Is the commercial vehicle industry ready for BS IV?

Come April 2017 and every new commercial vehicle will have to be BS IV-compatible. Is the domestic CV industry ready for this upgrade and what is the state of readiness?

The statistics are boggling. India is the world’s fifth-largest economy by nominal GDP, the second largest bus manufacturer, the fifth largest heavy truck manufacturer and eighth largest commercial vehicle market globally.

Given the pressing need to develop infrastructure and improve public transportation in what is possibly the world’s fastest growing emerging market, the commercial vehicle industry has a promising future. The CV industry, which is cyclical in nature, has seen fairly rapid growth in the past two years. Come April 2017, it will witness one of the biggest transformations in decades.

As India is committed to global warming and reduction in CO2 levels, the government wants the country and its automakers to embrace cleaner, fuel efficient vehicles. A cohesive step in this direction is the mandatory shift to BS IV emission standards nationwide for all vehicles starting April 2017.

While all other vehicles are already compliant with this standard, the CV sector will see a complete shift to BS IV in another three-and-a-half months. Thirty-six months after that, the sector will, like the rest of the country, upgrade to BS VI which is really the much bigger challenge considering India has leapfrogged BS V entirely.

Although some segments like light commercial vehicles, small commercial vehicles, pickups and even a few buses have already upgraded to BS IV, the key segment which is bracing for this transformation is the critical medium and heavy commercial vehicle (M&HCV). Most M&HCVs in India are still BS III-compliant.

How OEMs are readying for BS IV

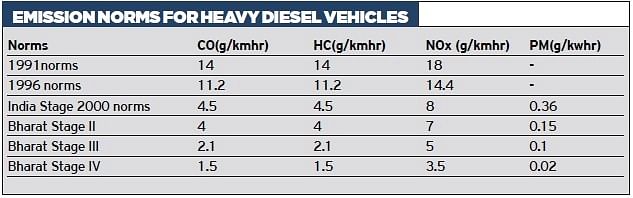

Since India embarked on a formal emission control regime only in 1991, there is a gap in implementation when compared to Europe. However, this has helped technologies to mature and facilitated Indian industry to meet the regulations at an affordable cost for Indian consumers. BS IV fuel is likely to reduce the emissions of carbon monoxide, hydrocarbon, oxides of nitrogen and sulphur, which are a lot less in BS IV fuel compared to BS III fuel.

With BS IV already partially being implemented in NCR and select Indian cities (Mumbai, Kolkata, Chennai, Bangalore, Hyderabad, Ahmedabad, Pune, Surat, Kanpur, Lucknow, Sholapur, Jamshedpur and Agra), truck makers have been ready with their technologies and manufacturing capabilities. April 1, 2017, is when every truck rolling out from assembly lines will have to comply with the new regulation. Market leader Tata Motors, which has the widest product portfolio, has been working on a war footing to get itself ready before BS IV kicks in across the country.

Commenting on this regulatory change, Ravi Pisharody, executive director, commercial vehicle business division, Tata Motors, says: “The major change due to BS IV regulation will come in M&HCVs like tractor-trailers, tippers, and multi-axle trucks as almost 95 percent of M&HCVs today are BS III. We have been preparing for this big change for quite some time. From April 2017, we will shut down all the BS III vehicles and only BS VI vehicles will be available.”

Ashok Leyland, the second largest player in the commercial vehicle segment, which makes all its engines in-house has already geared up for the transition. Speaking about its readiness, Dr Seshu Bhagavathula, chief technical officer, Ashok Leyland, says, “We have had BS IV-ready vehicles since 2010 when major cities in the country migrated to BS IV and the products have been well established in the market. This has helped us understand customer needs and duty cycles of the vehicles better. The all-India rollout next year will be handled seamlessly as we already have the technology and products in place.”

Truck prices to see 10-12% hike

Given the quantum jump in fuel emission technology, the direct impact of this regulatory change is that vehicle prices will increase by 10-12 percent. This is largely because the powertrain will see major changes and truck operators will have to buy AdBlue and urea dose from time to time for maintenance. This will have an impact on the demand cycle of the industry in the short term. It is expected there will be significant pre-buying of CVs which will lead to higher demand in Q4 of FY 2017.

Speaking to Autocar Professional, Sunny Manjani, consultant, Frost & Sullivan, says, “With BS IV vehicles, the cost of M&HCVs can go up between Rs 100,000-Rs 200,000. Usage of SCR (Selective Catalytic Reduction) requires urea to be filled after certain intervals and this will see operating costs rise by up to 2 percent. To avoid this, fleet owners will try to prepone buying in the last quarter of this fiscal year. This may lead to a jump in volume in Q4 FY2017 and a decline in next-year volumes in the range of 10-15 percent.”

In the near-term, aftersales service and maintenance will see higher cost in BS IV-compliant vehicles as the electronics content in them will be higher and the ability of independent mechanics to service such vehicles will drop initially. OEMs have been working on this front to avoid an inefficient customer response in the event of vehicle failure. For example, Tata Motors – along with its engine partner Cummins – has already started intensive training programmes in over 1,000 locations across the country to train service technicians of its dealers and service network.

BS IV will facilitate On Board Diagnostics (OBD) on vehicles, which help detect failures that adversely affect emissions and warn the driver about faults. OBD enables diagnosis and repair of complex electronic engine controls, keeps emissions low by early identification of controls that needs repair, and is a life-long solution for the vehicle.

Also, in a bid to be prepared for better aftersales and service experience, OEMs are equipping and training roadside mechanics to conduct primary diagnostics so that a truck can travel to the nearest service station where it can get comprehensive service.

“Whenever there is an emission change, in the period prior to that, people tend to buy the earlier vehicles. So in the first few months, there will be some slackness but subsequently, it will catch up and the industry will depend more on the economy rather than these things,” says Pisharody. “Initially, BS III and BS IV will co-exist and there will be some confusion. However, it will be addressed within two quarters and BS IV vehicles will take over completely,” he adds.

Tangible benefits in the offing for fleet owners

BS IV quality fuel will facilitate On Board Diagnostics on commercial vehicles and help detect failures that adversely impact emissions.

Despite having to deal with complexities brought about by the upgrade to BS IV fuel quality, there will be tangible benefits for vehicle owners. As powertrains transform from largely mechanical engines to electronic engines, they will benefit from the improved fuel economy and lowered emissions, and also reduced maintenance costs.

“BS IV will bring sophistication in fleet management due to increased electronics. There will be more precision components in place with good control mechanisms. This should also improve life and reliability of vehicles due to prognosis and also proper diagnosis for remedy. Existing service models will see a shift towards OEMs. Availability of BS IV fuel across India and a monitoring system to ensure the quality of the fuel is a must. The quality of fuel will decide the life of the after-treatment system and hence, it would be of paramount importance,” says Dr Bhagavathula.

Keeping trucks happy, and maintenance costs down

OEMs are also working hard to increase the reliability level of their trucks to avoid breakdowns, which will reduce the maintenance cost due to fewer instances of vehicle downtime or not plying.

India being a highly cost-competitive market, truck operators will not want vehicle prices and maintenance costs to increase. In view of this, OEMs are working hard to increase the reliability level of their trucks to avoid breakdowns. As reliability increases, the cost of maintenance comes down due to fewer instances of vehicle downtime or not plying. More and more predictive analysis will be provided to customers for any likely failure in the vehicle, helping operators in keeping their trucks on the road for the maximum possible time and thereby ensuring profitability. Also with improving road infrastructure and overloading penalties being stringently imposed across the country, truck operators are achieving better turnaround time and seeing a reduction in maintenance cost.

Also read: India Commercial Vehicle sales remain under pressure in December

S P Singh, senior fellow, Indian Foundation for Transport Research and Training, which tracks the trucking industry, favours the BS IV mandate as coming at the right time. He says, “Implementation of BS IV from next year is a progressive move as commercial vehicles need to move up in terms of emission regulations. This decision will have an impact on the industry in the short-term as the demand cycle will see disruption. This is definitely good for the environment but there are several issues of the industry that need to be addressed by the government.”

Commenting on the upcoming all-India emission upgrade for the CV industry, Manjani says the Indian trucking industry has, for many decades, been lacking two major reforms. The first is emission norms which are getting addressed by implementation of BS IV. The other major element is factory-built cabins. Unless factory-fitted bodies become a norm in India, trucks will not see radical change. “In BS IV trucks, cowls are still allowed and nearly 80 percent of haulage customers still go for cowls as they save a lot of cost. Unless there is a regulation, cowls will remain in India or customer will go for it because of low cost and low maintenance. So by BS IV, you may see a change in the driveline but nothing beyond that,” he cautions.

For the CV industry – particularly M&HCVs – which is the barometer of the country's economy, adopting BS IV norms is a major landmark. While challenges remain in the form of a large parc of existing BS III and even lower emission vehicles plying across the country, this upcoming move will be a stepping stone towards the bigger challenge of achieving BS VI standards by April 2020, which is barely three years away and never before attempted globally in such a short span of time.

INTERVIEW: Ravi Pisharody, ED — CV division, Tata Motors

Do you view the shift to BS IV as a challenge for the domestic commercial vehicle industry?

There was enough advance notice for BS IV. The real challenge is the investment that we are making for BS IV. We will have to recover it quickly and immediately work on BS VI which is a big jump in technology. That would be a much bigger challenge because that will have to be done for both passenger cars and commercial vehicles.

The April 2017 deadline is not really relevant for passenger cars because they have already moved to BS IV. I see the BS VI as the big challenge.

What is Tata Motors’ preparedness towards meeting BS IV norms?

Being the market leader, we have been working on this for quite some time and will get completely new engines for BS IV vehicles. In M&HCVs, we have been working on new platforms and all our engines above 180hp are from the Tata Cummins joint venture. Cummins makes BS IV, V and VI engines in different countries. We have proposed a new range of engines for BS IV now and had planned this a few years ago.

We are on track and, one by one, all our current models started with a BS IV engine and platform. BS IV, if it is with SCR, will need some after-treatment. November 2016 onwards, we have started making BS IV vehicles in small numbers for trial, validation and checking fuel economy. The real production will start from April 2017.

Will the shift to BS IV offer an advantage for exports?

There are two types of markets. One which is not even BS IV which includes Middle East, Africa and some South East Asian countries. There will be very few markets left when India moves to BS IV. However, we will have an advantage when the market moves to BS VI in the next few years and we won’t have to start from scratch. CV makers in Australia and Europe are already on BS VI. Exports will improve when we go to BS VI. With BS IV, there is very marginal benefit and many markets where Indian companies are selling are not even BS IV.

INTERVIEW: Dr Seshu Bhagavathula, CTO, Ashok Leyland

What, in your opinion, are the structural changes that BS IV will bring to the Indian CV industry?

BS IV will bring sophistication in fleet management due to increased electronics. More precision components are in place with good control mechanisms. It should also improve life and reliability of vehicles due to prognosis and then, also proper diagnosis for remedy. Existing service models will have a shift towards OEMs.

What do you think will be the likely impact on trucks and buses in terms of technology and pricing due to the BS IV upgrade?

Price parameters depend on the technology adopted. Ashok Leyland has simplified electronics and customer adaptations that are affordable. On the technology front — apart from combustion — after-treatment technologies are an addition. This necessitates strict control over usage of BS IV fuel of good quality. This needs constant monitoring by the authorities for fuel quality.

Can you highlight how Ashok Leyland has been working on this and what are the changes incorporated in BS IV-compatible vehicles?

Ashok Leyland, in its BS IV products, offers new engines and technologies. In-cylinder combustion is refined by Ashok Leyland to reduce load on the after-treatment system.

Hence, we have simplified packaging and OBD (On-Board Diagnosis). As said earlier, EMS (Electronic Management System), after-treatment suitable for customer needs like EGR, SCR and diagnostic tools are being upgraded and made user-friendly in application and use.

BS IV will bring in a lot of electronics in engines. How do you plan to upskill your aftersales service across the country?

Ashok Leyland has been using electronics for the past 10 years and now, it is getting stabilised. Hence, it is more of skill upgradation / enhancement that we are currently focusing on.

We have geared up training for all the related stakeholders in the development cycle including service managers, technicians, dealer personnel, and mechanics who serve our customers. Customised service training in our own training centres, and mobile service training centres will ramp up reach. Electronics and telematics support will be offered for prognosis and diagnosis.

What challenges still remain for the CV industry in making BS IV a reality?

Supply chain, ramp-up and aftersales service may still remain a challenge. At Ashok Leyland, we are well prepared for a smooth transition. Fuel availability throughout the country will be a key component and handling electronics will need constant monitoring so that the transition to BS IV is smooth.

This feature was first published in Autocar Professional's 12th Anniversary issue. Subscribe to our magazine to get exclusive news, features and analysis.

RELATED ARTICLES

RSB Group Prepares for Hyper-Growth: New Markets, Tech and Mission ₹10,000 Cr

From a small workshop in Jamshedpur to an engineering group with global reach, RSB Transmissions is preparing for its mo...

Beyond Helmets: NeoKavach Wants to Make Rider Airbags India’s Next Safety Habit

As premium motorcycles proliferate and riding culture evolves, an Indo-French venture is betting that wearable airbags, ...

Inside Mahindra Last Mile Mobility’s Rs 500 Crore Modular Platform Strategy

Mahindra Last Mile Mobility has launched the UDO, an electric three-wheeler built on a new Rs 500-crore modular platform...

By Kiran Bajad

By Kiran Bajad

03 Jan 2017

03 Jan 2017

46209 Views

46209 Views

Darshan Nakhwa

Darshan Nakhwa

Shahkar Abidi

Shahkar Abidi