BS IV: Two-Wheeler OEMs ready and willing, some more than others

Mandate that asks all two-wheeler OEMs across segments, new and old, to comply with new BS IV emission norms has sparked off a debate based on different interpretations of the original government notification. Amit Panday reports.

On February 15, Bajaj Auto held a press conference in Mumbai where managing director Rajiv Bajaj announced that his company had become the first vehicle manufacturer in India to have converted all models (both two- and three-wheelers), which were earlier compliant with BS III emission norms, to BS IV by end-January 2017. The company, which began this conversion of existing vehicles across its manufacturing plants in September last year, said it is ready to comply with the direction provided by the Environment Pollution Control Authority (EPCA).

“Bajaj Auto as a responsible corporate has complied with this directive and had already commenced manufacturing of BS IV-compliant vehicles from October 2016. Moreover, with effect from January 2017, all products from all our three plants are BS IV-compliant. We have thus ensured that all vehicles presented for registration from April 1 onwards will be BS IV compliant. This has been possible because of meticulous planning for dealer stocks and switching over to production of BS IV-compliant vehicles well in advance,” Bajaj said.

Rajiv Bajaj also appealed to the concerned authorities and government departments that all other companies seeking time beyond April 1, 2017 to sell their BS III-compliant vehicle inventory should not be given any amnesty or they be allowed only after imposing sizeable financial penalties.

It is understood that although all manufacturers agree to meet the April 1 deadline for manufacturing BS IV-compliant vehicles, some of them seek some more time to sell off their accumulated inventory that comprises of BS III vehicles. A few companies claim that their inventories have reached acute levels due to the negative impact of demonetisation.

The point of contradiction that emerges between the two arguments is that Bajaj Auto, along with other companies including Toyota Kirloskar Motor and Daimler India Commercial Vehicles (DICV), sees April 1, 2017 as the date for manufacture, sale and registration of vehicles compliant only to BS IV. The other OEMs say that they must manufacture only BS IV vehicles from the said date while sales and registration of BS III inventory should be allowed.

The Gazette of India notification dated July 4, 2014, as released by the Ministry of Road Transport and Highways (MoRTH) says: “Provided that the two-wheelers manufactured on and after the 1st April 2016 for new types of vehicle models and from the 1st April, 2017 for existing types of vehicle models shall be type approved as per requirements of sub-rule (16)”

The sub-rule (16), which is on mass Bharat Stage IV emission standards for two-wheelers, states: “Bharat Stage IV shall come into force for two-wheelers manufactured on and after the 1st April, 2016 for new types of vehicle models and from the 1st April, 2017 for existing types of vehicle models.”

The interpretation of the three-year-old government notification clearly defines the futuristic approach of each company, its management principles, business interests, and management of vendors and the supply chain.

Going by the literal meaning of the notification, in legal terms, it is clear that it notifies about manufacturing of BS IV-compliant vehicles from April 1, 2017, all old and new. Interestingly, the same gazette notification also mentions a key point, which conveys that the new draft rules were first published by MoRTH in the Gazette of India on 14 March 2014 “inviting objections and suggestions from all persons likely to be affected thereby.”

This raises an unanswered question about why the ongoing debate on the correct interpretation of the above notification did not spark off in March 2014? Surprisingly, all media reports conveyed that only BS IV-compliant vehicles would be allowed for sales and registration after April 1, 2017.

Speaking on the subject, Anumita Roy Chowdhury, executive director, Research and Advocacy, and head, Air Pollution and Clean Transportation Program, Centre for Science and Environment (CSE) spoke to Autocar Professional recently. She said, “Technically, the government notification talks about manufacture of BS IV vehicles from the said date. From past experience, when we moved to BS III and then to BS IV, we understand that the (auto) industry tends to build up the inventory of the older technology and they continue to sell those vehicles in the market beyond the deadlines for a long time.”

“However, anticipating this trend again and to be able to plug the (inventory) gap this time, the appointed committee (at) EPCA had much in advance (in October 2016) called upon a meeting with the vehicle manufacturers and had conveyed that they would be expected to sell only BS IV-compliant vehicles after April 1, 2017, and hence manage their inventories effectively.”

The meeting was attended by representatives from all major OEMs, committee members, concerned authorities and the ministries. She disclosed that the EPCA had asked the auto industry to submit the exact inventory levels across all vehicle segments so that the final numbers are absorbed and frozen.

“The inventory data that they (auto industry) have submitted is of around 20,000 cars, over 300,000 two-wheelers and nearly 75,000 commercial vehicles. This is now submitted to the Supreme Court appointed committee,” she revealed.

“The OEMs won’t be allowed to continue selling outdated stock for months, as it used to happen earlier,” she added. It is expected that with official inventory data in hand, the OEMs would take four-six weeks beyond the deadline to sell off their inventories.

While Bajaj has proposed that such companies be allowed only after being imposed with considerable financial penalties, Roy Chowdhury clarified that, “Unfortunately, we do not have any policy for imposing penalties on companies that continue to clear off their outdated inventory. This is the reason why other two-wheeler makers aren’t prepared before time. Clearly, we now need a system of incentives and penalties to ensure that the industry responds timely and proactively.”

Nevertheless, in the context of Bajaj Auto she added, “Bajaj Auto has been the most proactive two-wheeler company of all. It had given in writing that it will not manufacture and sell any BS III-compliant vehicle after 1 April 2017. Bajaj Auto has been the first one to do so.”

Speaking to Autocar Professional on the condition of anonymity, a senior official from Society of Indian Automobile Manufacturers justified the legitimacy of the BS III vehicle inventories. “The government notification is extremely clear; there is no ambiguity at all. The most important operative word in the notification is – manufacture. It does not use the words sell or register. Sometimes, dealers take several months to sell a vehicle. Therefore, the existence of inventory is legitimate,” he stated.

Lauding the efforts of Bajaj Auto, he said: “Hats off to Bajaj Auto for being able to convert its entire production before the date and this is a credit to the entire industry. Companies like Bajaj Auto make us feel proud that we can go beyond the regulations also.”

“However, is this legally required?” he queried. This industry representative believes that it is impossible for any sector with a large pipeline of products and vendors to ensure zero stock on a certain date.

TAKING STOCK

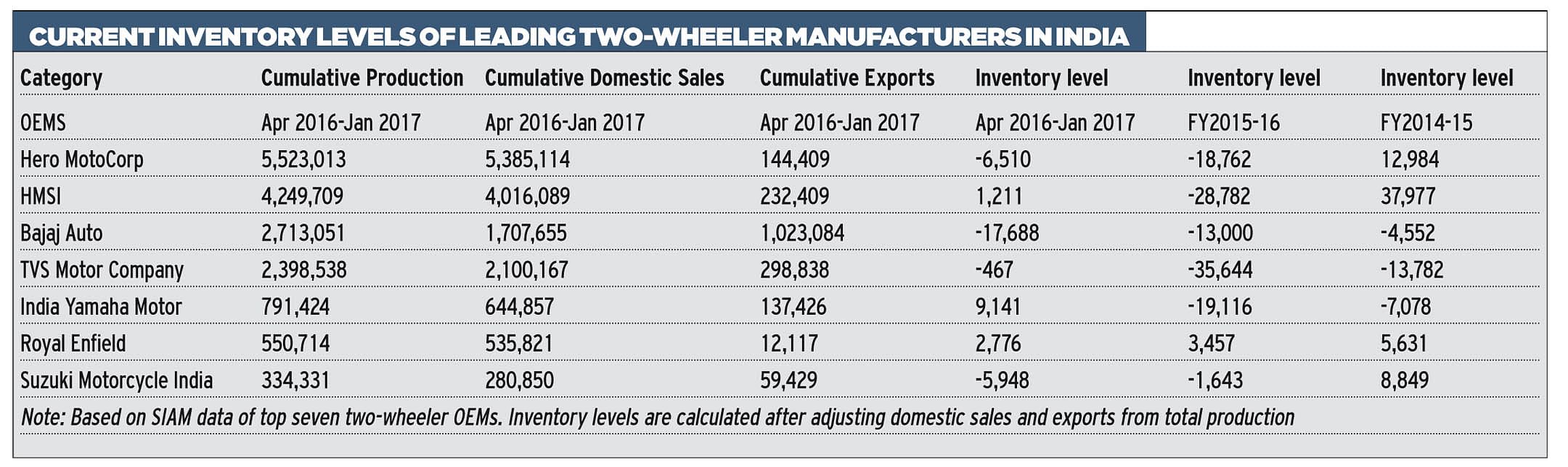

A quick analysis to understand the current (FY2017) inventory level (of the top seven two-wheeler OEMs) by adjusting cumulative domestic sales and exports against cumulative production shows that the current inventory is not only tightly monitored by the companies but there are stock carry overs from the last fiscal year. “The negative stock is drop stock. This data shows the production and billing by the OEM and not by the dealerships,” clarified Eric Vas, president, motorcycle business, Bajaj Auto.

This further simplifies that the two-wheeler inventory of over 300,000 units, as shared by the industry with EPCA, is parked at dealership yards. Additionally, analysts say that some BS III vehicles could also be in the form of capital work in progress (CWIP) in the production plants.

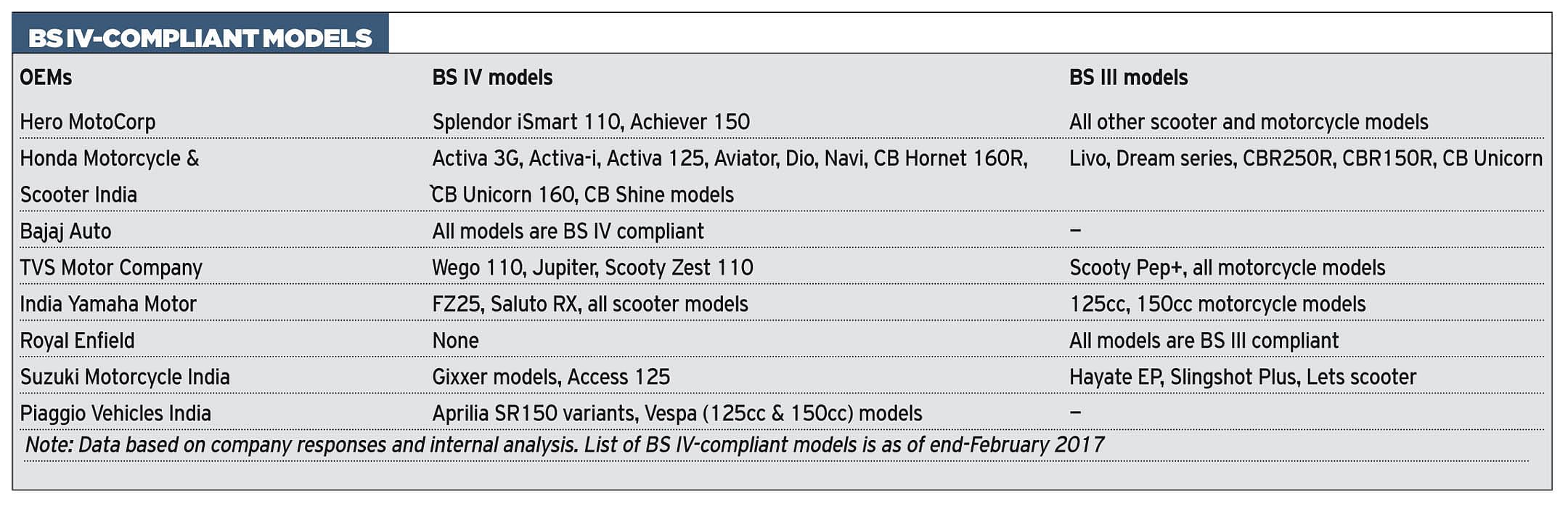

Other OEMs including Hero MotoCorp, HMSI and TVS have confirmed they are geared up for the April 1 deadline. “TVS Motor Co is a responsible corporate citizen and fully supportive of a better environment for our customers, employees and stakeholders. We are fully geared up to meet the government’s new BS-IV emission guidelines,” commented K N Radhakrishnan, president and CEO, TVS Motor Co.

Yadvinder Singh Guleria, senior VP (Sales & Marketing), HMSI, spoke in the same vein: “We are prepared for the incoming BS IV deadline. Currently, more than 85 percent of our models are BS IV compliant. For Honda, our market strategy is well placed for existing BS III stock and from March 1, 2017, we will be producing only BS IV models,” he informed.

In a recent conversation, Dr Markus Braunsperger, CTO, Hero MotoCorp had also reiterated similar thoughts. “Development-wise, we are through and are rolling out BS-IV in our entire model range including scooters by April 1, 2017,” he had said.

One can, therefore, surmise that the Indian two-wheeler industry does not stand divided on the incoming emission regulations. The company that outperforms its contemporaries in terms of BS IV readiness is Bajaj Auto. Importantly, it will give the company a first-mover advantage in the market which is something it is eager to take benefit of. OEMs which make the move to BS IV swiftly also win green points in the eyes of the consumer.

RELATED ARTICLES

Beyond Cars: VinFast's Full-spectrum EV Push in India

With $2 billion committed, VinFast is constructing an integrated play spanning cars, scooters, buses, ride-hailing and c...

A Breather for Hero

A combination of policy tailwinds, new products and Honda’s cautious approach on EVs put a stop to the constant encroach...

Renault India's Quiet Fixer

As the head of Renault India, Francisco Hidalgo Marques faces his biggest challenge yet.

06 Mar 2017

06 Mar 2017

15208 Views

15208 Views

Kiran Murali

Kiran Murali