High-Base Effect Breaks Indian Auto's Three-Month Growth Run

Year-on-Year Comparison Skewed by Exceptional July 2024 Recovery; Underlying Demand Shows Mixed Signals

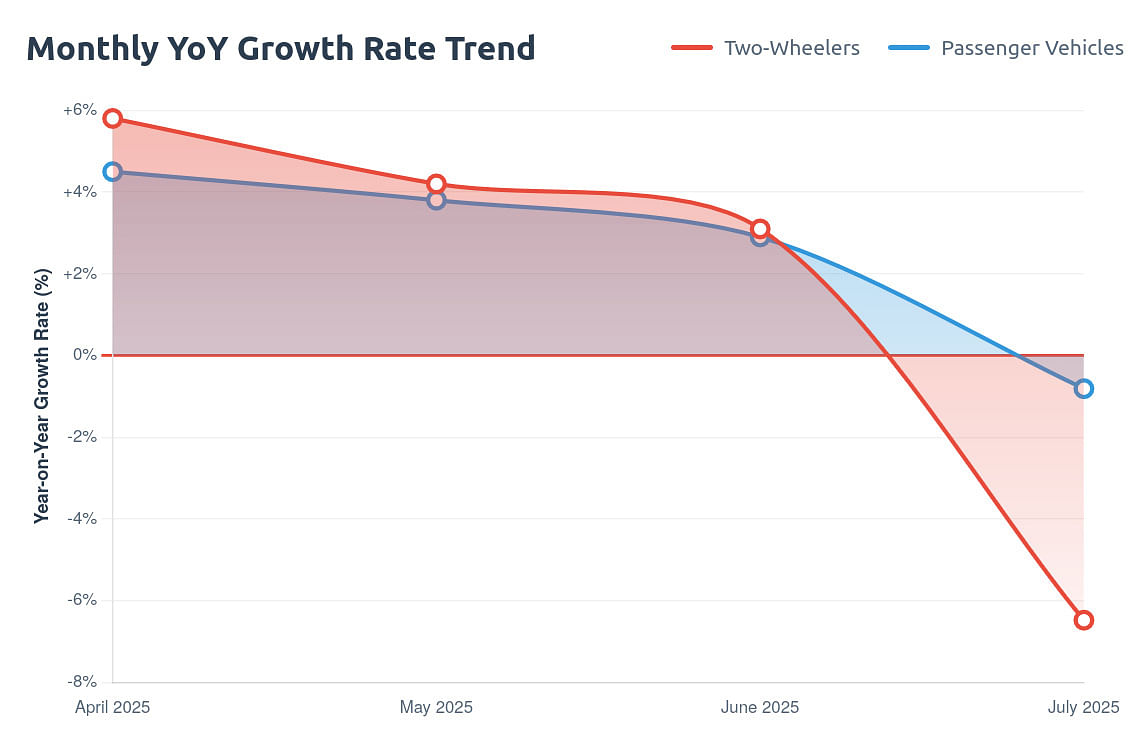

India's automobile retail sector recorded a 4.31% year-on-year decline in July 2025, ending a three-month growth streak, primarily due to a high-base effect from an exceptional performance in July 2024. Total sales dropped to 19,64,213 units, according to data released by the Federation of Automobile Dealers Associations (FADA).

The decline, while appearing significant on paper, masks a more nuanced reality. July 2024 had witnessed an unusual demand pattern – an extreme heat wave followed by excessive rainfall initially suppressed sales, leading to pent-up demand that resulted in a strong rebound later that month. This created an artificially high base for year-on-year comparisons.

"After three consecutive months of growth, India's auto retail sector applied the brakes in July, with overall retails declining by 4.31% YoY. This pullback largely stems from a high-base effect in July 2024," explained C S Vigneshwar, FADA President, emphasizing that the previous year's unusual weather-driven volatility is distorting current growth metrics.

Two-Wheeler Segment: Base Effect Meets Monsoon Challenges

The two-wheeler segment, which recorded a 6.48% year-on-year decline to 13,55,504 units, exemplifies how the high-base effect is compounding with current market conditions.

While July 2024 saw a surge in two-wheeler purchases during its late-month recovery, July 2025 faced headwinds from heavy monsoon rains and ongoing crop-sowing activities that dampened rural footfalls.

Despite the statistical decline, month-on-month data tells a different story. The 6.28% sequential drop from June 2025 suggests that while seasonal factors are at play, the year-on-year comparison exaggerates the weakness.

Dealers remain optimistic, with many reporting that purchase decisions are merely being deferred to August ahead of the festive season rather than being cancelled outright.

Passenger Vehicles: Strong Sequential Growth Overshadowed

The passenger vehicle segment's marginal 0.81% year-on-year contraction to 3,28,613 units becomes more meaningful when viewed against its robust 10.38% month-on-month growth. This divergence clearly illustrates how the high-base effect is masking underlying strength in the market.

The sequential growth was driven by surprising rural demand strength, particularly towards month-end, aided by the Aashaada period, auspicious delivery days, and new model introductions.

The year-on-year decline appears less concerning when considering that July 2024's late-month surge created a particularly challenging comparison base.

Urban demand remained subdued with low enquiry levels, though industry observers note this is partly seasonal, with many urban buyers traditionally waiting for festive season offers. Inventory levels at 55 days suggest dealers are not panicking despite the headline decline, maintaining stable

RELATED ARTICLES

Gulf Oil, Mahindra Tractors Renew Multi-Year Partnership

Gulf Oil to continue to supply lubricants to Mahindra’s tractor division and hold the largest share of business for the...

Punch EV Pushes Closer to the Mainstream With 355 km Real-World Range: Anand Kulkarni

Tata Motors says the upgraded Punch.ev, with higher real-world range, faster charging and its new Acti.ev platform, is a...

Tata Motors PV Expects 30–50% Jump in Punch.ev Volumes After New Launch

Automaker bets on higher range, faster charging, and accessible pricing to lift EV adoption in the entry segment.

By Angitha Suresh

By Angitha Suresh

07 Aug 2025

07 Aug 2025

1395 Views

1395 Views

Arunima Pal

Arunima Pal

Darshan Nakhwa

Darshan Nakhwa