CNG price cut by Rs 6 for second time this year, demand revs up for CNG PVs, CVs

This is the second CNG price cut this year, which has also seen six price hikes. CNG’s lower pricing versus diesel and petrol is driving CNG car and CV sales even as the filling network is being expanded.

In what comes as some relief to users and owners of compressed natural gas-powered passenger and commercial vehicles, Mahanagar Gas has, on August 17, reduced CNG price by Rs 6 to Rs 80 a kilogram in Mumbai.

This is the second price reduction for CNG this year, following the similar Rs 6 per kg cut on April 1, 2022 which brought down CNG price to Rs 60 a kg at the opening of FY2023.

The previous CNG price revision, a hike of exactly Rs 6 on August 3, had taken prices to Rs 86 per kg. Between February 8, 2021 and August 3, 2022, a period of 19 months, CNG price has risen by 72% or Rs 36.60 per kg (see data table below). CY2022 has already seen six price hikes till early August.

In its communication dated August 17, Mahanagar Gas said: “Consequent upon upward revision in allocation of domestically produced natural gas by the Ministry of Petroleum and Natural Gas, Mahanagar Gas Limited (MGL) is pleased to reduce its Compressed Natural Gas (CNG) price by Rs. 6.00/Kg in and around Mumbai. Accordingly, the revised MRP inclusive of all taxes of CNG will be Rs.80/Kg. The revised MRP of CNG offers attractive savings of about 48% compared to petrol at current price level in Mumbai.”

OEMs witness growing demand for CNG cars

What continues to draw PV and CV buyers to CNG are that the running costs are significantly lower compared to either petrol or diesel as a vehicle inherently gives better fuel economy when driven on CNG.

Given the high prices of fossil fuels – petrol at Rs 106.31 a litre and diesel at Rs 94.27 a litre in Mumbai as of August 18, 2022 – the shift to cheaper and also eco-friendly CNG has been underway for sometime now.

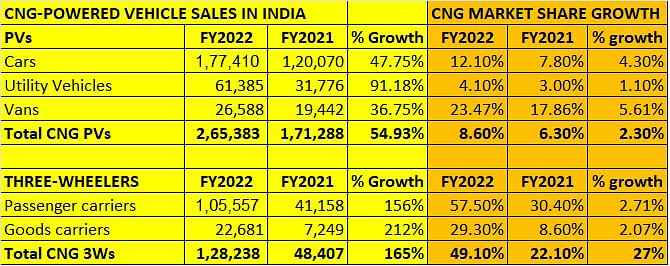

In FY2022, the passenger vehicle segment saw CNG-powered sales clock near-55% YoY growth with sales of 265,383 units, accounting for 8.64% of total PV sales of 3,069,499 units compared to 6.30% CNG PV share in FY2021.

Maruti Suzuki India, which has the first-mover advantage in the CNG car market, and Hyundai Motor India are reaping dividends from their CNG portfolio. Maruti, whose departure from diesel has been filled by handsome demand for its CNG offerings – Alto, S-Presso, Wagon R, Celerio, Dzire, Ertiga, Eeco, Super Carry and Tour-S and more recently the Swift – has cumulatively crossed a million CNG vehicle sales.

The PV market leader is also exploring a CNG option for its Nexa range, which could mean a CNG option for its Baleno, Ciaz and other premium models. In fact, a survey conducted by the company has indicated that offering a CNG option does not impact the aspirational quotient of the cars sold under Nexa.

Of Maruti’s current order backlog of an estimated 387,000 units, CNG variants account for 33% or around 126,000 units.

Speaking to Autocar Professional earlier this year, Shashank Srivastava, senior ED, Marketing & Sales, MSIL, said: “CNG is doing very good numbers for MSIL, and almost 17% of our portfolio’s sales are being contributed by CNG variants. In the models, where we have a CNG option, the contribution is about 33 percent.”

Hyundai and Tata Motors have also recognised the potential of CNG sales and are offering CNG cars in higher-spec variants such as the Hyundai Grand i10 Nios, Aura, and Tata Tiago and Tigor respectively. From average monthly sales of 3,000 units in the first half of CY2021, Hyundai Motor India’s CNG sales have crossed monthly volumes of 5,000 units mark in first-half CY2022. The company says it is eyeing monthly volumes of 6,000 units in the remaining half of this year.

Lower cost of ownership USP for CNG CV buying

With total cost of ownership (TCO) being the mantra for profitability in the commercial vehicle sector, CNG makes wallet sense for fleet operators as also electric vehicles (availability of eCVs is still low in India). Reason why the past few months have seen a growing number of commercial vehicle OEMs launch new CNG-powered models.

The CV consumer shift to CNG is underway and has been mainly driven by the marked rise in diesel costs over the past two-odd years, which has adversely impacted CV owner profitability. Tata Motors, which has a strong portfolio of CNG vehicles across the small CV, intermediate LCV, LCV and bus segments, is benefiting from the increased buying.

Earlier this month, at the Prawaas 3.0 expo in Hyderabad, Tata Motors’ alternate fuel products for the future included the Starbus Long Range CNG and LPO 10.2 CNG AC school bus.

Furthermore, as Girish Wagh, executive director, Tata Motors told Autocar Professional earlier this year, the initial price difference between similar diesel-powered and CNG-powered vehicles has reduced after the transition to BS VI emission norms in April 2020. Other positives is the growing availability of CNG across metros, Tier 2 and 3 towns along with various exemptions for CNG vehicles in different states / cities across the country.

Ashok Leyland is betting big on CNG. The Chennai-based CV maker has outlined plans to introduce CNG variants across its model range including the Dost+, Bada Dost, Ecomet and the modular AVTR range.

On August 8, Mahindra & Mahindra launched the New Jeeto Plus CNG CharSau, priced at Rs 526,000. The vehicle has a claimed range of up to 400km with best-in-class mileage of 35.1 km/kg.

Speedy all-India CNG station network expansion underway

One of the challenges to speedier adoption of CNG-powered vehicles is the not-so-wide CNG filling network across the country. refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. Also, servicing costs of CNG-powered cars are higher compared to petrol siblings with the CNG filter requiring scheduled replacement in factory-fitted CNG kits.

However, the government of India is now addressing the issue speedily. On July 15, the Union Minister of Petroleum & Natural Gas, Hardeep Singh Puri inaugurated 166 new CNG stations. This is in addition to 1,332 CNG stations, the highest ever, in FY2022. The government plans to substantially increase the existing parc of 4,500 CNG stations to 8,000 in the next two years.

With additional inputs from Mayank Dhingra

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

19 Aug 2022

19 Aug 2022

27517 Views

27517 Views

Autocar Professional Bureau

Autocar Professional Bureau