Auto stocks clock handsome gains in FY2021 on improved fundamentals

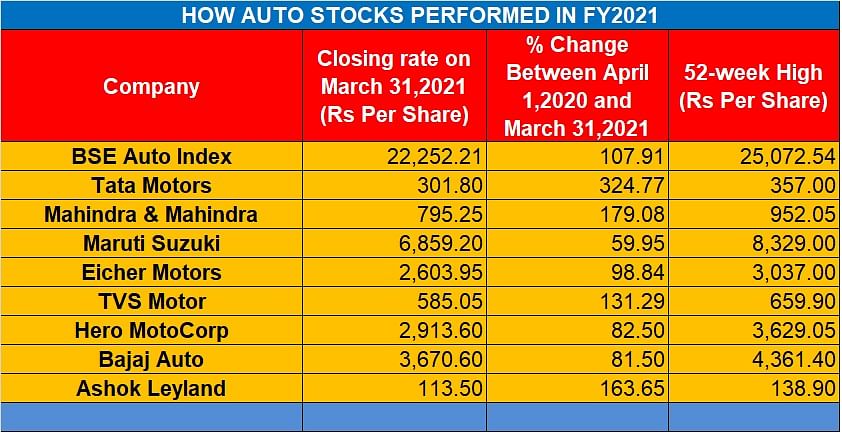

The stock performance of the top auto stocks has been encouraging in FY2021 with the Auto Index generating over 100 percent return in the past one year. A look at individual stock action.

It is the dawn of a brand-new financial year for India and with regards to automotive sales, it has not been a particularly noteworthy fiscal for most players. From passenger vehicles to commercial operators, none of the segments are completely out of the woods. However, in terms of stock market performance, it’s been a rather smooth ride for the auto stocks this financial year. The BSE Auto Index closed trade on March 31, 2021 at 22,252.21, up over 107 percent in one year from April 1, 2020.

In the last quarter of FY2021, passenger vehicles and two-wheeler stocks were amongst the top gainers with nearly 62 percent gains in Tata Motors, 12.44 percent gains M&M. However, Maruti Suzuki has been an underperformer down 8 percent in the same period. In the two-wheeler space, TVS Motor jumped 18 percent while Bajaj Auto and Eicher Motors have gained seven percent in the last quarter of FY2021. Ashok Leyland has been one of the star performers in commercial vehicle space, up over 19 percent.

Tata Motors

In individual stock action – Tata Motors is literally one of the shining stars on Dalal Street with a whopping 300 percent plus gains in this fiscal. The stock market performance matches the bellwether auto stock’s retail performance too. Its PV business has scripted a remarkable turnaround with sales soaring to an eight-year high.

Mahindra & Mahindra

Mahindra & Mahindra gained nearly 180 percent this financial year and closed trade on March 31 at Rs 795.25 per share. It is 16.48 percent away from its 52-week high of Rs 952.05/share. The new Thar is giving it new market traction and has been adjudged the 2021 Car of the Year by Autocar India. Overall, Mahindra & Mahindra is at No. 3 position with sale of 138,887 units in the first 11 months of FY2021 and a UV market share of 15.38 percent, down from 19 percent a year ago. This fiscal also marked the end of a 27-year long tenure of Dr Pawan Goenka at the helm of M&M.

Maaruti Suzuki India

The stock market underperformance in the last quarter of FY2021 has not dented Maruti Suzuki’s market share. The PV market leader has also maintained leadership position in the UV segment with 202,927 units sold between April 2020 and February 2021 and a 22.47 percent market share. What is creditable is that despite diving out of the diesel engine market in the past year, the company is just 9.16 percent behind its year-ago sales of 223,394 units. Over the last one year, Maruti Suzuki stock has yielded nearly 60 percent return and is 18.34 percent away from its 52-week high of Rs 8329/share.

Eicher Motors

In the two-wheeler space, Royal Enfield is no doubt making waves with the Meteor 350 bagging Autocar India’s 2021 Bike of the Year. While the Classic Meteor is amongst the top 10 selling bikes in India, the bike maker clocked a 6 percent growth in February sales on a year-on-year basis and the stock of the parent company, Eicher Motors is buzzing on D-street. It is up almost 100 percent in this fiscal and is just 14.26 percent away from its 52-week high of Rs 3037/share. Not just the auto sector but overall, it’s been one of the outperforming stocks.

TVS Motor Co

The other big buzzer amongst the two-wheelers, TVS Motor has recorded over 130 percent gains in FY2021 backed by strong fundamentals and nearly 7 percent CAGR growth in its net profit in the last three years. Its two-wheeler exports clocked 100,000 units in March 2021. This fiscal also marked TVS Motor’s takeover of 123-year old British bike brand, Norton. Norton is currently finalising the construction of its new factory in Solihull and is expected to open by the second quarter of this calendar year.

Hero MotoCorp

Hero MotoCorp continued to maintain its lead as the market leader in bikes and scooters and spread the cheer in the stock market. The stock is up close to 83 percent in what’s been a rather busy fiscal for the bikemaker. It not just crossed the 100 million cumulative production milestone, but also rejigged its leadership team and finalised its partnership with Harley-Davidson in the past twelve months. The stock is 19.71 percent away from 52-week high of Rs 3629.05/share.

Bajaj Auto

Bajaj Auto too clocked 80 percent plus gains in the stock market in FY2021. This mid-range momentu stock is about 15 percent away from its 52-week high of Rs 4361.40/share while the Bajaj Pulsar remains amongst the five most selling bikes in India. Though, the slowed-down supply chain for semiconductors has affected Bajaj Auto, Bajaj Auto has clocked total sales of 1,979,936 two-wheelers in the domestic market (-18%) and exported 1,756,656 units (-6%) in the first 11 months of this Covid-impacted fiscal.

Ashok Leyland

In the commercial vehicle space, Ashok Leyland has been making big strides both in retail performance as well its stock movement. The stock is up almost 130 percent in FY2021 with nearly 50 percent jump in prices in the past six months. The launch of Modular Platform AVTR and Bada Dost are the key stars of the action this fiscal. The company’s truck volumes have grown at almost twice the rate of the industry, on a year-on-year basis in Q3.

Overall, it’s been a buzzing one year for the auto stocks on Dalal Street. A lot of the price action has been on the back of gradually improving fundamental triggers. All eyes on how the new financial year, FY2022 pans out. Especially with the renewed surge in number of people affected by Covid-19 and some restrictions in select auto hubs and the continuing supply chain bottlenecks, it’s surely wait and watch for now.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

01 Apr 2021

01 Apr 2021

7541 Views

7541 Views

Autocar Professional Bureau

Autocar Professional Bureau