Ford and Mahindra call off planned joint venture

Fundamental changes in global economic and business conditions – caused, in part, by the global pandemic – over the past 15 months influence decision.

Ford Motor Company and Mahindra & Mahindra have ended their discussions for a joint venture. In an official statement issued in the closing hours of the last day of 2020, first by Ford and then by Mahindra & Mahindra, the two automakers have mutually and amicably determined that “they will not complete a previously announced automotive joint venture between their respective companies.”

The decision follows the passing of the December 31 “longstop,” or expiration, date of a definitive agreement the organizations entered into in October 2019.

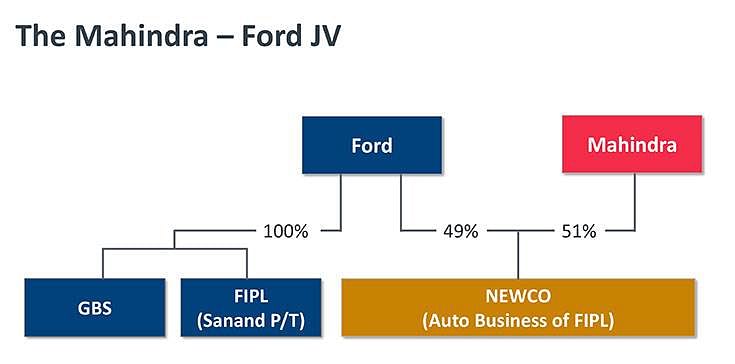

On October 1, 2019, Mahindra & Mahindra and Ford Motor Company had signed an agreement in Mumbai to create a joint venture that will develop, market and distribute Ford brand vehicles in India, and Ford brand and Mahindra brand vehicles in high-growth emerging markets worldwide. The JV was to see Mahindra having the 51 percent controlling stake and Ford owning a 49 percent stake. Ford was to transfer its India operations to the JV, including its personnel and assembly plants in Chennai and Sanand. Ford was to retain the Ford engine plant operations in Sanand as well as the Global Business Services unit, Ford Credit and Ford Smart Mobility.

The JV was planned to be the next step in the strategic alliance forged between Ford and Mahindra in September 2017 and aimed at exploiting new mobility opportunities, among other things. It was aimed at growing the Ford brand in India and exporting its products to Ford entities globally. While Ford-branded vehicles were to be distributed through the Ford India dealer network, Mahindra would continue to operate its own independent dealer network in India. Importantly, there were to be planned synergies in product portfolio, sourcing and manufacturing, which would have achieved substantial cost savings.

In a statement issued in the early hours of January 1, 2021, Mahindra & Mahindra said: "This decision will not have any impact on the company’s product plan. It is well positioned in its core true SUV DNA and product platforms with a strong focus on financial performance. In addition, the company is accelerating its efforts to establish leadership in Electric SUVs."

Impact on upcoming producrts from the JV

What impact does this new development have on the products being developed jointly? Ford is already far down the road with its next big launch the C-SUV (code: C757) which is based on the next-gen Mahindra XUV500 (code:W601). The W601 is due for launch in the first half of 2021 whilst For’s equivalent C-SUV is slated for an early 2022 launch. It is hence likely that Ford will enter into a contract manufacturing arrangement with Mahindra to build the C-SUV in its Chakan plant.

Ford is also likely to source engines from Mahindra going forward. The upgraded Ecosport due in mid-2021 will be powered by a Mahindra’s 1.2 TGDI (G12) motor. The Ford C-SUV too will be use the same 2-litre petrol and 2.2 diesel engines that will power the next XUV500.

Global business conditions contribute to calling off of JV

The decision to call off the JV, according to the companies, “was driven by fundamental changes in global economic and business conditions – caused, in part, by the global pandemic – over the past 15 months. Those changes influenced separate decisions by Ford and Mahindra to reassess their respective capital allocation priorities.”

Ford says its independent operations in India will continue as is. Ford is “actively evaluating its businesses around the world, including in India, making choices and allocating capital in ways that advance Ford’s plan to achieve an 8% company adjusted EBIT margin and generate consistently strong adjusted free cash flow.

Ford’s plan calls for developing and delivering high-quality, high-value, connected vehicles – increasingly electric vehicles – and services that are affordable to an even broader range of customers and profitable for Ford. The company is moving quickly to

- Turn around its automotive business – competing like a challenger while simplifying and modernising all aspects of the company, and

- Grow by capitalising on existing strengths, disrupting the conventional automotive business, and partnering with others to gain expertise and efficiency.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

01 Jan 2021

01 Jan 2021

186175 Views

186175 Views

Ajit Dalvi

Ajit Dalvi