Hyundai Motor Company and President & CEO, Hyundai Motor North America, during HMI’s first-ever CEO Investment Day in Mumbai, where the company outlined its Vision 2030 roadmap for India.

Phased Market Entry

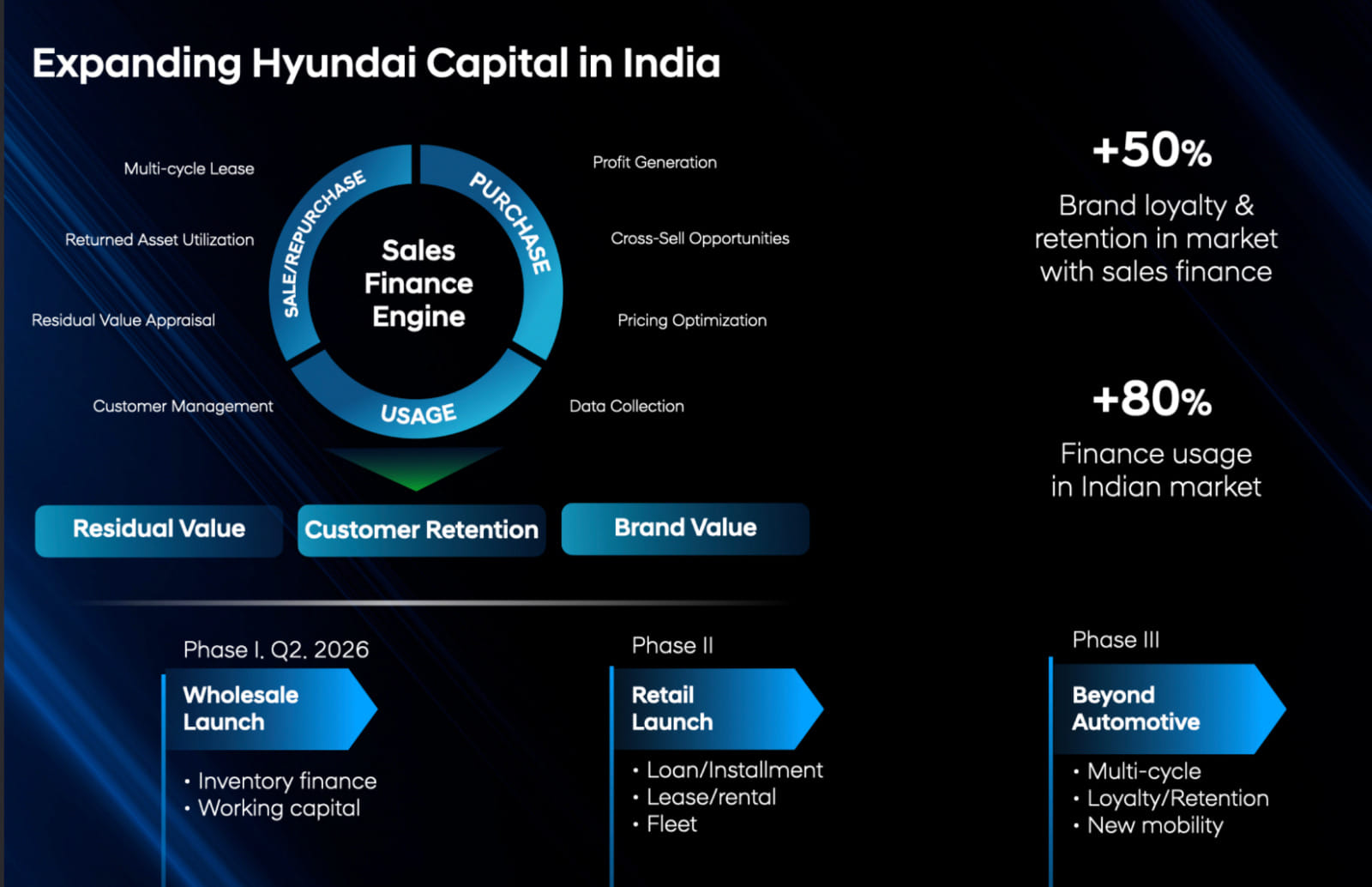

The financial arm will enter the country through a three-phase rollout designed to support dealers, customers and future mobility operators.

Phase 1 (Q2 2026): Launch of inventory financing and working capital solutions to strengthen liquidity for Hyundai’s nationwide dealer network.

Phase 2: Expansion into retail loans, leases, rentals and fleet finance to offer customers a wider choice of flexible ownership models.

Phase 3: Introduction of multi-cycle finance and new-mobility products, such as subscriptions and shared-mobility financing, to align with emerging ownership trends.

“This isn’t just about lending — it’s about enabling sustainable growth, customer retention and brand trust,” said Muñoz. “Sales finance drives residual value and strengthens the brand ecosystem.”

Strategic Leverage in a Growing Market

With auto finance penetration already above 80 percent in India, Hyundai sees strong potential for a captive finance arm that can enhance dealer profitability, accelerate vehicle turnover, and deepen customer loyalty. Globally, Hyundai Capital operations have improved repeat-purchase and retention rates by up to 50 percent, underscoring the business case for a local presence.

The move also complements Hyundai’s rapid network expansion — from over 3,600 touchpoints today to 85 percent district coverage by 2030, including a strong rural focus. Hyundai aims to generate 30 percent of domestic sales from rural India, supported by easier access to retail finance and after-sales credit solutions.

Creating a Full-Stack Ownership Ecosystem

The financial services plan integrates seamlessly with Hyundai India Insurance Broking, which has already issued five million policies and assisted 1.3 million claims, using AI-driven pre-inspection and claims processing. Together, Hyundai Capital and Hyundai Insurance will offer a comprehensive “ownership lifecycle” platform — spanning purchase, protection, and upgrade.

Additionally, Hyundai is exploring micro-mobility finance in collaboration with TBS Motor, to support advanced three-wheelers for urban shared-mobility applications.

Hyundai Capital’s India debut will coincide with the company’s broader Vision 2030 strategy — which projects India to become the second-largest region for Hyundai Motor Company globally, behind only North America.

As part of this roadmap, Hyundai plans 26 new model launches by 2030, half of which will be electrified, and a fully localised EV supply chain anchored by its upcoming Pune facility and enhanced Chennai operations.

“India is no longer just a key market — it’s an integrated pillar of Hyundai Motor Company’s global operations,” said Muñoz. “With Hyundai Capital, we are embedding the financial backbone needed to power our next decade of growth.”

RELATED ARTICLES

Bajaj Auto Lines Up Product Blitz to Rebuild Premium Segment Share

Seven products launched since Diwali and eight more planned as Bajaj sharpens focus on strengthening the Pulsar franchis...

Bajaj Auto Approves Rs. 12 Crore Investment in Clean Energy Project

The renewable power will be supplied to Bajaj's plants located at Akurdi and Chakan in Pune, Maharashtra.

Bajaj Auto Sees Steady Two-Wheeler Demand in Coming Months After GST Boost

Bajaj Auto sees near-term domestic two-wheeler demand staying firm after GST rationalisation, with seasonality and uptra...

By Ketan Thakkar & Darshan Nakhwa

By Ketan Thakkar & Darshan Nakhwa

15 Oct 2025

15 Oct 2025

2635 Views

2635 Views

Darshan Nakhwa

Darshan Nakhwa

Arunima Pal

Arunima Pal