BEV sales in Europe witness largest YoY decline since January 2017

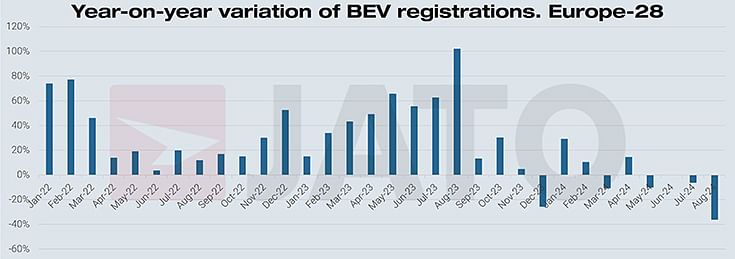

A total of 125,070 battery electric vehicles were sold in Europe in August 2024, marking a 36% YoY fall and the largest drop the segment has experienced since January 2017. As a result, BEV market share has fallen to 16.6% from 21.8% in August 2023. Lack of clarity around incentives, high BEV prices and concerns around the low residual value of EVs impact demand.

The decline in consumer demand for battery electric vehicles continues in Europe, and also continues to drag overall sales of passenger vehicles. According to JATO Dynamics’ latest retail sales data for 28 European markets, 753,482 new cars were registered in August 2024. This marks a 16% year-on-year decrease on the 899,881 units registered in August 2023, and the biggest year-on-year drop since June 2022. A key contributor to the overall passenger vehicle sales decline is the sharp 36% decline in sales of battery electric vehicles (BEVs)

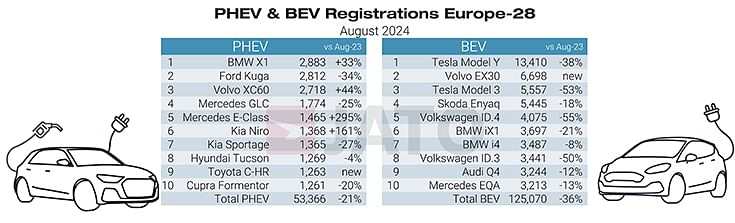

In August 2024, 125,070 units BEVs were retailed in Europe, down 36% YoY. The Tesla Model Y was the best-seller but its sales were down 38% YoY.

In August 2024, 125,070 units BEVs were retailed in Europe, down 36% YoY. The Tesla Model Y was the best-seller but its sales were down 38% YoY.

BEVs suffer biggest year-on-year drop in registrations

The decline in demand for battery electric vehicles (BEVs) had a significant impact on the performance of the overall market. A total of 125,070 units were registered in August, marking a 36% fall in year-on-year sales. This is the largest drop the segment has experienced since January 2017, when registrations were first recorded. Munoz added: “Appetite for BEVs among consumers is quickly diminishing. There are many factors contributing to this, including the lack of clarity around incentives, high prices and concerns around the low residual value of EVs.”

Due to this performance, the market share of BEVs fell from 21.8% in August 2023 to 16.6% last month. Despite the year on-year decline, the segment recorded its highest monthly market share this year and surpassed both August 2022 and August 2021 – 3.6 points and 4.6 points lower respectively. Munoz said: “While market share has risen from previous years, the increase is not as large as we would expect given the significant amount of time that has passed.”

The companies that suffered the most from the drop in BEV registrations were Renault Group (-64%); SAIC (-65%); Stellantis (-52%); Hyundai-Kia (-51%); and Tesla (-44%). Looking at the results by brand, Volkswagen suffered a fall of 46% and was outsold by BMW. Other fallers included Smart (-68%); MG (-65%); Opel/Vauxhall (-63%); Citroen (-63%); Fiat (-55%); Hyundai (-53%); Kia (-50%); and Polestar (-47%). BMW Group experienced a small decline of 5%, whereas Geely Group and BYD registrations rose by 52% and 18% respectively.

In contrast, the market share of Chinese carmakers (including Geely-owned Volvo, Polestar and Lotus) within the BEV segment increased from 10.5% in August 2023 to 15.5% in last month. The strong performance of Chinese-made cars was largely due to the success of the Volvo EX30 and certain BYD models. As a result, the total market share of Chinese carmakers was larger than Tesla’s at 15.3% and outperformed only by Volkswagen Group at 22.5%.

Commenting on last month’s sales, Felipe Munoz, Global Analyst at JATO Dynamics, said: “The industry is going to face further challenges in the coming months. Buyers are still grappling with the pressure to make the switch to electric, and EVs continue to be more expensive than already-pricey combustion engine cars.”

A total of 8.64 million new cars have been registered in Europe so far in 2024 – an increase of just 1.9% compared to the same period last year. Munoz commented: “If this trend continues, the end-of-year results could present an overall decline in vehicle registrations.”

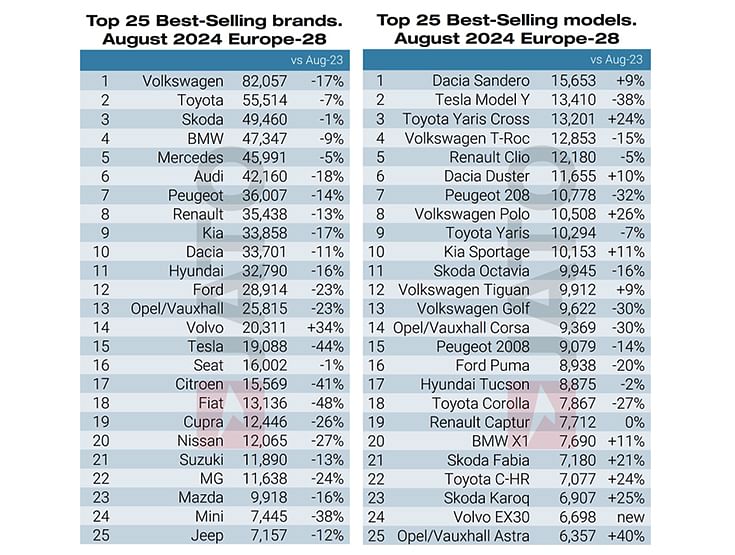

Dacia Sandero reclaims its crown

Dacia’s B-hatch, the Sandero, took the top spot in the overall model ranking last month, registering 15,653 units – a 9% year-on-year increase, taking its year-to-date total volume to almost 183,000 units. The Tesla Model Y followed closely with 13,410 units – a drop of 38%. The Toyota Yaris Cross was in third position, recording a 24% increase in registrations. The Toyota Yaris Cross was in third position, recording a 24% increase in registrations.

Other players that performed well included the Dacia Duster (+10%); Volkswagen Polo (+26%); BMW X1 (+11%); Skoda Fabia (+21%); Toyota C-HR (+24%); Skoda Karoq (+25%); Opel/Vauxhall Astra (+40%); Peugeot 3008 (+22%); and Seat Ibiza (+74%).

Among the latest models introduced, the Volvo EX30 became the region’s second best-selling BEV in August and the third best-selling vehicle in 2024. MG registered 3,151 units of the MG 3; Volkswagen registered 2,803 units of the ID.7; the Renault Scenic registered 2,193 units; the Fiat 600 recorded 2,047 units; the BMW i5 registered 1,748 units; the Lexus LBX sold 1,634 units; and the Ford Explorer EV registered 1,424 units.

All data tables and charts: JATO Dynamics

ALSO READ:

Electric car and SUV sales in August lowest in past eight months in India: 6,335 units

World EV Day Special: Will EV sales in India hit 2 million units in FY2025?

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

By Autocar Professional Bureau

By Autocar Professional Bureau

20 Sep 2024

20 Sep 2024

6881 Views

6881 Views

Ajit Dalvi

Ajit Dalvi