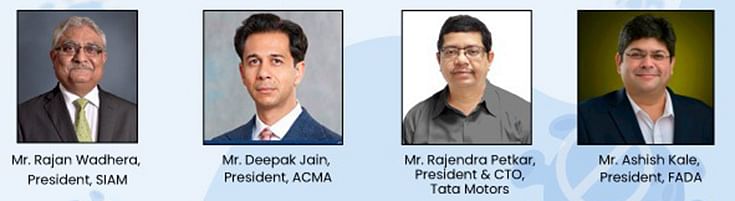

SIAM, ACMA, FADA presidents and Tata Motors' Rajendra Petkar: Collaboration is the way ahead for people, plants, performance

SIAM's Rajan Wadhera, ACMA's Deepak Jain, FADA's Ashish H Kale and Tata Motors' president and CTO participate in a lively, thought-provoking debate on Autocar Professional's webinar platform in a time of lockdown.

When the heads of three apex industry bodies in India and the president and CTO of a top automaker come together, it clearly makes for a high-powered meeting: of mind, matter and mega businesses. That's just what took place at Autocar Professional's webinar on the subject of 'Rising to a Challenge: Business in the Midst of a Pandemic' held on April 11, in the thick of the countrywide lockdown. And in the fitness of things and the new Work-From-Home dynamic, all participants in India and abroad logged in from the comfort of their homes.

Between them, Rajan Wadhera, President of Society of Indian Automobile Manufacturers (SIAM); Deepak Jain, President, Automotive Component Manufacturers Association of India (ACMA); Ashish H Kale, President, Federation of Automobile Dealers Associations (FADA) and Rajendra Petkar, President and Chief Technology Officer, Tata Motors, represented the eco-system of India Auto Inc.

Not surprisingly, the 90-minute webinar saw plenty of perspective and a number of takeaways for all industry stakeholders, whichever vehicle segment they belong to or the automotive supply chain per se.

A balmy Saturday afternoon came to life at 3pm, when Sumantra B Barooah, executive editor, Autocar Professional, threw open the debate about how an industry, which has already been battling a prolonged slowdown for over 18 months, plans to handle the new – and mega – challenge of a coronavirus-driven countrywide lockdown, which has ramifications across plants, people and performance.

Industry to see sharp decline in FY2021

According to SIAM's Rajan Wadhera, “The current crisis has led to the global economic activities coming to a standstill. Particularly for India, the economy saw significant de-growth in 2019. Now I believe it will worsen and indicators are that the ongoing lock-down may not be lifted anytime soon.”

“The need of the hour is to take care of everyone’s health and ensure the pandemic does not spread. Immediate requirement is health and safety. While the government has announced a comprehensive package, the RBI has also announced a series of measures including reducing repo rates to far lower than even 2009 levels, increased moratorium as well as lower-value cash loans. All these are all good measures but I am sure we will need a lot more. Industry is losing approximately Rs 2,300 crore for every day of the closure. This in the backdrop of last year’s de-growth is a worrying situation,” he added.

Rajan Wadhera: "Biggest lesson from Covid-19 is the need for sustainable supply chains in India. Before BS VI, almost every part could be sourced from India. With BS VI, a lot of parts had to be quickly sourced from Europe or China. Indian industry did not get enough time to collaborate & the scale of production quantity & investment was not tenable."

Giving a clue to the industry’s performance in the last fiscal (FY2019-20) which closed on March 31, Wadhera said that initial estimates hint at sharp negative growth of 20-21 percent, with PVs recording an overall de-growth of 18 percent.

However, as per the scenario planning done by the SIAM Secretariat, he gave a broad outlook on the growth of the automobile sector. Taking into consideration the fact that the lock-down is unlikely to be lifted on April 15, Wadhera mentioned that the expected range of de-growth could be in the territory of “15-20 percent for the industry if the GDP is maintained around 3 percent levels, with maximum damage to be seen in PVs and CVs.”

However, if the current GDP projections for FY2021 further slip to about 1 percent, the industry could face a 25-35 percent decline in FY2020-21, which could break the back of the auto industry. “So, the challenges include – spurring up demand and also the extent to which the supply chains are integrated for every manufacturing company. Integration of supply chains globally is also an important point of concern. Supply challenges could range from 15 days to 50 days depending on companies, but a bigger concern is how we look at addressing the demand challenges,” he commented.

Collateral damage to components sector

Ascertaining the collateral damage caused by the pandemic, ACMA's Deepak Jain put forth his viewpoints and said that the components sector is likely to close FY2019-20 with a sharp negative growth of 15 percent, leading to a significant drop in revenues compared to the US$ 57 billion industry earnings in FY2018-19.

Jain added that while the components sector had started getting disrupted in January itself with a lot of supplies from China getting impacted due to the outbreak of the virus, just a week’s closure of operations in March has added up to 3 percent de-growth in the overall outlook for the last fiscal. “Revenues have dried up and right now, cash conservation is crucial. We will have to defer all investments planned for FY2020-21," he remarked.

He further raised the concerns of the MSMEs so far receiving no fiscal stimulus from the government. “While timely payment from OEMs is a big help, we have not yet seen any specific aid or package for the components sector,” Jain pointed out.

Deepak Jain: "Now, it's all about how do we survive this period. Covid-19 is not going away anytime soon. We have to adjust shopfloors to the new normal with a staggered approach. What will be key is to give confidence to the workforce to come back to the shopfloor."

Even as the government-imposed lock-down in many parts of the country might start getting lifted up over the next few weeks, the on-ground situation will still be far from normal. According to Jain, “Even if we restart, the Covid-19 risk is not going away anytime soon. We will have to ensure the health and safety of the workers and give them the confidence to come back to the job. We will have to adjust to the new normal. Currently, the challenge is how the supply chains prepare their shopfloors for resumption of work. Balancing seamless supply chains is going to be a challenge going forward and resuming operations will involve ramping up with lean resources.”

“The safety aspect is going to be the key and ACMA is in the process of rolling out a set of protocols for its members,” assured the president of the components body.

Using the lockdown as a time to strategise

Farsighted leaders always see challenges in a manner that's different to what the hoi polloi does. So, when Tata Motors' Rajendra Petkar says that the industry should utilise this time of manufacturing shutdown judiciously to strategise and employ the new work-from-home dynamic gainfully, it all starts making sense.

Commenting on the role of engineering and R&D in such a situation, he said: "While there has been no experience within organisations regarding a work-from-home scenario, many of us are exploring it over the past few weeks. Dealing with year-end closing, incoming materials and BS VI transition have been the key challenges for industry stakeholders."

Rajendra Petkar, President and CTO, Tata Motors: "Collaboration is going to be key, going forward. People have realised the importance of supporting & working with each other. This pandemic is paving the way for significant collaborative opportunities across the value chain."

“Industry is in the process of discovering the work-from-home culture. The safety aspect is the topmost priority across industry from manufacturing to warehousing. The challenge is to come up with ways to engage with employees while they are working from home. However, all of this wouldn’t be possible if some key enablers are not available, for instance, the digital tools such as internet and seamless IT support to allow communication. Disciplined use of online and data streaming tools are the most important enablers in terms of continuing the engineering activities through home,” he explained.

According to Tata Motors’ CTO, “Activities related to DFMEA, regulatory issues, discretions and any activity related to a company’s balance score sheet for the financial year – all of this can be conducted while being at home, but when it comes to the testing procedures which are physical in nature, those have been the most affected so far."

He advises a four-pronged, phased approach: Preparation & Execution; Shutdown Phase; Restart Protocols and Ramp up. If properly implemented, each phase can help ensure a sustainable practice for both the employees’ health/welfare and organisational stability. He outlined how certain initiatives in each phase can deliver optimum results.

As Tata Motors’ CTO, Petkar’s thought process can be said to be backed by his engineer-first approach. During his presentation, he outlined how organisations can employ the best engineering practices during the shutdown phase. Right from reviewing and taking decisions to supporting employees with health issues with HR and administration guidance. “A structured approach during such a crisis can help address and make things easier. Once the shutdown is lifted, not everything will restart on the first day, we will need to still continue to maintain certain learnings such as social distancing,” added Petkar.

He further added his views on the significance of collaboration during these trying times and mentioned, “Collaboration is going to be absolutely key and it is increasing across locations and teams. It is also a good opportunity for cost avoidance and cash conservation which is currently the crying need of the hour. This kind of a pandemic is paving the way for significant collaboration across the value chain. It’s a one virtual ecosystem which is getting shaped up as we are witnessing it.”

Automobile dealers skating on thin ice

Bringing a perspective from the Covid-19 impact on on-ground retail sales in showrooms, FADA's Ashish Kale, said, “It’s now a question of survival for the dealer community as we have been working on thin margins with very low sustenance levels. Fortunately for us, we will be able to ramp up very quickly as most of the dealer manpower is based locally.”

Ashish H Kale: "Automobile dealership needs and auto retail loans need to be prioritised. This will help banks and NBFCs to allocate resources accordingly and look towards enhancing demand. Need structural support for dealerships to help return to normalcy."

With most dealerships being able to smoothly release March salaries, with a total lockdown for major portion of the month, April salaries are going to be a big challenge. The president of the dealers’ association put forth key suggestions for the government to help the sector. Some of the key recommendations include salary reimbursement through ESI to reduce pressure on dealers and MSME benefits for auto dealerships which usually employ more than 100 people. “It is an unprecedented situation and needs unprecedented measures from government. Auto sales have a multiplier effect and are also a sentiment booster. If auto is focussed to be a key enabler to come back to normalcy, it will help boost consumer confidence. Even if it is temporary, today is the right time for GST cut as well as bringing an incentive-based scrappage policy. Cash flow for automobile dealers is currently zero and we would appeal to the government to reset the clock for the lockdown period to lessen the burden for dealerships,” he remarked.

“SIAM's projections for the potential de-growth in the auto industry in FY2020-21 are scary. If we go by the projections of the de-growth coming forward, even if we take the most pessimistic scenario, we will need to lower our cost structures and also look at the overall dealership model. The current model is meant for continuously growing markets but the past 15 months have taught us a lot and we are definitely going to advocate to SIAM that an operating structure with proper margins is worked out,” said Kale.

Raising his concern about revival of demand after the lock-down is lifted, Kale mentioned, “There is a sword hanging on our heads until a vaccine comes out. Consumers are going to focus on essentials rather than discretionary purchase. We are definitely going to recommend that depreciation gets included for individual buyers and is continued for this year (FY2020-21) as well. The banks and NBFCs are going to have their own set of problems and they need to support the dealer fraternity with their working capital needs, and we are suggesting giving special interest rates for at least the next one year.”

With social distancing becoming the new norm for humans, will it have a significant impact on the way we conduct ourselves in gatherings or bring a change in behaviour on how we approach a lot of things from here on?

Hinting at the only green shoot, Kale acknowledged the fact that ride sharing in a post-Covid world could take a hit which could spur demand in the short-term. According to Wadhera, “Social distancing is going to be inevitable for a safe and sustainable work culture. A much higher transformation is going to happen across value chains – the digital transformation which saw resistance from everyone, all this is going to be stopped, a lot of the vehicles will be sold digitally, and across all kinds of countries and products we will be working towards bringing the costs down and increasing margins.”

“Within the workplace, the norms are going to change. We are already requesting the government to allow us to do 12-hour shifts to prevent multiple gatherings on shopfloors. Models such as canteen, food and sanitising models are going to be changed. A number of jobs can be done from home, so to that extent, social distancing will be required till we find a cure for the coronavirus,” Wadhera added.

All panellists unanimously agreed that India Auto Inc will need to intensify its efforts at collaboration – in their manufacturing plants, with the people they employ and the partners they tie up with, in India and overseas – in a bid to ensure positive performance. Wadhera said, “The kind of changes whether they are in the form of technology such as ride sharing, EVs, et al – all these transformations cannot happen unless the entire value-chain collaborates. The entire auto industry in India has evolved based on collaborations. All the trading partners have to collaborate in these troubled times.”

According to Deepak Jain, “Definitely, collaboration and consolidation will happen. Covid-19 has not disrupted just one market, but it has had an impact on the whole world; today, everyone will have to fend themselves and it will be akin to the Darwin’s theory – survival of the fittest.”

Autocar Professional thanks all esteemed panellists, attendees from India and overseas and partners Orbitsys, Trinity Simulations and Ultra Labs for being part of the Webinar.

READ MORE

Tata Motors' Rajendra Petkar: 'Pandemic paving the way for significant collaboration opportunities.’

SIAM's Rajan Wadhera: Industry may see 50% sales decline over two years

FADA's Ashish Kale: Reviving auto industry vital as it has a multiplier effect on sentiment

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

12 Apr 2020

12 Apr 2020

17851 Views

17851 Views

Autocar Professional Bureau

Autocar Professional Bureau