India will have over 2 crore end-of-life vehicles by 2025: CSE Report

The report aims to draw attention to what should be the critical parameters of an effective vehicle scrapping policy.

By 2025, India will have a monumental load of over 2 crore old vehicles nearing the end of their lives. These, along with other unfit vehicles, will cause huge pollution and environmental damage says a report by the Centre for Science and Environment (CSE). The report titled ‘What to do with old vehicles: Towards effective scrappage policy and infrastructure’ aims to draw attention to what should be the critical parameters of an effective vehicle scrapping policy – even as the country awaits the notification of such a policy prepared by the Union Ministry of Road transport and Highways for Cabinet approval.

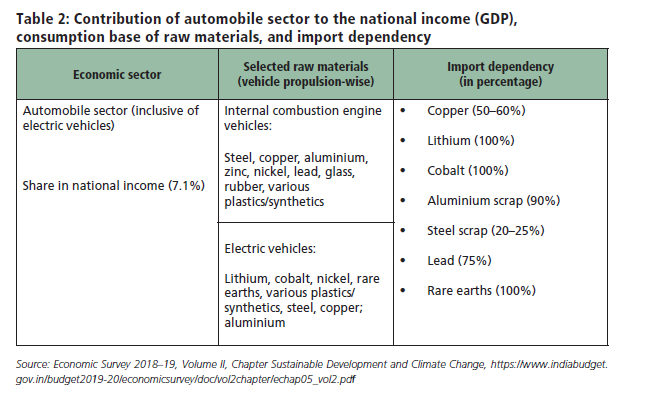

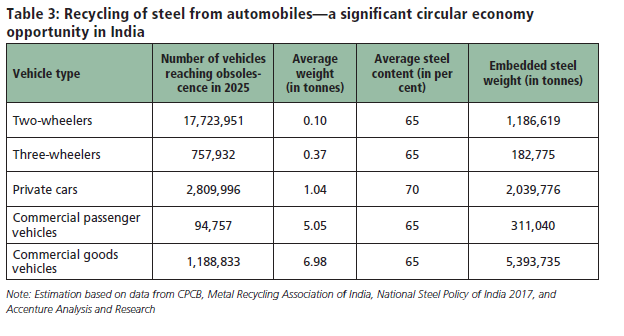

Anumita Roychowdhury, executive director-research and advocacy, CSE spearheaded the research that has gone into the report. She said “There is an enormous opportunity to turn this policy into an instrument for green recovery. Bharat Stage VI emissions standards and electric vehicle incentives are in place and polluted cities have included old vehicle phase-out as part of their clean air action under the National Clean Air Programme. The new policy must leverage these opportunities to maximise emissions gains from replacement of end-of-life vehicles and recover material from the wasted clunkers for reuse and recycling.”

Roychowdhury was speaking at a webinar to release the CSE report. The event was anchored by Sunita Narain, director general, CSE and was addressed by a number of expert panelists including Anil Srivastava, principal consultant and mission director, National Mission on Transformative Mobility and Battery Storage, NITI Aayog, government of India; Manisha Saxena, secretary cum commissioner, Transport Department, government of NCT of Delhi; Peter Mock, MD - European operations, International Council on Clean Transportation; Prashant Gargava, member secretary, Central Pollution Control Board; Neelkanth V Marathe, officiating director, Automotive Research Association of India; P K Banerjee, executive director (technical), Society of Indian Automobile Manufacturers; Vijay Arora, COO, Mahindra Accelo and director, Mahindra Steel Service Centre; and Sohinder Gill, director general, Society of Manufacturers of Electric Vehicles.

Kickstarting the discussions, Sunita Narain said: “With growing motorisation and obsolescence of vehicles, cities and regions are getting burdened with junk and grossly polluting vehicles. A well-designed policy at this stage can help to renew the fleet to leverage the new investment in BS VI emissions standards and accelerate fleet electrification for clean air.”

The key highlights of the CSE report assessment are:-

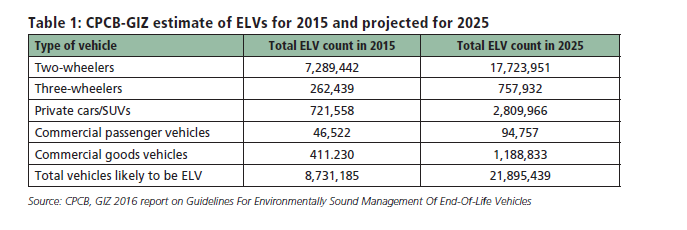

Old vehicles – uncertain numbers: It is difficult to arrive at definitive numbers for older and end-of-life vehicles, as the vehicle registration database in India is cumulative and not corrected for retirement and scrappage. The VAHAN database under the Union Ministry of Road Transport and Highways (MoRTH) that records realtime data, is an opportunity to clean up the database nation-wide – if all RTOs across the country clean up their respective databases and link up with VAHAN effectively. A CPCB-GIZ study of 2016 estimates that as of 2015, there were more than 87 lakh end-of-life vehicles and this would increase to 2.18 crore by 2025. Fortunately, India is not an importer of used vehicles, as local laws do not permit any vehicle that does not comply with the local standards. This has dampened the interest in the global trade in used vehicles. But vehicles in the domestic market change several hands and are used more intensely.

Age profile of the Indian fleet: In the absence of reliable estimates, several studies have relied on parking lot surveys and fuel retail outlet surveys to assess the age profile of vehicles in different cities. The CPCB carried out such surveys in 2015 in six cities and found that 13 percent of trucks, 8 percent of buses, 5 percent of three-wheelers, 3 percent of cars and 7 percent of two-wheelers were above the 15-year age limit. Moreover, if a broad retirement curve of 20-years for vehicles is considered, then – as of 2018 – about 69 percent of the total registered vehicles are expected to have survived. The growing fleet of obsolete vehicles poses serious threats to the environment and public health. Cities are already facing problems due to old, junk and abandoned vehicles.

High pollution potential of older vehicles: Even though the older legacy vehicles are smaller in numbers, their contribution to the pollution load from vehicles can be disproportionately high. In its consultation note of 2018, MoRTH had mentioned that although commercial vehicles (such as trucks and buses, taxies and three-wheelers etc) constitute only about 5 percent of the total fleet, but they contribute nearly 65-70 percent of the vehicular pollution. Of these, the older commercial vehicles, typically manufactured before the year 2000, account for 15 percent of the total vehicular pollution as these pollute 10-25 times more than a modern vehicle.

Another 2013 study from the International Council on Clean Transportation (ICCT) estimates that in 2011, pre-2003 vehicles were about 23 percent of the fleet but were responsible for about half of the particulate emissions from vehicles. IIT Bombay’s multi-city study in 2014 estimated that pre-2005 vehicles were responsible for 70 percent of total pollution load from vehicles. In fact, old heavy-duty vehicles have higher impact in smaller cities and towns and contribution of old diesel cars and two-wheelers can vary between 8-23 percent across cities. Fleet renewal of heavy-duty vehicles based on BS VI emissions standards can give significant benefits. For example, an old BS-I heavy-duty diesel vehicle is designed to emit 35 times higher particulate matter compared to a BS VI vehicle. As cities begin to take stronger action on old and junk vehicles, these will begin to crowd in other areas and transfer pollution. This programme, therefore, requires a national framework.

Fiscal stimulus package for green recovery: It is not yet clear if the central government will announce monetary incentives for targeted fleet renewal for market recovery and emissions gains in the post-pandemic period. The original draft version of the policy in 2018 is reported to have focused on fleet renewal for commercial vehicles, especially old heavy-duty vehicles, with a proposed age cap of 20-years and above. It was reported that about 280,000 vehicles would be scrapped with monetary incentives that might reduce overall cost of new vehicles by about 15 percent. It is not known yet how the scheme is to be announced. This is also expected to combine voluntary incentives from the industry.

EV policy linked with scrappage incentives needed at the national level

CSE’s new report argues that to maximise emissions gains from this initiative, it is important to prioritise the scrappage of old heavy-duty vehicles and replace them with BSVI vehicles. Also, if the stimulus package is extended to personal vehicles (two-wheelers and cars), then the public incentive programme along with voluntary incentives from the industry should be linked with electric vehicles. This is needed as an accelerator to stay on course to meet the target of 30-40 percent electrification of the fleet by 2030.

The Delhi government, in its Electric Vehicle Policy, has already linked scrappage incentives with electric vehicles for 25 percent electrification by 2024. A similar linkage is needed at the national level. Also, for national-level implementation, additional criteria for identifying grossly polluting and unfit vehicles based on fitness and roadworthiness, damaged vehicles, emissions performance, are needed to guide the nation-wide programme. Age caps can work in pollution hotspots.

The policies on junk vehicles evolving in India need stronger steps to upscale scrappage infrastructure: Polices related to older vehicles have already started to evolve in India. Clean air policies are leading to fixing of age of vehicles for phase-out in polluted cities. Delhi has banned 10-year-old diesel vehicles and 15-year-old petrol vehicles. Kolkata has phased out 15-year-old vehicles. Several clean air action plans for non-attainment cities under the National Clean Air Programme (NCAP) have included old vehicle phase-out provisions.

The policies on junk vehicles evolving in India need stronger steps to upscale scrappage infrastructure: Polices related to older vehicles have already started to evolve in India. Clean air policies are leading to fixing of age of vehicles for phase-out in polluted cities. Delhi has banned 10-year-old diesel vehicles and 15-year-old petrol vehicles. Kolkata has phased out 15-year-old vehicles. Several clean air action plans for non-attainment cities under the National Clean Air Programme (NCAP) have included old vehicle phase-out provisions.

Currently, Section 59 of the amended Central Motor Vehicle Act of 2019 provides for fixing of age and restrictions on the plying of unfit vehicles. But this does not specify the criteria for defining end-of-life vehicles yet. On the other hand, the CPCB has taken the step to frame the ‘Guidelines on Environmentally Sound Facilities for Handling Processing and Recycling ELVs, 2019’ to minimise environmental hazards from the disposal of old vehicles. The notification of the Draft Vehicle Fleet Modernisation Programme is awaited.

These need to be enforceable to scale up scrappage infrastructure across the country. At the state level, the government of Delhi has notified its own scrappage policy in 2018 to enable setting up of proper scrapping infrastructure and compliance with the CPCB guidelines to facilitate the process of phasing out 10-year-old diesel vehicles and 15-year-old petrol vehicles. This process has started, but will have to be ramped up. This will also require action to integrate informal scrappers and dismantlers with adequate state support to set up common infrastructure for waste processing and treatment.

Furthermore, the proposed end-of-life regulations for vehicle manufacturers need to be further strengthened. The Automotive Indian Standard Committee under the aegis of the MoRTH has framed the Automotive Industrial Standard – 129 (AIS 129) standards on reuse, recycling and material recovery from vehicles in 2015. This requires 80-85 percent of material used in manufacturing of vehicles by mass to be recoverable / recyclable / reusable at the end of life. It has restricted the use of heavy metals including lead, mercury, cadmium, hexavalent chromium etc. and asked for coding of plastics to inform dismantlers.

This establishes the manufacturer’s responsibility but has a deficiency – as it does not mandate Extended Producer Responsibility (EPR). EPR regulations are essential to ensure that the manufacturers are responsible for the safe disposal of the waste from their products and produce safe products for lifetime use. AIS-129 says it has excluded this provision as “unviable” in an emerging market such as India.

But the proposed Indian rules are not as strong as the European regulations on end-of-life. European regulations require 85-95 percent recoverability by mass. Indian regulations have also included only two-wheelers and cars and not the goods vehicles within the scope of the rules. India has not yet adopted EPR to make the manufacturers take the responsibility of recycling their own products. Europe carries out coding of more materials.

For a country like India, it is important to tap the global learning curve on green recovery. It is important to draw lessons from the major vehicle producing countries. Despite the pandemic and the resultant economic slow-down, governments across the world – as in Europe – have continued to link their stimulus packages with the electric mobility programme for a green recovery (as in Germany, Spain, Italy and France). The temporary stimulus measures must be leveraged well to maximise emissions gains.

An opportunity to drive sustainable mobility

India has the opportunity to accelerate fleet renewal based on BSVI standards and zero-emissions requirements to maximise public health benefits and material recovery. Designed well, this can ensure green recovery from the pandemic and lead to a long-term policy framework for environmentally sound vehicle end-of-life management practices.

- For fiscal stimulus package, prioritise replacement of heavy-duty diesel vehicles with BS VI vehicles.

- If cars and two-wheelers are included in the stimulus scheme, link scrappage incentive more explicitly with electric vehicles to enable 30-40 percent electrification by 2030. Delhi has taken this approach.

- Make CPCB guidelines mandatory in states and link with the National Clean Air Programme.

- Reform AIS-129 to include EPR, increase recyclability requirements, and include goods vehicles – a consolidated policy is needed as several agencies and ministries will be involved with enforcement. The MoRTH along with CPCB need to take the lead.

- Need state-level scrappage policies synced with the national policy objectives for automobile industry to set clear milestones for scrappage infrastructure for safe dismantling, disposal and material recovery.

- Lay down criteria for selection of ELVs and unfit vehicles for a national programme. An age cap can work in pollution hotspots. Leverage vehicle inspection and certification (I/C) centres and remote sensing monitoring to screen grossly polluting vehicles.

- Scale-up scrapping facilities with adequate environmental safeguards. But integrate the informal sector by providing support for common infrastructure for pollution control and hazard management. Enforcing the policy.

- Adopt other strategies to discourage old and polluting vehicles (such as stronger on-road emissions inspection, low emissions zones, tax measures etc).

- Clean up the vehicle database for accurate estimate of end-of-life vehicles.

Infographics courtesy: CSE

ALSO READ: Scrappage policy vital to charge India's eco-friendly mission: Experts at Earth Day webinar

Delhi notifies EV policy, targets 500,000 EVs by 2024, announces scrappage benefits

Mahindra Accelo keen to prove its mettle in vehicle scrappage era

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

By Autocar Pro News Desk

By Autocar Pro News Desk

28 Sep 2020

28 Sep 2020

42110 Views

42110 Views