Bajaj Auto in strong position in H1 FY2020, revs up for electric mobility

The Pune-based motorcycle maker, which is targeting a 25% market share in FY2020, has registered a robust export performance that helps buffer the domestic market slowdown. Now, it is readying to enter a new mobility segment.

The Bajaj Chetak is reborn, in an electric avatar. Bajaj Auto today took the covers off its first electric vehicle at a high-powered product reveal in New Delhi, attended by Transport Minister Nitin Gadkari and Amitabh Kant, CEO, NITI Aayog.

If there is one company, on two wheels only, which seems to be not so ruffled by the ongoing carnage in the Indian automobile market, then it is the Pune-based Bajaj Auto. Even as the motorcycle manufacturer rides out the storm in the domestic market, it stands secure in the fact that it is well buttressed by its strong export market performance.

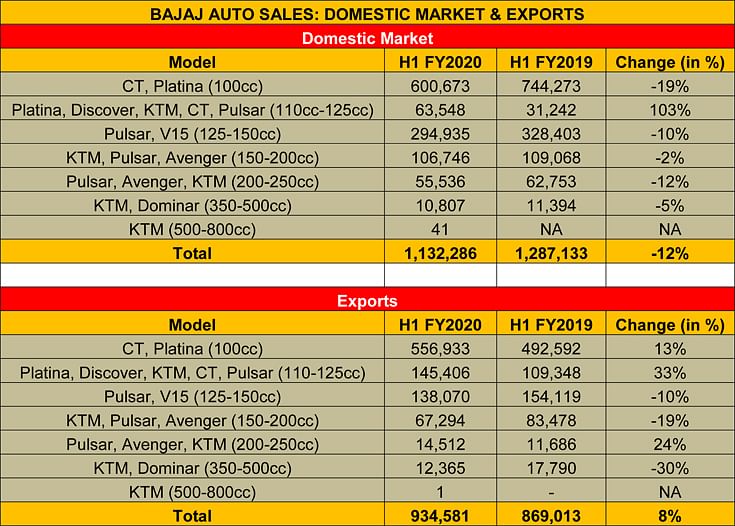

For the first half of FY2020 (April-September 2019), Bajaj Auto, which has produced a shade over 2 million bikes (2,070,297 / -2.77%), has sold a total of 1,132,286 units (-12.03%) in the domestic market and 934,581 units in the export market (7.50%). Together, the sales add up to 2,066,867 units, which means the company is judiciously maintaining a lean inventory, no mean feat in the ongoing troubled times for industry.

Gunning for 25% motorcycle market share in FY2020

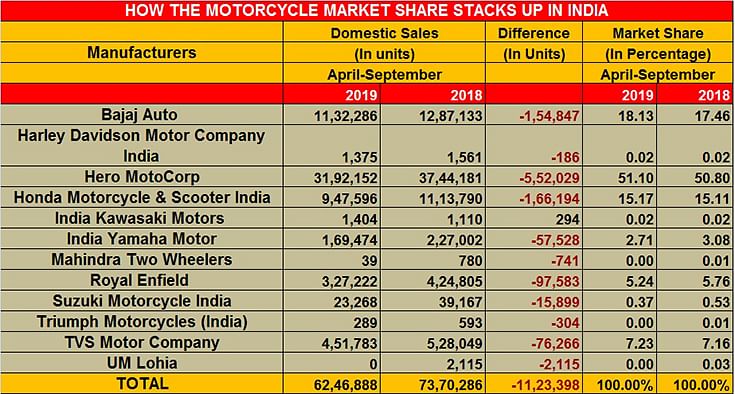

The world's third-largest motorcycle manufacturer, which currently has a domestic motorcycle market share of 18.13 percent (April-September 2019) is targeting a 25 percent market share by the end of this fiscal. "All this is happening thanks to segment innovation," said Rajiv Bajaj, managing director, Bajaj Auto, told the Hindu BusinessLine in August.

The company had closed FY2019 with a market share of 18.69 percent (2,541,320 units), having notched 28.7 percent growth. The bike maker had a 15.69 percent market share in FY2018 (1,974,577 units).

Low-cost segment innovation, a sharp focus on exports and a tight control on costs has the motorcycle manufacturer bullish about increasing its domestic market share by 7 percentage points.

The company's MD had attributed the company's outperformance, compared to its rivals, to a carefully thought-out strategy -- segment innovation, sharp focus on exports, and a tight control on costs. This is helping the company to ride out the storm which continues to blow fiercely in the face of the industry. Low-cost innovation has richly paid off handsomely, particularly in the 100-110cc commuter bike segment where the CT100 and the Platina have won favour with buyers.

Take a look at how the company's products have fared, both in the domestic and export markets. Bajaj Auto, of course, is not immune to the Indian market scenario where overall motorcycle sales in H1 FY2020 have shrunk by 24%.

Of the seven sub-segments that Bajaj Auto is active in India, it has fared relatively decently in the volume commuter bike market albeit sales are down 10 percent in the 100cc category. Its quintet of products in the 110-125cc have delivered the goods, selling 63,548 units and marking robust 103% year-on-year growth. Even in the 150-200cc category, its trio of the Pulsar, Avenger and KTM bikes have gone home to 106,746 buyers, down by a marginal 2% YoY. And in the segment above it, the 200-250cc bikes, the company has managed deliveries of 55,536 units, down 12% YoY. KTM and the Dominar 400 together sold 10,807 units, down 5%. Remember, all this

On the export front, the 100cc to 125cc commuter motorcycles have delivered the goods. Over half-a-million (556,933) units comprising of the 100cc CT, Platina and Discover have helped notch 13% YoY growth while the 110-125cc bikes (Platina, Discover, CT, Pulsar and KTM) have sold 145,406 units, up by a strong 33%. Overall, Bajaj Auto's two-wheeler export performance is solid and the gap to No 2 position is a yawning one: nearly 600,000 units away. In fact, Bajaj Auto's overseas motorcycle shipments alone make up for 52% of the total two-wheeler industry's exports in H1 FY2020 (1,793,957).

Bajaj Auto increases market share

A close look at the market shares of the 12 motorcycle manufacturers in the country for H1 FY2020 reveals that only three – Bajaj Auto, Hero MotoCorp and TVS Motor Co – managed to increase their market share in the tumultuous first six months of the ongoing fiscal year.

Even though the year-on-year market share growth is marginal for the trio, Bajaj Auto has managed to achieve the most – from 17.46% to 18.13%; Hero MotoCorp has increased its share from 50.80% to 51.10% and TVS from 7.16% to 7.23%. And, its newest product, the KTM 790 Duke, launched on September 23 at Rs 864,000 has also clicked. Of the only 100 units brought in via the CKD route, 41 have already been sold. At Rs 864,000, the 790 Duke is significantly more expensive than the Suzuki GSX-S750 (Rs 746,000) and the Kawasaki Z900 (Rs 770,000), but below direct European rivals such as the Street Triple S (Rs 919,000) and the Ducati Monster 821 (Rs 10.99 lakh).

Getting ready for e-mobility

Now Bajaj Auto, once a revered scooter manufacturer with a Maruti-like position in the two-wheeler market in India, is set to announce a product expansion into electric mobility later today. It is understood that the company will reveal the Urbanite brand.

The company has earlier said it has been working on some product propositions aimed to excite electric vehicle customers, a breed that is currently rare in India. Could Urbanite be a defining moment like Pulsar, the brand which established the erstwhile maker of the renowned Bajaj Chetak scooter, as a formidable motorcycle maker? Will the blast from the past -- the Chetak -- be back in a brand-new avatar? We will know in a few hours.

The Bajaj Chetak epitomised mobility on two wheels for decades in India before the company logged out of scooters. The 'Hamara Bajaj' ad campaign still resonates strongly with scooter aficionados of another generation.

All photos: Autocar Professional

Also read: Bajaj Auto “seriously committed” to e-mobility, plans "exciting” products under Urbanite brand

Bajaj Auto sells 41 KTM 790 Dukes in September

TVS and Suzuki maintain momentum, grow scooter market share, Suzuki beats Hero to take No. 3 slot

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

15 Oct 2019

15 Oct 2019

13867 Views

13867 Views

Autocar Professional Bureau

Autocar Professional Bureau