India Commercial Vehicle sales remain under pressure in December

Muted market sentiment, reduced freight movement across the country and buyers awaiting sops in the FY2018 Budget are impacting overall commercial vehicle sales.

Like the passenger vehicle industry, the critical medium and heavy commercial vehicle (M&HCV) segment in India is feeling the pressure of slowing sales.

For most of 2016, the light commercial vehicle (LCV) segment remained largely positive barring November when following the November 8 demonetisation, sales fell by nearly 10%. The M&HCV segment, after recording buoyant sales early in 2016, saw a gradual sales decline due to replacement demand tapering down. After the first six months of sustained growth, M&HCV numbers started falling from July 2016. After three months of de-growth, M&HCV sales turned positive in October by an impressive 17% but November numbers were hit by demonetisation.

The overall CV market is currently seeing muted conditions and freight transport demand has been sizeably impacted due to a slowdown in supply chains across the country’s economy. As a result, fleet operators have deferred their purchases. Also, with BS IV becoming mandatory for all CVs in April 2017, fleet owners are delaying their purchases to March 2017 which is when a considerable uptick in sales is expected.

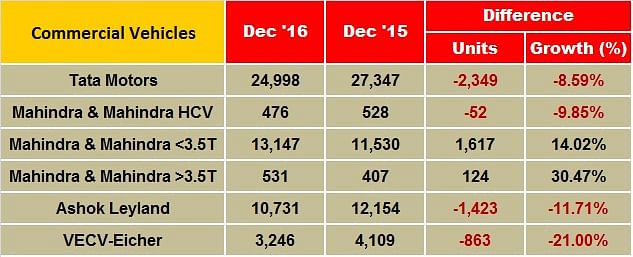

In December 2016, except for Ashok Leyland, most OEMs reported sales declines across segments. While Mahindra & Mahindra posted overall positive growth, thanks to a strong performance by its small CVs (both less-than-3T and above-3T vehicles) its HCVs numbers remained negative.

Tata Motors, which has posted a 17% decline in its overall sales in November 2016, continued to see de-growth in December, selling a total of 24,998 units, lower by 9% year on year. The company says the market will continue to remain under pressure due to the impact of demonetisation felt across segments, particularly in the long-haul cargo segment. However, what can be seen an encouraging sign, the construction vehicle segment continues to grow strongly (+22%) due to an increase in road construction activities; the coal and mining vehicle market is also gaining momentum. Meanwhile, Tata Motors saw its bus sales rise by 59% in December 2016 as a result of orders from government/STUs, intercity and staff segments.

Ashok Leyland’s total sales were down 12% YoY at 10,731 units (December 2015: 12,154 units). After recording positive growth in October and November, its M&HCV numbers slipped into negative territory (-9%) with sales of 8,782 units (December 2015: 9,703s). LCV sales dropped sizeably by 20% to 1,949 units (December 2015: 2,451 units).

Mahindra & Mahindra’s total CV sales were up by 14% to 14,154 units (December 2015: 12,465). The company sold 476 M&HCVs, down 10% YoY (December 2015: 528). However, it saw its below-3.5T GVW products recover after November 2016’s sharp fall – sales were up by 14% to 13,147 units (December 2015: 11,530). Vehicles in the above-3.5T GVW segment maintained their strong growth and sales rose 30% to 531 units (December 2015: 407).

VE Commercial Vehicles’ sales remained in negative territory. At 3,246 units, its sales in the domestic market declined by 21% (December 2015: 4,109).

Seen overall, it might be a while before CV numbers consistently ride into the black. The muted market sentiment, considerable reduction in freight transport across the country and potential buyers awaiting sops in the Budget to be announced on February 1, 2017, are all factors that are weighing heavy on the sector. Stay tuned for more updates.

Recommended:

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

By Kiran Bajad

By Kiran Bajad

02 Jan 2017

02 Jan 2017

7669 Views

7669 Views