PV airbags and 2W ABS as a big business opportunity in India

Economies of scale will lead to airbags and anti-lock braking systems becoming cheaper and their use widespread.

2019 will see India mandate standard fitment of airbags in all passenger vehicles and anti-lock braking systems in two-wheelers. Suppliers of this life-saving safety equipment will benefit from the sheer volume of demand pegged at up to Rs 7,500 crore.

Even as you read this feature, someone somewhere in India has been injured or died in a road accident. While 2017 India road crash data is yet to be released, 2016 saw an average of 1,317 accidents and 413 accident deaths taking place on Indian roads each day – or 55 accidents and 17 deaths every hour. These absolutely shocking numbers have goaded the government, industry and other stakeholders to actively debate the path ahead to ensure safer roads. This involves a multi-pronged approach to solve the problem that identifies actionable steps under different heads – to make vehicles safer, rework road design and spread awareness among road users to follow traffic discipline.

ABS for all existing and new 125cc and above two-wheelers will be compulsory from April 1, 2019

On the product side, while OEMs are beginning to increasingly equip their products for the domestic market with safety features albeit many optional and at a price to the consumer, the government, seized of the urgency to reduce road crash injuries and fatalities, has over the past few years rolled out a mandatory safety equipment programme designed to enhance the level of safety equipment in vehicles. These mandatory regulations, which are already seeing implementation, will ensure that vehicles across all segments and types are equipped with minimum required safety features.

Mandate for airbags in PVs

According to the government gazette on safety standards, October 1, 2017 was the date of implementation of mandatory protection of driver against steering column intrusion (standard: AIS 096 or UN equivalent: UN ECE R12) in case of impact at ~ 50kph (full frontal crash) for all new cars and light motor vehicles (LMVs) with gross vehicle weight (GVW) of less than 1,500kg. This regulation resulted in mandatory fitment of the airbag(s) in all new passenger vehicles from the given date.

The Gazette also mandates that all cars and LMVs of GVW < 1500kg must-have feature(s) for protection of driver against steering column intrusion (standard: AIS 096 or UN equivalent: UN ECE R12) in case of impact at ~ 50kph (full frontal crash) from October 1, 2019. This regulation would result in all existing and new cars to feature at least one airbag (meant for the driver) from the given date, which also means achieving 100 percent airbag penetration (for single airbag fitment).

JATO Dynamics India's Ravi Bhatia: "Competition among OEMs and growing consumer awareness about in-vehicle safety features are defining airbag penetration in India's passenger car market."

FY2018 saw 3.28 million passenger vehicles (PVs) being sold in India, of which 2,173,950 were cars, 921,780 SUVs, and 192,235 vans. In 2016, 23 percent of the total vehicle accidents involved PVs. With the PV market growing at around 8 percent, and airbags set to become standard fitment 16 months from now, airbag suppliers have a humungous opportunity staring them in the face. Speaking to Autocar Professional, Shamsher Dewan, vice-president and sector head (Auto), ICRA Ltd, an independent consulting and credit rating agency, said, “The penetration of airbags and other safety features is growing in the passenger vehicle segment. Every new car that is launched in the market will have to offer airbag(s) as a standard feature. We estimate that the mandatory fitment of airbags in PVs presents a business opportunity in the range of Rs 2,000 crore to Rs 2,400 crore spread over a few years in the automotive industry.”

Dewan, who agrees that the penetration of airbags is being driven by the government’s safety regulations, estimates an average cost of an airbag to be about Rs 6,000. He also sees fast penetration of the dual airbags in PVs.

On the contrary, according to Ravi Bhatia, president, JATO Dynamics India, a data insights and consulting company, market forces are playing a stronger role than the government regulations in terms of boosting the penetration of airbags in the cars sold in India. Nevertheless, he agrees that the government safety regulations will fundamentally drive the airbag fitment as a standard feature in the entry-level cars positioned in the cost-sensitive market. For most of the other categories but the entry-level cars, Bhatia says, “Consumer awareness for safety features will play an important role.”

Citing examples of different models, he points out that the Ford Freestyle, Ford Figo, Ford Aspire, Hyundai Elite i20 and i20 Active offer six airbags as standard. This, he underlines, is the result of several factors including the cut-throat competition of overall product packaging.

“Toyota and Volkswagen, is the world’s largest two carmakers, offered airbags as standard across their portfolio. They followed global safety benchmarks in the Indian market too and this had clearly set the beginning of new agenda. The competition between carmakers is driving the number of airbags offered in cars now. Secondly, the consumers are becoming very conscious about the benefits of critical safety features such as the airbags. Thirdly, the roads are widening up and the infrastructure is expanding. This has resulted in an increase in the average speed of vehicles on our highways. These three factors are defining the airbag penetration in the PV market,” explains Bhatia, who himself is a road accident survivor wherein he credits the life-saving role essayed by the airbags in his car. According to him, currently the penetration for single airbags in India is 68 percent and the penetration of dual airbags as standard is 57 percent.

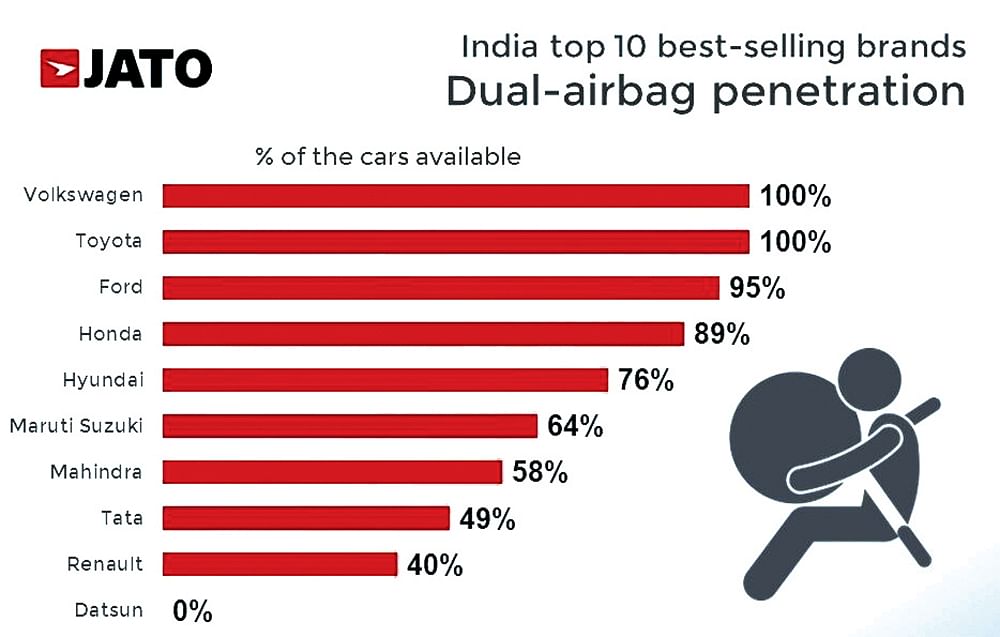

Dual-airbag penetration in India's top 10 PV brands

As per the statistics maintained by JATO Dynamics India, only VW and Toyota currently offer dual airbags as a standard feature across all models. They are followed by Ford India (95 percent) and Honda Car India (89 percent) respectively. JATO’s data indicates that 64 percent of all models sold by market leader Maruti Suzuki offers airbags as a standard feature. On May 9, the company announced that it is offering dual airbags as standard fitment across all variants of its popular Vitara Brezza, which is also India's best-selling SUV.

Another recent example is the Toyota Yaris, which will compete in the midsize sedan segment with the Honda City, Maruti Ciaz, Hyundai Verna, VW Vento and Skoda Rapid. The all-new Yaris offers seven airbags as standard.

Bhatia of JATO Dynamics India estimates that the market perception value of a single airbag unit could be in the range of Rs 8,000 to Rs 10,000.

Compulsory ABS / CBS in two-wheelers

In the booming two-wheeler segment, the government regulation has already mandated compulsory fitment of anti-lock braking system (ABS) on 125cc and bigger models. For smaller and more affordable models up to 125cc, the mandate is for compulsory fitment of the combi-braking system (CBS). While this regulation for all new models came into effect from April 1, 2018, all the existing models will be required to follow the norm from April 1, 2019.

“At ICRA, we estimate the market opportunity for compulsory ABS fitment on the two-wheelers to be in the range of Rs 4,000 crore to Rs 5,000 crore,” says Dewan. According to him, the average cost of a single-channel ABS unit and a CBS unit could be in the range of Rs 1,500 to Rs 2,000. “The overall business opportunity in the area of safety will be primarily driven by the airbags in passenger vehicles and the ABS / CBS fitments in two-wheelers. Both put together to offer a market opportunity of up to Rs 7,400 crore, depending upon the market growth and numbers,” sums up Dewan.

ICRA's Shamsher Dewan: "We estimate mandatory fitment of airbags in PVs presents a business opportunity in the range of Rs 2,000–Rs 2,400 crore and two-wheeler ABS in the region of Rs 5,000 crore."

While companies such as Takata, Autoliv, Rane TRW, UNO Minda-Toyoda Gosei and KSS Abhishek Safety Systems are understood to be the leading suppliers of airbags for PVs, Bosch and Denso are the critical suppliers of the airbag control units and other electronic parts required in its assembly. On the other hand, Bosch, Continental and Endurance are understood to be gunning for the two-wheeler ABS market. In FY2018, nearly 25 million two-wheelers were sold in India and growing at 14 percent per annum.

With the safety quotient in both PVs and two-wheelers set to rise thanks to the current and upcoming mandates, many lives on Indian roads will be saved. Importantly, for the Indian vehicle buyer, who loathes spending on safety equipment compared to spending on accessories, he/she gets safety factored into the final sticker price. And with safety kits like airbags or ABS not impacted by the planned shift to electric mobility, it will remain a constant, which means now the onus is on suppliers to ensure they have the capacity to deliver and on time.

(This article was published in the 15 May 2018 issue of Autocar Professional)

Also read: Global car sales up 2.4% in 2017 with Europe, APAC, Latam driving the numbers

Indian PV exports slump amidst piling cess credit concerns

US sanctions on RUSAL put Indian auto industry in crossfire, says ICRA

India’s motorcycle market returns to double-digit growth after 5 years

RELATED ARTICLES

Policy, Protectionism and Pressure: Inside India’s Construction Equipment Downturn

India’s construction equipment sector faces a tough battle as it takes on cheaper imports from China and a slowdown in g...

Beyond Cars: VinFast's Full-spectrum EV Push in India

With $2 billion committed, VinFast is constructing an integrated play spanning cars, scooters, buses, ride-hailing and c...

A Breather for Hero

A combination of policy tailwinds, new products and Honda’s cautious approach on EVs put a stop to the constant encroach...

09 Jun 2018

09 Jun 2018

44604 Views

44604 Views

Shahkar Abidi

Shahkar Abidi

Kiran Murali

Kiran Murali