Indian PV exports slump amidst piling cess credit concerns

With a deadlock in outstanding amount of state compensatory cess, implemented with GST still to be credited/refunded back to Indian PV OEMs, exports take a hit

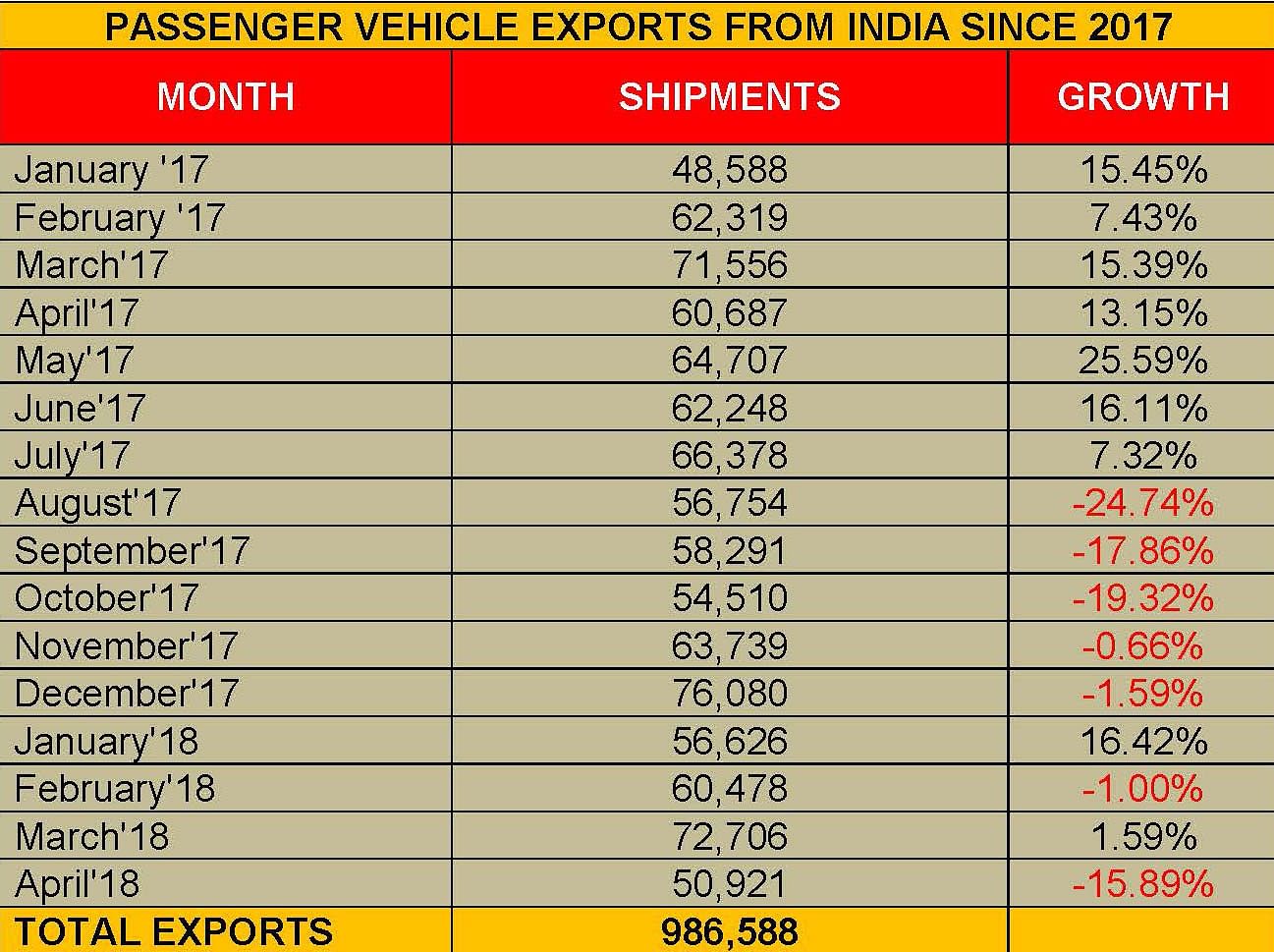

Passenger vehicle (PV) exports in April 2018 de-grew by a significant 15.89 percent, the second highest decline after the 19 percent slump registered in October 2017 over the past six months.

While the Indian automobile industry is flourishing and riding a tidal wave of booming domestic sales, the sector also sees over US$ 23 billion worth in exports, with roughly half of that being contributed by shipments of PVs and two-wheelers.

India’s domestic vehicle sales clocked 21,862,128 units in FY2017 (+6.81%) and grew to touch the 25-million mark by the end of FY2018, when sales reached 24,972,788 units and grew by a substantial 14.22 percent.

In FY2017, India’s vehicle exports clocked 3,479,824 units, constituting around 14 percent of the total vehicle production in the fiscal, which stood at 25,316,044 units. While PVs and two-wheeler exports comprised 758,830 units (+16.20%) and 2,339,273 units (-5.78%) respectively, they together brought in US$ 11 billion in revenues for the Indian automobile industry. Out of this, PVs alone stood at US$ 6 billion, holding on a notable 3 percent of the total vehicle export revenue.

In FY2018, vehicle exports grew to 4,041,777 units, posting a notable 16.12 percent growth. However, the fiscal saw PV exports slump by a marginal 1.51 percent to settle at 747,287 units. Two-wheeler exports, however, grew by a significant 20.29 percent with total shipments clocking 2,815,016 units and accounting for 12.16 percent of the total two-wheeler produce in the country, which stood at 23,147,057 units in the fiscal.

PV exports go up and down

While PV exports until the month of July 2017 were on an upward trend with growth registered in the month pegged at 7.32 percent, with shipments of 66,378 units, however, the input tax credit structure, enforced with implementation of the GST regime in July, doesn't seem to be helping vehicle exports from the country. PV exports have been on an incline ever since, with only positive break coming in after five months in January 2018, when PV shipments grew to 56,626 units, registering a 16.42 percent growth.

But this could also be attributed to generic demand coming on the onset of the new year, and as is the case, PV exports again declined in February to 60,478 units (-1,00%). While there was a recovery in March (72,706 / +1.59%), April 2018 again saw PV exports slump by a sharp 15.89 percent to stand at 50,921 units.

While there isn't a concrete answer to the oscillating trend of the export numbers, according to apex industry body SIAM, while member OEMs are saying that they are focusing to cater to the growing domestic demand at this moment, exports are always based on long-term commitments and thus, there is yet a suitable response to be found to the situation.

A clear anomaly to that argument lies in the export numbers of Maruti Suzuki where, despite growing at a notable 13.43 percent in April 2018 in the domestic market, the company went on to ship 7,736 units, posting a significant 15.69 percent growth rate. On the other hand, Nissan Motor India, whose domestic sales dropped by 16.39 percent last month, saw its export shipments plummet by 79.92 percent to a mere 1,265 units.

GST-based cess creates a mess

According to Sugato Sen, deputy director general, SIAM, “Yes, right now we are facing problems with exports. Also, what could likely be a deterrent is the huge deadlock in outstanding amount of the state compensatory cess, implemented with the GST, which needs to be credited/refunded back to the companies, and unless that gets streamlined, exports are expected to remain troublesome.”

According to the body, an estimated Rs 2,000 crore is stuck in the pipeline and not getting processed due to technical constraints in the GST system. Indian auto exports majorly go to the Latin American markets like Mexico, and other emerging markets like South Africa, Turkey, Nigeria, Colombia as well as to neighboring countries including Sri Lanka, Bangladesh and Nepal.

“We have appointed a research body and are doing a study and looking at what are the difficulties being faced by the companies and this research will take some time. We are also working with the government and the Ministry of Heavy Industries, and will pass on the results of the study to them for better understanding of the scenario,” Sen added.

“We had also appointed ICRA Management Consulting some four years when they had identified almost 20 export markets for India. At that time, India was entering into an FTA with a number of countries and as per ICRA’s study, we were doing this with the markets where our automotive export was negligible, for instance, Japan and ASEAN countries.”

“In all the FTAs that India has entered, the trade balance has worsened. We would, however, like to have FTAs with developing countries like Algeria, Nigeria, Peru, and Chile, which will boost our auto exports to these nations,” Sen pointed out.

With global market sentiments recovering, Indian automobile exports are pegged to grow at a CAGR of 3 percent between 2016 and 2026, and by leveraging its strength and potential in the low-cost car segments, India remains a market with strong potential to be a small car manufacturing hub for exports to developing and emerging markets across the world.

Also read: Ford replaces Hyundai as India's No. 1 car exporter

India's PV exports grow by 250% over a decade

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

14 May 2018

14 May 2018

5374 Views

5374 Views

Autocar Professional Bureau

Autocar Professional Bureau