Emerging markets see significant twist in growth story

The global light vehicle market is expected to remain in positive territory this year with growth at 3 percent to over 87 million units, according to automotive intelligence provider LMC Automotive.

The global light vehicle market is expected to remain in positive territory this year with growth at 3 percent to over 87 million units, according to automotive intelligence provider LMC Automotive.

However, in what is a worrying sign, several emerging markets are underperforming and the outlook for vehicle sales in some of these previously high growth markets is being downgraded. Slower growth in the emerging markets is creating pressure for the global automotive industry and adding an element of uncertainty for key players which have invested heavily in these markets.

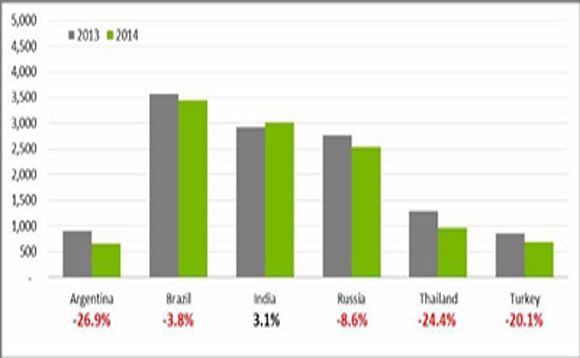

In September 2013, with the exception of Thailand, LMC Automotive had expected growth in many of the emerging markets in 2014. By April this year, it had revised all of its forecasts downwards. Of the six emerging markets under consideration – Argentina (-26.9%), Brazil (-3.8%), India (3.1%), Russia (-8.6%), Thailand (-24.4%) and Turkey (-20.1%) – only India is currently expected to show any growth in 2014, and even that is exposed to considerable downside risk.

Ever since the US Federal Reserve suggested in 2013 that it may begin tapering off asset purchases under its quantitative easing programme, underlying macroeconomic fragilities have been increasingly exposed in emerging economies. In this weakened context, light vehicle demand is also undergoing a period of volatility and LMC Automotive says it has made a number of downward revisions to near-term forecasts.

Meanwhile, mature markets, having been battered during the financial crisis and subsequent years, are showing much firmer vehicle demand. US auto sales, after a brief weather-related interruption in January and February, resumed the upward path that has been in evidence since 2010. West European markets – still far below their pre-crisis levels – are beginning to gain ground. And of course momentum in China, while not unstoppable, lies at the heart of gains at the global scale.

"While the US, China and Western Europe continue to be likely sources of expansion in 2014, driving our outlook for the year, a number of large and previously dynamic emerging markets have moved from growth to stagnation, or even outright contraction," says Pete Kelly, managing director of LMC Automotive.

South America

The outlook for Brazil and Argentina has darkened over the past year. For Brazil, the inability of the economy to regain rapid economic growth rates has led to a stall in vehicle sales. Future expansion will be delayed. More worryingly, and in the context of weakened markets, a relatively rapid expansion in capacity in Brazil now appears less justifiable. If there is little, or only modest, demand growth over the coming years, utilisation levels in South America will be well below desirable levels posing a clear threat to profitability in the region.

In Brazil, for example, the expansions by a number of vehicle manufacturers that are underway are aimed at raising overall capacity by 1.3 million units by 2016 versus 2013. This may have made commercial sense 18 months ago, but it may now contribute to a fall in overall South American utilisation to 63-65 percent by 2016. Demand risks appear to be on the downside, so this situation could worsen.

"Such low levels of utilisation in South America are consistent with financial stresses within the industry. It may well turn out that the drift away from high-income country automotive manufacturing has created over-extension in new localised operations close to the emerging markets that had previously promised so much," says Jeff Schuster, LMC Automotive's senior VP of forecasting in the Americas.

Europe

If Western Europe is turning the corner, the same cannot now be said in Eastern Europe. We have yet to see a real downturn in Russia, but all of the fundamentals point towards a weaker market this year, with recovery in 2015 now on a knife edge. The waters are further muddied by events in Crimea, which have already led to a reduction by several percentage points in LMC's forecast. Sales in Turkey – always subject to a high degree of volatility – plummeted in March by 30 percent, underscoring the effects of political and economic fragility.

"A large decline in the total East European vehicle market is not expected, but downside risks in certain countries within the region are clearly rising," says Carol Thomas, LMC Automotive's Central and Eastern European Analyst.

Asia

Chinese sales are continuing to expand rapidly – sales were up by 10 percent, year on year, in the first quarter of 2014 – and, assuming a banking crisis does not emerge, should post solid growth this year.

However, Indian demand remains fragile. The rapid expansion in demand that began in the mid-2000s went into reverse in 2013 as the economy slowed sharply. There is now little prospect for serious growth in 2014. In September 2013, LMC Automotive was forecasting growth of 9.2 percent; that has been revised down to 3.1 percent. Given the political and economic uncertainty, the speed and timing of a return to vehicle market growth is subject to a significant degree of, mostly negative, risk. However, as mentioned earlier, of the six emerging markets under consideration, India is the sole country forecast to record positive, albeit flat, growth.

Political trouble in Thailand, a country in which a post-incentive situation is already leading to significant sales decline, poses a further threat.

In all, while only some of the risks to emerging vehicle markets may materialise, the combination of already-reduced baseline expectations and general instability are of increasing concern. However, globally, industry volume remains at record levels, thanks in large part to the expansion in China, completion of recovery in the US, and a West European market climbing out of the depths of the worst automotive recession in living memory.

"An expansion in the global light vehicle market of around 3 percent this year – and that implies sales of over 87 million units – is still a reasonable assumption. But the key issue for some industry players will now be how reliant they are on some of the riskier markets in the world," concluded Pete Kelly.

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

25 Apr 2014

25 Apr 2014

3493 Views

3493 Views

Ajit Dalvi

Ajit Dalvi