'We believe that you need a very large dealer network to enable used car transactions in India.'

Mahindra First Choice Wheels recently unveiled the first-ever used car market report in India. Dr Nagendra Palle, Managing Director and CEO, Mahindra First Choice Wheels, gives some insights to the in-depth study.

Mahindra First Choice Wheels recently unveiled the first-ever used car market report in India. Dr Nagendra Palle, managing director and CEO, Mahindra First Choice Wheels, gives some insights into the Indian Blue Book and the future of the domestic used car space. An interview by Shourya Harwani.

How did you decide to compare the Indian used car market with those of US and China?

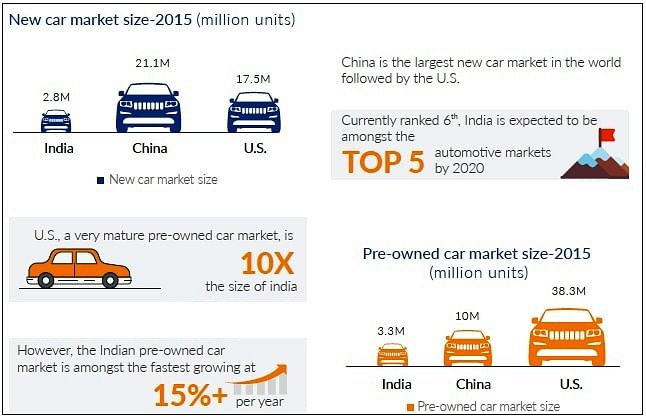

We have been out in the market talking to industry observers and practitioners like banks and OEMs. Typically, they look at the US as a developed market and where India needs to be and at China as the pinnacle of emerging markets. So the US gives context on the eventual destination while China shows us a point in time in the process of evolution. India is also now past the point of being compared with smaller markets.

How long would it take for India to replicate the standards set by the used car market in the US?

It will be a long time before India could reach similar levels. There are elements of the US market that are coming in. For example, the dealer experience and the classified industry. However, India inherently has some weaknesses when it comes to infrastructure and structure which will slow down the progress. For instance, consumer protection laws are very weak here and if a customer buys a bad car, there aren’t a lot of options for him but to plead to the dealer.

In the US, there are very strong consumer protection laws which prevent instances of bad sales. Also, there the dealers can originate loans themselves which makes selling much easier. So, there are many fundamental infrastructural differences that will not let the market in India come close to the model in the US as quickly as you think.

What are the margins like for Mahindra First Choice dealers and what are the trends that you have seen here?

Currently, our dealers work with margins of around 8-10 percent. What we have seen is that margins do get a bit squeezed, partially because of the fact that there is more transparency in the system, more visibility and the consumers are more knowledgeable now. This is what particularly happens when the market is evolving and the dealers now need to adjust with this by selling more and compensating through volumes.

How do you see financing of used cars panning out in the near future and what is the banking industry’s outlook on the market?

Currently, only 15 percent of the cars sold in the used car market are fi nanced but we clearly see large headroom for improvement on this front, both in metros and the Tier 2 and Tier 3 cities. As the market gets a lot more organised, banks will become more comfortable in financing used cars in India.

How important a role will the online channel play for the used car industry in India?

Online channels play a very important role when it comes to search and research on the used cars. However, for me in India, that is about it. Online channels have a big role to play in helping consumers find content, reviews and locating inventory. However, we believe that you need a very large dealer network to enable the transactions.

Pricing is a very important hook for the customer and hence we are pacing our investments in the Indian Blue Book accordingly. However, I don’t think transactions will happen online anytime soon. I do not even see that happening with us.

What is your target for expanding the franchisee network?

We today stand at around 883 outlets in 401 towns. We want to end the fi scal at 1,300 outlets in around 650 towns. We are operating very much in the local markets, and over the past six months, we have analysed almost 75 percent of the country down to the localities in order to track the potential markets. That is how we are approaching our expansion process.

Are you looking to expand to foreign markets as well?

We are not looking at expansion of our franchisee network in the foreign markets per se, but what we are working on is technology licensing and technology services in other geographies. We have enough going on here right now, but we are in talks with a couple of entities outside India which are interested in using our Indian Blue Book and the inspection platforms. However, it will take some time to materialise.

Recommended: India’s pre-owned car market growing at over 15%

RELATED ARTICLES

"Connectivity and ADAS will drive the next wave of disruption": Sundar Ganpathi

Tata Elxsi's CTO Sundar Ganapathi on how connectivity, ADAS, and data will define the next wave of automotive disruption...

INTERVIEW- Renault CEO Cambolive: 'India Is Renault' — Targets 3–5% Market Share by 2030

Renault is pursuing a fundamental reset of its India strategy, says brand CEO and Chief Growth Officer Fabrice Cambolive...

INTERVIEW: "EV Demand is Rebounding both in India and Around the Globe" - JLR's Rajan Amba

Jaguar Land Rover India MD Rajan Amba discusses the India–UK FTA, the company’s manufacturing plans, the upcoming Panapa...

By Shourya Harwani

By Shourya Harwani

16 Sep 2016

16 Sep 2016

8464 Views

8464 Views

Darshan Nakhwa

Darshan Nakhwa

Hormazd Sorabjee

Hormazd Sorabjee