SIAM's Rajan Wadhera: 'Industry may see 50% sales decline over two years (FY2020, 2021).'

With FY2020 numbers down nearly 20% YoY and the GDP slowing, India Auto Inc could see sales down 25-35% in FY2021. SIAM president also calls for sustainable supply chains in India.

The projected decline in sales arising out of the ongoing Covid19 pandemic combined with FY2020's double-digit fall may downswing the Indian automobile industry by a colossal 50 percent within just two years.

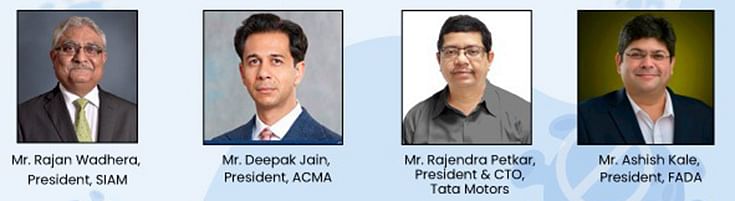

As one of the four panellists in Autocar Professional's webinar on 'Rising to a Challenge: Business in the mist of a pandemic', Rajan Wadhera, President, Society of Indian Automobile Manufacturers (SIAM), said that the industry has been losing around Rs 2,300 crore every day on account of plant closures. The losses come on the back of 20-21% sales decline in 2019 due to lack of liquidity, stricter safety and environmental regulations, geo-political reasons and dampened market and consumer sentiment. Now, with the 21-day lockdown in place and all set to get extended, India’s automotive industry which contributes about 7.5 percent of the country's GDP has come to a standstill.

According to a calculation done by SIAM, if the country’s GDP grows by about 3 percent, then the automotive industry can see itself going down by 15-25%, the rate of decline varying as per performance of each vehicle segment. Passenger and commercial vehicles are likely to be impacted the most. If GDP is all of only 1%,, then the decline can dive further to 25-35 percent. Hence, the cumulative sales decline in the last fiscal and current fiscal may come out to be 50 percent. “This will break the back of the automobile industry,” said Wadhera.

The SIAM president's apprehensions may not be off the mark, as various GDP estimates suggest India’s growth to be plummeting to a level not seen in the past several decades. A Goldman Sachs report claims India’s GDP to fall to 1.6 percent in FY2021. Likewise, Fitch Ratings slashed its India growth expectation to a 30-year low at 2 percent.

Supply challenges to get sorted, poor demand new pain-point

Wadhera claims that challenges related to supply chain which, despite being globally interlinked, may get addressed eventually. The only difference would be that while a particular company may take 30 days, another will be able to sort it out in 50 days depending upon the geographical locations from which it sourced its components, be it Europe or China.

"Challenges call for action both on demand & supply side. Supply impact is at 15-30 days, depending how integrated supply chains are for a company & whether it is sourcing fm Italy,Spain, Europe or China. Supply chain complexities are different for all.. Before BS VI, almost every part could be sourced from India. With BS VI, a lot of parts had to be quickly sourced from Europe or China. Indian industry did not get enough time to collaborate with overseas partners and the scale of production quantity and investment was not tenable either," pointed out Wadhera.

"The biggest lesson from Covid-19 is the need for sustainable supply chains in India. Auto is not only about cars but also CVs, three- and two-wheelers. Nearly Rs 60,000 crore was spent for BS VI; recovering that is not easy, and transition of supply chains not cost effective," he added.

When webinar moderator Sumantra B Barooah asked Wadhera as to whether the Indian automotive industry will now bank more on localisation with lesser dependence on importing, Wadhera said it’s a complex call for each company as the cost of shifting to a new vendor is huge and may not be affordable from a time, cost effectiveness and scaling point of view.

However, more than restructuring of its component sourcing, what is of utmost concern is the lack of consumer demand for vehicles, believes Wadhera. “How will we be able to cope with the demand challenges after the lockdown period gets over as customers will still be concerned?” he queried. It's a concern dealers will themselves be having sleepless nights over.

A new, socially distanced world

How different will India Auto Inc be in the months and years to come? Will there be a change in the work culture or norms? Wadhera, an industry veteran with nearly four decades of experience, foresees social distancing to become the new norm and affect the industry’s functioning in various ways. SIAM, in its role as an industry lobby body, is already in talks with the government to allow for working of two 12-hour shifts consisting instead of the conventional three shifts. “Many jobs will change till we find a cure for this problem (Covid19),” remarked Wadhera.

Wadhera pointed out that the ride-sharing industry, which has been on an upward trajectory since the past couple of years, could now see a reversal. He expects people to now avoid using ride-sharing vehicles for commuting purposes as social distancing becomes mainstream.

READ MORE

Tata Motors' Rajendra Petkar: 'Pandemic paving the way for significant collaboration opportunities.’

FADA's Ashish Kale: Reviving auto industry vital as it has a multiplier effect on sentiment

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

12 Apr 2020

12 Apr 2020

46599 Views

46599 Views

Autocar Professional Bureau

Autocar Professional Bureau