India’s pre-owned car market growing at over 15%

Do you know that the 3.3 million pre-owned passenger car market in India is currently notching 15% year-on-year growth? Or that the demand is coming from first-time buyers and upgraders?

Do you know that the 3.3 million pre-owned passenger car market in India is currently notching 15% year-on-year growth? Or that the demand is coming from first-time buyers and upgraders? Or that for more than half of these buyers (55%), a pre-owned car is the first car in the family?

This and a lot of other information is part of the ‘India Pre-Owned Car Market Report’, an in-depth study of the Indian pre-owned car market released in Indian Blue Book. The report details the rapidly growing pre-owned vehicle market and provides insight into the scale, stage and structure of the industry.

According to Dr Nagendra Palle, MD and CEO, Mahindra First Choice Wheels, “Over the last 24 months, the pre-owned vehicle industry has been the subject of much attention from a variety of industry stakeholders such as investors, automotive OEMs, car dealers, financial institutions and consumers. However, little is specifically understood about the industry due to the severe paucity of data. This first-of-its-kind report should be extremely useful to all stakeholders in assessing the Indian pre-owned vehicle industry, both domestically and in the global context.”

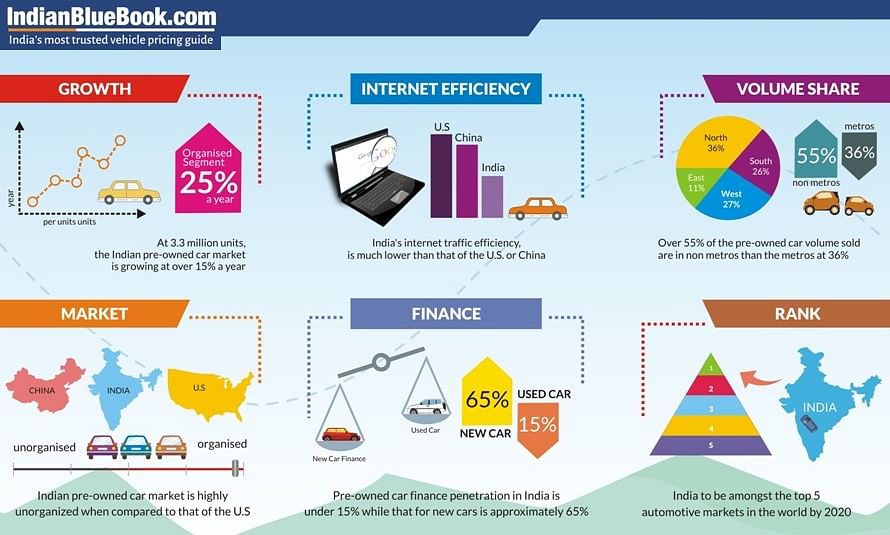

At present, India, which is slated to be among the top five global automotive markets by 2020, sees the pre-owned car market growing at over 15% a year (the organized segment is seeing over 25% growth). While 45% of all pre-owned cars are sold in metro cities, non-metros account for 55% and growing faster than the metros. Zone-wise, the North with 36% leads the pre-owned car market in India, followed by the West (27%), South (26%) and the East (11%). The report also reveals that the North and West exhibit more organised channels than the South.

The report reveals the typical customer profile and buying behaviour. Fifty percent of buyers are in the 25-34 age group. The average age of a pre-owned car at the time of sale is 4 years with the average ticket size being Rs 3-4 lakh. For more than half (55), a pre-owned car is the first in the family. The key reasons for buying a used car is affordability, followed by value for money. And typically, a used car buyer looks for a trusted source and quality product to complete his/her sales transaction.

Largely unorganised retail and wholesales

The pre-owned car market in India is supply constrained, with inventory turns at dealers under 30 days compared to over 60 days in the US. Pre-owned car channels are also highly fragmented with four primary market segments:

- Organised: 12% market share. Average volume at 16 per month

- Semi-organised: 35% market share. Average volume 9 per month

- Consumer to consumer: 34% market share

- Unorganised: 19% market share. Average volume is less than 3 per month

As is known, the unorganised sector is highly fragmented but it accounts for the bulk of the dealer population (58%) and only 19% of the total volume. There are no formal wholesales channels for dealers to procure pre-owned cars.

India market developed in some ways, nascent in many

The motorisation rate in India is currently 22 cars per 1,000 people. In the US, it is over 800 cars per 1,000 people with a car parc that is 10 times that of India. What’s common with the US market is thast the pre-owned car market in India is larger than its new car market. While the market in india is highly unorganised, it is more organised than that of China.

Other findings of the Indian BlueBook is that scale and price point are major drivers in India – dealer productivity and gross margins make India a relatively shallow market. There is significant growth potential for pre-owned car financing, with growing expected in the coming years. Finance penetration in this sector is under 15% while that for new cars is in the region of 65%. Finance penetration is significantly higher within the organized channel (40% in metros and non-metros), while the semi-unorganised channel is highly fragmented with higher channel costs for lenders.

Interview: Dr Nagendra Palle, MD & CEO, Mahindra First Choice Wheels on the Indian Blue Book

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

By Shourya Harwani

By Shourya Harwani

23 Aug 2016

23 Aug 2016

9694 Views

9694 Views