UV sales in India set to race past a million units in FY2021

At 902,951 units in April 2020-February 2021, cumulative utility vehicles sales will scale a record high this fiscal.

Apex industry body SIAM yesterday released the wholesale vehicle numbers for India Auto Inc for February 2021 and cumulative data for the April 2020-February 2021 period.

While the passenger vehicle industry is not out of the woods yet, with sales of 23,35,808 units (-10.35%) in the 11-month period with passenger car sales at 13,36,473 units (-16.20%) and vans at 96,384 units (-23%), it is the utility vehicle (UV) segment which is packing all the punches. At 902,951 units (1.96%), it is the sole sub-segment in the April 2020-February 2021 period to be in positive territory amongst PVs, three-wheelers and two-wheelers.

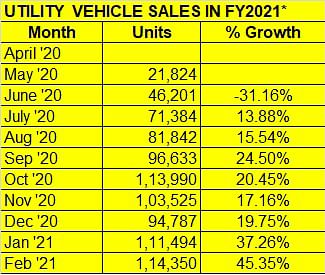

Check out the monthly stats below for the ongoing fiscal year and it’s amply clear that the UV segment, which includes SUVs and MPVs, is firing on all cylinders. Sales crossed the 100,000-units mark in October and November 2020, January and February 2021 and came close to that figure in two other months. What’s more, there was a decent run in the early months of the Covid-19-impacted year, the washout month of April 2020 notwithstanding.

Given that UV sales in the first 11 months of FY2021 in the domestic market are logged at 902,951 units (add Tata Motors’ 22,334 units for January and February 2021), it can be forecast that UV sales for FY2021 will easily cross the 1,000,000 or one-million mark for the first time ever.

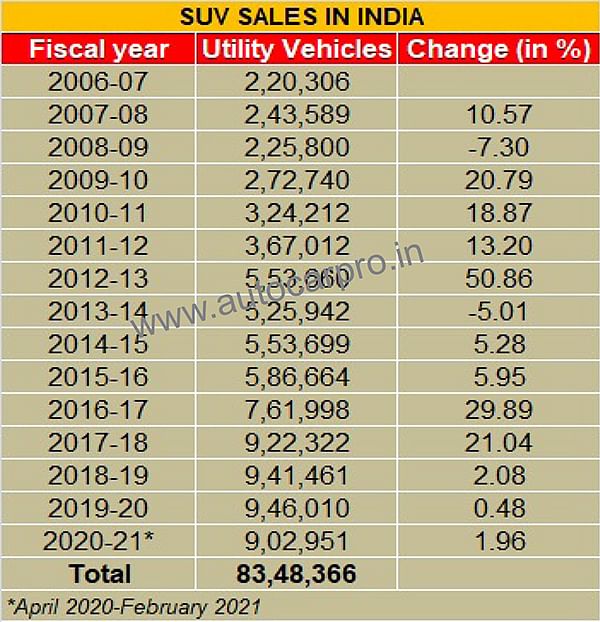

The closest the Indian auto industry came to hitting the million-units mark in UV sales was in FY2020, when at 946,010 units it fell short of the milestone by 53,990 units. Total UV sales in FY2019 were 941,461 units.

Some number-crunching reveals that cumulative 15-year UV sales in India have crossed the 8.3 million mark, speedy growth coming from FY2013 when UV sales crossed the half-a-million units mark for the first time. Nearly 9 million UVs have been sold in the past nine fiscal years (see data table below)

How the OEMs stack up, market share-wise

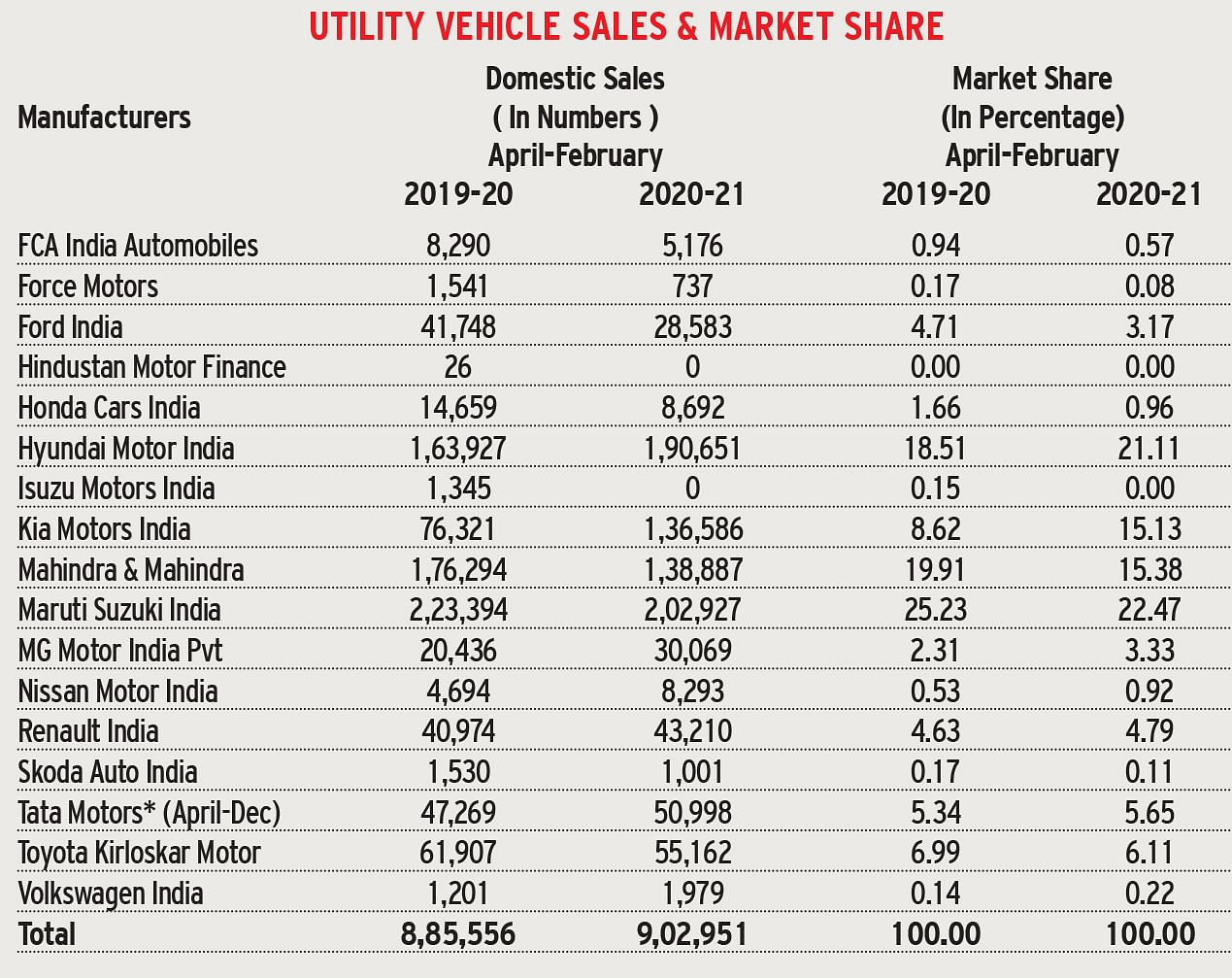

In a vehicle segment where sales are booming, rivalry can only be intense which is amply seen in the UV market share statistics for the April 2020-February 2021 period (see detailed table below).

PV market leader Maruti Suzuki India is also the UV market leader with 202,927 units and a 22.47% market share. What is creditable is that despite diving out of the diesel engine market in the past year, the company is just 9.16% behind its year-ago sales of 223,394 units.

Meanwhile, a hard-charging Hyundai Motor India with 190,651 units (up 16.30% YoY) is close behind with a 21.11% share, up from 18.51% a year ago. Credit a lot of that seedy growth to the surging demand for India’s best-selling UV – the new Creta.

Mahindra & Mahindra, at No. 3 position, has 138,887 units to its name and a UV market share of 15.38%, down from 19% a year ago but the new Thar is giving it new market traction.

Kia Motors India, with 136,586 units and 15.13%, is in fourth position – a remarkable achievement having launched its first product — the Seltos — barely 18 months ago. A resurgent Tata Motors is at No. 5 position.

Things turn interesting when Hyundai and Kia sales and market share are clubbed together. With a total of 327,237 units, the two Korean OEMs have the majority UV market share of 36.24 percent.

SUVs: the cars for all reasons and all seasons

The all-encompassing appeal of the SUV is not difficult to fathom. Bigger and taller than regular cars, they give the driver a better view of the road ahead – so important in a country like India. And, the raised ground clearance is always helpful when it comes to driving over rugged terrain.

Furthermore, being larger than hatchbacks and some sedans, they also pack ample storage space, have cavernous boots and have plenty of room at the rear to stretch out. Just right to be used as a family car. But big can also be small because with the advent of the sub-4-metre compact SUV category in India, these SUVs can easily manoeuvre through dense traffic and also fit into tight spots armed as they are these days with driving aids.

Tanking up is also not a hugely expensive affair as it used to be with SUVs in the past. OEMs and engine engineering have made huge advances over the years, which is why SUVs in recent years are both fuel efficient and also more eco-friendly.

Of course, when it comes to ride and handling, SUVs are the vehicle you’d like to have when you are driving in bad weather conditions or unknown roads. Sizeable weight, bigger and wider wheels and robust nature ensure they deliver improved grip and stability. Safety is paramount and today most SUVs come with ABS, EBD, ESP and even hill-hold and hill-descent control in some cases.

Growth outlook: SUV-ival of the fittest

Moreover, in India, demand for sub-four-metre compact SUVs seems insatiable and OEMs are going all out to introduce new products. The coming months will see a number of new models getting introduced including the likes of Mahindra’s new XUV500, Skoda’s Kushaq, Volkswagen’s Taigun and Citroen’s C5 Aircross.

Clearly, there's plenty of action coming up on the UV front in 2021. Stay tuned to more number-crunching coming your way.

RELATED ARTICLES

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

TVS And Bajaj Auto Spar for E-2W Leadership, Ampere Outsells Ola

Powered by demand from the new and aggressively pricedChetak 2501 which takes on the popular TVS iQube2.2 kWh variant, B...

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

11 Mar 2021

11 Mar 2021

11092 Views

11092 Views

Ajit Dalvi

Ajit Dalvi

Shahkar Abidi

Shahkar Abidi