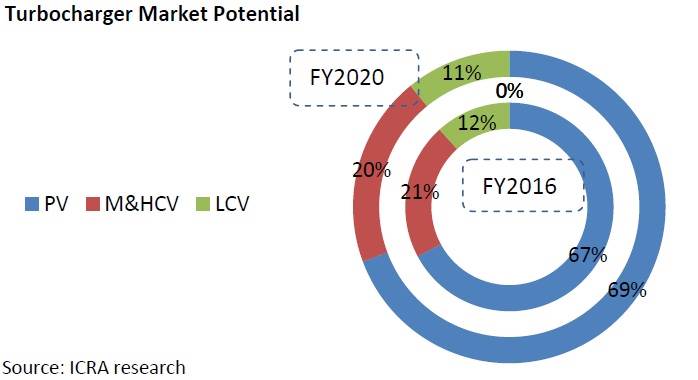

Indian turbocharger market to notch 14% growth till FY2020

Market potential for the domestic turbocharger industry is slated to grow to around Rs 2,600-2,800 crore by FY2020, registering CAGR of 14% during FY16-FY20.

There’s good news for turbocharger manufacturers supplying to the Indian market. The market potential for the domestic turbocharger industry is slated to grow to around Rs 2,600-2,800 crore by FY2020, registering CAGR of 14% during FY16-FY20.

While volume growth could be modest at around 8-9% CAGR, value growth will be healthy as higher value added solutions (VGTs, twin spool turbos) as well as new products to meet stricter regulatory requirements drive higher content per vehicle. This forecast comes from ICRA which says CAFE norms, as well as stricter emission norms, will further propel usage of turbochargers.

Two years ago, a survey report by Honeywell had predicted that 43 percent of new production vehicles globally will be turbocharged by 2019.

Lower excise duty on small cars with small engines ( < 1.2L petrol or < 1.5L diesel) is also pushing turbocharger penetration, as OEMs can deliver higher power with a small engine. Recognising future demand, turbocharger manufacturers are increasingly localising their raw material requirements, supporting the growth of Tier 2 ancillaries.

On an average, for a passenger vehicle, a diesel turbocharger costs Rs. 4,000 – 5,000 whereas petrol turbocharger is priced at ~Rs 15,000 per unit. Petrol turbochargers are designed to operate at much higher RPMs [revolution per minute] (as compared to diesel counterparts) which require the components to withstand high temperature; this explains the cost difference between petrol and diesel turbochargers. Cost also varies depending on the type of turbocharger i.e. a twin scroll turbocharger1-will cost almost double a single scroll turbocharger, whereas relatively complex variable geometry turbocharger could be even more costly. Realisation of turbocharger for trucks is in the range of Rs 10,000 – Rs 12,000.

In India, turbochargers are present in over 90% of diesel vehicles, though its penetration level in petrol vehicles is relatively low. In the backdrop of changing customer preference towards petrol engines in the PV segment, the domestic turbocharger industry – which is attuned to the diesel turbocharger – could face some temporary readjustment pains, especially for supplies to the passenger vehicle industry. Nevertheless, increasing acceptance of turbocharged petrol engines should support demand for the turbocharger industry over the medium term.

While the share of diesel vehicles in India is expected to moderate going forward, increasing the share of turbocharged petrol engines as well as superior realisation will drive the overall turbocharger market. Considering, gross margins of 45% and sizable raw material requirements (55% of the industry’s turnover), primarily sourced from Tier 2/3 ancillaries, demand for turbocharger components is expected to drive Rs. 1,300-1,400 crore of revenue for Tier 2/3 ancillaries by FY2020.

Improved fuel efficiency and reduced emissions draw OEMs to turbos

Turbochargers in petrol vehicles are gaining prominence thanks to enabling improved fuel efficiency and reduced emissions.

The CAFÉ norms notified by the government of India in April 2015 mandate a 14% improvement in fuel efficiency by FY2018 and 38% improvement after FY2022 for OEMs. In order to meet the stipulated target by April 2017, fleet fuel efficiency for petrol and diesel vehicles should improve to 18.2kpl and 20.41kpl respectively, from the current average of 16kpl and 18kpl, respectively. Turbocharger cost effectively could drive a 20%+ improvement in fuel efficiency, as compared to non-turbocharged engines.

Globally, the turbocharger market is primarily dominated by three players, namely Honeywell (34%), BorgWarner (29%) and IHI, Japan (15%). Other large suppliers include Mitsubishi Heavy Industries, Bosch Mahle and Cummins Turbo Technologies.

It is understood that turbos, being a critical component with high technological entry barrier and a long validation process for vendor selection, lends high margins to turbocharger manufacturers. Assuming optimal capacity utilisation, ancillaries could enjoy high operating margins (~17%-20%) in the turbocharger manufacturing business.

Considering the strong technical know-how requirements, most of the domestic market is catered to by international majors either through their step-down subsidiary or JVs in India. Turbo Energy Private Ltd (Turbo Energy) is one of the largest turbocharger manufacturers in the domestic market, catering to all major PV OEMs as well as CV players. Cummins by virtue of its JV (Tata Cummins) with Tata Motors (for supplies of M&HCV engines) is one of the largest players in the M&HCV market. ICRA says Turbo Energy, Honeywell Turbo Technologies India and Cummins Turbo Technologies together account for over 90% of the domestic turbocharger requirement.

Related:

- Global sales of turbocharged vehicles to go up 35% by 2021

- Honeywell's Milind Godbole, "Demand for turbos in India will grow to 48% in 2020."

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

By Autocar Pro News Desk

By Autocar Pro News Desk

02 Nov 2016

02 Nov 2016

13224 Views

13224 Views