Ford and Hyundai in neck-and-neck PV export race in April-May 2018

The Chennai-based carmakers fought a close battle throughout the second half of FY2018 and it looks like tussle to be boss will continue this year.

After making Hyundai Motor India lose in a tug-of-war battle in FY2018 by emerging as the No. 1 car exporter from India, Ford India is looking to put out a strong show in FY2019 as well. But arch export rival Hyundai Motor India and FY2018's No.2 vehicle exporter is also doing all to grab the top spot.

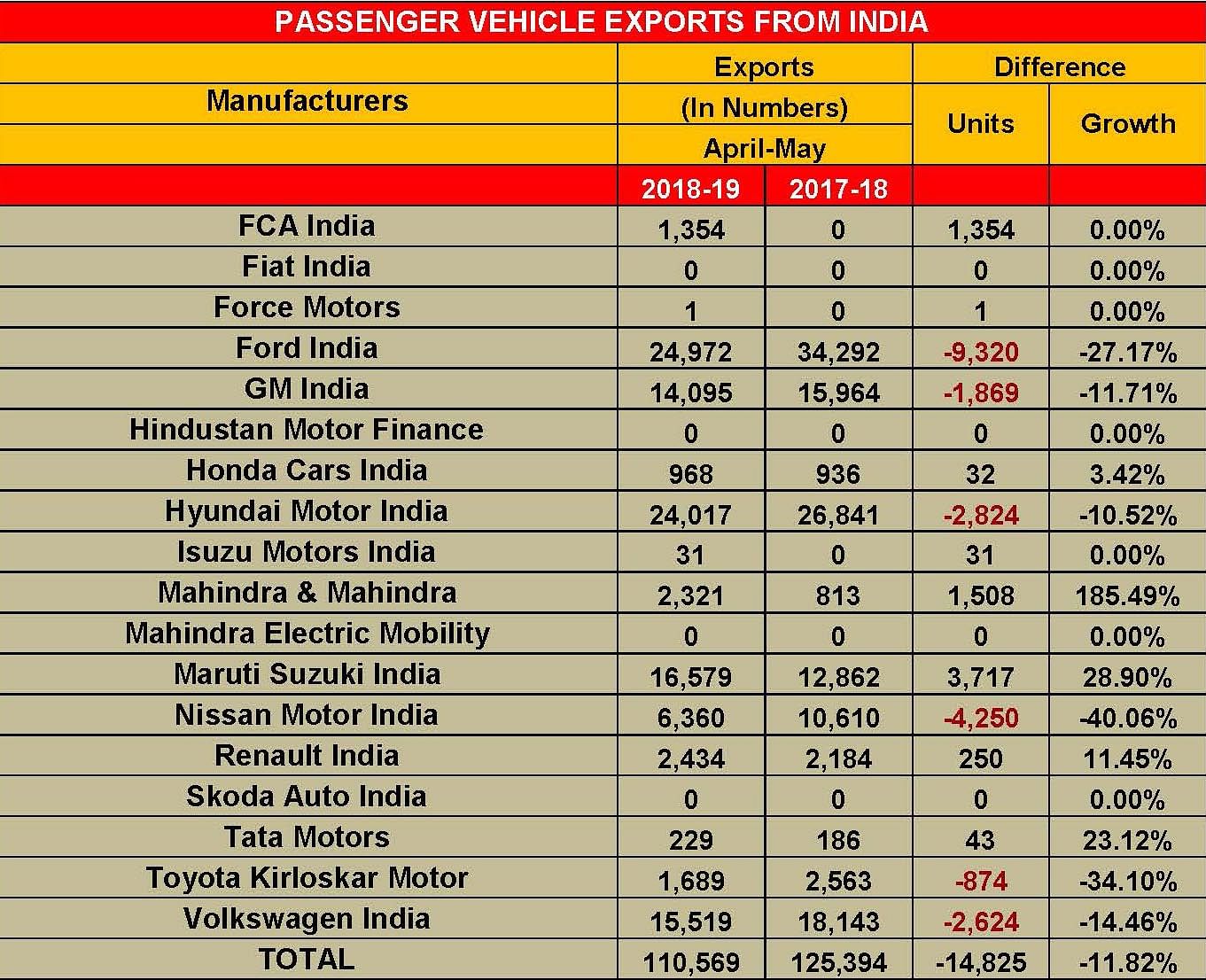

In the April-May 2018 period, the first two months of the ongoing fiscal year, the two carmakers are separated by 955 units.

Ford India has shipped a total of 24,972 units, which helps it maintain top dog status albeit its year-on-year export growth is down by 27 percent.

Korean carmaker, Hyundai Motor India is hot on Ford India’s heels with export shipments pegged at 24,017 units in the first two months of FY2019, growing at a notable 20.89 percent.

While Ford India’s export despatches mainly comprise its two hatchback-based siblings – the second- generation Ford Figo/ KA+ hatchback and the Ford Aspire compact sedan, which get exported to more than 50 countries across Europe, Middle-East, Sub-Saharan Africa, Asia, and to emerging markets in North America as well as in Australia, Hyundai Motor India ships its local produce to Middle-Eastern markets, where its Verna sedan (Accent) is very popular.

Fittingly securing the third spot, Maruti Suzuki India has cumulatively shipped 16,579 units over the first two months of FY2019, registering growth of 28.90 percent. Apart from the Baleno hatchback, which gets exported to Japan and Europe from its parent Suzuki’s wholly-owned plant in Gujarat, the company also began exporting its latest generation Swift hatchback to South Africa from April. Maruti’s exports have expanded to over 100 countries and regions and include Europe, Japan, Asia, Africa, and Latin America.

While exports are facing some concerns due to piling up GST-based cess credit concerns, industry body SIAM has revealed that a sum of Rs 7,000 crore has been cleared off by the tax agencies until May 2018. However, with OEMs primarily functioning in an export-oriented fashion from India – General Motors (April-May 2018: 14,095 / -11.71%), Nissan Motor India (6,360 / 40.06%) and Volkswagen India (15,519 / 13.68%) – all continuing to register a de-growth in their shipment numbers, how the global market recovery gives a boost to the Indian bases of these companies will be unravelled in the coming months.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

14 Jun 2018

14 Jun 2018

7778 Views

7778 Views

Autocar Professional Bureau

Autocar Professional Bureau