India's PV exports grow by 250% over a decade

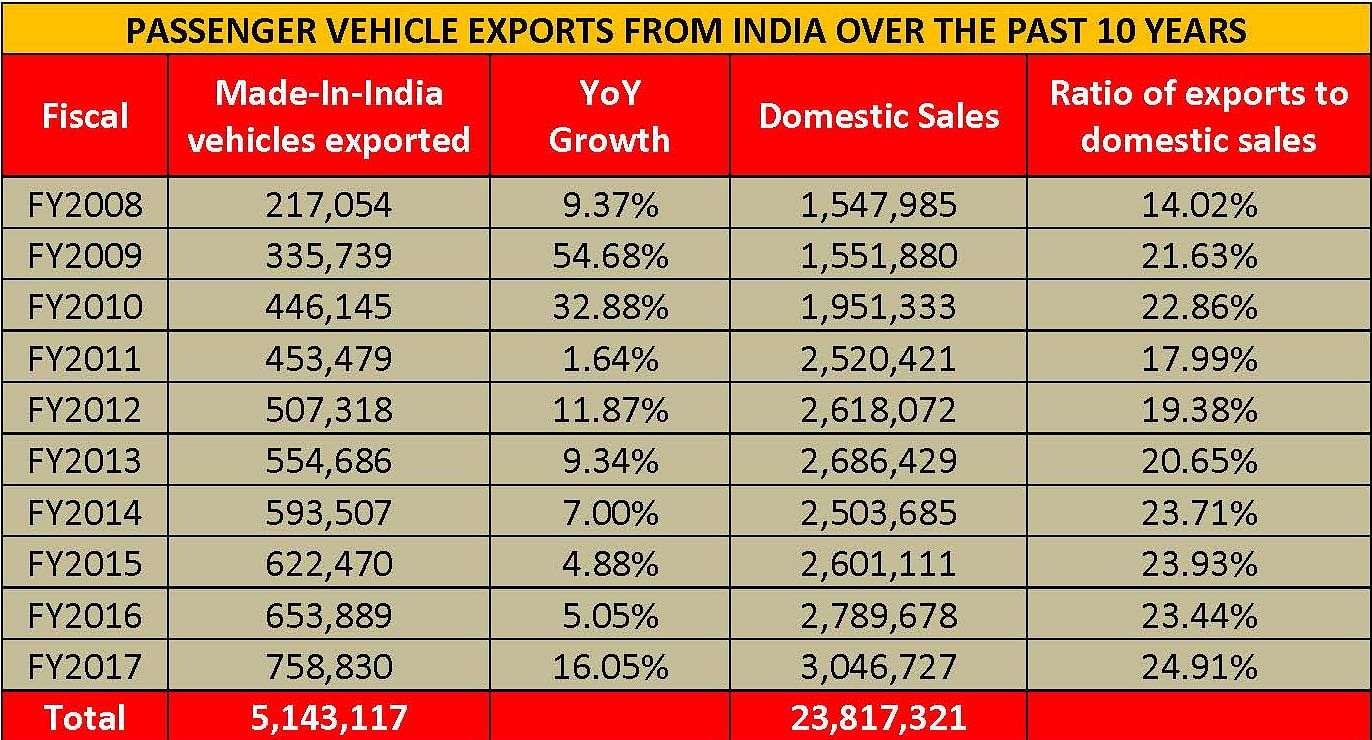

Overseas shipments of passenger vehicles, which were a modest 217,054 units in FY2008, have seen a 250 percent – or two-and-half times – growth, to 758,830 units in FY2017.

Even as demand for passenger vehicles in the domestic market continues to accelerate, overall export numbers in the just-ended fiscal year 2017-18 have been tepid. Nonethless, seen over a 10-year period, overseas shipments of PVs, which were a modest 217,054 units in FY2008, have seen a 250 percent increase to 758,830 units in FY2017.

The Indian passenger vehicle industry, which is billed to become the world’s third largest by 2020 with an estimated five million units sold annually, has come a long way over the past decade. From sales of 1.54 million units in FY2008, PV sales in the domestic market drove past the 2-million mark in FY2011 and the 3-million mark in FY2017. Expect total PV sales in FY2018 to be around the 3.25- to 3.3-million units mark. Industry statistics also reveal that it took a decade for domestic market sales to double.

Meanwhile, exports of PVs, which were a modest 217,054 units in FY2008, have seen a 250 percent – or two-and-half times – growth, rose to 758,830 in FY2017. While final numbers for the just-ended FY2018 have yet to be released by apex automobile body SIAM, 11-month export data shows 673,555 PVs were shipped from India (-1.80% YoY). In line with the growing Indian market and demand for Indian-made PVs, the ratio of PV exports to domestic market sales has risen from 14.02 percent in FY2008 to nearly 25 percent in FY2017, and to 22.54 percent in FY2018 (April-February 2018).

Ten years ago, Hyundai Motor India, Maruti Suzuki, Ford India and Tata Motors were the primary players catering to overseas markets. Of this quartet, Hyundai has been the most aggressive exporter since the beginning; in FY2008, the Korean carmaker shipped around 40 percent of the total production from its Chennai plant (144,439 units) and accounted for over 66 percent of the total exports from Indian OEs. While emerging markets like South Africa, Mexico, Latin America and Gulf countries have been the top export markets for OEMs, neighbouring Nepal, Bangladesh and Sri Lanka too are popular destinations for companies exploring export opportunities.

It was FY2008 onwards that the industry consistently improved its exports performance over the next four years, shipping 335,739 units (+54.68%) in FY2009, 446,145 units (+32.88%) in FY2010, 453,479 units (+1.64%) in FY2011 and 507,318 units (+11.87%) in FY2012. The numbers went on to account for as high as 22.86 percent of the domestic sales of 1,951,333 units in FY2010. While the Top 4 players continued to thrive on both domestic as well as export frontiers, a new entrant like Nissan Motor India significantly increased its exports in FY2012, shipping 100,909 units (+118.73%) from its Chennai facility, located strategically to leverage the potential offered by the port next door.

FY2013 saw other players including Honda Cars India (2,610), Mahindra & Mahindra (6,171), and Toyota Kirloskar Motor (23,442) join the export programme to take cumulative exports to 554,686 units (+9.34%) and account for 20.65 percent of Indian industry’s total domestic sales. For some foreign carmakers like Volkswagen, GM, Ford and Nissan, the export business has helped act as a buffer to slowing domestic market sales.

Volkswagen India began exporting its cars in FY2014, shipping 32,588 units (+297%) and contributing 5.5 percent to the overall 593,507 units (+7.00%) despatched from the country. The German carmaker doubled its exports in FY2015 to 64,994 units even as it saw a 14.30 percent de-growth in the domestic space. American carmaker General Motors India, whose domestic sales plummeted 35.91 percent in FY2016, shipped out 37,082 units (+1621.54%), which along with VW India’s 75,989 units (+16.92%), together contributed 5.6 percent and 11 percent to overall shipments of 653,889 units (+5.05%) in FY2016.

In FY2017, GM’s domestic business slid even further, with the company not even accounting for 1 percent of the PV market share but almost doubled its outbound shipments to 70,969 units (+88.69%) and its HQ in the US decided to bring full closure to its domestic business in India by December 2017. Higher exports compared to domestic sales have helped Nissan Motor India and Volkswagen India to keep their plants buzzing.

Ford claims No. 1 exporter title in FY2018

The PV segment’s cumulative exports stood at 758,830 units in FY2017 (+16.05%), with Hyundai emerging the top player with 167,120 units (+ 3.02%) and Ford following close behind with 158,469 units (+ 42.94%).

The companies continued their tug-of-war in FY2018 as well, with Ford clinching the top spot from Hyundai, shipping 181,148 units (+14.31%) and also widening the horizons, bringing in new markets like North America into its realms, in order to export its made-in-India global models.

On similar lines, Maruti Suzuki has already made strides, sending made-in-India hatchbacks back to parent Suzuki Motor Corporation, iconic American UV player Jeep (through FCA India) has invested heavily in its Ranjangaon plant in Pune to cater to all the right-hand drive markets in the company’s global business, with shipments going out to as far as the UK, Japan and Australia.

Also read: PV exports scale a new high in FY2017, sustain drive for Ford, Nissan, VW and GM

In FY2018, FCA India has shipped over 5,000 Jeep Compass SUVs, manufactured at its Ranjangaon plant.

With India offering many lucrative benefits for business operations under the government’s ‘Make in India’ scheme, as well as being an attractive location with huge technological advancements, good vendor concentration, and cheap manufacturing costs, major automobile companies from around the world are charting out plans to make the country their global manufacturing hub in the times to come.

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

05 Apr 2018

05 Apr 2018

6637 Views

6637 Views

Autocar Professional Bureau

Autocar Professional Bureau