Global sales of turbocharged vehicles to increase 35% by 2021

Honeywell's Transportation Systems Forecast sees automakers continuing to adopt turbocharging technology to the tune of 48 percent of annual global sales by 2021, up 9 percentage points from 2016. Demand set to rise in the USA, China and India.

The findings of a recent global study indicate that global demand for turbochargers is set to rise substantially as vehicle manufacturers on the back of tighter emission norms.

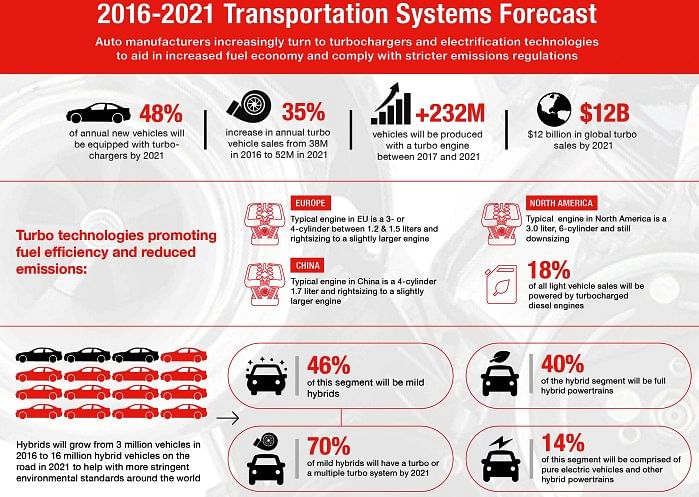

Honeywell's latest Transportation Systems Forecast sees automakers continuing to adopt turbocharging technology to the tune of 48 percent of annual global sales by 2021, up 9 percentage points from 2016. This annual sales estimate, combining both passenger and commercial vehicles, would add more than 232 million turbocharged vehicles globally between 2017 and 2021 — an increase of 35 percent from today.

"As emission regulations continue to tighten, mature automotive markets like the United States and high-growth regions like China and India are turning to turbochargers to help provide cleaner transportation. This is creating what we refer to as the 'Golden Age of Turbo,'" said Olivier Rabiller, Honeywell Transportation Systems president and CEO. "With the ability to improve emissions and fuel economy by 20 to 40 percent in gas and diesel engines, turbocharging technology is a smart choice for helping automakers meet tougher global emissions standards without sacrificing performance."

This year's forecast recognises an industry trend for slightly bigger engine sizes in Europe and China as automakers adapt powertrain strategies to tackle updated emissions regulations developed for real-world driving conditions. In these regions, a typical powertrain is a three- or four-cylinder engine with a displacement size between 1.2 litres and 1.7 litres. By rightsizing engines with available technologies, automakers are able to continue applying the benefits of smaller turbocharged engines while fine-tuning powertrain systems to further optimize fuel economy, emissions and performance.

In addition, Honeywell's forecast calls for electric boosting products to help support compliance with more stringent environmental standards. To this end, it is anticipated that the industry will begin moving from 12-volt battery systems to 48-volt systems. This change opens the door for a cost-effective electric boosting technology solution featuring e-chargers and e-turbos to help improve efficiency and performance of the internal combustion engine in a mild hybrid vehicle. E-boosting products can dramatically improve engine responsiveness and also provide better fuel economy. Specific to diesel, it also has the potential to significantly reduce pollutant emissions, like mononitrogen oxide (NOx), and help meet more stringent regulations including the Real-Driving Emissions test in Europe.

16 million EVs and hybrids by 2021

Electrics and hybrids are expected to grow from a total of 3 million vehicles in 2016 to a total of 16 million by 2021. Within the electrified category, mild hybrids are expected to account for 46 percent of the mix; full hybrids will account for 40 percent; and pure electric vehicles will be most of the remaining 14 percent. Honeywell estimates 70 percent of all mild hybrid vehicles will have a turbo or multiple turbo systems (mechanical and electric). In addition, Honeywell has drawn upon its engineering competencies in the automotive and aerospace industries to create a new two-stage electrical compressor used by Honda Motor Co for its hydrogen-powered Clarity Fuel Cell vehicle.

Key global findings

- The projected increase in annual sales of vehicles with a turbo from 38 million today to 52 million in 2021 equates to a 35 percent increase, or 6 percent CAGR (compounded annual growth rate) compared with a 2 percent CAGR for all global industry sales.

- The global turbo business is expected to reach almost $12 billion in industry sales in 2021.

- Globally, diesel engines will retain a significant share of global light vehicle sales at nearly 18 percent, due to their lower fuel consumption and carbon dioxide (CO2) emissions. Diesel engines also provide increased torque, range and driving pleasure especially for pickup trucks, SUVs and light commercial vehicles, which remain extremely popular.

- Vehicle complexity will increase with the onboarding of new technology, making automotive software such as Honeywell's OnRAMP Design Suite, a key enabler for meeting more stringent emission regulations. The automotive industry currently spends between $2 billion and $4 billion a year just on the development and calibration of powertrain controls to manage a vehicle's engine and after-treatment functions such as diagnostics. OnRAMP can reduce development time from months to days as well as help optimize engine controls of subsystems designed to reduce CO2 and other emissions.

Regional highlights

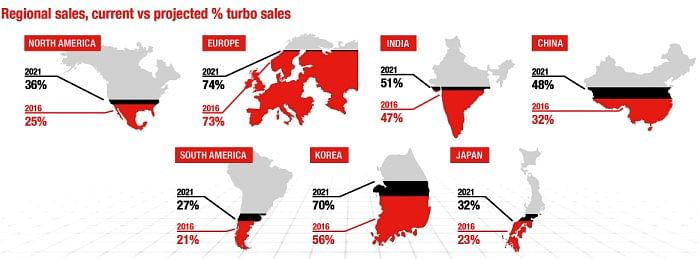

- In North America, more engine downsizing is expected. The current average engine size is a 3.0-litre six-cylinder. As the region continues to shift from larger naturally aspirated engines to smaller turbocharged ones, Honeywell says it is working to provide more twin-scroll turbo technology support, which extracts more energy from four-cylinder exhaust profiles. The turbo manufacturer expects light vehicle sales of turbocharged vehicles to grow 11 points to 33 percent of regional sales or more than 7 million vehicles by 2021. Turbocharged diesel engines will continue to be in demand on light-duty trucks.

- Europe will easily remain the global leader with an overall turbo penetration of 74 percent. The mix between petrol and diesel will shift slightly as gas turbo penetration in light vehicle sales grows 9 points to 52 percent in 2021. Additional technology benefits are needed as many automakers still have a gap of 15 to 30 g/km before meeting the 2021 target of 95 g/km.

- In China, emissions regulations are scheduled to become the toughest in the world. These new rules will favor the development of petrol turbocharged engines and wider adoption of electrification. China will be the highest growth market for turbocharged light vehicles with a 16 point increase in penetration of total sales. This equates to an expected 80 percent increase in the number of annual sales in 2021 at more than 13.5 million versus 7.5 million in 2016. Honeywell is supporting this massive turbo adoption in China especially in the three-cylinder engine segment using its third-generation gas technology. This features a wastegate with a Honeywell-developed mono-block arm and valve, reducing noise by 5 to 10 decibels and improving fuel economy by up to 0.5 percent with better controllability and 50 percent less wear due to repetitive motion within the turbo housing.

- Other regions including Japan, Korea, India and South America will see on average a 7 percent growth in turbocharging volume driven by the expected recovery of South America and Southeast Asia economies, and more stringent regulations including India's Bharat Stage VI and Brazil's Inovar-Auto and future programs.

Recommended: Indian turbocharger market to notch 14% growth till FY2020

Charts and information source: Honeywell Transportation Systems

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

10 Dec 2016

10 Dec 2016

10112 Views

10112 Views

Ajit Dalvi

Ajit Dalvi