‘EVs are the way to go and we see a big future in electric mobility’: Sunjay Kapur

From manufacturing bevel gears and differentials 30 years ago to currently producing a varied range of EV components, Sona Comstar has evolved with the fast-changing automotive industry. Chairman Sunjay Kapur, who is bullish about vehicle electrification, states that the company’s EV-sourced revenues are expected to jump from 30% to around 78% over the next four to five years. What also helps is that the majority of Sona Comstar’s core products today are powertrain-agnostic.

Gurugram-headquartered Tier-1 major Sona Comstar, which began operations nearly three decades ago in 1995 as Sona Okegawa Precision Forgings, is on a strong footing with a highly diversified portfolio that today spans beyond its proprietary warm-forged bevel gears and differentials, to also incorporate EV-related components such as traction motors, active-suspension motors, and sensors. The company, which envisions EVs to comprise about 78-79% of its overall revenues in the next four to five years, is eyeing newer technologies by virtue of its acquisitions, in-house development, as well as collaborations with innovative startups.

In this exclusive interview, Sunjay Kapur, Chairman, Sona Comstar, talks about how the company’s relentless focus on R&D, new technologies, as well as manufacturing excellence, are set to keep it in a strong position as one of the key players in the Indian and global mobility ecosystem in the future.

Can you revisit the Sona Comstar's three-decade-long journey?

It has been almost 30 years since we incorporated Sona BLW, which was originally called Sona Okegawa Precision Forgings. We started with a joint venture with Mitsubishi Materials to make warm-forged bevel gears. When we began our journey, we had an investment from Sona Koyo Steering, and then we separated into Sona Okegawa, before eventually becoming Sona BLW after acquiring Thyssen Krupp’s forging division – BLW – in 2008.

The history of getting into gears dates to the mid-1970s when my father started a company called Bharat Gears to manufacture bevel gears for automotive application. But these were hot-forged and machined gears. Later, an association with BLW in gave us access to a unique technology of warm forging that enabled near-net shaped gears. BLW invented the warm forging technology, and licensed it out to different companies. Since then, we have been able to learn the technology which has been of great advantage to us because we now have complete control over the technology.

We do not need any partnerships or joint venture partners today, like we did in the past. And that has also helped us to make our own dyes and tools, and it has also helped us to forward integrate to make differentials.

So, the journey spans from our inception in 1995, to start of commercial production, almost 25-26 years ago. Then, we bought out Mitsubishi’s stake in 2017, brought in Blackstone in 2019, and then, continuously grew the business. When we brought in Blackstone, we also bought Comstar from them. And incidentally, Comstar also started around the same time as Sona BLW. Subsequently, we merged Comstar and Sona BLW, thereby rebranding as Sona Comstar around four years ago.

In these last 30 years, we have come a long way from being just a one-product company, to today, making differentials, different kinds of gears, as well as traction motors, starter motors, and active suspension motors. We have also expanded in the sensor space, wherein we acquired a company in Serbia called Novelic in 2023. Novelic’s products can determine a person or a child's breathing and heart rate, thereby being suitable for safety applications in a vehicle. Moreover, in industrial applications too, these sensors can determine heartbeats to ascertain whether there are people in a room or not.

So, it has been a great journey with a heightened focus on technology. We will continue to grow in the areas of technology and continue bringing products that give us an advantage with respect to the emerging trends in the automotive industry as it evolves. Having said that, today we need to look at the automotive industry beyond the lens of just ‘automotive’ and more as a ‘mobility’ industry to be able to keep supplying relevant products.

EVs have hit a roadblock in major markets such as the US and Europe. What is your viewpoint about sustainable mobility solutions for the future?

The passenger car segment will continue to move to electrification. And we are seeing that happen globally. It is a global trend. Yes, there will be cyclicality, but that is there in any industry. The real challenge with passenger vehicles, however, is range anxiety and as infrastructure gets built, charging stations get established, that range anxiety problem will get taken care of eventually.

So, I do not see how we can stay away from electrification. For instance, in China, one will never hear any problem of range anxiety, because the country has established an unparalleled charging infrastructure. And that is the way the world is going towards as well. I think in the domestic market, we will have an opportunity to examine different fuels and powertrains, but eventually, we will move towards electrification.

For our own business, we have increased our EV revenues in the last quarter as we have continuously captured more market share, despite there being a slight decline in global EV volumes. I also feel that businesses in India will have the option to capture more market shares as they develop better technologies, and as they invest in new technologies, and as the market grows. So, I believe that this slowdown in EV sales is cyclical, and not related to any substantial or structural change. I think these are just cycles, and we will overcome these cycles. EVs are the way to go.

Would Sona Comstar remain committed to its earmarked investments towards future EV products?

While we are very careful about the investments that we make, we will continue to invest into EV-specific aspects of our business as per the requirements of our customers. We see a big future in electric mobility. We have earmarked an investment in the region of Rs 1,000 crore to Rs 1,200 crore over the next three years, and we will meet our targets.

Sona Comstar has a diversified product revenue mix – by powertrain. While the battery EV business has increased to 35% of its revenue, its pure ICE dependence continues to reduce steadily going from 18% in FY22 to 9% in H1 FY2025.

Sona Comstar has a diversified product revenue mix – by powertrain. While the battery EV business has increased to 35% of its revenue, its pure ICE dependence continues to reduce steadily going from 18% in FY22 to 9% in H1 FY2025.

We hope to continue to invest in new technologies to address the market. Today, where about 30% of our revenue comes from EVs, it is slated to go up to about 78 to 79% over the next four to five years. And this is very illustrative of where the market is going. The market is moving more towards electrification, and autonomous driving, and it is for the latter that our sensor play with Novelic will help us play a crucial role in that space.

Sona Comstar’s dependency on ICE in our business is about 10%, and majority of our core products today are powertrain-agnostic. Therefore, it does not matter on what platform a vehicle comes out – be it flex-fuel, alternative fuel, hydrogen, et al. We will not be disturbed be any of these propulsion technologies.

Sona Comstar, which participated at the world’s largest tech show – CES 2025 in Las Vegas – last month drew strong interest from both the automotive and other industries.

Sona Comstar, which participated at the world’s largest tech show – CES 2025 in Las Vegas – last month drew strong interest from both the automotive and other industries.

What business growth do you envisage for Novelic in the near- to mid-term future?|

Over the next three to five years, we will see a significant increase in terms of the usage of sensors, and we are going to see that across the board. If one looks at the sensors we have today, the in-cabin sensors, as well as the proximity sensors, they can be used for various applications.

We have also developed an active suspension system motor which functions when a sensor reads the coverage of the road and sends a signal back to the controller, which, in turn, activates the motor. Hence, we will see a lot of use cases for sensors and we will see that increase not just in automotive but in industrial applications as well going forward.

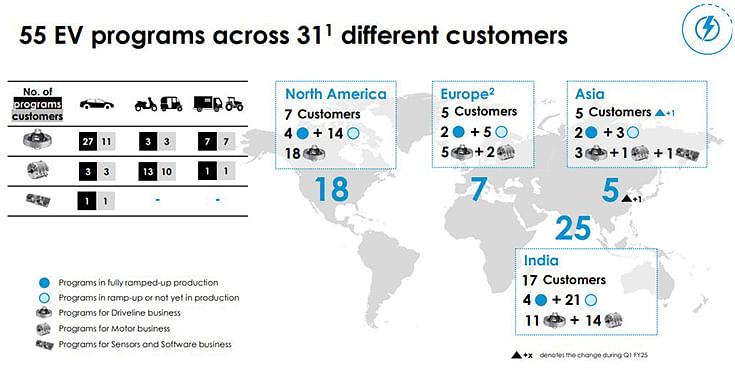

As the industry is undergoing a disruption, we are seeing a lot more technology emerge, and hence, we will see more growth in these areas of sensors, radars, et al. And therefore, we will continue to see growth in Novelic’s area of expertise. As of now, Novelic primarily caters to the European market, and we supply a lot of components from our Chennai facility to our sensor division overseas. Sona Comstar’s R&D focuses on drive motors, controllers, and transmission solutions for electric vehicles. With 55 EV programs across 31 customers, it has derived 79% of its net orderbook from EVs as of Q1 FY2025.

Sona Comstar’s R&D focuses on drive motors, controllers, and transmission solutions for electric vehicles. With 55 EV programs across 31 customers, it has derived 79% of its net orderbook from EVs as of Q1 FY2025.

What is Sona Comstar’s R&D roadmap, going forward?

We spend between 3.5%-6% of our annual revenue into R&D. So, we are very committed to investing in R&D as we realise that unless we make significant investments in technology development, we are not going to make a major impact. And therefore, we are geared towards investment in R&D in the future.

We understand what it takes to invest in R&D; we understand that some products may fail, while the others will succeed. And this is part of the journey in terms of learning, investing, and innovating. We have built an innovative culture at the company, and all our products so far are very high-tech.

We want to continue to play in the technology space more than any anywhere else, because we believe it brings a lot of value to the business. Other than the sensor business, our entire R&D happens out of India. Hence, we will continue to invest in R&D in India as we believe there is good engineering talent in the country; the opportunity is great. We will create a more robust structure for both R&D as well as testing.

The company has been actively engaging with overseas startups in the mobility domain. What are the outcomes thus far?

We have aligned for certain technologies with several startups in Israel, Canada, and in the UK, to specifically look at motor technology with the latter. We have also invested in an incubation fund in Israel to scout for new technologies. Therefore, we will continue with these initiatives as technology is evolving very rapidly and there could be opportunities in the future that give us a chance to integrate it into our core business.

The marrying of Sona and Comstar too has created a lot of synergy in terms of not just the financials, but even in technology, as well as cross crossing over to each company’s diverse customer base. So, it has been a good, well-defined strategy in terms of how we have grown after making this acquisition.

The way Sona Comstar is positioned is that we are very good at hardware, and are becoming better at software as well. So, we could be good at integrating software and hardware together, and eventually become an end-to-end systems supplier. That is an essential role that automotive component companies must play in the future as we increasingly move in the direction of autonomous driving and electrification.

Sona Comstar has recently also acquired Escorts Kubota’s railways business. What has been the strategy behind it?

Railways is one of the cleanest forms of mobility which aligns in the direction we are headed into. The railways business that Escorts Kubota has built is just phenomenal in terms of the technology that they have. And from our perspective, the railway sector in India growing with the government spending a lot of money in infrastructure enhancement. Therefore, we see this as a big advantage, and we will continue to grow this business, because there are different kinds of railway systems that we can eventually supply into.

While there is the traditional rail, we are seeing the advent of high-sped Vande Bharat and bullet trains, as well as Metros. So, it is a big business opportunity. It is a big market opportunity for us and aligns very well with how we are positioned as well in terms of clean mobility, sustainability, and technology. We are very much mobility-focused or even obsessed with mobility.

We are clear that we will only expand in areas of mobility, and the way things are moving, 20 years from now, one could see mobility having a deeper corelation with energy as well. Companies like Sona Comstar could evolve into energy companies in the distant future. Having said that, today, we are not looking at batteries. But anything could happen in the future; it is an ever-evolving space.

At Sona Comstar, we like technology, and mobility, and strive for manufacturing excellence. These are the things that will continue to drive us.

What is your growth outlook for the automotive component industry in FY25?

From the component industry’s perspective, there are three growth drivers – domestic, export and aftermarket. So, whilst the passenger car or automotive industry will see a low-single-digit growth in in India in FY2025, the components industry is likely to record a high-single-digit or a low-double-digit growth this year because it also has the opportunity of exports as well as aftermarket.

Sona Comstar's new plant in Silao, Mexico went on stream in April 2024 and aims to cater to growing demand for high-quality driveline solutions for BEVs in North America.

Sona Comstar's new plant in Silao, Mexico went on stream in April 2024 and aims to cater to growing demand for high-quality driveline solutions for BEVs in North America.

Can you provide an update on the company’s overseas facilities in Mexico and China?

While our Mexican facility for our motor business has been around and it supplies into North America. On the other hand, our Mexican facility for the driveline business is new and was only inaugurated last year. We are in the process of setting up shop there. With regards to China, we supply into the local market with our starter motors and active suspension motors with a local assembly. Having said that, our facilities in Mexico and China are mostly for final assemblies, whereas most of our manufacturing only happens in India across our plants in Haryana and Tamil Nadu.

How has the company progressed in terms of its ethics, people, and culture?

We have always focused on long-term partnerships with our employees, and we have people working with us since the beginning of time. We have had a great run with several people in our company. We continue to stick to our core values of integrity, frugality, and agility because we have always believed that we need to live by our value system. And even if someone is not watching, we must always follow our values.

My father used to always say, if one takes a decision with their values in mind, they can never go wrong. So, whether it is integrity, agility, frugality, or vitality, we continue to follow that those values very closely, and that has evolved over time in terms of how we have integrated that culture into everything that we do.

All data charts: courtesy, Sona Comstar

ALSO READ: ‘Our new plant in Mexico is an offensive move’: Sona Comstar’s Vivek Vikram Singh

Sona Comstar wins American Axle’s global supplier excellence award

RELATED ARTICLES

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

TVS Celebrates 20 Years of Apache, Eyes Premium and Global Push

Marking two decades of its flagship performance brand, TVS Motor unveiled special anniversary editions on Saturday while...

Q&A: Mahindra's Nalinikanth Gollagunta on Upcoming Festive Season, 'Bold' Design Choices

Automotive Division CEO Nalinikanth Gollagunta says mid-teens growth is achievable with Roxx ramp-up, BEVs, and a resil...

19 Jan 2025

19 Jan 2025

12876 Views

12876 Views

Prerna Lidhoo

Prerna Lidhoo

Darshan Nakhwa

Darshan Nakhwa